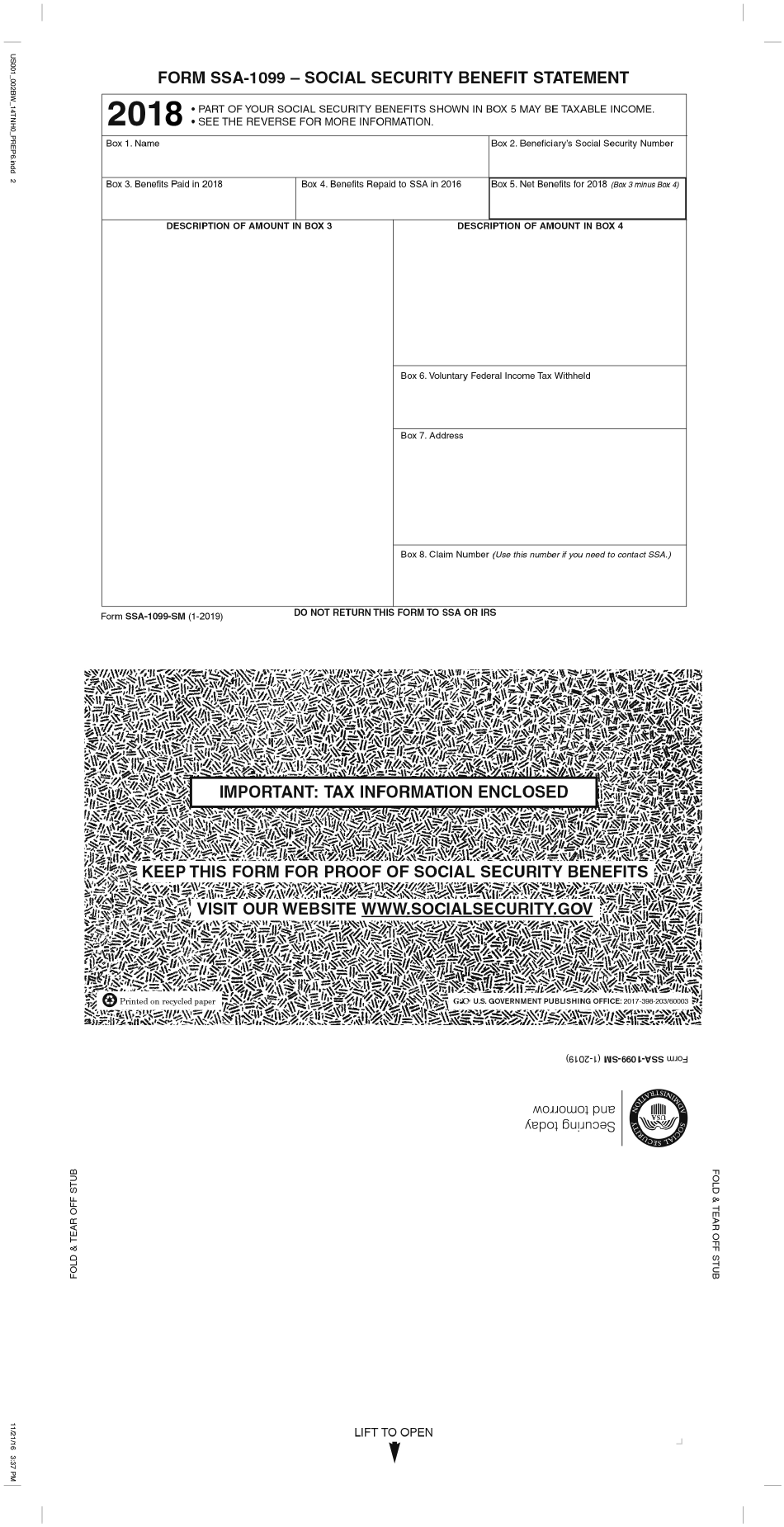

Sample Form Ssa-1099

Sample Form Ssa-1099 - It shows the total amount of benefits you received from social security in the previous year, so you know how much social security income to report to the irs on your tax return. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. Show details we are not affiliated with any brand or entity on this form. Web use a ssa 1099 form example template to make your document workflow more streamlined. Web download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Distributions from an hsa, archer msa, or medicare advantage msa. The taxable portion of the benefits. • see the reverse for more information. Web social security forms | social security administration forms all forms are free. They do not include supplemental security income (ssi) payments, which are not taxable and do not need to be reported on your tax return.

Social security benefits include monthly retirement, survivor, and disability benefits. See the reverse for more information. Your social security number 2. They do not include supplemental security income (ssi) payments, which are not taxable and do not need to be reported on your tax return. How it works open the ssa 1099 form 2021 pdf and follow the instructions easily sign the ssa 1099 with your finger send filled & signed ssa 1099 form 2022 pdf or save The tax year for which the form is being filed 5. Social security administration created date: It shows the total amount of benefits you received from social security in the previous year, so you know how much social security income to report to the irs on your tax return. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. • you exclude income from sources outside the united states or foreign housing, income earned by bona fide residents of american samoa or puerto rico, interest income from series ee or i u.s.

Not all forms are listed. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. Social security benefits include monthly retirement, survivor, and disability benefits. They do not include supplemental security income (ssi) payments, which are not taxable and do not need to be reported on your tax return. Sign in to your account and click the link for replacement documents. The taxable portion of the benefits. The tax year for which the form is being filed 5. • you exclude income from sources outside the united states or foreign housing, income earned by bona fide residents of american samoa or puerto rico, interest income from series ee or i u.s. Your name and address 3. Contacting your local social security office.

Understanding Your Tax Forms 2016 SSA1099, Social Security Benefits

Sign in to your account and click the link for replacement documents. Contacting your local social security office. They do not include supplemental security income (ssi) payments, which are not taxable and do not need to be reported on your tax return. Your name and address 3. See the reverse for more information.

Example Of Non Ssa 1099 Form / How To Fill Out A 1099 Nec Box By Box

Sign in to your account and click the link for replacement documents. Web use a ssa 1099 form example template to make your document workflow more streamlined. How it works open the ssa 1099 form 2021 pdf and follow the instructions easily sign the ssa 1099 with your finger send filled & signed ssa 1099 form 2022 pdf or save.

Solved FORM SSA1099SOCIAL SECURITY BENEFIT STATEMENT PART

Your name and address 3. See the reverse for more information. • see the reverse for more information. Distributions from an hsa, archer msa, or medicare advantage msa. Show details we are not affiliated with any brand or entity on this form.

Form SSA1099 Download Printable PDF or Fill Online Social Security

• you exclude income from sources outside the united states or foreign housing, income earned by bona fide residents of american samoa or puerto rico, interest income from series ee or i u.s. See the reverse for more information. The tax year for which the form is being filed 5. For privacy act and paperwork reduction act notice, see the..

How Do I Get Form Ssa 1099 For 2020 Darrin Kenney's Templates

Your social security number 2. It shows the total amount of benefits you received from social security in the previous year, so you know how much social security income to report to the irs on your tax return. The tax year for which the form is being filed 5. Distributions from an hsa, archer msa, or medicare advantage msa. •.

Irs.gov Form Ssa 1099 Universal Network

Box 1.name box 2.beneficiary’s social security number box 3.benefits paid in 2016 box 4.benefits repaid to ssa in 2016 box 5.net. It shows the total amount of benefits you received from social security in the previous year so you know how much social security income to report to irs on your tax return. Not all forms are listed. Show details.

Social Security 1099 Form Pdf Form Resume Examples qb1VND61R2

For internal revenue service center. Contacting your local social security office. How it works open the ssa 1099 form 2021 pdf and follow the instructions easily sign the ssa 1099 with your finger send filled & signed ssa 1099 form 2022 pdf or save For privacy act and paperwork reduction act notice, see the. Box 1.name box 2.beneficiary’s social security.

Ssa 1099 Form 20202022 Fill and Sign Printable Template Online US

You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. Web social security forms | social security administration forms all forms are free. Contacting your local social security office. Your name and address 3. Sign in to your account and click the link for replacement documents.

Ssa7 Form 7 7 Moments To Remember From Ssa7 Form 7 AH STUDIO Blog

• you exclude income from sources outside the united states or foreign housing, income earned by bona fide residents of american samoa or puerto rico, interest income from series ee or i u.s. Web download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Sign in to your.

Breanna Image Of Form Ssa 1099

The tax year for which the form is being filed 5. How it works open the ssa 1099 form 2021 pdf and follow the instructions easily sign the ssa 1099 with your finger send filled & signed ssa 1099 form 2022 pdf or save Your name and address 3. Your social security number 2. Show details we are not affiliated.

For Internal Revenue Service Center.

How it works open the ssa 1099 form 2021 pdf and follow the instructions easily sign the ssa 1099 with your finger send filled & signed ssa 1099 form 2022 pdf or save It shows the total amount of benefits you received from social security in the previous year so you know how much social security income to report to irs on your tax return. Web use a ssa 1099 form example template to make your document workflow more streamlined. Your name and address 3.

Sign In To Your Account And Click The Link For Replacement Documents.

Social security benefits include monthly retirement, survivor, and disability benefits. Not all forms are listed. Contacting your local social security office. Distributions from an hsa, archer msa, or medicare advantage msa.

Beneficiary's Scial Security Number Box 5.

The tax year for which the form is being filed 5. They do not include supplemental security income (ssi) payments, which are not taxable and do not need to be reported on your tax return. The taxable portion of the benefits. • see the reverse for more information.

See The Reverse For More Information.

Web social security forms | social security administration forms all forms are free. Box 1.name box 2.beneficiary’s social security number box 3.benefits paid in 2016 box 4.benefits repaid to ssa in 2016 box 5.net. • you exclude income from sources outside the united states or foreign housing, income earned by bona fide residents of american samoa or puerto rico, interest income from series ee or i u.s. Social security administration created date:

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)