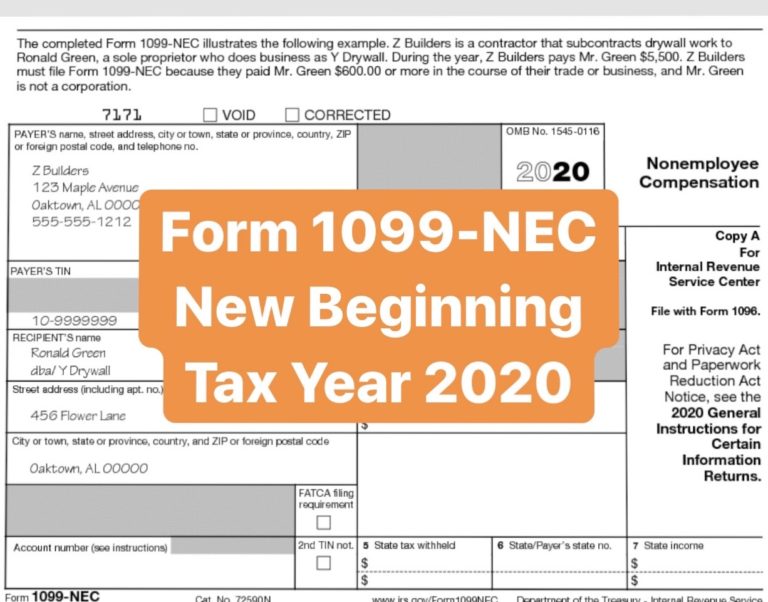

Sample 1099 Nec Form

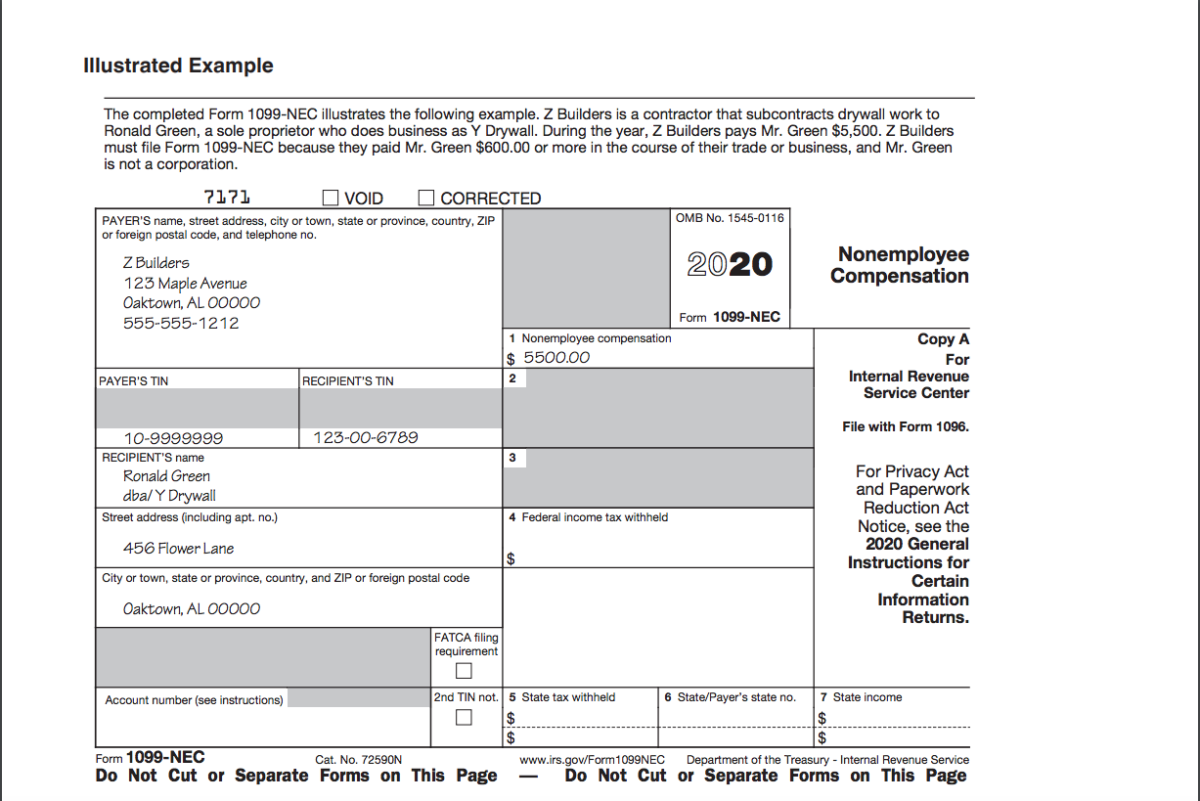

Sample 1099 Nec Form - The compensation being reported must be for services for a trade or business. Follow the instructions included in the document to enter the data. Gather the necessary information, including your name, address, and social security number. Their business name (if it’s different from the contractor’s name). Current general instructions for certain information returns. Both the forms and instructions will be updated as needed. For internal revenue service center. For privacy act and paperwork reduction act notice, see the. Locate a blank template online or in print. Copy a for internal revenue service center.

Examples of this include freelance work or driving for doordash or uber. For privacy act and paperwork reduction act notice, see the. Web 9 understanding sources of information for the 1099 form. After they were published, go to www.irs.gov/form1099nec. Current general instructions for certain information returns. Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact number. Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone. For internal revenue service center. Download the template, print it out, or fill it in online. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported.

Follow the instructions included in the document to enter the data. Gather the necessary information, including your name, address, and social security number. Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact number. Copy a for internal revenue service center. Examples of this include freelance work or driving for doordash or uber. Their business name (if it’s different from the contractor’s name). For internal revenue service center. The 2021 calendar year comes with changes to business owners’ taxes. 10 understanding 1099 form samples. Current general instructions for certain information returns.

What is Form 1099NEC for Nonemployee Compensation

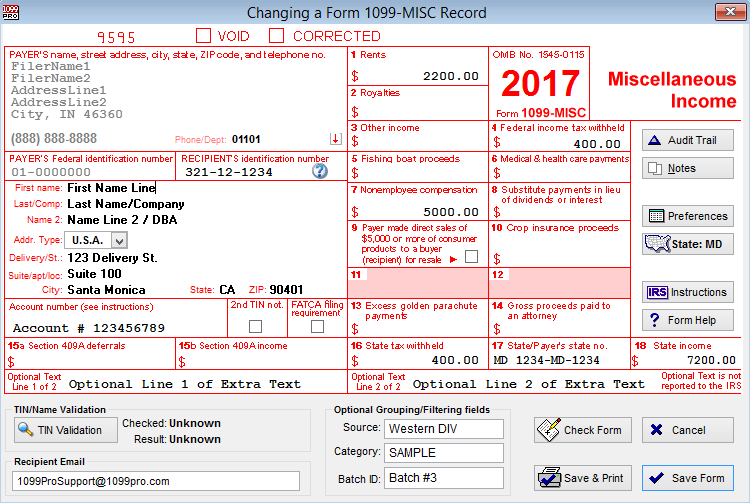

And on box 4, enter the federal tax withheld if any. Their business name (if it’s different from the contractor’s name). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For internal revenue service center. Sources of information for the 1099 form;

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

After they were published, go to www.irs.gov/form1099nec. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Examples of this include freelance work or driving for doordash or uber. Follow the instructions included in the document to.

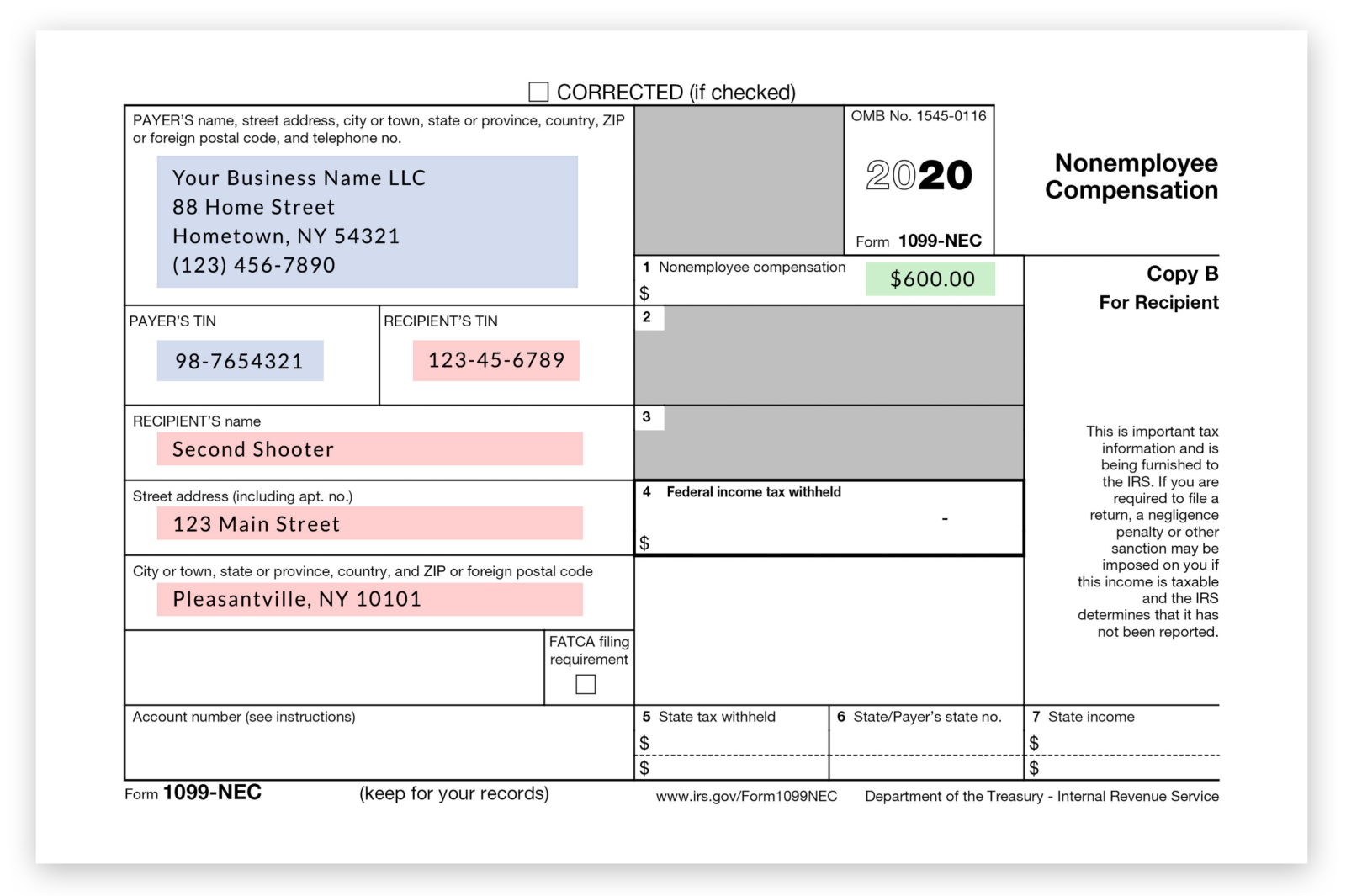

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Gather the necessary information, including your name, address, and social security number. Web 9 understanding sources of information for the 1099 form. Sources of information for the 1099 form; Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. For privacy act and paperwork reduction act notice,.

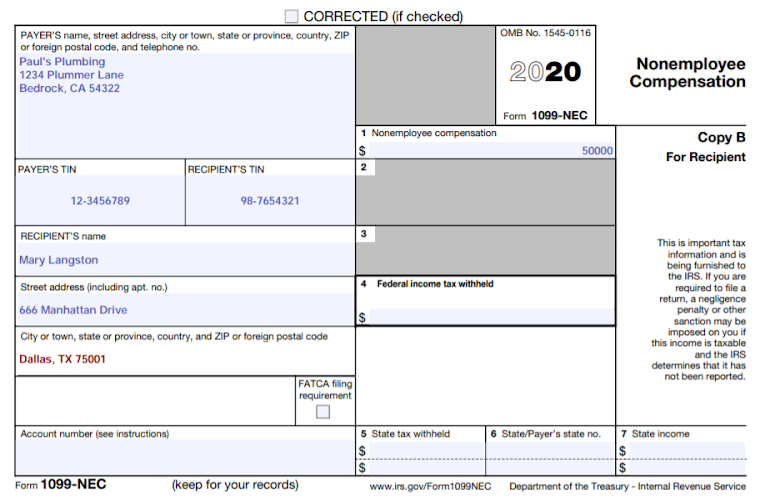

Form1099NEC

Both the forms and instructions will be updated as needed. Locate a blank template online or in print. Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact number. Web 9 understanding sources of information for the 1099 form. For internal revenue service center.

IRS Form 1099 Reporting for Small Business Owners

For internal revenue service center. After they were published, go to www.irs.gov/form1099nec. Web here’s what you need: Web instructions for recipient recipient’s taxpayer identification number (tin). Their business name (if it’s different from the contractor’s name).

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

Both the forms and instructions will be updated as needed. Download the template, print it out, or fill it in online. Web 9 understanding sources of information for the 1099 form. Web here’s what you need: 10 understanding 1099 form samples.

1099NEC Software Print & eFile 1099NEC Forms

Copy a for internal revenue service center. After they were published, go to www.irs.gov/form1099nec. Web here are the steps you need to take to complete the template: Current general instructions for certain information returns. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported.

1099NEC Software to Create, Print & EFile IRS Form 1099NEC

Copy a for internal revenue service center. Sources of information for the 1099 form; Their business name (if it’s different from the contractor’s name). The 2021 calendar year comes with changes to business owners’ taxes. Locate a blank template online or in print.

1099NEC 2020 Sample Form Crestwood Associates

Their business name (if it’s different from the contractor’s name). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). And on box 4, enter the federal.

Introducing the New 1099NEC for Reporting Nonemployee Compensation

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). And on box 4, enter the federal tax withheld if any. Their business name (if it’s different from the contractor’s name). Download the template, print it out,.

Gather The Necessary Information, Including Your Name, Address, And Social Security Number.

Web 9 understanding sources of information for the 1099 form. Sources of information for the 1099 form; Both the forms and instructions will be updated as needed. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported.

Web Here’s What You Need:

10 understanding 1099 form samples. Web instructions for recipient recipient’s taxpayer identification number (tin). Services performed by a nonemployee (including parts and materials) fish purchased (in cash) from someone. Current general instructions for certain information returns.

And On Box 4, Enter The Federal Tax Withheld If Any.

Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact number. For internal revenue service center. Examples of this include freelance work or driving for doordash or uber. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein).

After They Were Published, Go To Www.irs.gov/Form1099Nec.

For privacy act and paperwork reduction act notice, see the. 2020 general instructions for certain information returns. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Download the template, print it out, or fill it in online.