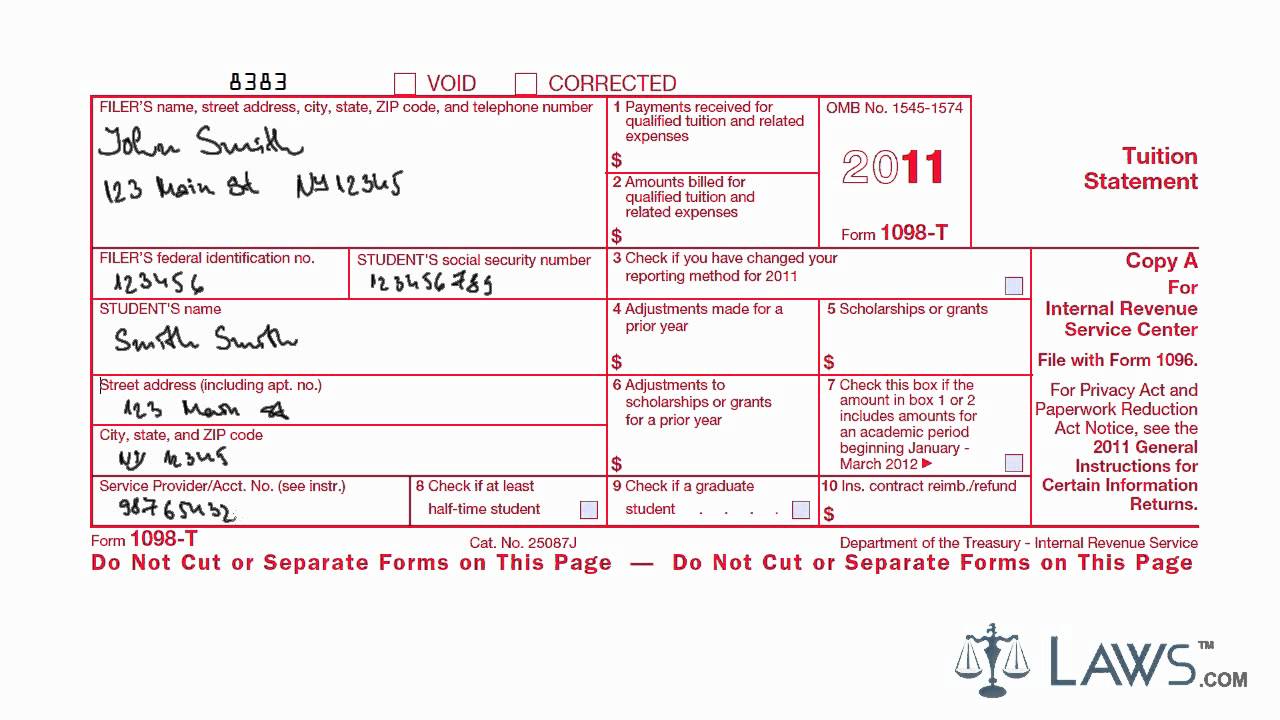

Sample 1098 T Form

Sample 1098 T Form - Web here are the seven types of 1098 forms and a brief description of what they’re for. Beginning in tax year 2018, btc will be reporting payments received for qualified tuition and related expenses, and no longer reporting amounts billed for qualified tuition and related expenses. Form 1098 (mortgage interest statement) — if you paid at least $600 in mortgage interest, your mortgage company is required to provide you with this form, which may help you deduct mortgage interest. This form must be used to complete form 8863 to claim education credits. 2 amount billed for qualified tuition and related expenses. The document can be obtained online or printed in a blank template. Payments received for qualified tuition and related expenses. Filer's name, street address, city or town, state or province, country, zip or foreign postal code, and telephone number. Forgot username • forgot password. Click on a box number description for more information.

Retain this statement for your records. The amount reported is the total amount of payments received less any. Forgot username • forgot password. Here’s what’s included in each box. For a payment to be reportable, it must relate to qualified tuition and related expenses billed during the same calendar year. 2 amount billed for qualified tuition and related expenses. Course materials required for a student to be enrolled The form is reported to the irs and sent to the borrower. Web here are the seven types of 1098 forms and a brief description of what they’re for. The institution has to report a form for every student that is currently enrolled and paying qualifying tuition and related expenses.

2 amount billed for qualified tuition and related expenses. For a payment to be reportable, it must relate to qualified tuition and related expenses billed during the same calendar year. Payments received for qualified tuition and related expenses. This form must be used to complete form 8863 to claim education credits. Click on a box number description for more information. Course materials required for a student to be enrolled Click the link below for detailed instructions. Failing to file it on time can result in federal penalties. Contract reimb./refund this is important tax information and is being furnished to the irs. The american opportunity tax credit allows taxpayers to reduce their federal income tax based upon qualified tuition and fees.

Form 1098 T Alchetron, The Free Social Encyclopedia

This box reports the total amount of payments received for qualified tuition and related expenses from all. Web this form must be used to complete form 8863 to claim education credits. Fees that are required for enrollment; Click on a box number description for more information. Here’s what’s included in each box.

Learn How to Fill the Form 1098T Tuition Statement YouTube

This statement is required to support any claim for an education credit. This box reports the total amount of payments received for qualified tuition and related expenses from all. Click the link below for detailed instructions. Failing to file it on time can result in federal penalties. The institution has to report a form for every student that is currently.

Form 1098T Information Student Portal

This statement is required to support any claim for an education credit. Payments received for qualified tuition and related expenses. Here’s what’s included in each box. Give it to the tax preparer or use it to prepare the tax return. 2 amount billed for qualified tuition and related expenses.

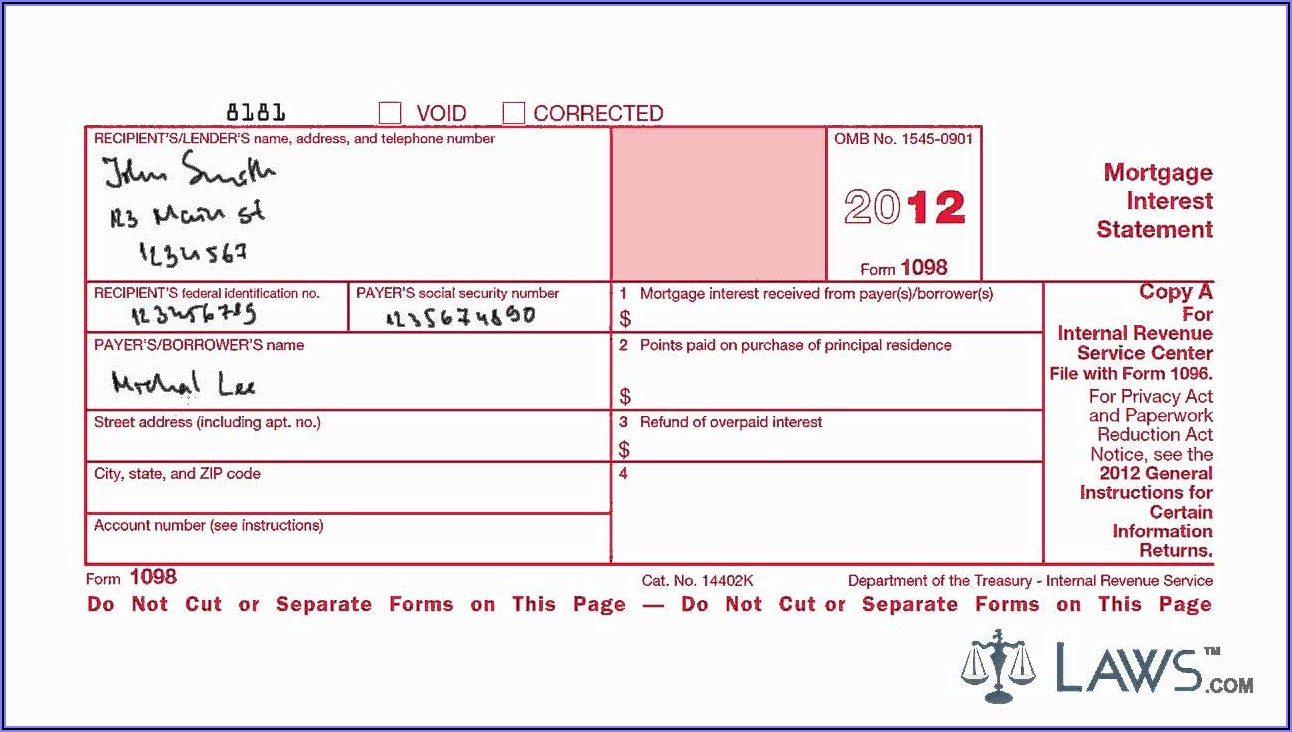

Sample 1098 Mortgage Interest Form Form Resume Examples djVaJGXE2J

Payments received for qualified tuition and related expenses. The irs requires schools to report payments received for qualified tuition and fees during the calendar year. The amount reported is the total amount of payments received less any. Contract reimb./refund this is important tax information and is being furnished to the irs. Here’s what’s included in each box.

Understanding your IRS Form 1098T Student Billing

It documents qualified tuition, fees, and other related course materials. 2 amount billed for qualified tuition and related expenses. Course materials required for a student to be enrolled This box reports the total amount of payments received for qualified tuition and related expenses from all. Here’s what’s included in each box.

1098T Niner Central UNC Charlotte

Click on a box number description for more information. Click the link below for detailed instructions. The form is reported to the irs and sent to the borrower. Filer's name, street address, city or town, state or province, country, zip or foreign postal code, and telephone number. For a payment to be reportable, it must relate to qualified tuition and.

1098T IRS Tax Form Instructions 1098T Forms

Form 1098 (mortgage interest statement) — if you paid at least $600 in mortgage interest, your mortgage company is required to provide you with this form, which may help you deduct mortgage interest. Give it to the tax preparer or use it to prepare the tax return. For a payment to be reportable, it must relate to qualified tuition and.

OCCC 1098T Tuition Statement Information

1 payments received for qualified tuition and related expenses. Form 1098 (mortgage interest statement) — if you paid at least $600 in mortgage interest, your mortgage company is required to provide you with this form, which may help you deduct mortgage interest. The form is reported to the irs and sent to the borrower. The american opportunity tax credit allows.

1098T IRS Tax Form Instructions 1098T Forms

2 amount billed for qualified tuition and related expenses. The educational institution generates this form and mails it to the students by january 31. 1 payments received for qualified tuition and related expenses. A form published by the irs that a lender uses to report the interest that a borrower pays on a student loan in a year in excess.

Form 1098T Still Causing Trouble for Funded Graduate Students

1 payments received for qualified tuition and related expenses. The document can be obtained online or printed in a blank template. Fees that are required for enrollment; Here’s what’s included in each box. A form published by the irs that a lender uses to report the interest that a borrower pays on a student loan in a year in excess.

The Amount Reported Is The Total Amount Of Payments Received Less Any.

1 payments received for qualified tuition and related expenses. Forgot username • forgot password. This statement is required to support any claim for an education credit. For a payment to be reportable, it must relate to qualified tuition and related expenses billed during the same calendar year.

Click The Link Below For Detailed Instructions.

Payments received for qualified tuition and related expenses. Click here for help changing your password. Contract reimb./refund this is important tax information and is being furnished to the irs. Web this form must be used to complete form 8863 to claim education credits.

Beginning In Tax Year 2018, Btc Will Be Reporting Payments Received For Qualified Tuition And Related Expenses, And No Longer Reporting Amounts Billed For Qualified Tuition And Related Expenses.

A form published by the irs that a lender uses to report the interest that a borrower pays on a student loan in a year in excess of $600. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related expenses to you. Return to 1098tforms.com 1098tforms.com is a service provided by herring bank, powered by the financial payments platform. The form is reported to the irs and sent to the borrower.

Retain This Statement For Your Records.

Payments received for qualified tuition and related expenses. Web here are the seven types of 1098 forms and a brief description of what they’re for. This form must be used to complete form 8863 to claim education credits. The american opportunity tax credit allows taxpayers to reduce their federal income tax based upon qualified tuition and fees.