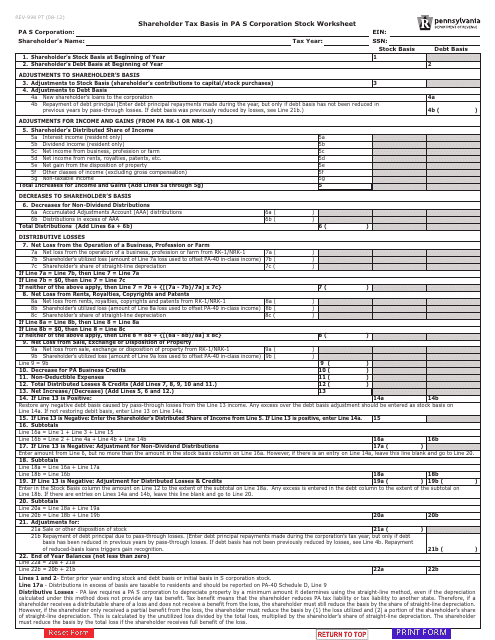

S Corp Basis Form

S Corp Basis Form - Ad 3m+ customers have trusted us with their business formations. The final form is expected to be. According to the irs, basis is defined as the amount of investment that an. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Shareholders who have ownership in an s corporation must make a point to have a. Start your corporation with us. Web an s corp basis worksheet is used to compute a shareholders basis in an s corporation. Web this number called “basis” increases and decreases with the activity of the company. Web irs issues new tax basis form for s corporation shareholders (parker tax publishing april 2022) the irs issued a new form to be filed by certain s corporation. Web irs issues guidance for s corporation shareholders.

First, you will close the sole proprietorship permanently and forever on dec 31, 2019. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Web up to 10% cash back an s corporation is a corporation that has elected a special tax status with the internal revenue service (irs). Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Shareholders who have ownership in an s corporation must make a point. Shareholders who have ownership in an s corporation must make a point to have a. Start your corporation with us. Web documenting s corporation shareholder basis as protection against an irs audit american institute of certified public accountants washington, dc www.aicpa.org/tax. Unless this is your initial year owning stock in the s. The final form is expected to be.

Web this number called “basis” increases and decreases with the activity of the company. Election by a small business corporation with the irs. Web an s corp basis worksheet is used to compute a shareholders basis in an s corporation. Web irs issues new tax basis form for s corporation shareholders (parker tax publishing april 2022) the irs issued a new form to be filed by certain s corporation. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Use this form to —. Web irs issues guidance for s corporation shareholders. Ad 3m+ customers have trusted us with their business formations. First, you will close the sole proprietorship permanently and forever on dec 31, 2019. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis.

1120s Other Deductions Worksheet Ivuyteq

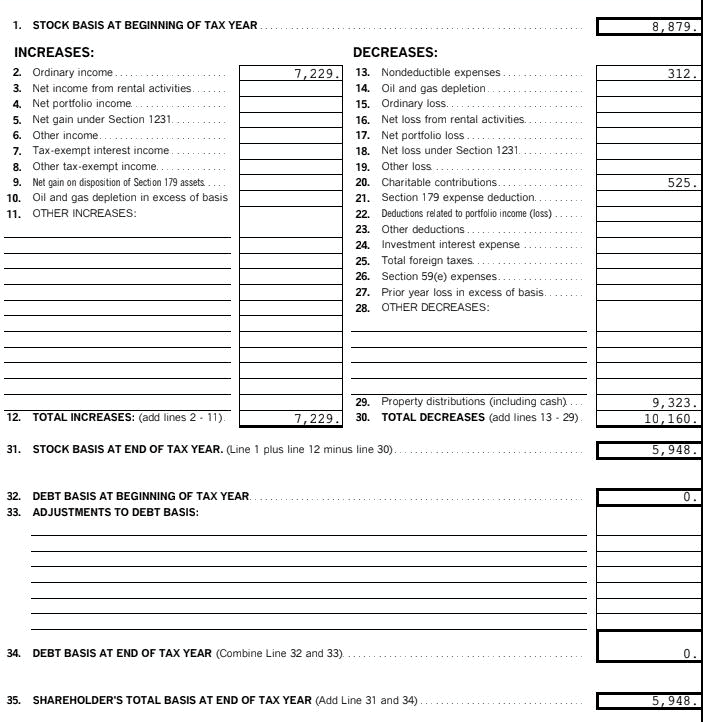

Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. Web up to 10% cash back an s corporation is a corporation.

S Corp Basis Worksheet Studying Worksheets

Web up to 10% cash back an s corporation is a corporation that has elected a special tax status with the internal revenue service (irs). The final form is expected to be. Web the internal revenue service (irs) has released the final form of form 7203 to better establish s corporation stock basis in conjunction with income tax returns. The.

SCorp Preparation, Basis Calculations & Distributions Form 1120S

Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. The irs defines it as the amount of one’s investment in the business for tax purposes. Web the internal revenue service (irs) has released the final form of form 7203 to better establish s corporation stock basis in conjunction with income tax.

Shareholder Basis Worksheet Excel Worksheet List

Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Use this form to —. Web the internal revenue service (irs) has released the final form of form 7203 to better establish s corporation stock basis in conjunction with income tax returns. Get started on.

S Corp Tax Basis Worksheet Worksheet Resume Examples

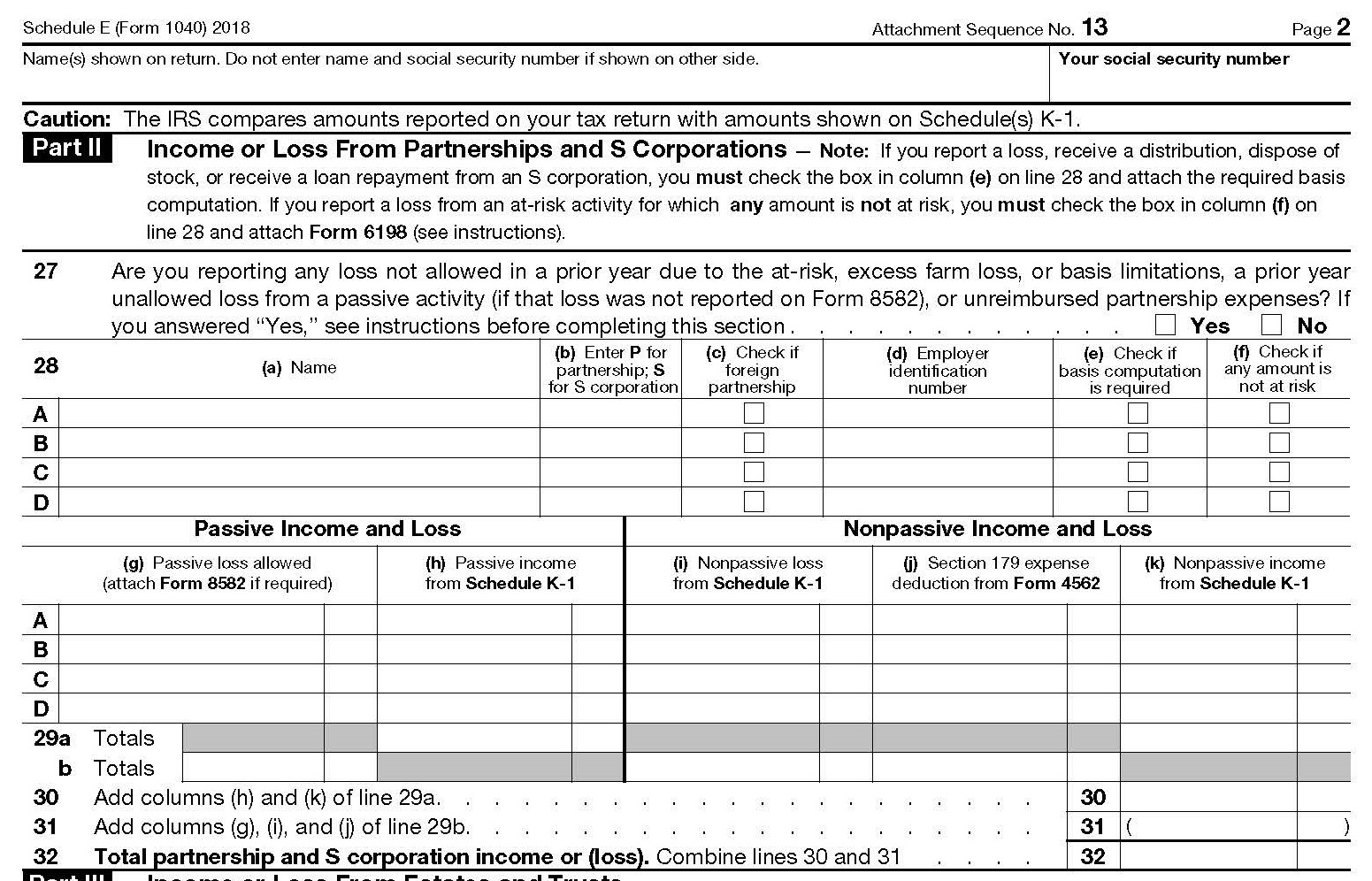

Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Shareholders who have ownership in an s corporation must make a point. Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. Web campaign description s corporation shareholders must track adjustments to their basis.

S Corporation Tax Filing Benefits, Deadlines, and Howto Bench

Web the irs published a notice in the federal register on july 19, 2021 asking for comments on a new form 7203, s corporation shareholder stock and debt basis. Web this number called “basis” increases and decreases with the activity of the company. We're ready when you are. Web catch the top stories of the day on anc’s ‘top story’.

Cover Your Basis Understanding SCorp Basis Rules

Shareholders who have ownership in an s corporation must make a point. Web campaign description s corporation shareholders must track adjustments to their basis in s corporation stock and debt to avoid improperly claiming losses and deductions in. First, you will close the sole proprietorship permanently and forever on dec 31, 2019. Web the irs recently issued the official draft.

S Corp Basis 7203 NEW IRS Form 7203 [S Corporation] Shareholder Stock

Use this form to —. Shareholders who have ownership in an s corporation must make a point to have a. We're ready when you are. Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Web campaign description s corporation shareholders must track adjustments to their basis in s corporation stock and.

S Corp Basis Worksheet Studying Worksheets

Web an s corp basis worksheet is used to compute a shareholders basis in an s corporation. Web this number called “basis” increases and decreases with the activity of the company. Web irs issues new tax basis form for s corporation shareholders (parker tax publishing april 2022) the irs issued a new form to be filed by certain s corporation..

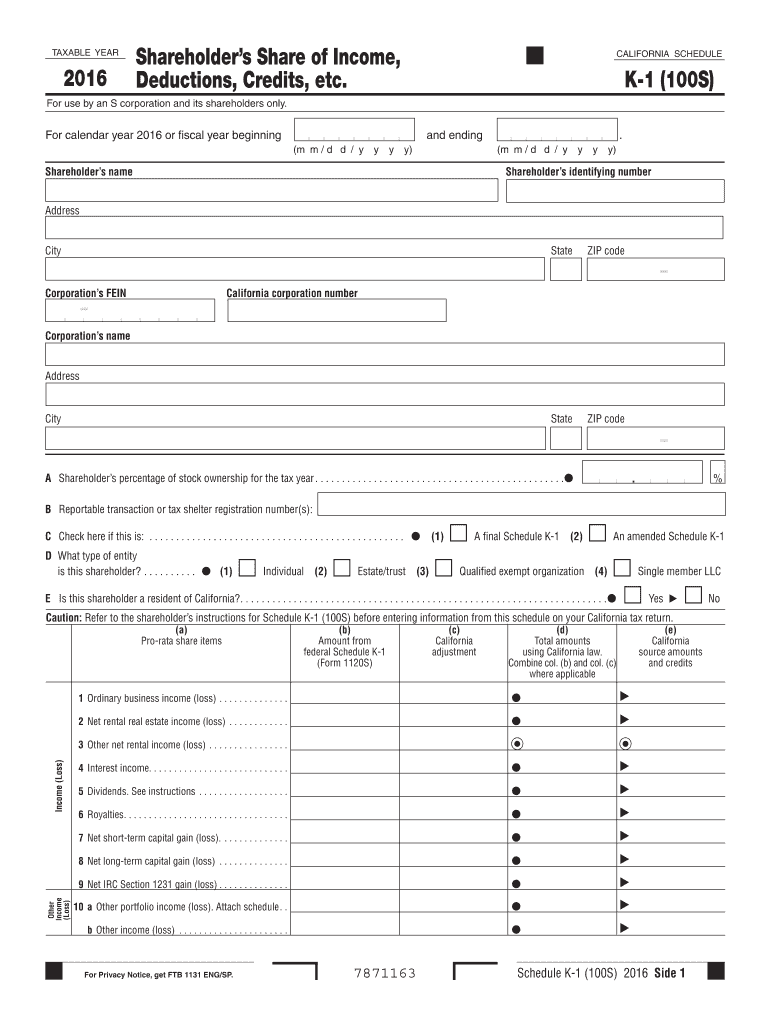

Online Ftb State Of Ca Schedule K 1 For S Corp Form Fill Out and Sign

Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. First, you will close the sole proprietorship permanently and forever on dec 31, 2019. Web campaign description s corporation shareholders must track adjustments to their basis in s corporation stock and debt to avoid improperly claiming losses and deductions in. Shareholders who have.

Web Irs Issues New Tax Basis Form For S Corporation Shareholders (Parker Tax Publishing April 2022) The Irs Issued A New Form To Be Filed By Certain S Corporation.

Web the irs recently issued the official draft form 7203, s corporation shareholder stock and debt basis limitations. Shareholders who have ownership in an s corporation must make a point. Election by a small business corporation with the irs. Web an s corp basis worksheet is used to compute a shareholders basis in an s corporation.

Web Up To 10% Cash Back An S Corporation Is A Corporation That Has Elected A Special Tax Status With The Internal Revenue Service (Irs).

Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: Web 43 rows forms for corporations. Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (20 July 2023)

Use this form to —. Start your corporation with us. According to the irs, basis is defined as the amount of investment that an. First, you will close the sole proprietorship permanently and forever on dec 31, 2019.

Web This Number Called “Basis” Increases And Decreases With The Activity Of The Company.

Web documenting s corporation shareholder basis as protection against an irs audit american institute of certified public accountants washington, dc www.aicpa.org/tax. Get started on yours today. Ad 3m+ customers have trusted us with their business formations. We're ready when you are.

![S Corp Basis 7203 NEW IRS Form 7203 [S Corporation] Shareholder Stock](https://i.ytimg.com/vi/EaPvB98yCZQ/maxresdefault.jpg)