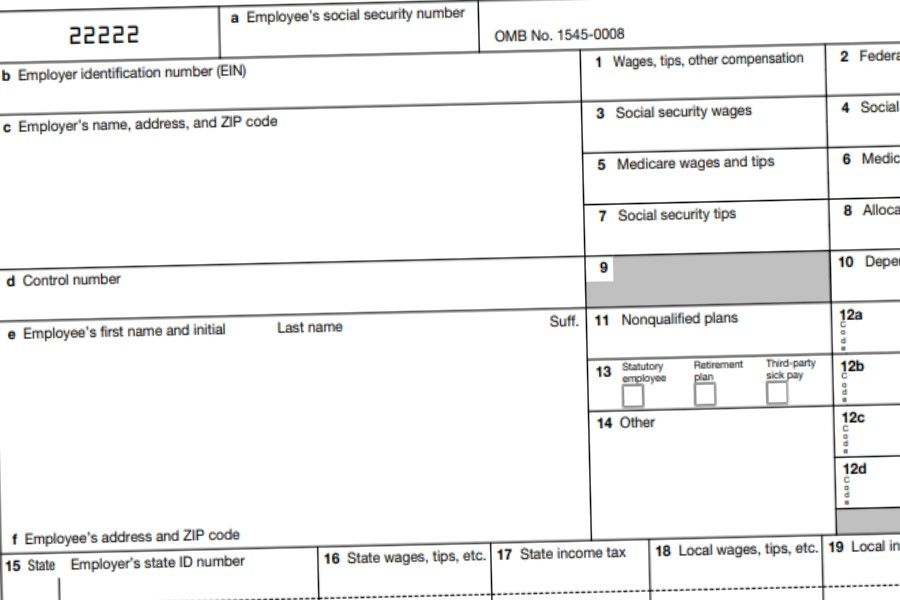

Pennsylvania W-2 Form

Pennsylvania W-2 Form - Web instructions for employee box 1. Web it is the federal law for employers in the u.s. Web visit corporate tax, compliance, and payroll. Enter this amount on the federal income tax withheld line of your tax return. Department of the treasury—internal revenue service. Web select the “online w2/w2c forms” menu option. Include those items of compensation, such as various types of retirement plan deferrals and any other items of compensation that are not included in federal If you have not submitted or do not submit your consent for electronic delivery only by the end of the calendar year, the payroll office will also arrange u.s. It provides an immediate receipt for proof that you filed. However the method, it must be done by the deadline, or you have something to complain about.

Department of the treasury—internal revenue service. It saves time and reduces filing burden. Web w2r annual reconciliation earned income tax. If you have not submitted or do not submit your consent for electronic delivery only by the end of the calendar year, the payroll office will also arrange u.s. Web instructions for employee box 1. My box 20 says “philadelphia” instead of “22”. Free, easy returns on millions of items. Enter this amount on the wages line of your tax return. W2 instructions, which appear on the back of the paper copy, can also be accessed by clicking on the “w2 instructions” tile found to the left of the “online w2/w2c forms” tile. Philadelphia is exempt from act 32.

Enter this amount on the wages line of your tax return. It is free, fast and secure. However the method, it must be done by the deadline, or you have something to complain about. Enter this amount on the federal income tax withheld line of your tax return. If you have not submitted or do not submit your consent for electronic delivery only by the end of the calendar year, the payroll office will also arrange u.s. My box 20 says “philadelphia” instead of “22”. Web instructions for employee box 1. It saves time and reduces filing burden. What are pennsylvania's employer withholding requirements? Include those items of compensation, such as various types of retirement plan deferrals and any other items of compensation that are not included in federal

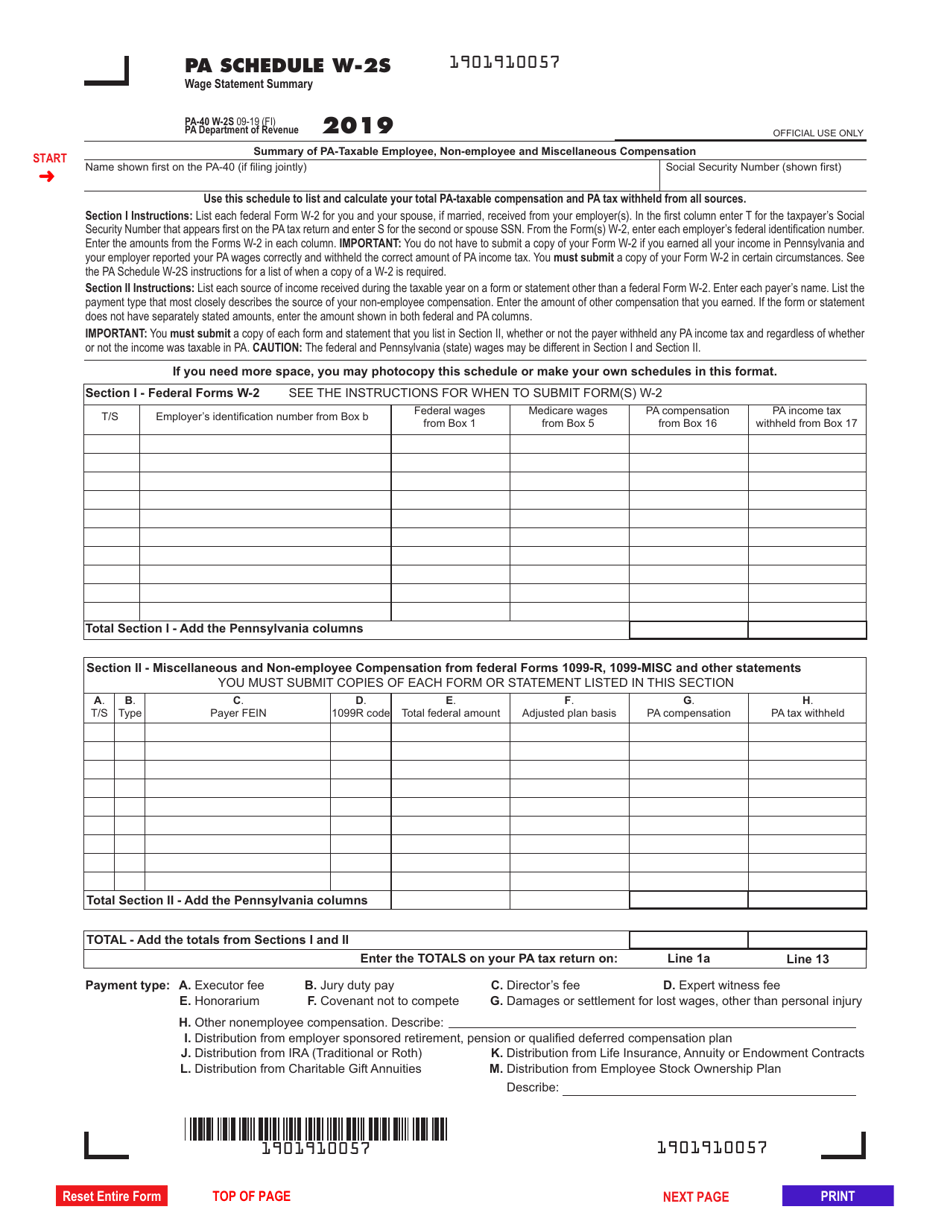

Pa Schedule W 2s Fill Online, Printable, Fillable, Blank PDFfiller

Web instructions for employee box 1. Web w2r annual reconciliation earned income tax. Web visit corporate tax, compliance, and payroll. Ad free shipping on qualified orders. Web select the “online w2/w2c forms” menu option.

Rev 1667 form Fill out & sign online DocHub

It provides an immediate receipt for proof that you filed. However the method, it must be done by the deadline, or you have something to complain about. Find deals and low prices on 2022 tax forms w2 at amazon.com My box 20 says “philadelphia” instead of “22”. Web visit corporate tax, compliance, and payroll.

How To Create W2 For Employee Santos Czerwinski's Template

Department of the treasury—internal revenue service. Web select the “online w2/w2c forms” menu option. If you have not submitted or do not submit your consent for electronic delivery only by the end of the calendar year, the payroll office will also arrange u.s. Web it is the federal law for employers in the u.s. Ad free shipping on qualified orders.

FBI warns of spreading W2 email theft scheme San Antonio ExpressNews

This information is being furnished to the internal revenue service. If you have not submitted or do not submit your consent for electronic delivery only by the end of the calendar year, the payroll office will also arrange u.s. Web select the “online w2/w2c forms” menu option. This change is part of a larger effort to embrace technology to better.

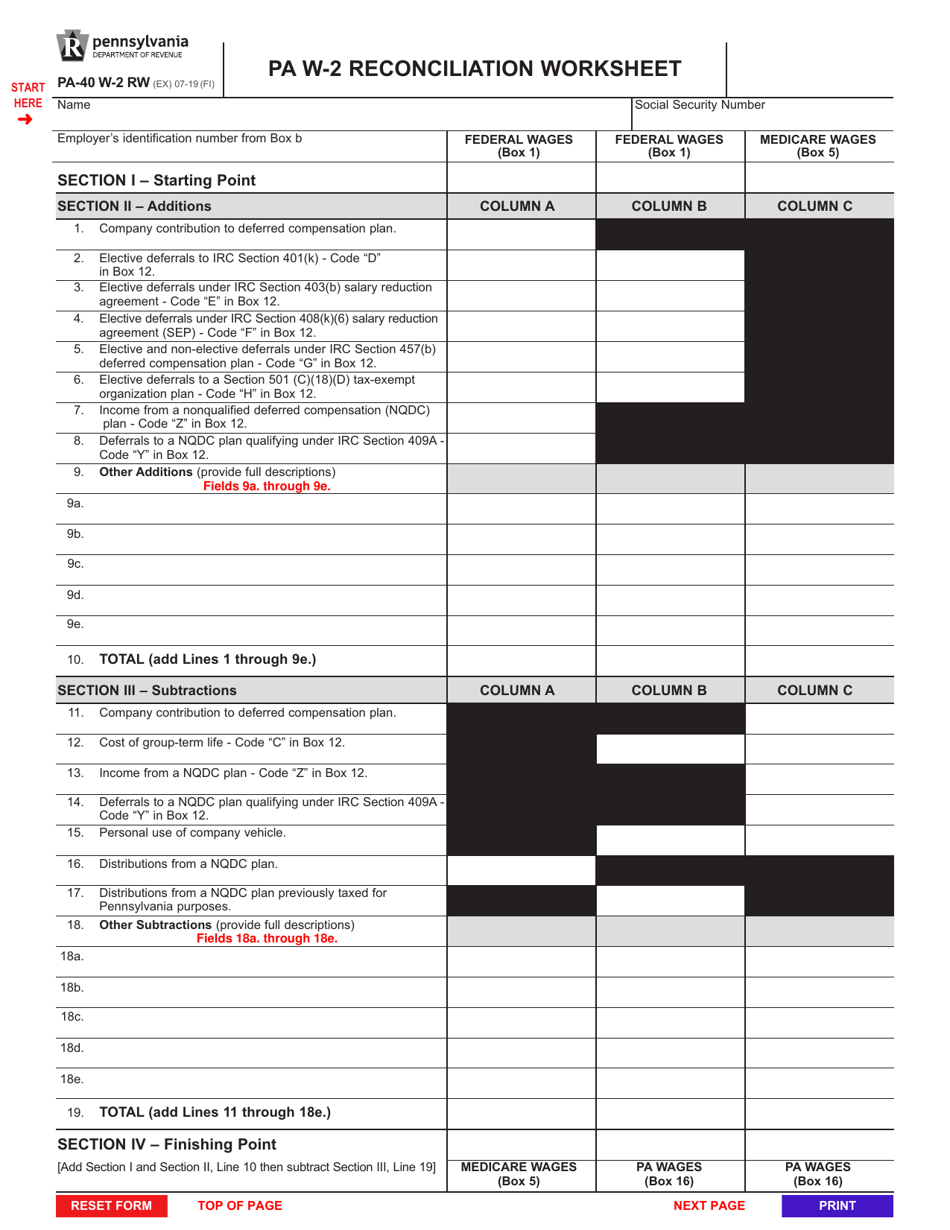

Form PA40 W2 RW Download Fillable PDF or Fill Online Pa W2

Enter this amount on the federal income tax withheld line of your tax return. Web instructions for employee box 1. Web it is the federal law for employers in the u.s. Find deals and low prices on 2022 tax forms w2 at amazon.com If you have not submitted or do not submit your consent for electronic delivery only by the.

Pa W 2 Form ≡ Fill Out Printable PDF Forms Online

Local income tax forms for individuals. Web select the “online w2/w2c forms” menu option. This information is being furnished to the internal revenue service. Enter this amount on the federal income tax withheld line of your tax return. Web why you should file online?

Pa Form W2 S Instructions Universal Network

This information is being furnished to the internal revenue service. Web select the “online w2/w2c forms” menu option. It is free, fast and secure. My box 20 says “philadelphia” instead of “22”. Philadelphia is exempt from act 32.

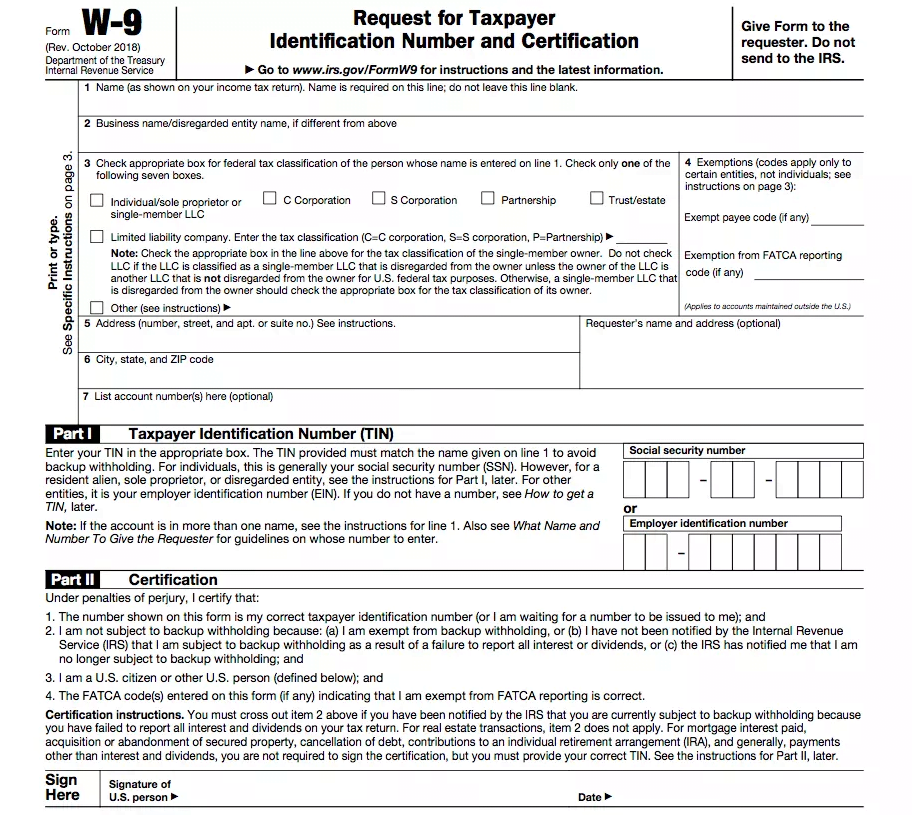

Blank W9 Form Fillable 2023 2023 Payroll Calendar

Web w2r annual reconciliation earned income tax. Include those items of compensation, such as various types of retirement plan deferrals and any other items of compensation that are not included in federal Web why you should file online? Department of the treasury—internal revenue service. Philadelphia is exempt from act 32.

Form PA40 Schedule W2S Download Fillable PDF or Fill Online Wage

Enter this amount on the wages line of your tax return. What are pennsylvania's employer withholding requirements? Web why you should file online? Web w2r annual reconciliation earned income tax. Web it is the federal law for employers in the u.s.

Printable 2021 W2 Form Printable Form 2021

Include those items of compensation, such as various types of retirement plan deferrals and any other items of compensation that are not included in federal My box 20 says “philadelphia” instead of “22”. Web w2r annual reconciliation earned income tax. It is free, fast and secure. This change is part of a larger effort to embrace technology to better serve.

W2 Instructions, Which Appear On The Back Of The Paper Copy, Can Also Be Accessed By Clicking On The “W2 Instructions” Tile Found To The Left Of The “Online W2/W2C Forms” Tile.

Web why you should file online? Web select the “online w2/w2c forms” menu option. What are pennsylvania's employer withholding requirements? This information is being furnished to the internal revenue service.

It Provides An Immediate Receipt For Proof That You Filed.

Web visit corporate tax, compliance, and payroll. Web instructions for employee box 1. Department of the treasury—internal revenue service. Ad free shipping on qualified orders.

Copy B—To Be Filed With Employee’s Federal Tax Return.

Web w2r annual reconciliation earned income tax. Philadelphia is exempt from act 32. Find deals and low prices on 2022 tax forms w2 at amazon.com Include those items of compensation, such as various types of retirement plan deferrals and any other items of compensation that are not included in federal

If You Have Not Submitted Or Do Not Submit Your Consent For Electronic Delivery Only By The End Of The Calendar Year, The Payroll Office Will Also Arrange U.s.

This change is part of a larger effort to embrace technology to better serve taxpayers and update departmental operations. It is free, fast and secure. Enter this amount on the wages line of your tax return. It saves time and reduces filing burden.