Payroll Liabilities On Balance Sheet

Payroll Liabilities On Balance Sheet - Customize it to include payroll item in your view, as well as paid. 28th payroll would include increases (credits) to liabilities for fica taxes of $250 (the employer has to. Go to reports, then employees and payroll. Web payroll liabilities are any type of payment related to payroll that a business owes but has not yet paid. Web the entry for the employer's payroll taxes expense for the feb. A payroll liability can include wages an employee earned. Types of payroll liabilities employee. Web payroll liabilities should be posted to a liability account in your chart of accounts. Web for the balance sheet account, run a quick report on that one account, such as payroll liabilities.

28th payroll would include increases (credits) to liabilities for fica taxes of $250 (the employer has to. A payroll liability can include wages an employee earned. Go to reports, then employees and payroll. Web for the balance sheet account, run a quick report on that one account, such as payroll liabilities. Web payroll liabilities are any type of payment related to payroll that a business owes but has not yet paid. Web payroll liabilities should be posted to a liability account in your chart of accounts. Web the entry for the employer's payroll taxes expense for the feb. Types of payroll liabilities employee. Customize it to include payroll item in your view, as well as paid.

28th payroll would include increases (credits) to liabilities for fica taxes of $250 (the employer has to. Go to reports, then employees and payroll. A payroll liability can include wages an employee earned. Web the entry for the employer's payroll taxes expense for the feb. Web for the balance sheet account, run a quick report on that one account, such as payroll liabilities. Customize it to include payroll item in your view, as well as paid. Types of payroll liabilities employee. Web payroll liabilities are any type of payment related to payroll that a business owes but has not yet paid. Web payroll liabilities should be posted to a liability account in your chart of accounts.

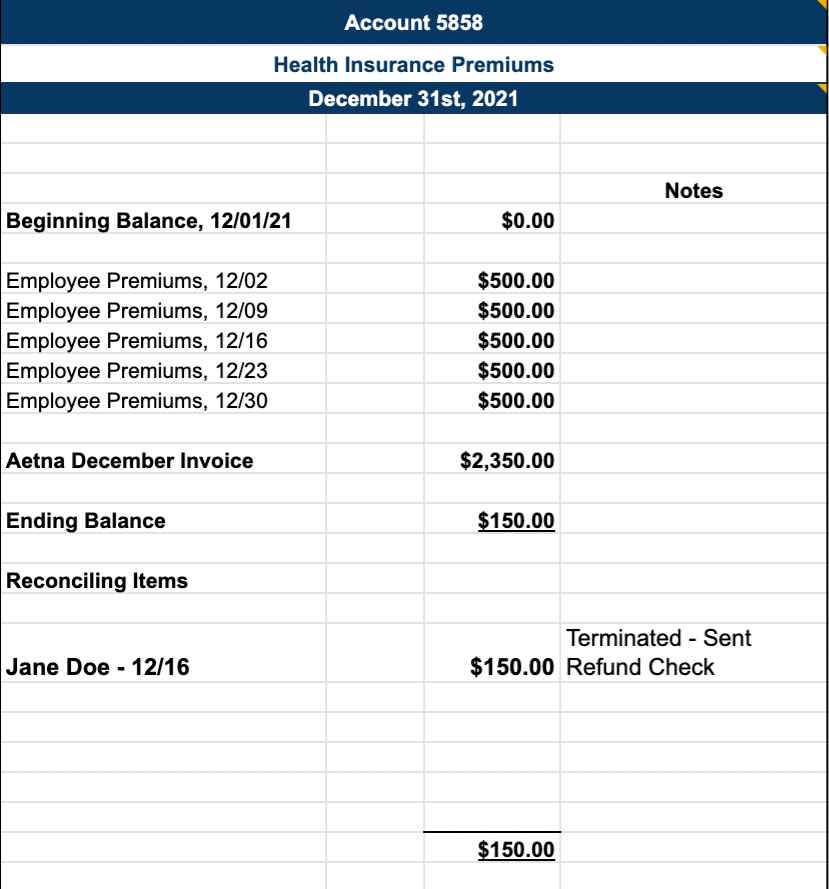

How to Do Payroll Reconciliation for Small Businesses [+ Free

Web payroll liabilities are any type of payment related to payroll that a business owes but has not yet paid. Go to reports, then employees and payroll. A payroll liability can include wages an employee earned. Customize it to include payroll item in your view, as well as paid. 28th payroll would include increases (credits) to liabilities for fica taxes.

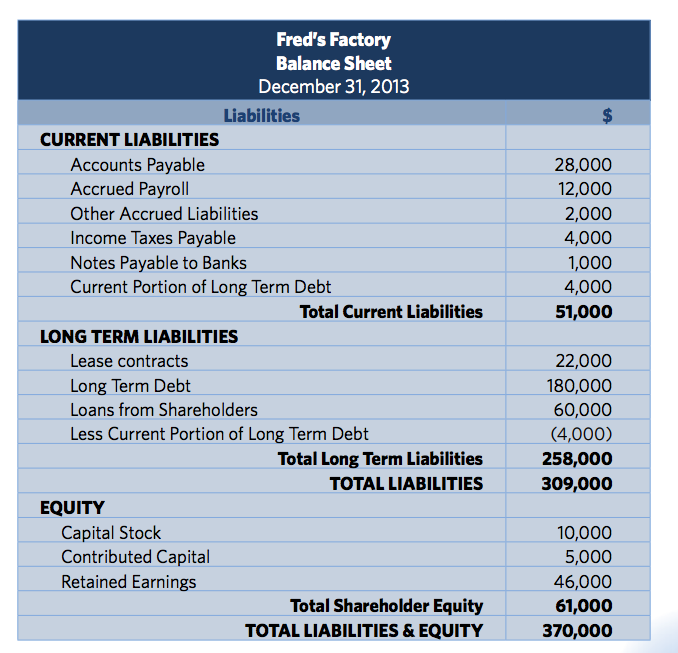

How To Calculate Current Liabilities Haiper

Types of payroll liabilities employee. Go to reports, then employees and payroll. A payroll liability can include wages an employee earned. Web the entry for the employer's payroll taxes expense for the feb. Web for the balance sheet account, run a quick report on that one account, such as payroll liabilities.

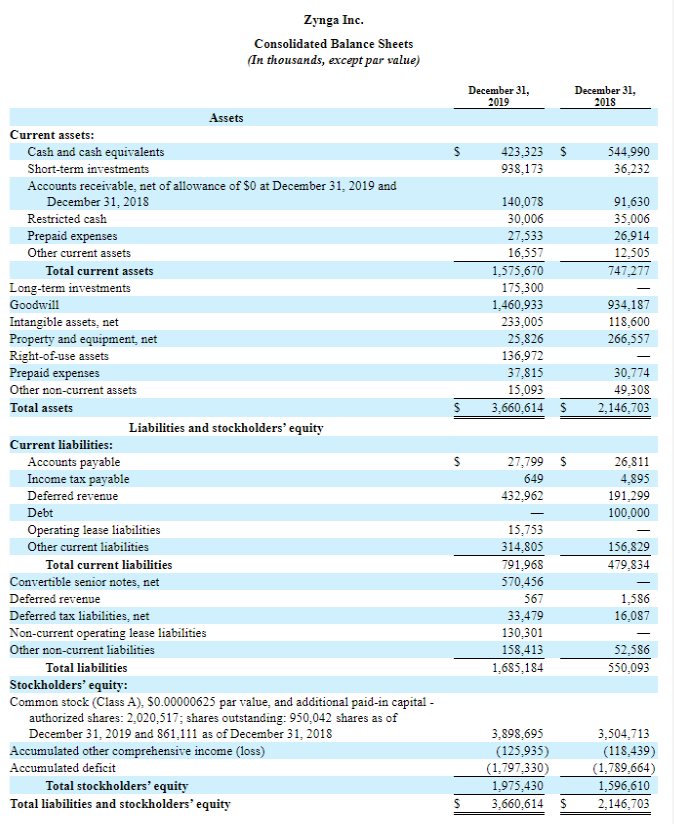

Types of Liabilities

28th payroll would include increases (credits) to liabilities for fica taxes of $250 (the employer has to. Web for the balance sheet account, run a quick report on that one account, such as payroll liabilities. Web the entry for the employer's payroll taxes expense for the feb. Customize it to include payroll item in your view, as well as paid..

Solved QB Desktop Payroll DD reclass QuickBooks Community

Web payroll liabilities are any type of payment related to payroll that a business owes but has not yet paid. Web the entry for the employer's payroll taxes expense for the feb. A payroll liability can include wages an employee earned. Web payroll liabilities should be posted to a liability account in your chart of accounts. Go to reports, then.

Accounting Principles II Payroll Liabilities Accounting Principles

28th payroll would include increases (credits) to liabilities for fica taxes of $250 (the employer has to. Web payroll liabilities are any type of payment related to payroll that a business owes but has not yet paid. A payroll liability can include wages an employee earned. Types of payroll liabilities employee. Web for the balance sheet account, run a quick.

Say Cheese! Bringing the Balance Sheet into Focus Multi Business

Web the entry for the employer's payroll taxes expense for the feb. Web for the balance sheet account, run a quick report on that one account, such as payroll liabilities. Go to reports, then employees and payroll. Web payroll liabilities are any type of payment related to payroll that a business owes but has not yet paid. Customize it to.

Cool Negative Payroll Liabilities Balance Sheet Financial Statement

Go to reports, then employees and payroll. Types of payroll liabilities employee. Web payroll liabilities are any type of payment related to payroll that a business owes but has not yet paid. 28th payroll would include increases (credits) to liabilities for fica taxes of $250 (the employer has to. A payroll liability can include wages an employee earned.

What Are Payroll Liabilities? + How to Calculate Them Hourly, Inc.

Customize it to include payroll item in your view, as well as paid. A payroll liability can include wages an employee earned. 28th payroll would include increases (credits) to liabilities for fica taxes of $250 (the employer has to. Types of payroll liabilities employee. Web payroll liabilities should be posted to a liability account in your chart of accounts.

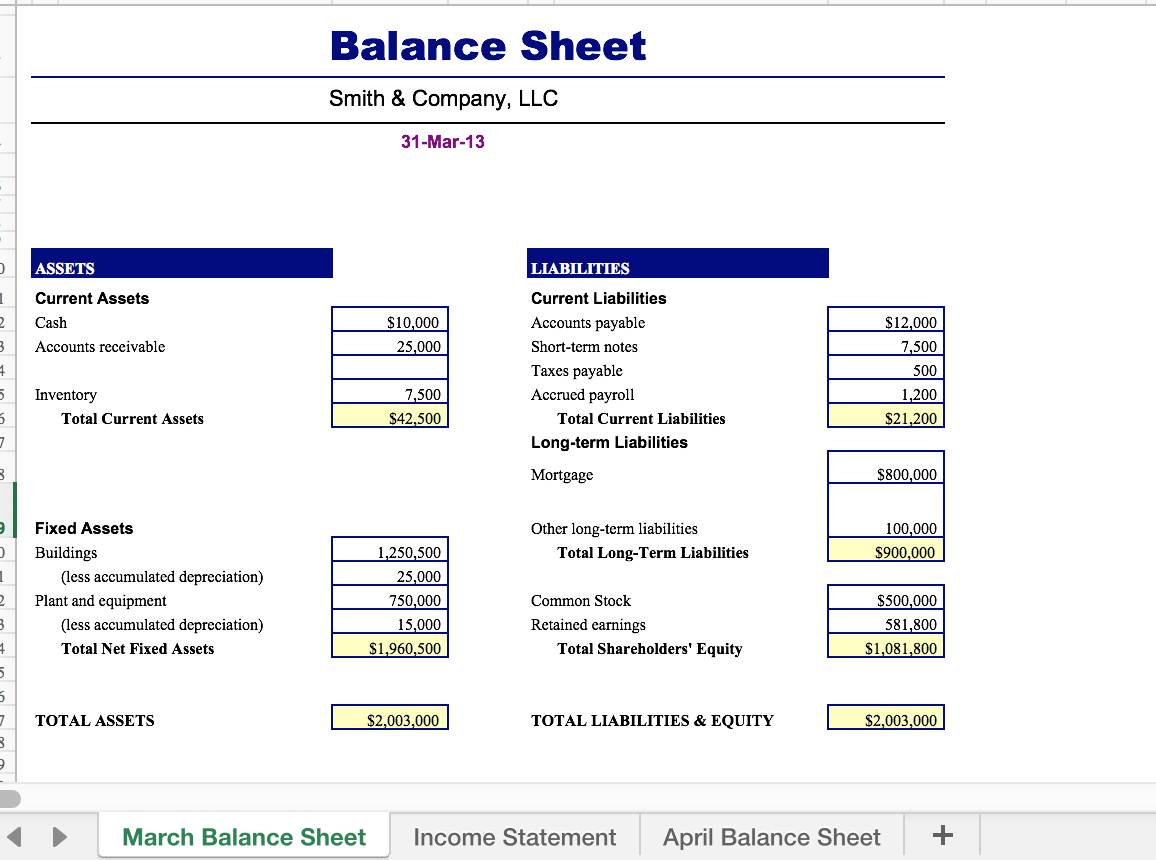

Excel Statement And Balance Sheet Template Template Walls

Types of payroll liabilities employee. Customize it to include payroll item in your view, as well as paid. A payroll liability can include wages an employee earned. Web for the balance sheet account, run a quick report on that one account, such as payroll liabilities. Go to reports, then employees and payroll.

Excel Payroll Spreadsheet Example within Quarterly Balance Sheet

Types of payroll liabilities employee. Go to reports, then employees and payroll. A payroll liability can include wages an employee earned. Web the entry for the employer's payroll taxes expense for the feb. Web for the balance sheet account, run a quick report on that one account, such as payroll liabilities.

28Th Payroll Would Include Increases (Credits) To Liabilities For Fica Taxes Of $250 (The Employer Has To.

Go to reports, then employees and payroll. A payroll liability can include wages an employee earned. Web for the balance sheet account, run a quick report on that one account, such as payroll liabilities. Customize it to include payroll item in your view, as well as paid.

Web Payroll Liabilities Are Any Type Of Payment Related To Payroll That A Business Owes But Has Not Yet Paid.

Web the entry for the employer's payroll taxes expense for the feb. Types of payroll liabilities employee. Web payroll liabilities should be posted to a liability account in your chart of accounts.