Pa Rent Rebate Form 2022

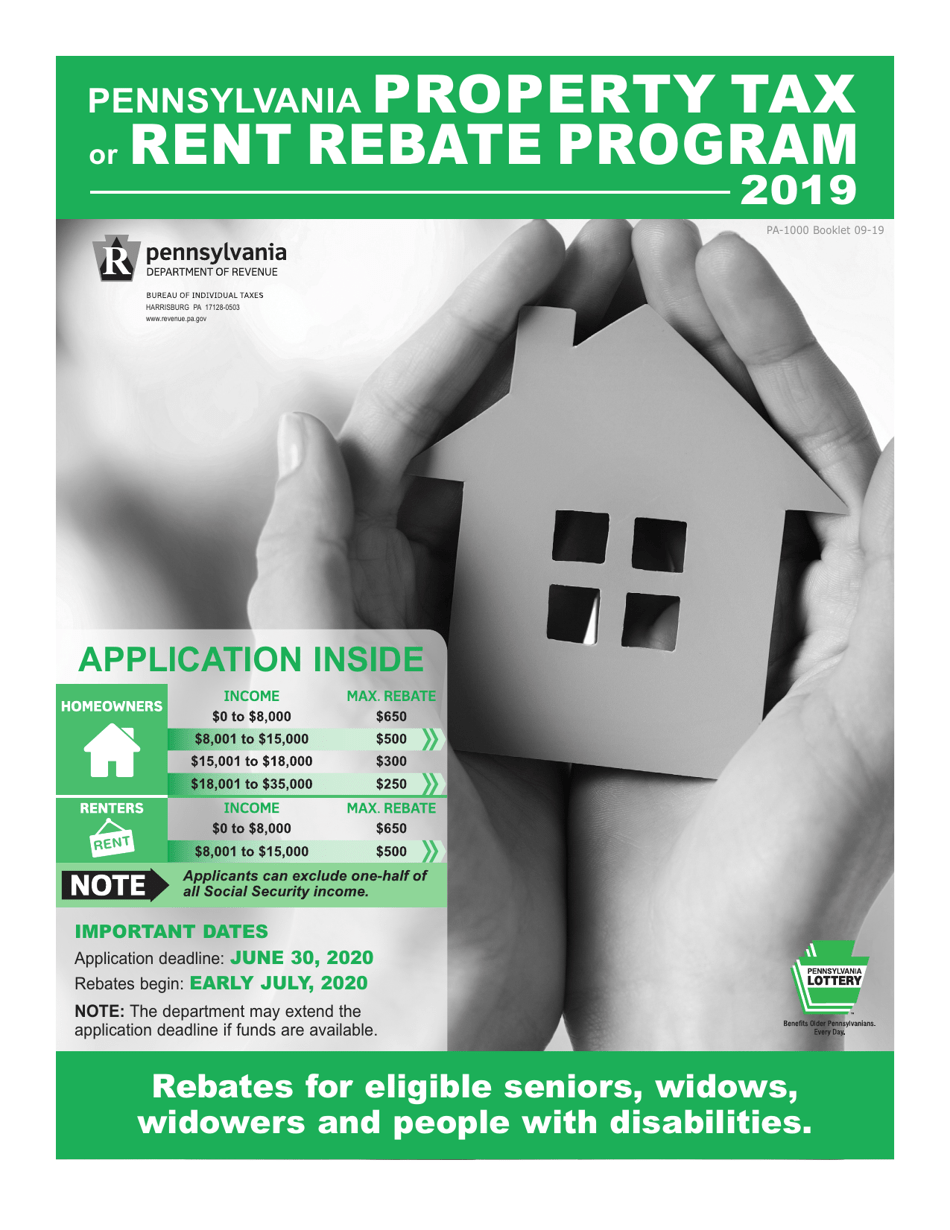

Pa Rent Rebate Form 2022 - Web efile your pennsylvania tax return now efiling is easier, faster, and safer than filling out paper tax forms. Visit the property tax/rent rebate program page on the department's website for more information on the program and eligibility. Since the program’s 1971 inception, older and disabled adults have received more than $7.6 billion in property tax and rent relief. Web harrisburg, pa — older and disabled pennsylvanians can now apply for rebates on property taxes or rent paid in 2022, the department of revenue announced today. Web learn more about the new online filing features for the property tax/rent rebate program by visiting mypath. File your pennsylvania and federal tax returns online with turbotax in minutes. 283,468 rebates on property taxes and rent paid in 2022 will be made starting today. Harrisburg, pa — starting today, 283,468 older homeowners, renters, and people with disabilities across pennsylvania will be issued rebates totaling nearly $132 million. Owners use table a and renters use table b. Web the maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975.

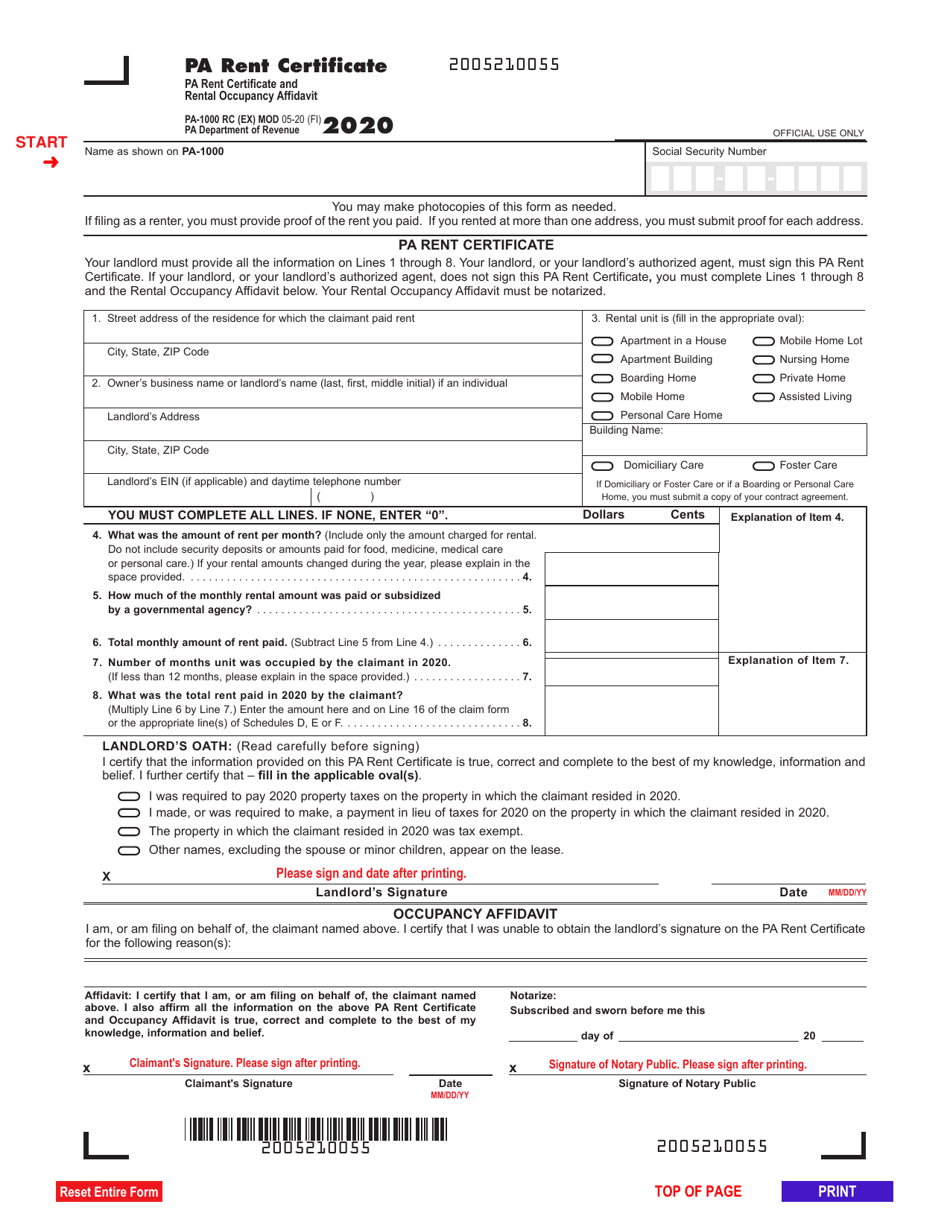

Harrisburg, pa — starting today, 283,468 older homeowners, renters, and people with disabilities across pennsylvania will be issued rebates totaling nearly $132 million. Free for simple returns, with discounts available for taxformfinder users! The property tax/rent rebate program is one of five programs supported by the pennsylvania lottery. File your pennsylvania and federal tax returns online with turbotax in minutes. Web the maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. Web property tax/rent rebate program forms. This assistance is available through the property tax/rent rebate program , which has delivered more than $7.6 billion to eligible pennsylvanians since the program's. Since the program’s 1971 inception, older and disabled adults have received more than $7.6 billion in property tax and rent relief. If you rented at more than one address, you must submit proof for each address. Visit the property tax/rent rebate program page on the department's website for more information on the program and eligibility.

June 30, 2023 rebates begin: Visit the property tax/rent rebate program page on the department's website for more information on the program and eligibility. This assistance is available through the property tax/rent rebate program , which has delivered more than $7.6 billion to eligible pennsylvanians since the program's. Web the maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. File now with turbotax related pennsylvania other forms: Web property tax/rent rebate program forms. Harrisburg, pa — starting today, 283,468 older homeowners, renters, and people with disabilities across pennsylvania will be issued rebates totaling nearly $132 million. If filing as a renter, you must provide proof of the rent you paid. File your pennsylvania and federal tax returns online with turbotax in minutes. Web learn more about the new online filing features for the property tax/rent rebate program by visiting mypath.

Pennsylvania Property Tax/Rent Rebate 5 Free Templates in PDF, Word

June 30, 2023 rebates begin: Web the maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. The rebates will be distributed to eligible pennsylvanians who submitted an. Web property tax/rent rebate program forms. Owners use table a and renters use table b.

PA1000 2014 Property Tax or Rent Rebate Claim Free Download

Web efile your pennsylvania tax return now efiling is easier, faster, and safer than filling out paper tax forms. If filing as a renter, you must provide proof of the rent you paid. File now with turbotax related pennsylvania other forms: Visit the property tax/rent rebate program page on the department's website for more information on the program and eligibility..

2021 Form PA PA1000 Fill Online, Printable, Fillable, Blank pdfFiller

283,468 rebates on property taxes and rent paid in 2022 will be made starting today. If you rented at more than one address, you must submit proof for each address. The property tax/rent rebate program is one of five programs supported by the pennsylvania lottery. File your pennsylvania and federal tax returns online with turbotax in minutes. June 30, 2023.

PA Rent Rebate Form Printable Rebate Form

Since the program’s 1971 inception, older and disabled adults have received more than $7.6 billion in property tax and rent relief. 283,468 rebates on property taxes and rent paid in 2022 will be made starting today. Web property tax/rent rebate program forms. Web learn more about the new online filing features for the property tax/rent rebate program by visiting mypath..

Form PA1000 RC Download Fillable PDF or Fill Online Pa Rent

Web property tax/rent rebate program forms. This assistance is available through the property tax/rent rebate program , which has delivered more than $7.6 billion to eligible pennsylvanians since the program's. Web harrisburg, pa — older and disabled pennsylvanians can now apply for rebates on property taxes or rent paid in 2022, the department of revenue announced today. If you rented.

“Driveup” Property Tax or Rent Rebate Event! Senator Lindsey Williams

Web property tax/rent rebate program forms. Web the maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. Since the program’s 1971 inception, older and disabled adults have received more than $7.6 billion in property tax and rent relief. This assistance is available through the property tax/rent rebate program , which has delivered more.

Download Instructions for Form PA1000 Property Tax or Rent Rebate

Owners use table a and renters use table b. File now with turbotax related pennsylvania other forms: Web the maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. The property tax/rent rebate program is one of five programs supported by the pennsylvania lottery. Harrisburg, pa — starting today, 283,468 older homeowners, renters, and.

20132022 Form WI Rent Certificate Fill Online, Printable, Fillable

June 30, 2023 rebates begin: Free for simple returns, with discounts available for taxformfinder users! Owners use table a and renters use table b. File now with turbotax related pennsylvania other forms: Web harrisburg, pa — older and disabled pennsylvanians can now apply for rebates on property taxes or rent paid in 2022, the department of revenue announced today.

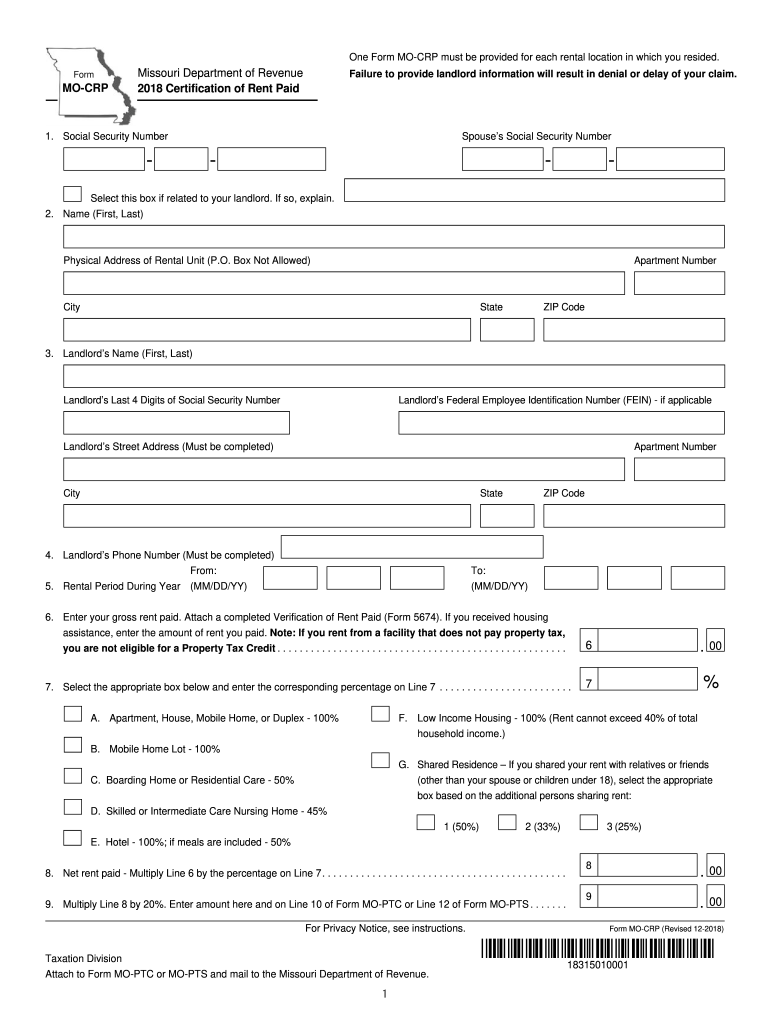

Missouri Rent Rebate 2019 Form Fill Out and Sign Printable PDF

The rebates will be distributed to eligible pennsylvanians who submitted an. 283,468 rebates on property taxes and rent paid in 2022 will be made starting today. If filing as a renter, you must provide proof of the rent you paid. Web efile your pennsylvania tax return now efiling is easier, faster, and safer than filling out paper tax forms. June.

PA Property Tax/Rent Rebate Apply by 6/30/2023 — Legal Aid of

283,468 rebates on property taxes and rent paid in 2022 will be made starting today. File now with turbotax related pennsylvania other forms: This assistance is available through the property tax/rent rebate program , which has delivered more than $7.6 billion to eligible pennsylvanians since the program's. If you rented at more than one address, you must submit proof for.

If You Rented At More Than One Address, You Must Submit Proof For Each Address.

The property tax/rent rebate program is one of five programs supported by the pennsylvania lottery. Web learn more about the new online filing features for the property tax/rent rebate program by visiting mypath. Web harrisburg, pa — older and disabled pennsylvanians can now apply for rebates on property taxes or rent paid in 2022, the department of revenue announced today. If filing as a renter, you must provide proof of the rent you paid.

Visit The Property Tax/Rent Rebate Program Page On The Department's Website For More Information On The Program And Eligibility.

This assistance is available through the property tax/rent rebate program , which has delivered more than $7.6 billion to eligible pennsylvanians since the program's. Harrisburg, pa — starting today, 283,468 older homeowners, renters, and people with disabilities across pennsylvania will be issued rebates totaling nearly $132 million. File now with turbotax related pennsylvania other forms: Web property tax/rent rebate program forms.

Owners Use Table A And Renters Use Table B.

Free for simple returns, with discounts available for taxformfinder users! Web the maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. The rebates will be distributed to eligible pennsylvanians who submitted an. 283,468 rebates on property taxes and rent paid in 2022 will be made starting today.

June 30, 2023 Rebates Begin:

Web efile your pennsylvania tax return now efiling is easier, faster, and safer than filling out paper tax forms. File your pennsylvania and federal tax returns online with turbotax in minutes. Since the program’s 1971 inception, older and disabled adults have received more than $7.6 billion in property tax and rent relief.