Oregon Income Tax Extension Form

Oregon Income Tax Extension Form - Check your irs tax refund status. Your 2021 oregon tax is due april 18,. Your 2019 oregon tax is due july 15,. Check the extension box on the voucher and send it in by the original due date of the return, with payment if. Web if you don’t have a valid federal extension and owe state tax due, file a separate state tax extension form on or before the original due date of your return. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Or personal income tax returns are due by april 15 th in most years. Web irs form 4868 $34.95 now only $29.95 file your personal tax extension now! Web current forms and publications. Web the personal income tax rate is 1.5% on multnomah county taxable income over $125,000 for individuals or $200,000 for joint filers, and an additional 1.5% on multnomah county.

Pay all or some of your oregon income taxes online via: Web if you don’t have a valid federal extension and owe state tax due, file a separate state tax extension form on or before the original due date of your return. Or personal income tax returns are due by april 15 th in most years. Your 2019 oregon tax is due july 15,. Web form 2350, application for extension of time to file u.s. Web irs form 4868 $34.95 now only $29.95 file your personal tax extension now! You can complete the forms with the help of. View all of the current year's forms and publications by popularity or program area. Select a heading to view its forms, then u se the search. If you cannot file by that.

Web the oregon tax forms are listed by tax year below and all or back taxes for previous years would have to be mailed in. Web oregon filing due date: Your rights as a taxpayer. Make your check, money order, or cashier’s check payable to the oregon department of revenue. Your oregon corporation tax must be fully paid by the original due date (april 15) or else penalties will. Web form 2350, application for extension of time to file u.s. Your 2021 oregon tax is due april 18,. Web the extension form and instructions are available on revenue online. Sign into your efile.com account and check acceptance by the irs. Check your irs tax refund status.

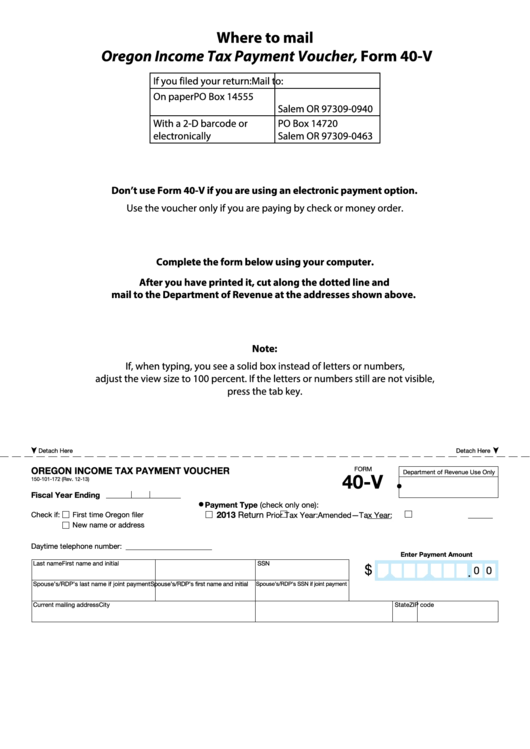

Fillable Form 40V Oregon Tax Payment Voucher printable pdf

If you cannot file by that. Web current forms and publications. Check the extension box on the voucher and send it in by the original due date of the return, with payment if. Web if you don’t have a valid federal extension and owe state tax due, file a separate state tax extension form on or before the original due.

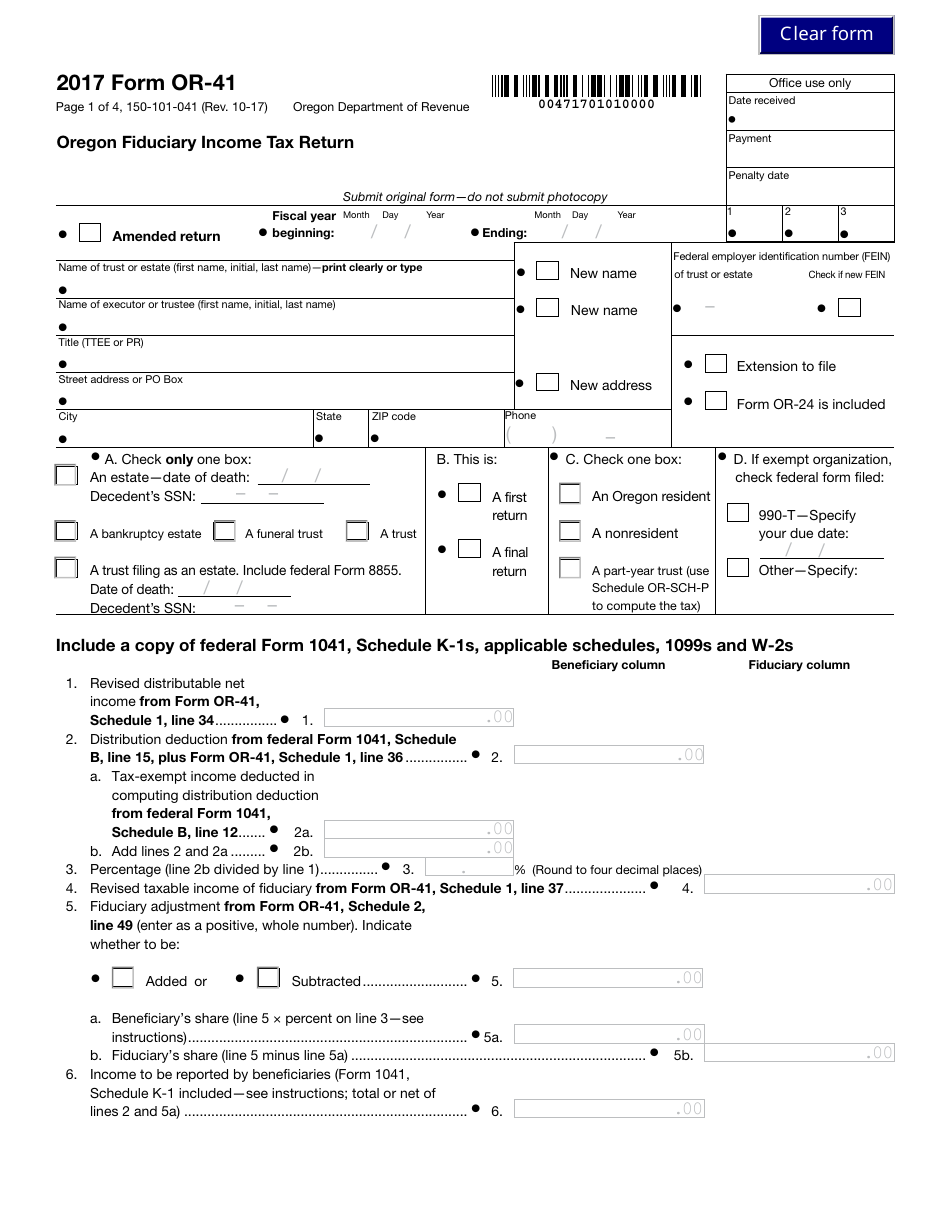

Form OR41 Download Fillable PDF or Fill Online Oregon Fiduciary

If you cannot file by that. Web the extension form and instructions are available on revenue online. Web a tax extension gives you more time to file, but not more time to pay. Web oregon filing due date: Web if you don’t have a valid federal extension and owe state tax due, file a separate state tax extension form on.

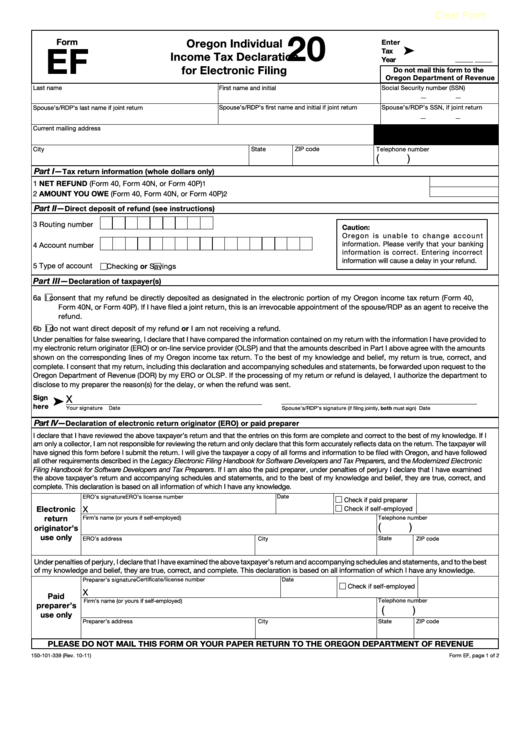

Fillable Form Ef Oregon Individual Tax Declaration For

Check the extension box on the voucher and send it in by the original due date of the return, with payment if. Your oregon corporation tax must be fully paid by the original due date (april 15) or else penalties will. Income tax return (for u.s. Web form 2350, application for extension of time to file u.s. Web current forms.

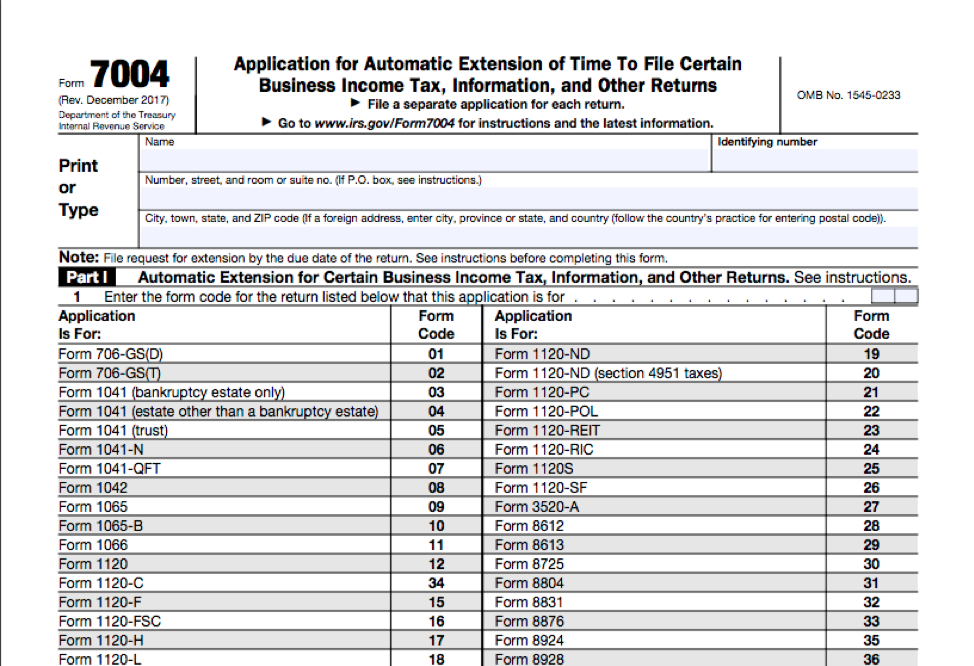

How Long Is An Extension For Business Taxes Business Walls

If you owe or income taxes, you will either have to submit a or tax. You can complete the forms with the help of. Sign into your efile.com account and check acceptance by the irs. Web apply for an extension. Web the personal income tax rate is 1.5% on multnomah county taxable income over $125,000 for individuals or $200,000 for.

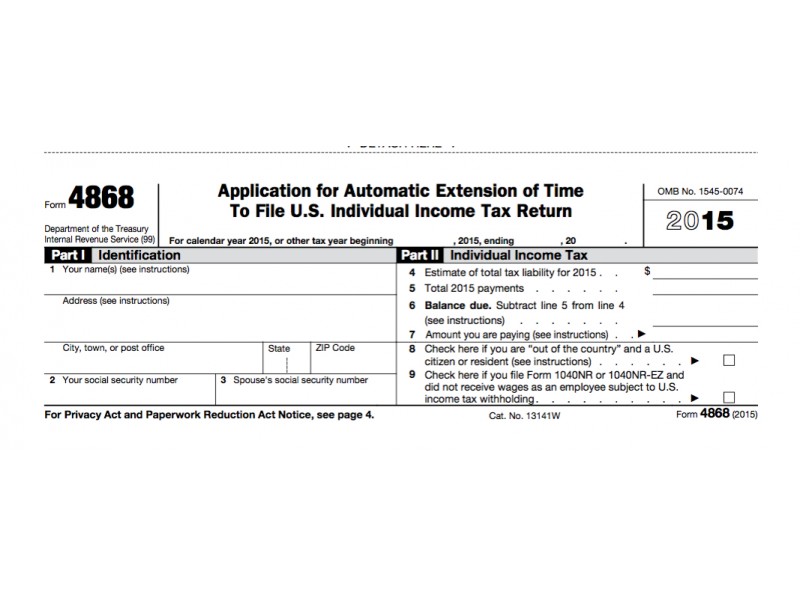

IRS Form 4868 Extension For 2016 Tax Deadline Oregon City, OR Patch

Web a tax extension gives you more time to file, but not more time to pay. Income tax return (for u.s. Your rights as a taxpayer. Web the oregon tax forms are listed by tax year below and all or back taxes for previous years would have to be mailed in. Extended deadline with oregon tax extension:

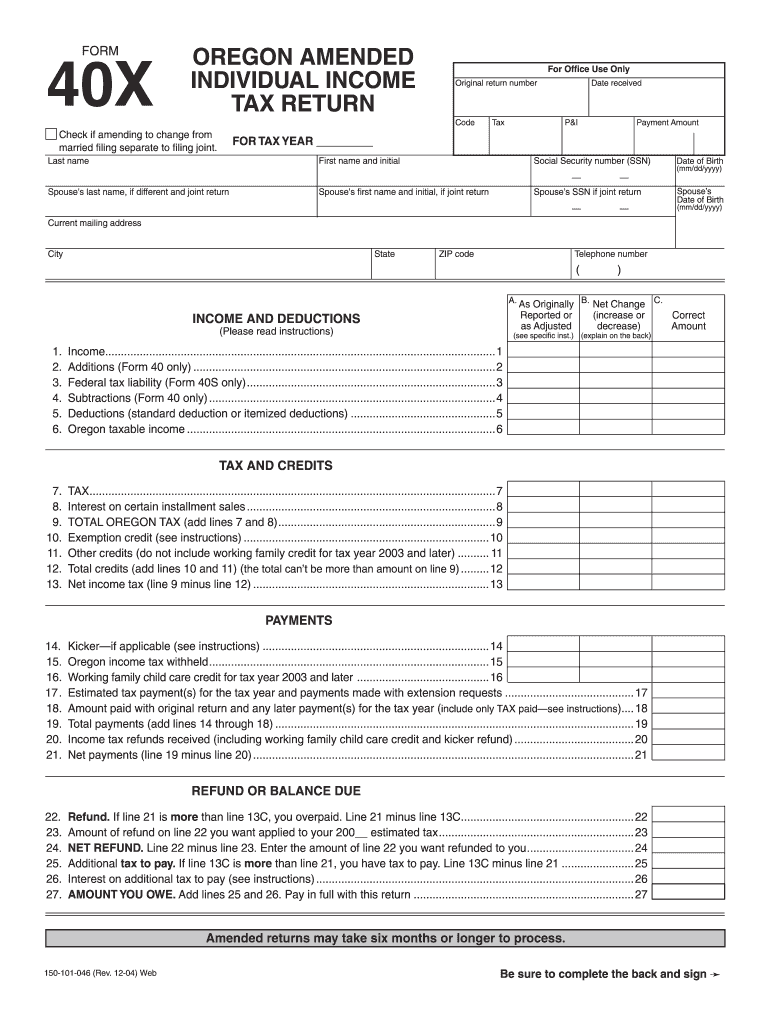

Oregon Form 40X Fill Out and Sign Printable PDF Template signNow

Extended deadline with oregon tax extension: Web a tax extension gives you more time to file, but not more time to pay. Web irs form 4868 $34.95 now only $29.95 file your personal tax extension now! Web the personal income tax rate is 1.5% on multnomah county taxable income over $125,000 for individuals or $200,000 for joint filers, and an.

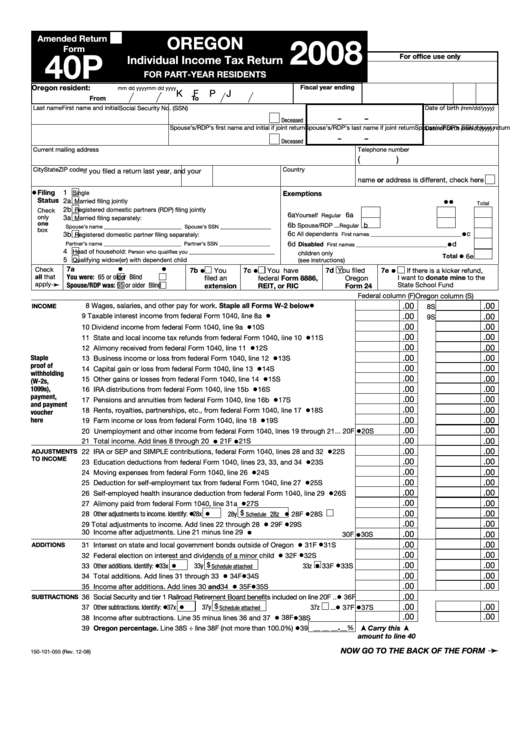

Fillable Form 40p Oregon Individual Tax Return For PartYear

You can complete the forms with the help of. View all of the current year's forms and publications by popularity or program area. Web a tax extension gives you more time to file, but not more time to pay. Web current forms and publications. Check your irs tax refund status.

Ny State Tax Extension Form It 201 Form Resume Examples erkKMqB5N8

Web apply for an extension. Your oregon corporation tax must be fully paid by the original due date (april 15) or else penalties will. Or personal income tax returns are due by april 15 th in most years. Web if you don’t have a valid federal extension and owe state tax due, file a separate state tax extension form on.

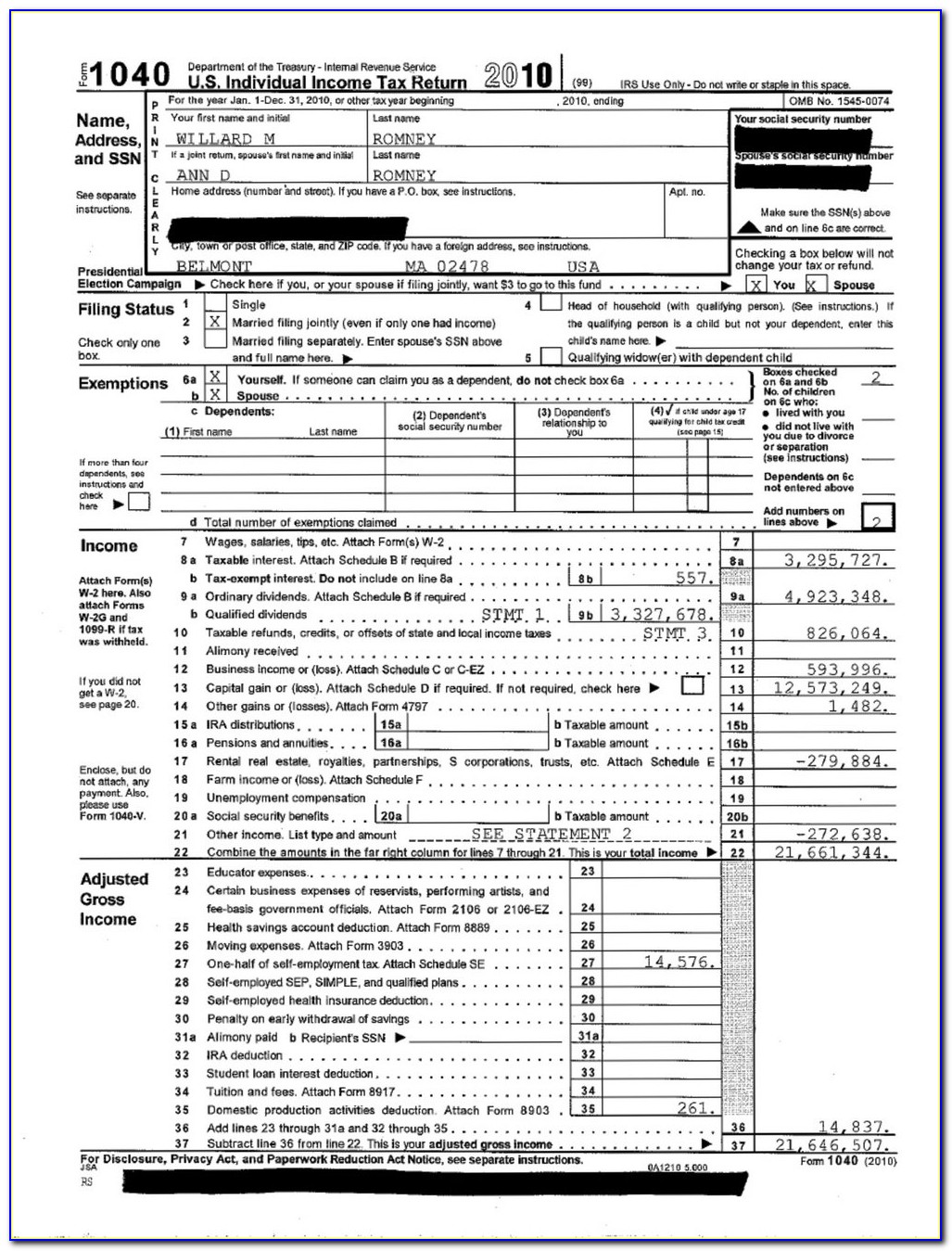

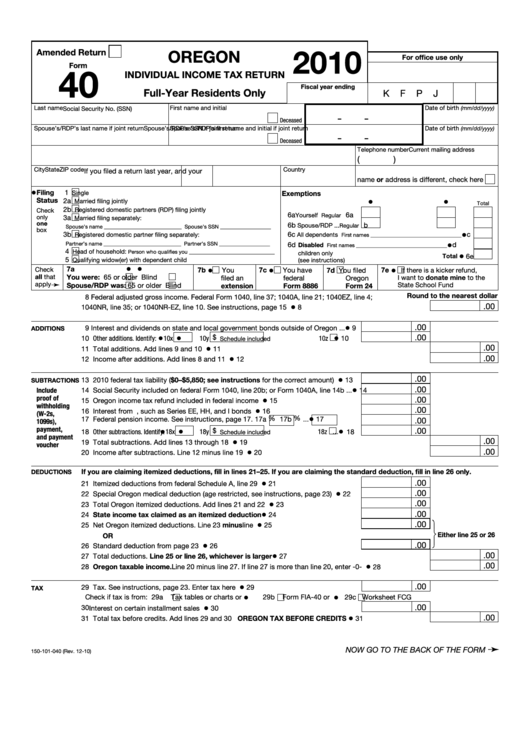

Fillable Form 40 Oregon Individual Tax Return (FullYear

Citizens and resident aliens abroad who expect to qualify for special. Web oregon filing due date: Web the oregon tax forms are listed by tax year below and all or back taxes for previous years would have to be mailed in. Your 2021 oregon tax is due april 18,. If you cannot file by that.

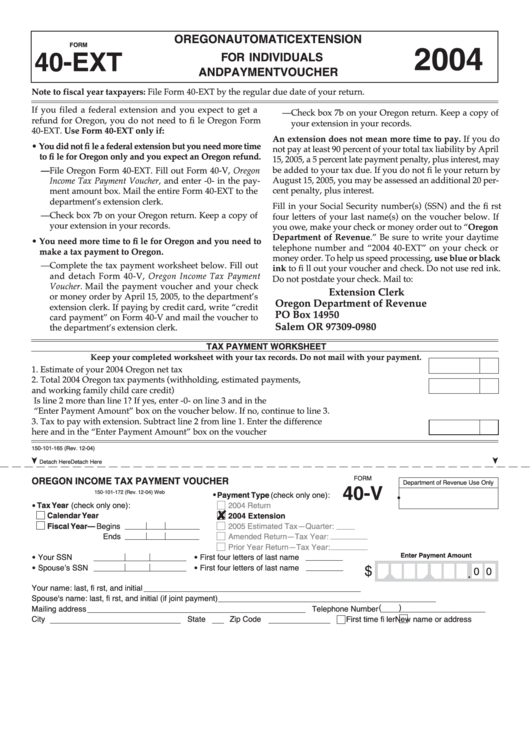

Fillable Form 40Ext Oregon Automatic Extension For Individuals And

If you owe or income taxes, you will either have to submit a or tax. Oregon doesn’t allow an extension of time to pay your tax, even if the irs is allowing an extension. Check the extension box on the voucher and send it in by the original due date of the return, with payment if. Check your irs tax.

Web Federal Tax Law No Extension To Pay.

Check your irs tax refund status. Web current forms and publications. Web oregon filing due date: Your 2019 oregon tax is due july 15,.

Oregon Doesn’t Allow An Extension Of Time To Pay Your Tax, Even If The Irs Is Allowing An Extension.

Web form 2350, application for extension of time to file u.s. Web a tax extension gives you more time to file, but not more time to pay. Web arts tax returns arts tax returns in additional languages 2022 personal income tax returns 2021 personal income tax returns general portland/multnomah county. If you cannot file by that.

Income Tax Return (For U.s.

Web the extension form and instructions are available on revenue online. Web if you don’t have a valid federal extension and owe state tax due, file a separate state tax extension form on or before the original due date of your return. Pay all or some of your oregon income taxes online via: Or personal income tax returns are due by april 15 th in most years.

Citizens And Resident Aliens Abroad Who Expect To Qualify For Special.

Web irs form 4868 $34.95 now only $29.95 file your personal tax extension now! Web the personal income tax rate is 1.5% on multnomah county taxable income over $125,000 for individuals or $200,000 for joint filers, and an additional 1.5% on multnomah county. Oregon individual income tax returns are due by april 15, in most years. Sign into your efile.com account and check acceptance by the irs.