Onlyfans W9 Form

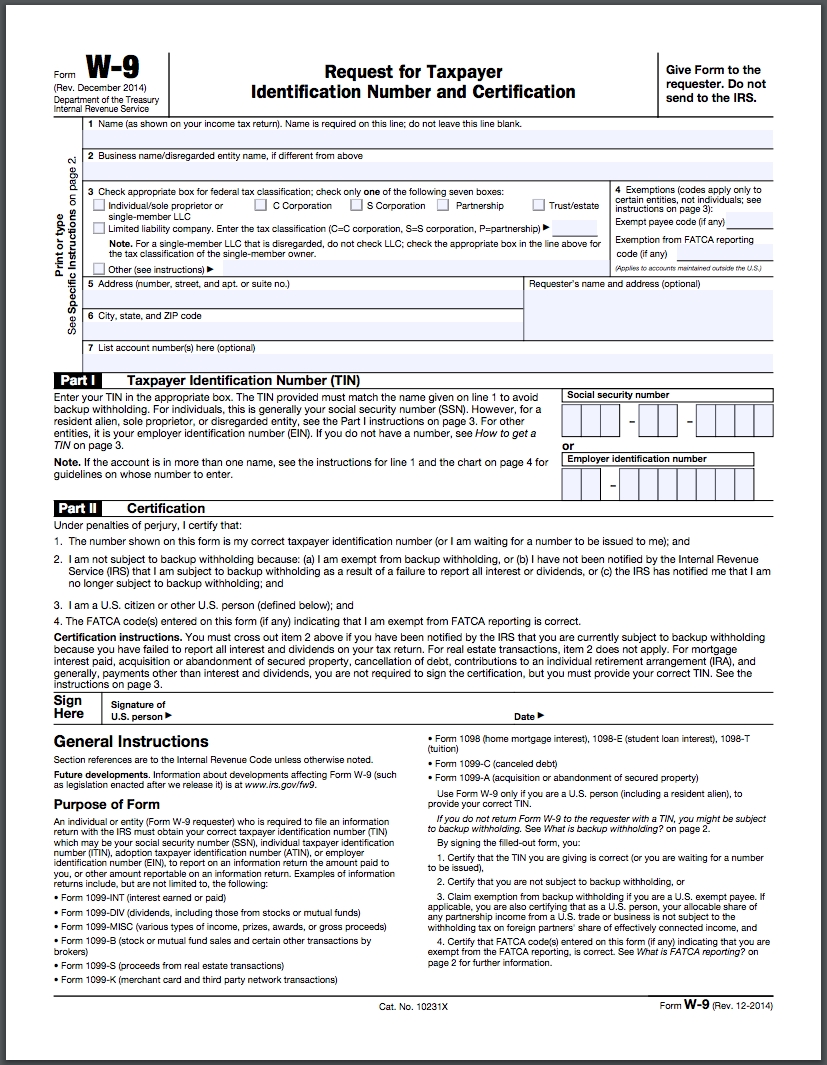

Onlyfans W9 Form - Web what is onlyfans w9 form? Login to your onlyfans account using your login credentials. Web onlyfans is the social platform revolutionizing creator and fan connections. The site is inclusive of artists and content creators from all genres and allows them to monetize their. I hope this video helps some of you out. I feel so dumb i don’t know why but i thought i had already sent this out to them. Navigate to the “banking” section in your settings. I made my onlyfans in january and thought i already sent it out. Person (including a resident alien), to provide your correct tin. You’ll get a 1099 (self employment tax form) if you make more than $600 per year.

You will be required to pay back around 25ish% since 1099/self. The site is inclusive of artists and content creators from all genres and allows them to monetize their. Onlyfans w9 form is a tax form that is used to report income to the internal revenue service (irs). Web a w9 form is a tax form used to gather information from independent contractors or freelancers. Web what is onlyfans w9 form? It’s used to report income paid to the irs. This form is commonly used by u.s. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Web trouble with w9 form for onlyfans i have seen another post about this and tried to follow the advice there but it doesn’t seem to be working. As a content creator on the platform, you must fill.

Web a w9 form is a tax form used to gather information from independent contractors or freelancers. I feel so dumb i don’t know why but i thought i had already sent this out to them. I hope you get the general idea on how onlyfans works. Web trouble with w9 form for onlyfans i have seen another post about this and tried to follow the advice there but it doesn’t seem to be working. I get the validation error asking to. Web you will need to fill out the onlyfans w9 form before you can withdraw earnings. It’s used to report income paid to the irs. Web us3rname9 • 3 yr. You will be required to pay back around 25ish% since 1099/self. Onlyfans w9 form is a tax form that is used to report income to the internal revenue service (irs).

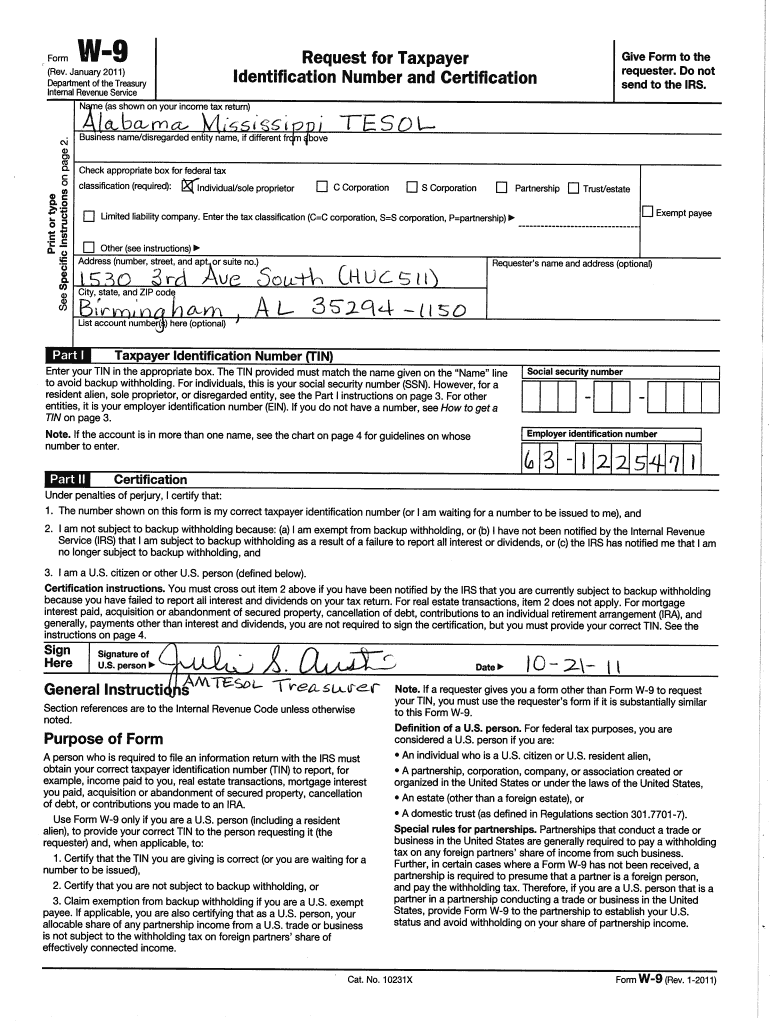

W9 Form 2012 Fill Out and Sign Printable PDF Template signNow

Web us3rname9 • 3 yr. Login to your onlyfans account using your login credentials. Web you will need to fill out the onlyfans w9 form before you can withdraw earnings. Web what is onlyfans w9 form? You’ll get a 1099 (self employment tax form) if you make more than $600 per year.

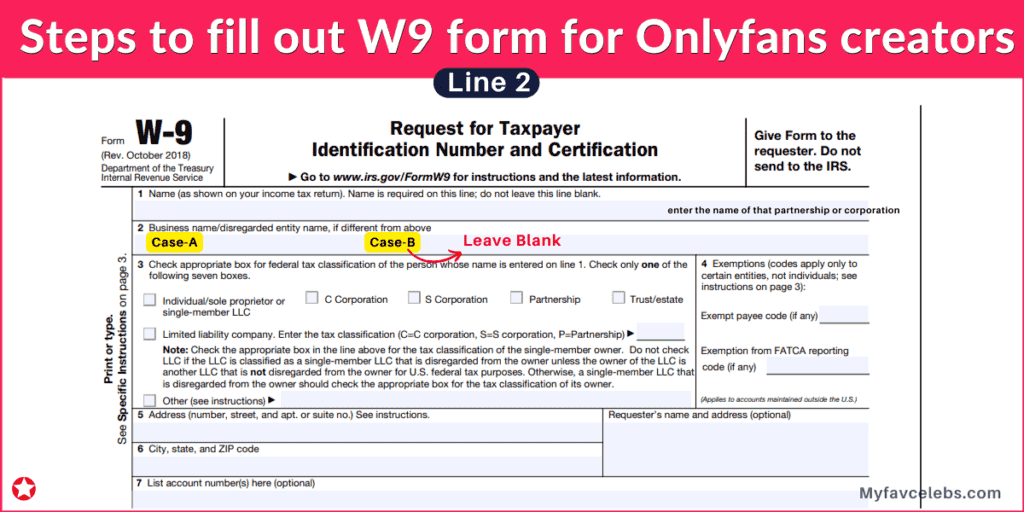

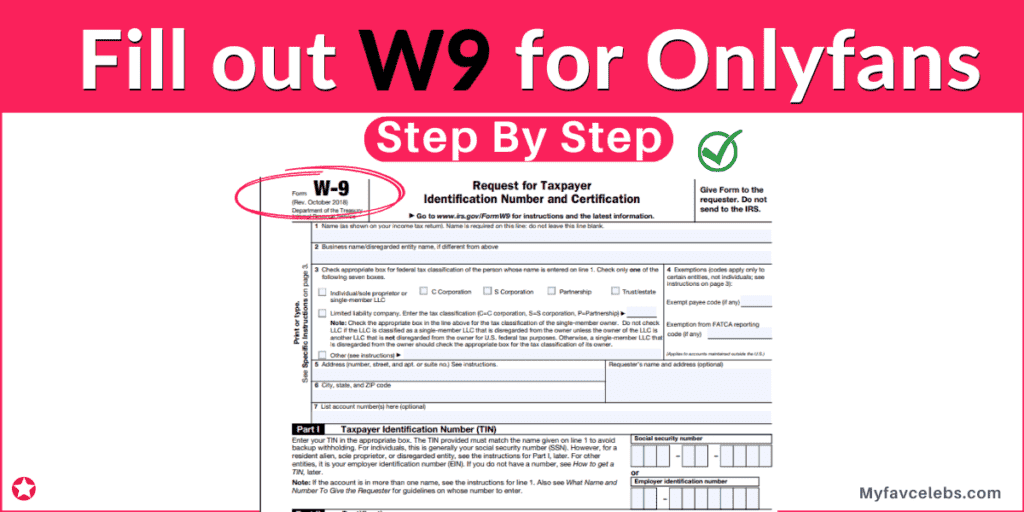

How to fill out W9 for Onlyfans? StepbyStep Guide

I hope this video helps some of you out. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Web answer (1 of 2): I get the validation error asking to. Login to your onlyfans account using your login credentials.

how to use onlyfans and fill out the w9 form YouTube

I get the validation error asking to. Web what is onlyfans w9 form? I made my onlyfans in january and thought i already sent it out. Navigate to the “banking” section in your settings. Login to your onlyfans account using your login credentials.

How to file OnlyFans taxes (W9 and 1099 forms explained)

I hope this video helps some of you out. You’ll get a 1099 (self employment tax form) if you make more than $600 per year. Person (including a resident alien), to provide your correct tin. Web us3rname9 • 3 yr. Web a w9 form is a tax form used to gather information from independent contractors or freelancers.

How to fill out a w9 form for onlyfans 🔥

If you look at your screen or if you’re reading the memo. Login to your onlyfans account using your login credentials. Navigate to the “banking” section in your settings. You will be required to pay back around 25ish% since 1099/self. The site is inclusive of artists and content creators from all genres and allows them to monetize their.

How to fill out W9 for Onlyfans? StepbyStep Guide

Web us3rname9 • 3 yr. The site is inclusive of artists and content creators from all genres and allows them to monetize their. This form is commonly used by u.s. It’s used to report income paid to the irs. I hope this video helps some of you out.

How to fill out a w9 form for onlyfans 🔥

It’s used to report income paid to the irs. Web how to use onlyfans and fill out the w9 form. I get the validation error asking to. Navigate to the “banking” section in your settings. Web us3rname9 • 3 yr.

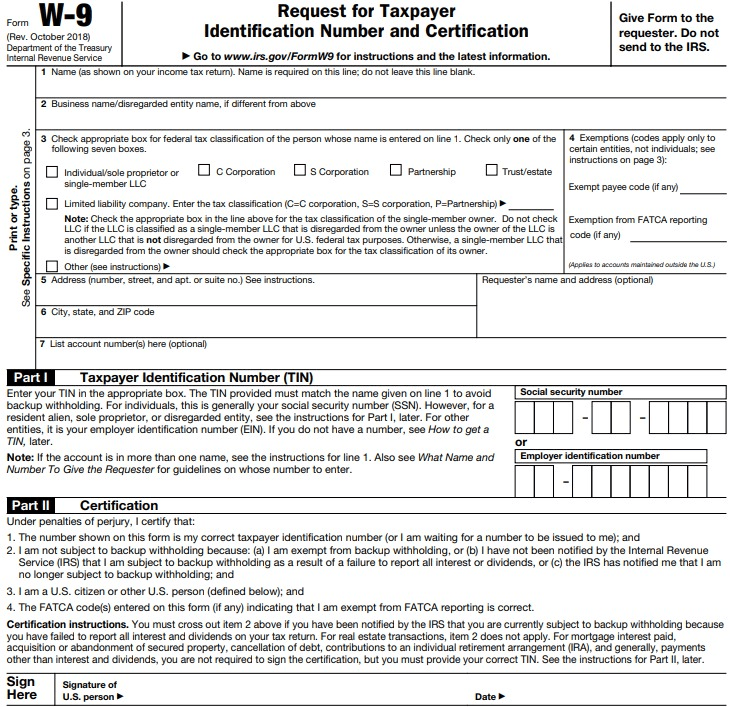

W 9 Form 2020 Printable Free Blank Calendar Template Printable

I hope this video helps some of you out. Person (including a resident alien), to provide your correct tin. Web trouble with w9 form for onlyfans i have seen another post about this and tried to follow the advice there but it doesn’t seem to be working. I made my onlyfans in january and thought i already sent it out..

16+ VIP How To Fill Out W 9 Form For Onlyfans Leaked Photo

You will receive an onlyfans 1099 form in january via mail and a digital version. It’s used to report income paid to the irs. Onlyfans w9 form is a tax form that is used to report income to the internal revenue service (irs). If you look at your screen or if you’re reading the memo. Web you will need to.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

Web onlyfans is the social platform revolutionizing creator and fan connections. It’s used to report income paid to the irs. As a content creator on the platform, you must fill. I get the validation error asking to. Web trouble with w9 form for onlyfans i have seen another post about this and tried to follow the advice there but it.

Login To Your Onlyfans Account Using Your Login Credentials.

Web how to use onlyfans and fill out the w9 form. Web what is onlyfans w9 form? I hope this video helps some of you out. In this article, learn the top 15 tax deductions an of creator can take to reduce tax.

If You Look At Your Screen Or If You’re Reading The Memo.

The site is inclusive of artists and content creators from all genres and allows them to monetize their. Web us3rname9 • 3 yr. Person (including a resident alien), to provide your correct tin. Businesses to request the taxpayer identification.

Navigate To The “Banking” Section In Your Settings.

It’s used to report income paid to the irs. Web a w9 form is a tax form used to gather information from independent contractors or freelancers. Web you will need to fill out the onlyfans w9 form before you can withdraw earnings. You’ll get a 1099 (self employment tax form) if you make more than $600 per year.

You Will Receive An Onlyfans 1099 Form In January Via Mail And A Digital Version.

Web trouble with w9 form for onlyfans i have seen another post about this and tried to follow the advice there but it doesn’t seem to be working. I hope you get the general idea on how onlyfans works. As a content creator on the platform, you must fill. You will be required to pay back around 25ish% since 1099/self.