Oklahoma Form 511Nr

Oklahoma Form 511Nr - We last updated the individual resident income. This form is for income earned in tax year 2022, with tax returns due in. Complete, edit or print tax forms instantly. Web instructions for form 511x this form is for residents only. • instructions for completing the oklahoma resident income tax return form. Download or email 511nr pkt & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. Web 2021 oklahoma resident individual income tax forms and instructions. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. • instructions for completing the form 511:

Web form 511 is the general income tax return for oklahoma residents. This form is for income earned in tax year 2022, with tax returns due in. Web form 511 is the general income tax return for oklahoma residents. We last updated the individual resident income. Complete, edit or print tax forms instantly. Sign, mail form 511 or 511nr to. Form 511 can be efiled, or a paper copy can be filed via mail. When to file an amended return generally, to claim a. Form 511 can be efiled, or a paper copy can be filed via mail. Web we last updated oklahoma form 511nr in january 2023 from the oklahoma tax commission.

Sales tax relief credit form • instructions for the direct deposit option. Web we last updated oklahoma form 511nr in january 2023 from the oklahoma tax commission. Complete, edit or print tax forms instantly. • instructions for completing the oklahoma resident income tax return form. • instructions for completing the 511nr income tax form • 511nr income tax form • 2018. Web form 511 is the general income tax return for oklahoma residents. Get ready for tax season deadlines by completing any required tax forms today. Web 2022 oklahoma resident individual income tax forms and instructions. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. This form is for income earned in tax year 2022, with tax returns due in.

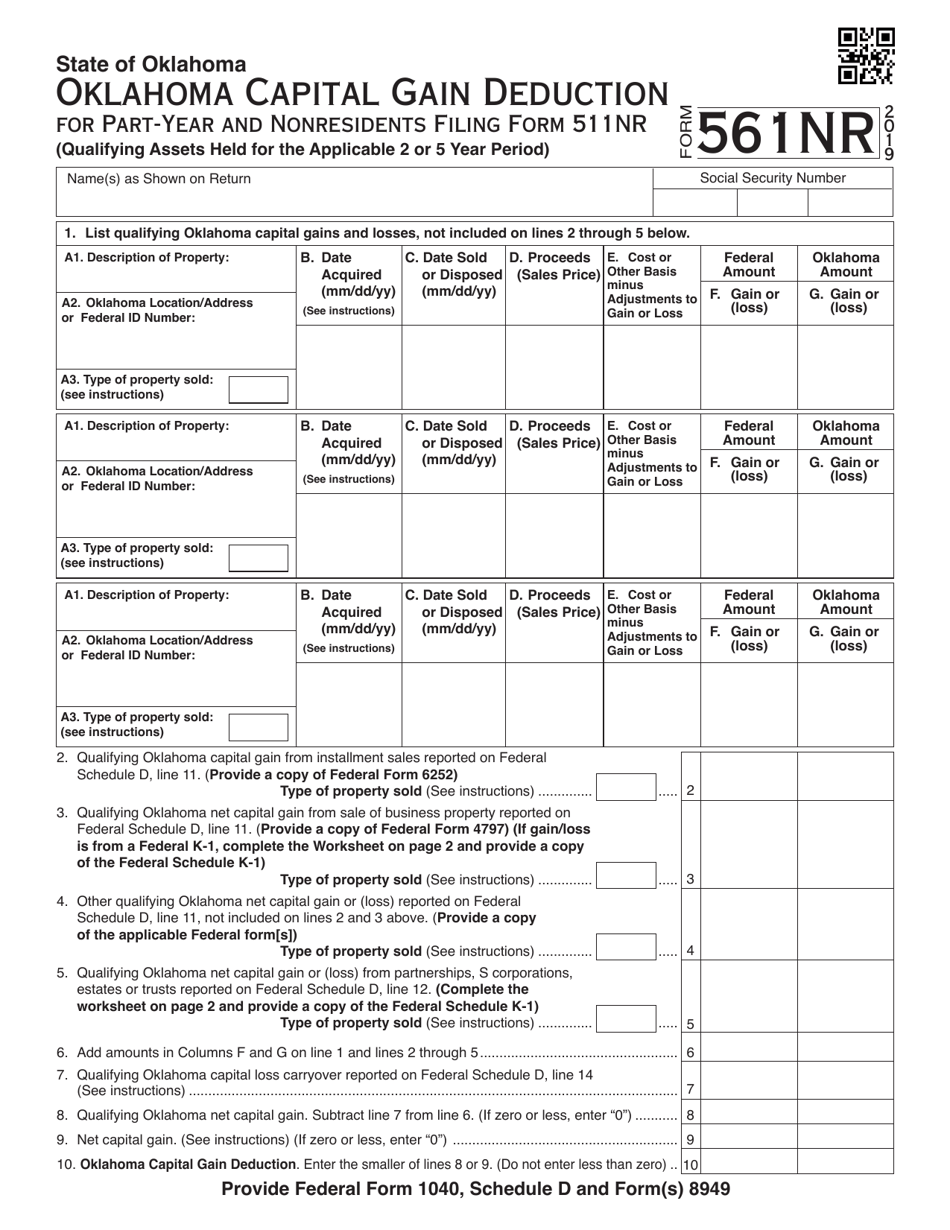

Form 561NR Download Fillable PDF or Fill Online Oklahoma Capital Gain

Provide this page only if you have an amount shown on a schedule. This form is for income earned in tax year 2022, with tax returns due in. Web 2022 oklahoma resident individual income tax forms and instructions. Sales tax relief credit form • instructions for the direct deposit option. • instructions for completing the form 511:

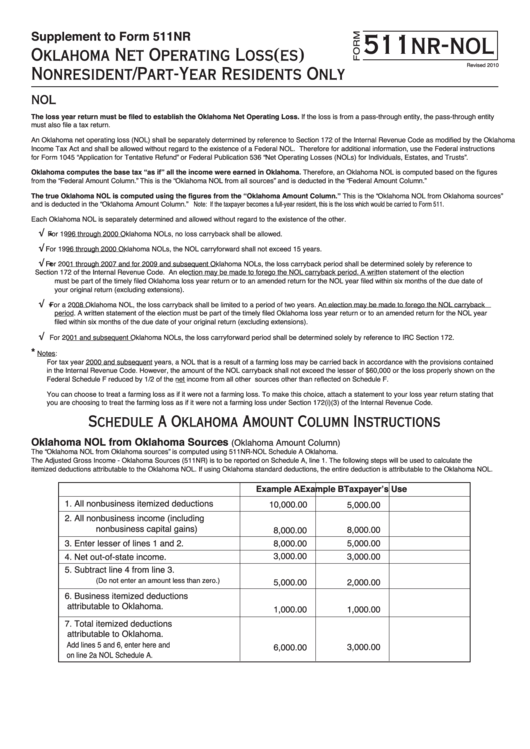

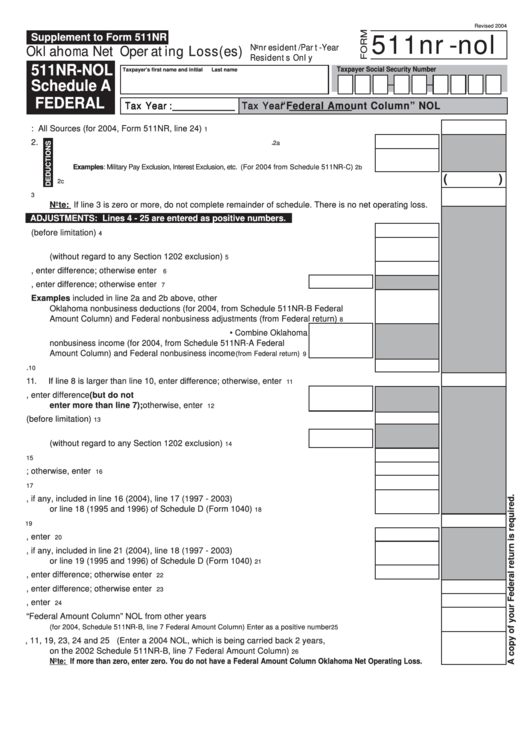

Fillable Form 511nrNol Oklahoma Net Operating Loss(Es) Nonresident

Download or email 511nr pkt & more fillable forms, register and subscribe now! Web form 511 is the general income tax return for oklahoma residents. • instructions for completing the 511nr income tax form • 511nr income tax form • 2018. Form 511 can be efiled, or a paper copy can be filed via mail. When to file an amended.

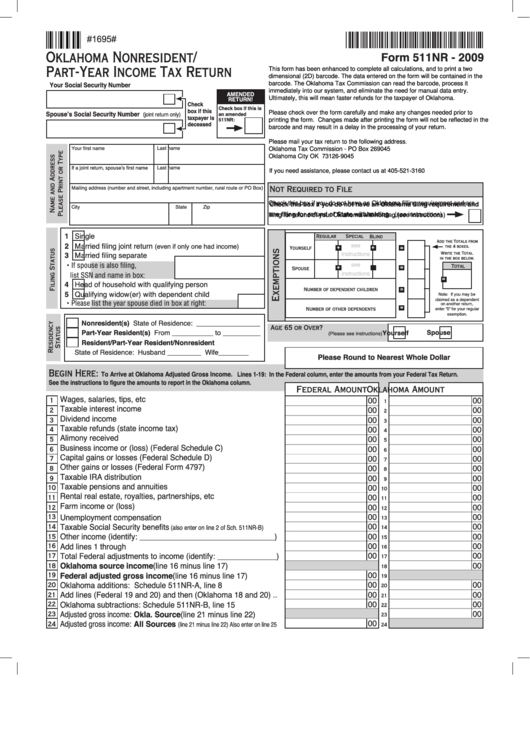

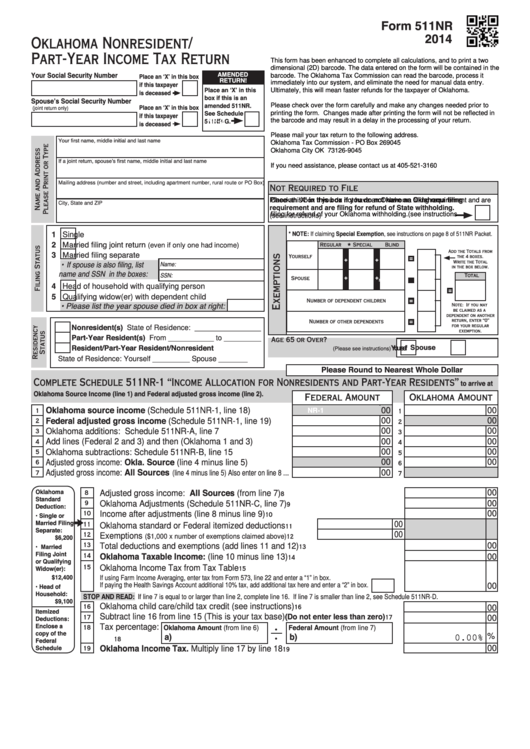

Fillable Form 511nr Oklahoma Nonresident/partYear Tax Return

• instructions for completing the form 511: Complete, edit or print tax forms instantly. • instructions for completing the oklahoma resident income tax return form. Form 511 can be efiled, or a paper copy can be filed via mail. Web 2021 oklahoma resident individual income tax forms and instructions.

2022 Form OK 511NR Packet Fill Online, Printable, Fillable, Blank

Web form 511 is the general income tax return for oklahoma residents. Web instructions for form 511x this form is for residents only. Web 2022 oklahoma resident individual income tax forms and instructions. This form is for income earned in tax year 2022, with tax returns due in. Web form 511 is the general income tax return for oklahoma residents.

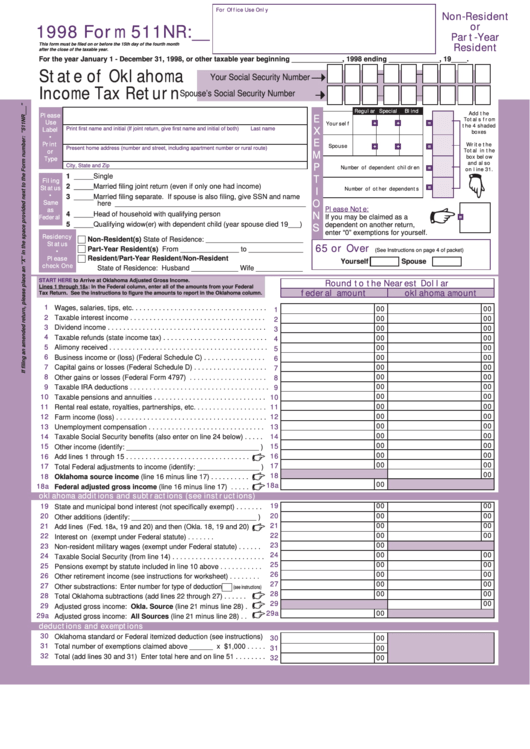

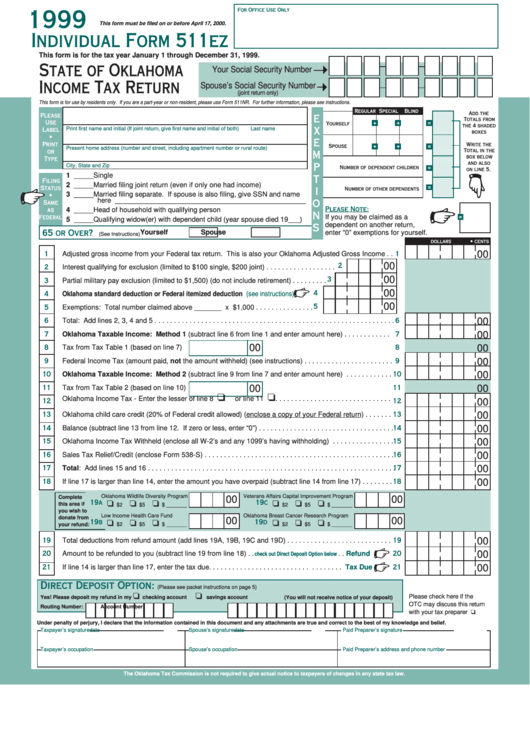

Fillable Form 511nr State Of Oklahoma Tax Return 1998

Form 511 can be efiled, or a paper copy can be filed via mail. We last updated the individual resident income. • instructions for completing the oklahoma resident income tax return form. Web 2022 oklahoma resident individual income tax forms and instructions. Form 511 can be efiled, or a paper copy can be filed via mail.

Form 511nrNol Supplement To Form 511nr Oklahoma Net Operating Loss

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web 2022 oklahoma resident individual income tax forms and instructions. We last updated the individual resident income. Web form 511 is the general income tax return for oklahoma residents.

Individual Form 511ez State Of Oklahoma Tax Return 1999

This form is for income earned in tax year 2022, with tax returns due in. • instructions for completing the 511nr income tax form • 511nr income tax form • 2018. • instructions for completing the oklahoma resident income tax return form. We last updated the individual resident income. Get ready for tax season deadlines by completing any required tax.

Fillable Form 511nr Oklahoma Nonresident/partYear Tax Return

Provide this page only if you have an amount shown on a schedule. • instructions for completing the 511nr income tax form • 511nr income tax form • 2018. Web form 511 is the general income tax return for oklahoma residents. Web we last updated oklahoma form 511nr in january 2023 from the oklahoma tax commission. Web the oklahoma tax.

Form 511NR Oklahoma Nonresident Part Year Tax Return YouTube

This form is for income earned in tax year 2022, with tax returns due in. Web 2021 oklahoma resident individual income tax forms and instructions. Complete, edit or print tax forms instantly. • instructions for completing the oklahoma resident income tax return form. When to file an amended return generally, to claim a.

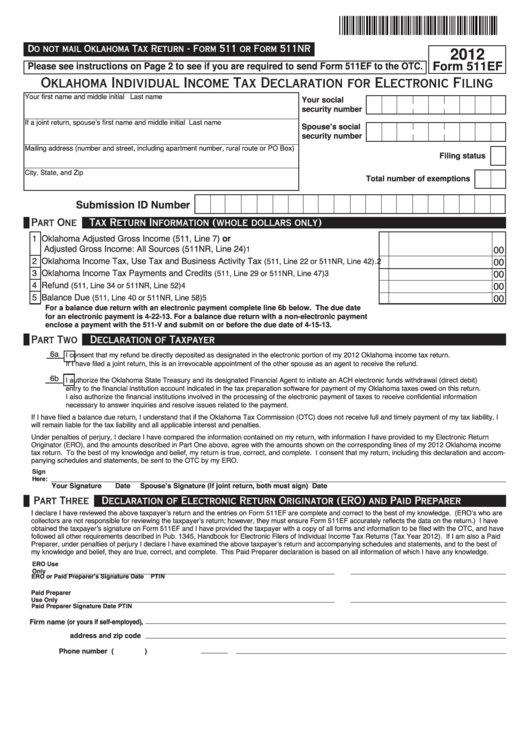

Fillable Form 511ef Oklahoma Individual Tax Declaration For

• instructions for completing the oklahoma resident income tax return form. When to file an amended return generally, to claim a. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. • instructions for completing the 511nr income tax form • 511nr income tax form • 2018. We last.

• Instructions For Completing The 511Nr Income Tax Form • 511Nr Income Tax Form • 2018.

Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in. Web instructions for form 511x this form is for residents only. Sign, mail form 511 or 511nr to.

We Last Updated The Individual Resident Income.

Sales tax relief credit form • instructions for the direct deposit option. Web 2022 oklahoma resident individual income tax forms and instructions. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. Web form 511 is the general income tax return for oklahoma residents.

• Instructions For Completing The Form 511:

Web 2021 oklahoma resident individual income tax forms and instructions. Form 511 can be efiled, or a paper copy can be filed via mail. Download or email 511nr pkt & more fillable forms, register and subscribe now! When to file an amended return generally, to claim a.

Provide This Page Only If You Have An Amount Shown On A Schedule.

Form 511 can be efiled, or a paper copy can be filed via mail. Web form 511 is the general income tax return for oklahoma residents. Complete, edit or print tax forms instantly. • instructions for completing the oklahoma resident income tax return form.