Ok Form 512 Instructions 2022

Ok Form 512 Instructions 2022 - Send form 512 oklahoma via email, link, or fax. Web do not use form 512. Enter the applicable amounts from the return, if any.) 2 declaration of officer,. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Complete lines a and b. Web we last updated the return of organization exempt from income tax in january 2023, so this is the latest version of form 512e, fully updated for tax year 2022. Edit your ok form 512 online. Your oklahoma return is due 30 days after the due date of your federal return. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Easily fill out pdf blank, edit, and sign them.

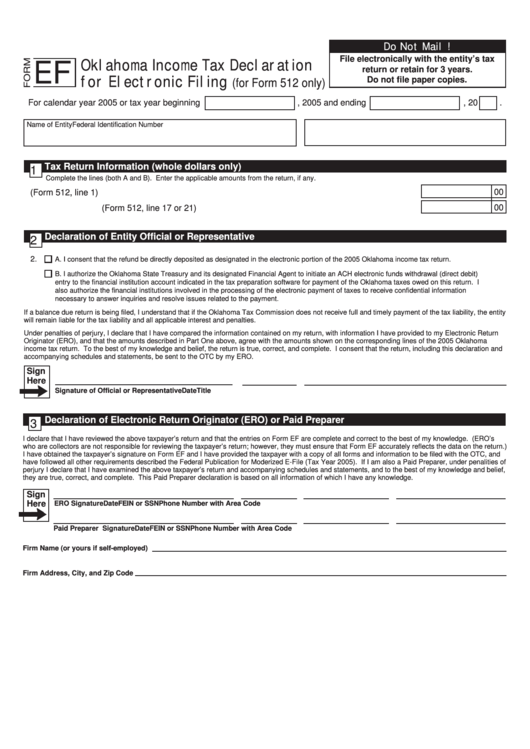

A complete copy of the federal return must be enclosed with the oklahoma income tax return. Edit your ok form 512 online. You can also download it, export it or print it out. Send form 512 oklahoma via email, link, or fax. See page 16 for methods of contacting the oklahoma tax commission. Web 2022 ef tax return information (whole dollars only. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web form 512 ok 512 instructions 2021 oklahoma form 200 oklahoma tax commission oklahoma form 512 due date 2022 tax.ok.gov forms oklahoma form 200 instructions. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Easily fill out pdf blank, edit, and sign them.

Complete lines a and b. Easily fill out pdf blank, edit, and sign them. Web 2022 ef tax return information (whole dollars only. Web we last updated the return of organization exempt from income tax in january 2023, so this is the latest version of form 512e, fully updated for tax year 2022. Edit your ok form 512 online. Send form 512 oklahoma via email, link, or fax. You can also download it, export it or print it out. Send form 512 oklahoma via email, link, or fax. For s corporations not required to complete the federal. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains:

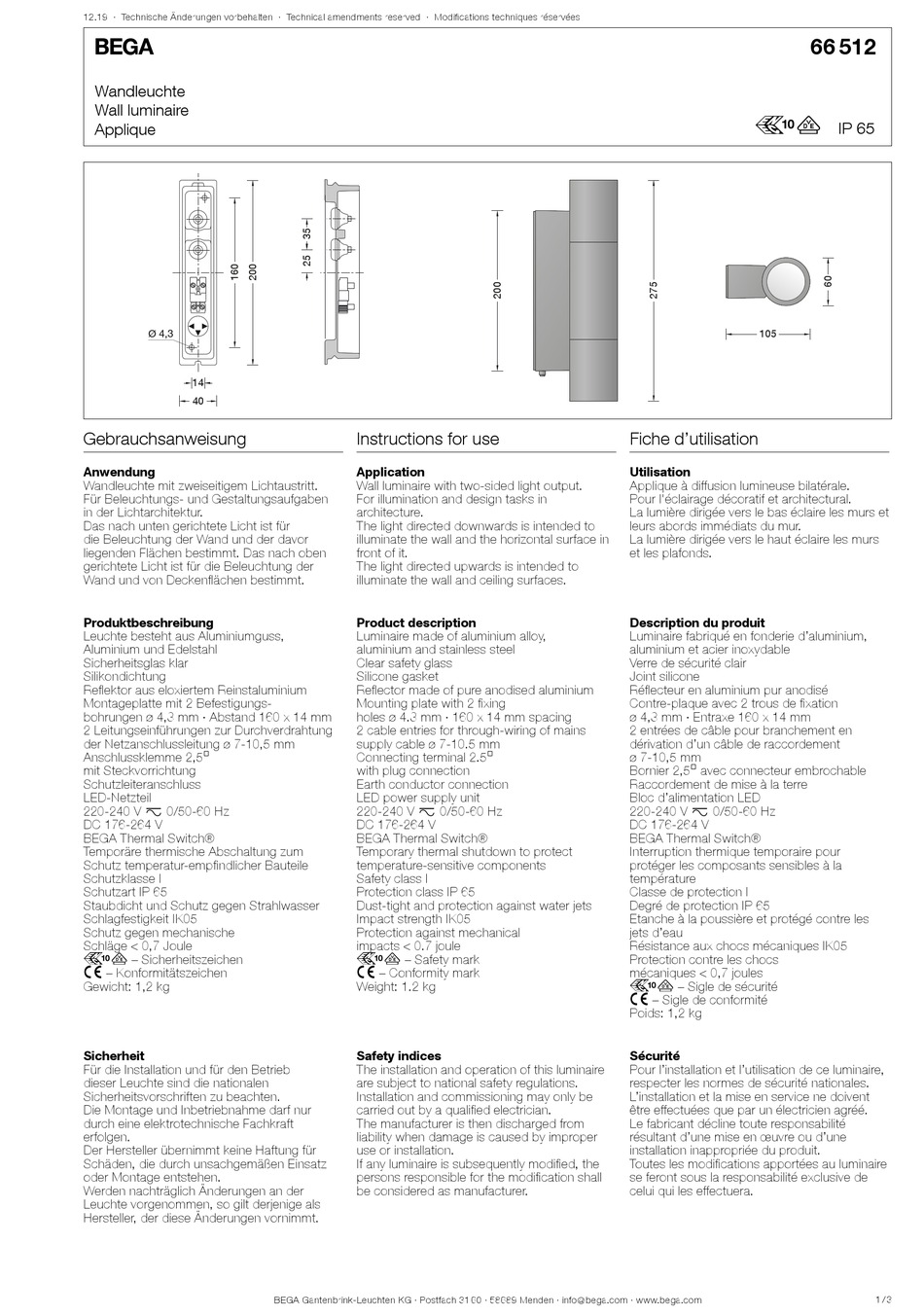

BEGA 66 512 INSTRUCTIONS FOR USE Pdf Download ManualsLib

Send form 512 oklahoma via email, link, or fax. Send form 512 oklahoma via email, link, or fax. You can also download it, export it or print it out. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Complete lines a and b.

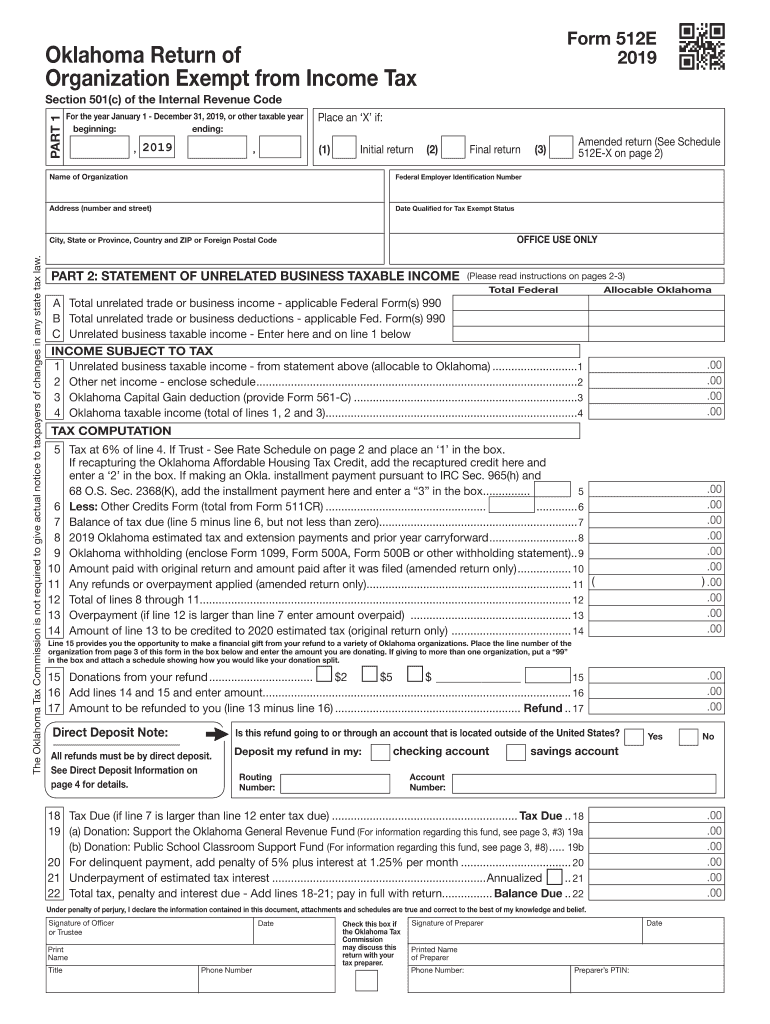

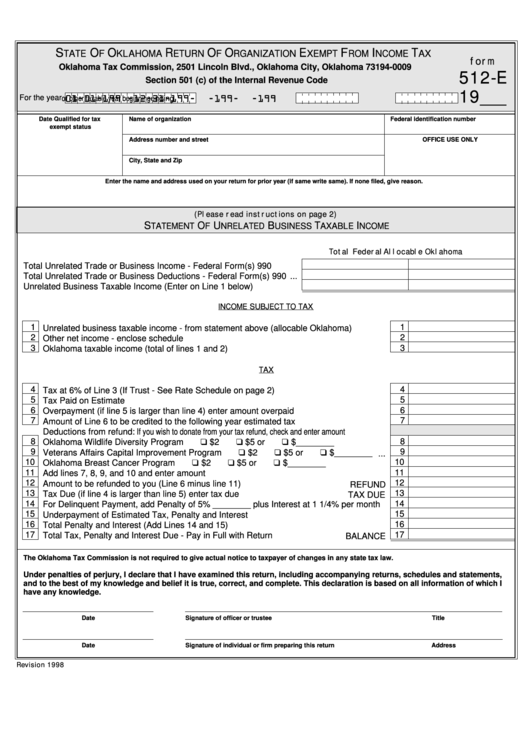

Form 512E Fill Out and Sign Printable PDF Template signNow

Web do not use form 512. Send form 512 oklahoma via email, link, or fax. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Enter the applicable amounts from the return, if any.) 2 declaration of officer,.

OK OTC 512E 2018 Fill out Tax Template Online US Legal Forms

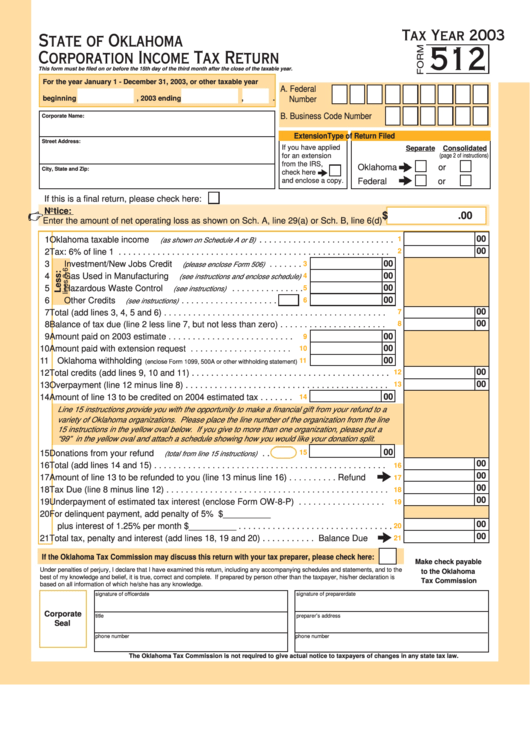

Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web the taxslayer pro desktop program supports the following oklahoma business forms. Web form 512 ok 512 instructions 2021 oklahoma form 200 oklahoma tax commission oklahoma form 512 due date 2022 tax.ok.gov forms oklahoma form 200 instructions. See page 16 for methods of contacting.

Check Ok Form Complete Svg Png Icon Free Download (524265

Complete lines a and b. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web form 512 ok 512 instructions 2021 oklahoma form 200 oklahoma tax commission oklahoma form 512 due date 2022 tax.ok.gov forms oklahoma form 200 instructions. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Edit your.

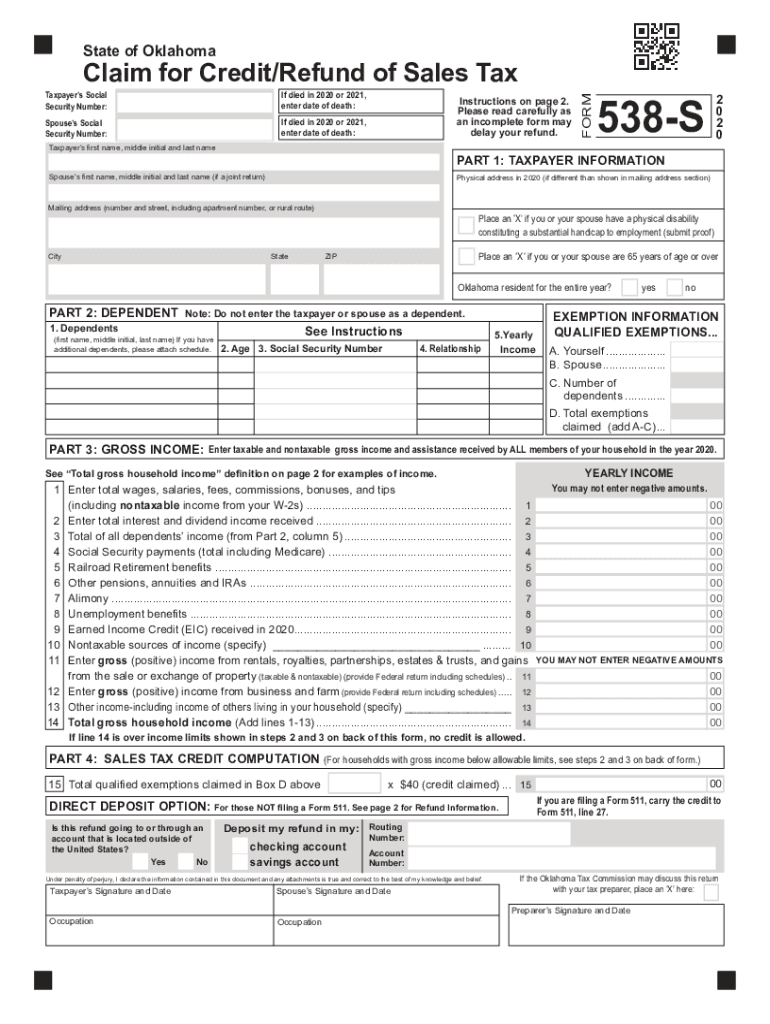

Work oklahoma tax credit online form Fill out & sign online DocHub

Web form 512 ok 512 instructions 2021 oklahoma form 200 oklahoma tax commission oklahoma form 512 due date 2022 tax.ok.gov forms oklahoma form 200 instructions. Web 2022 ef tax return information (whole dollars only. Enter the applicable amounts from the return, if any.) 2 declaration of officer,. Send form 512 oklahoma via email, link, or fax. Easily fill out pdf.

Form Ef Oklahoma Tax Declaration For Electronic Filing (For

Edit your ok form 512 online. Save or instantly send your ready documents. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Web 2022 ef tax return information (whole dollars only. Web share your form with others.

Ok, form, yes, good, check, mark icon Download on Iconfinder

Web form 512 ok 512 instructions 2021 oklahoma form 200 oklahoma tax commission oklahoma form 512 due date 2022 tax.ok.gov forms oklahoma form 200 instructions. Edit your ok form 512 online. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Complete lines a and b. For s corporations not required to complete the.

Fillable Form 512 Oklahoma Corporation Tax Return 2003

Complete lines a and b. Your oklahoma return is due 30 days after the due date of your federal return. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Edit your ok form 512 online. See page 16 for methods of contacting the oklahoma tax commission.

Form 512E Return Of Organization Exempt From Tax 1998

Save or instantly send your ready documents. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Application for extension of time to file an oklahoma income tax return. Your oklahoma return is due 30 days after the due date of your federal return. Your oklahoma return is due 30 days after the due.

OK Form 729 20152021 Fill and Sign Printable Template Online US

Easily fill out pdf blank, edit, and sign them. Web 2020 oklahoma small business corporation income and franchise tax forms and instructions this packet contains: Your oklahoma return is due 30 days after the due date of your federal return. You can also download it, export it or print it out. Enter the applicable amounts from the return, if any.).

Web Form 512 Ok 512 Instructions 2021 Oklahoma Form 200 Oklahoma Tax Commission Oklahoma Form 512 Due Date 2022 Tax.ok.gov Forms Oklahoma Form 200 Instructions.

You can also download it, export it or print it out. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Your oklahoma return is due 30 days after the due date of your federal return. Web 2022 ef tax return information (whole dollars only.

Web Do Not Use Form 512.

Complete lines a and b. Web we last updated the return of organization exempt from income tax in january 2023, so this is the latest version of form 512e, fully updated for tax year 2022. Application for extension of time to file an oklahoma income tax return. Save or instantly send your ready documents.

Edit Your Ok Form 512 Online.

You can also download it, export it or print it out. Enter the applicable amounts from the return, if any.) 2 declaration of officer,. A complete copy of the federal return must be enclosed with the oklahoma income tax return. Fill out & sign online | dochub web share your form with others.

For S Corporations Not Required To Complete The Federal.

Send form 512 oklahoma via email, link, or fax. Easily fill out pdf blank, edit, and sign them. Web share your form with others. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: