Ohio Median Income For Chapter 7

Ohio Median Income For Chapter 7 - Web you can earn significant monthly income and qualify for chapter 7 bankruptcy if you have a large family or considerable but reasonable expenses, such as a high mortgage and car loan payments, taxes, and other expenses. Or income from a transfer agreement. If not, you must pass the secondary “means test”. Filing $75,000.00 of earnings will result in $1,419.41 of your earnings being taxed as state tax (calculation based on 2023 ohio. In the test, you compare your income with your state’s income limits. Web the ohio bankruptcy means test applies to those filing for chapter 7 bankruptcy who have a higher income than the median income of those similar size households. However, just because your income is above the median doesn't mean you can't file for chapter 7. If your household income is below the ohio median, you need not complete a means test and can continue your chapter 7. Why do we have the means test? To find the median household income for your household size, visit the u.s.

If not, you must pass the secondary “means test”. Web if you would like to file a chapter 7 bankruptcy you must pass the ohio means test. The test only applies to higher income filers which means that if your income is below the ohio median for your household. How does the means test work? Web to file for chapter 7 bankruptcy, your household income must be below the median household income. To find the median household income for your household size, visit the u.s. If your income is less than the median for a household of similar size in your state, you automatically qualify for chapter 7 bankruptcy. Web let’s summarize… the means test determines whether you qualify for chapter 7 bankruptcy. Trustee’s website and enter your data. Web the first step of the ohio bankruptcy means test compares your average monthly income over the last six months to the median income in your state.

Or income from a transfer agreement. Web am i eligible to file for chapter 7 bankruptcy in ohio? Web the trustee objected claiming janice’s income was too high to file for chapter 7 in ohio. Web filing $75,000.00 of earnings will result in $5,737.50 being taxed for fica purposes. Comparing your household income to the median income determining the median income for your household size calculating your current monthly income part 2: Web updated july 12, 2023 table of contents the chapter 7 income limits and the bankruptcy means test part 1: Why do we have the means test? To find the median household income for your household size, visit the u.s. Amounts contributed to an ohio. Web the first step of the ohio bankruptcy means test compares your average monthly income over the last six months to the median income in your state.

Every Ohio city and county ranked for median family, household

Or income from a transfer agreement. Comparing your household income to the median income determining the median income for your household size calculating your current monthly income part 2: Web the first step of the ohio bankruptcy means test compares your average monthly income over the last six months to the median income in your state. In the test, you.

Salary Needed to Afford the Average Home Your State

Filing $75,000.00 of earnings will result in $1,419.41 of your earnings being taxed as state tax (calculation based on 2023 ohio. In the test, you compare your income with your state’s income limits. If your household income is below the ohio median, you need not complete a means test and can continue your chapter 7. How does the means test.

Political Calculations Telescoping Median Household Back in Time

Web to file for chapter 7 bankruptcy, your household income must be below the median household income. Web am i eligible to file for chapter 7 bankruptcy in ohio? How does the means test work? However, just because your income is above the median doesn't mean you can't file for chapter 7. The test only applies to higher income filers.

Drop in Ohio median a troubling sign of a haveandhavenot

Comparing your household income to the median income determining the median income for your household size calculating your current monthly income part 2: Web updated july 12, 2023 table of contents what is the chapter 7 means test? The median income in ohio. Web updated july 12, 2023 table of contents the chapter 7 income limits and the bankruptcy means.

Someone worked out how much you need in every state to buy a

Web to qualify for chapter 7, you must pass a “means test” which you will, if your family income is under the median income for a family your size in your state. For cases filed after may 1, 2018, the median income for a single earner in ohiois $48,596 per year. Trustee’s website and enter your data. How does the.

Millennial median wage map Business Insider

Trustee’s website and enter your data. If your household income is below the ohio median, you need not complete a means test and can continue your chapter 7. Web let’s summarize… the means test determines whether you qualify for chapter 7 bankruptcy. If your income is less than. Web updated july 12, 2023 table of contents what is the chapter.

Why has Ohio's median dropped? The Beat (poll)

Web if your household income is below the median income in your state, you'll qualify to file a chapter 7 bankruptcy. To find the median household income for your household size, visit the u.s. Interest income from ohio public obligations and purchase obligations; Not everyone in ohio qualifies for chapter 7 bankruptcy, so you need to determine whether you qualify.

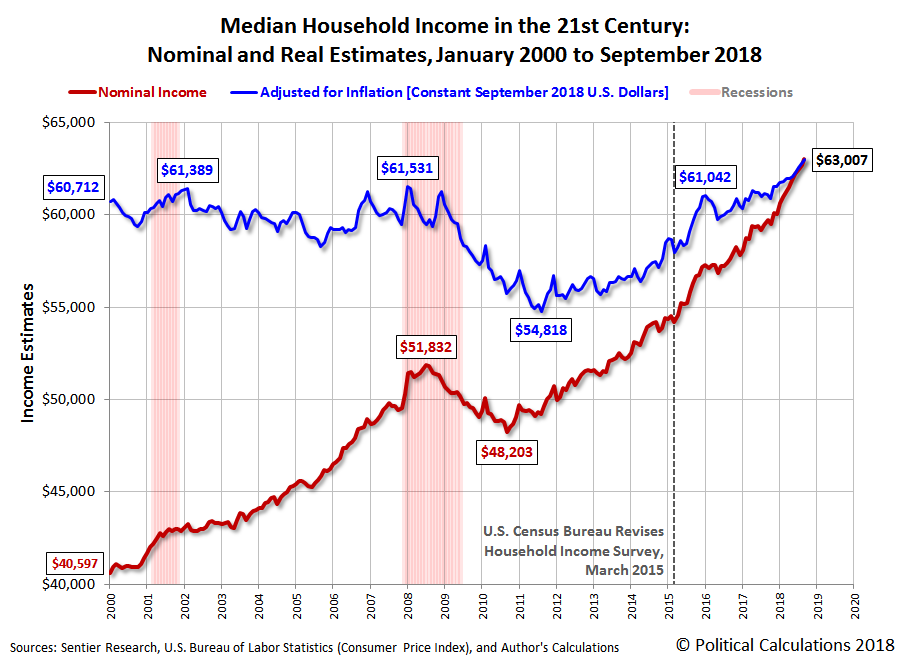

U.S. Median Household Hits New High In September 2018 Seeking

Web if your household income is below the median income in your state, you'll qualify to file a chapter 7 bankruptcy. Every additional person in a. If your income is less than. Trustee’s website and enter your data. Gains from the disposition of ohio public obligations;

Census Data Show Some KY Counties Among Nation’s Poorest Ohio Valley

Comparing your household income to the median income determining the median income for your household size calculating your current monthly income part 2: Web updated july 12, 2023 table of contents the chapter 7 income limits and the bankruptcy means test part 1: Comparing your current monthly income. How does the means test work? Amounts contributed to an ohio.

EconomicGreenfield Median Household Chart

Web to file for chapter 7 bankruptcy, your household income must be below the median household income. Web filing $75,000.00 of earnings will result in $5,737.50 being taxed for fica purposes. To find the median household income for your household size, visit the u.s. How does the means test work? Web to qualify for chapter 7, you must pass a.

However, Just Because Your Income Is Above The Median Doesn't Mean You Can't File For Chapter 7.

Gains from the disposition of ohio public obligations; How does the means test work? Interest income from ohio public obligations and purchase obligations; If your income is less than the median for a household of similar size in your state, you automatically qualify for chapter 7 bankruptcy.

The Test Only Applies To Higher Income Filers Which Means That If Your Income Is Below The Ohio Median For Your Household.

Why do we have the means test? If your income is less than. Web to qualify for chapter 7, you must pass a “means test” which you will, if your family income is under the median income for a family your size in your state. To find the median household income for your household size, visit the u.s.

The Means Test Compares Your Household Income To Ohio's Median Household Income…

Every additional person in a. If not, you must pass the secondary “means test”. Web if your household income is below the median income in your state, you'll qualify to file a chapter 7 bankruptcy. Web income tax calculator ohio find out how much your salary is after tax enter your gross income per where do you work?

Web Updated July 12, 2023 Table Of Contents What Is The Chapter 7 Means Test?

Comparing your household income to the median income determining the median income for your household size calculating your current monthly income part 2: Web the trustee objected claiming janice’s income was too high to file for chapter 7 in ohio. Calculate salary rate annual month biweekly weekly day hour withholding salary. Filing $75,000.00 of earnings will result in $1,419.41 of your earnings being taxed as state tax (calculation based on 2023 ohio.