Oh Cat Form

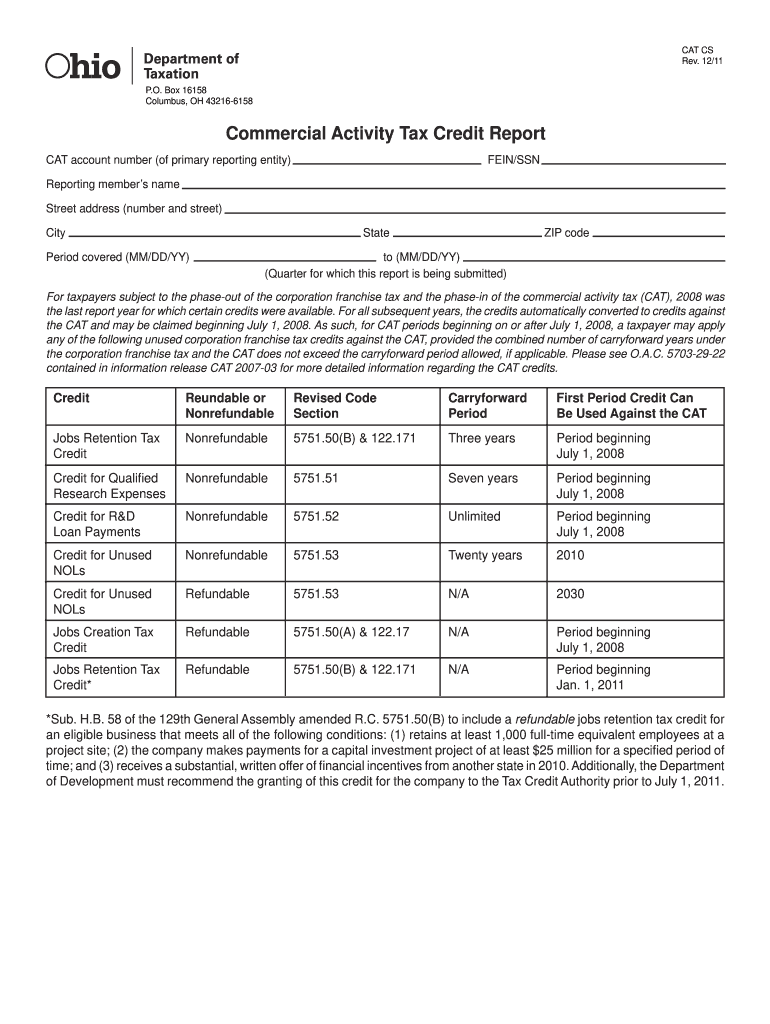

Oh Cat Form - Web commercial activity tax (cat) consolidated elected and combined taxpayer groups (this form only applies to existing taxpayer groups. 3 what identification number do i use if i do not have a fein or a ssn? Registrations processed on the gateway provide a cat account number and registration confirmation letter immediately. Web please use the link below to begin the registration process. Top individual forms it 1040/sd 100 instructions tax year: Options to submit this request: Web we last updated the ohio commercial activity tax (cat) instructions for registration in february 2023, so this is the latest version of form cat 1 instructions, fully updated for tax year 2022. Web the commercial activity tax (cat) is an annual tax imposed on the privilege of doing business in ohio, measured by gross receipts from business activities in ohio. Alternatively, taxpayers may register by submitting the cat 1 registration form. Web registration is available electronically through the ohio business gateway.

Top individual forms it 1040/sd 100 instructions tax year: 2 does the ohio department of taxation (odt) offer a voluntary disclosure program for the cat? Web business account update form current business information: Box 182215 columbus, oh 43218 telephone: Businesses with ohio taxable gross receipts of more than $150,000 per calendar year must register for the cat, file all the applicable returns, and make all corresponding payments. Web please use the link below to begin the registration process. Registrations processed on the gateway provide a cat account number and registration confirmation letter immediately. Cat 1 paper registration form Web we last updated the ohio commercial activity tax (cat) instructions for registration in february 2023, so this is the latest version of form cat 1 instructions, fully updated for tax year 2022. Web the commercial activity tax (cat) is an annual tax imposed on the privilege of doing business in ohio, measured by gross receipts from business activities in ohio.

Web 1 how often am i required to file? Top individual forms it 1040/sd 100 instructions tax year: Web registration is available electronically through the ohio business gateway. Businesses with ohio taxable gross receipts of more than $150,000 per calendar year must register for the cat, file all the applicable returns, and make all corresponding payments. Web the commercial activity tax (cat) is an annual tax imposed on the privilege of doing business in ohio, measured by gross receipts from business activities in ohio. Alternatively, taxpayers may register by submitting the cat 1 registration form. If you wish to complete the registration through the mail, please use the link below to obtain a copy of the paper registration form. Web representative (form tbor 1), which can be found on the department’s web site at tax.ohio.gov. Registrations processed on the gateway provide a cat account number and registration confirmation letter immediately. 2 does the ohio department of taxation (odt) offer a voluntary disclosure program for the cat?

Form CAT1 Download Fillable PDF or Fill Online Commercial Activity Tax

If you wish to complete the registration through the mail, please use the link below to obtain a copy of the paper registration form. Options to submit this request: You can print other ohio tax forms here. The processing of a paper application may take up to six weeks. Businesses with ohio taxable gross receipts of more than $150,000 per.

Oh my... Funny Cat Pictures

Alternatively, taxpayers may register by submitting the cat 1 registration form. Please complete form cat es for changing the filing status.) cat ar. Web business account update form current business information: Registrations processed on the gateway provide a cat account number and registration confirmation letter immediately. Web we last updated the ohio commercial activity tax (cat) instructions for registration in.

Image tagged in oh no cat,oh no black cat,google,google search,2020

Alternatively, taxpayers may register by submitting the cat 1 registration form. Box 182215 columbus, oh 43218 telephone: You can print other ohio tax forms here. Web commercial activity tax (cat) consolidated elected and combined taxpayer groups (this form only applies to existing taxpayer groups. The processing of a paper application may take up to six weeks.

Oh la la! Black Cat maid form "high p dogs here," Mr ink dye Story

Box 182215 columbus, oh 43218 telephone: Web the commercial activity tax (cat) is an annual tax imposed on the privilege of doing business in ohio, measured by gross receipts from business activities in ohio. Please complete form cat es for changing the filing status.) cat ar. Web registration is available electronically through the ohio business gateway. Web we last updated.

Uh oh is he cat? Catloaf

The processing of a paper application may take up to six weeks. Web please use the link below to begin the registration process. Web registration is available electronically through the ohio business gateway. If you wish to complete the registration through the mail, please use the link below to obtain a copy of the paper registration form. Web the commercial.

Oh Cat Form Cs Fill Online, Printable, Fillable, Blank pdfFiller

2 does the ohio department of taxation (odt) offer a voluntary disclosure program for the cat? Box 182215 columbus, oh 43218 telephone: Options to submit this request: You can print other ohio tax forms here. Reporting member cat account number.

Oh cat, not again.... ♥For More You Can Follow On Insta love_ushi OR

Web business account update form current business information: 3 what identification number do i use if i do not have a fein or a ssn? Web commercial activity tax (cat) consolidated elected and combined taxpayer groups (this form only applies to existing taxpayer groups. Web we last updated the ohio commercial activity tax (cat) instructions for registration in february 2023,.

Oh My Cat Brand Ambition

Web 1 how often am i required to file? 4 i registered as an annual taxpayer and my receipts for the calendar year now exceed the $1 million threshold. Alternatively, taxpayers may register by submitting the cat 1 registration form. Reporting member cat account number. Top individual forms it 1040/sd 100 instructions tax year:

All other cat forms WoW Amino

Please complete form cat es for changing the filing status.) cat ar. The processing of a paper application may take up to six weeks. Web we last updated the ohio commercial activity tax (cat) instructions for registration in february 2023, so this is the latest version of form cat 1 instructions, fully updated for tax year 2022. Reporting member cat.

Oh no cat Imgflip

3 what identification number do i use if i do not have a fein or a ssn? 2 does the ohio department of taxation (odt) offer a voluntary disclosure program for the cat? Web commercial activity tax (cat) consolidated elected and combined taxpayer groups (this form only applies to existing taxpayer groups. The processing of a paper application may take.

If You Wish To Complete The Registration Through The Mail, Please Use The Link Below To Obtain A Copy Of The Paper Registration Form.

Web representative (form tbor 1), which can be found on the department’s web site at tax.ohio.gov. Web please use the link below to begin the registration process. Alternatively, taxpayers may register by submitting the cat 1 registration form. Web we last updated the ohio commercial activity tax (cat) instructions for registration in february 2023, so this is the latest version of form cat 1 instructions, fully updated for tax year 2022.

Businesses With Ohio Taxable Gross Receipts Of More Than $150,000 Per Calendar Year Must Register For The Cat, File All The Applicable Returns, And Make All Corresponding Payments.

3 what identification number do i use if i do not have a fein or a ssn? You can print other ohio tax forms here. 2 does the ohio department of taxation (odt) offer a voluntary disclosure program for the cat? Web commercial activity tax (cat) consolidated elected and combined taxpayer groups (this form only applies to existing taxpayer groups.

Web Business Account Update Form Current Business Information:

The processing of a paper application may take up to six weeks. 4 i registered as an annual taxpayer and my receipts for the calendar year now exceed the $1 million threshold. Top individual forms it 1040/sd 100 instructions tax year: Please complete form cat es for changing the filing status.) cat ar.

Reporting Member Cat Account Number.

Web registration is available electronically through the ohio business gateway. Web the commercial activity tax (cat) is an annual tax imposed on the privilege of doing business in ohio, measured by gross receipts from business activities in ohio. Options to submit this request: Registrations processed on the gateway provide a cat account number and registration confirmation letter immediately.