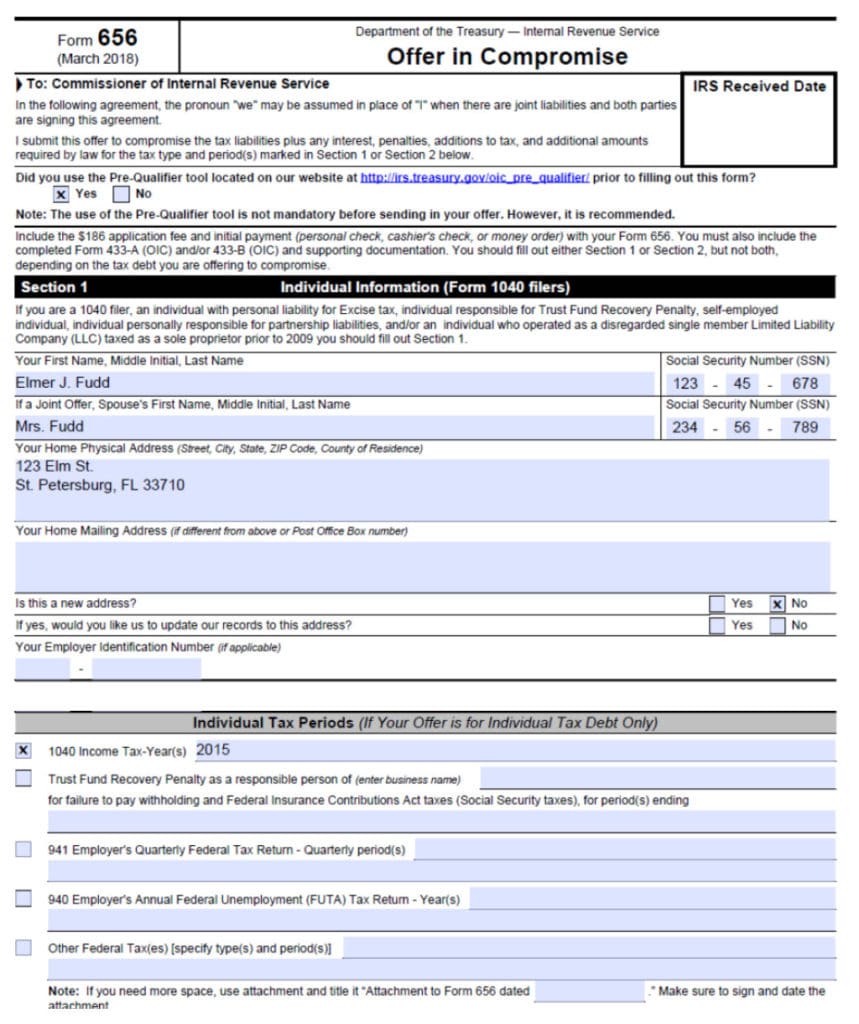

Offer In Compromise Form 656

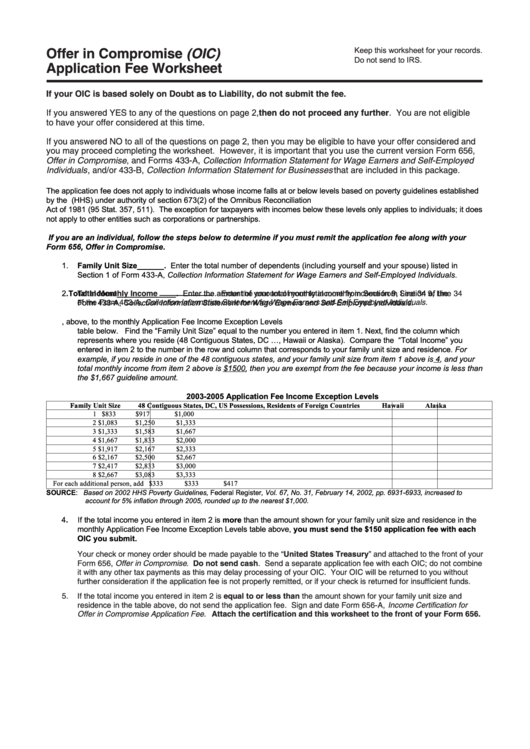

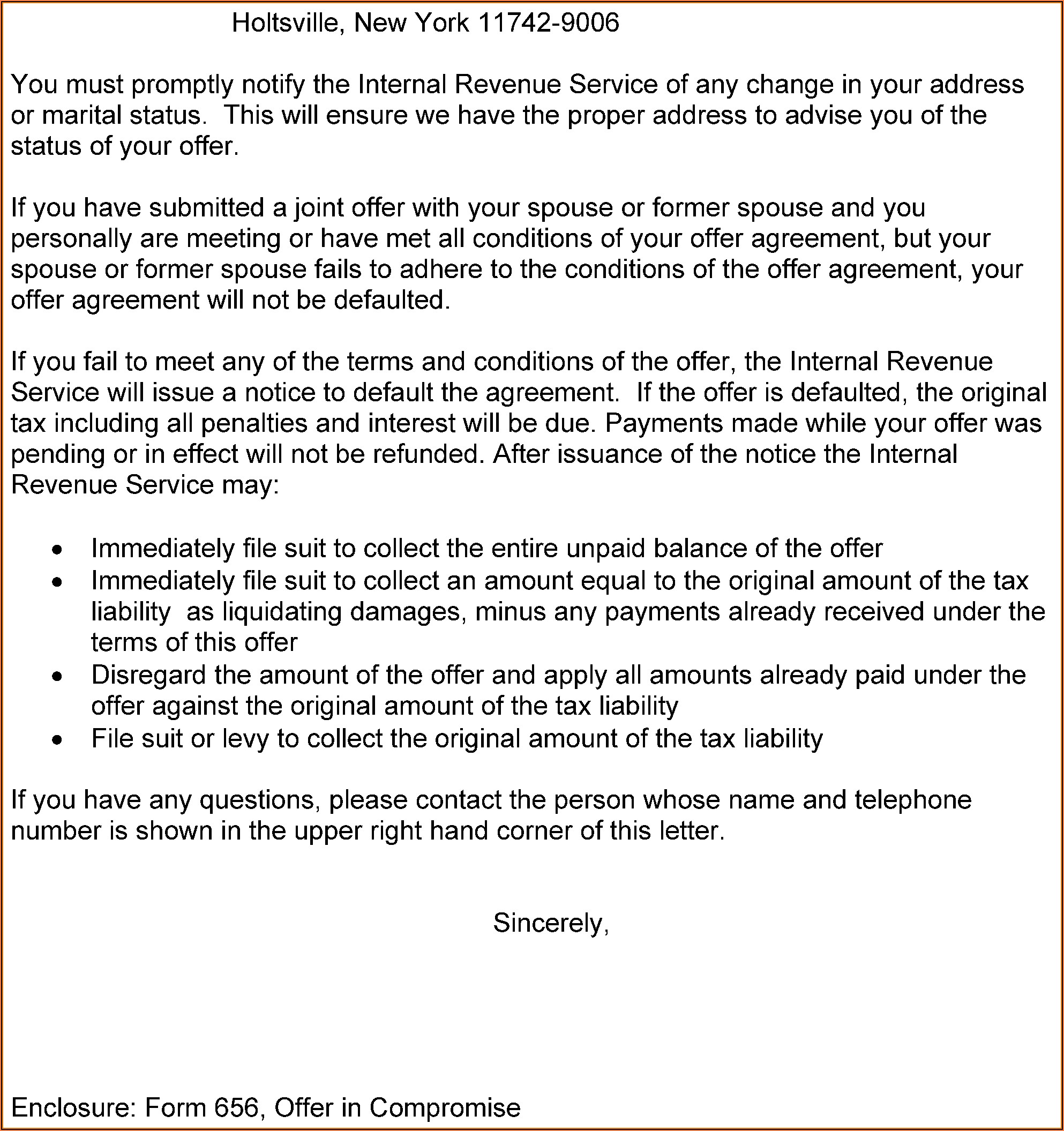

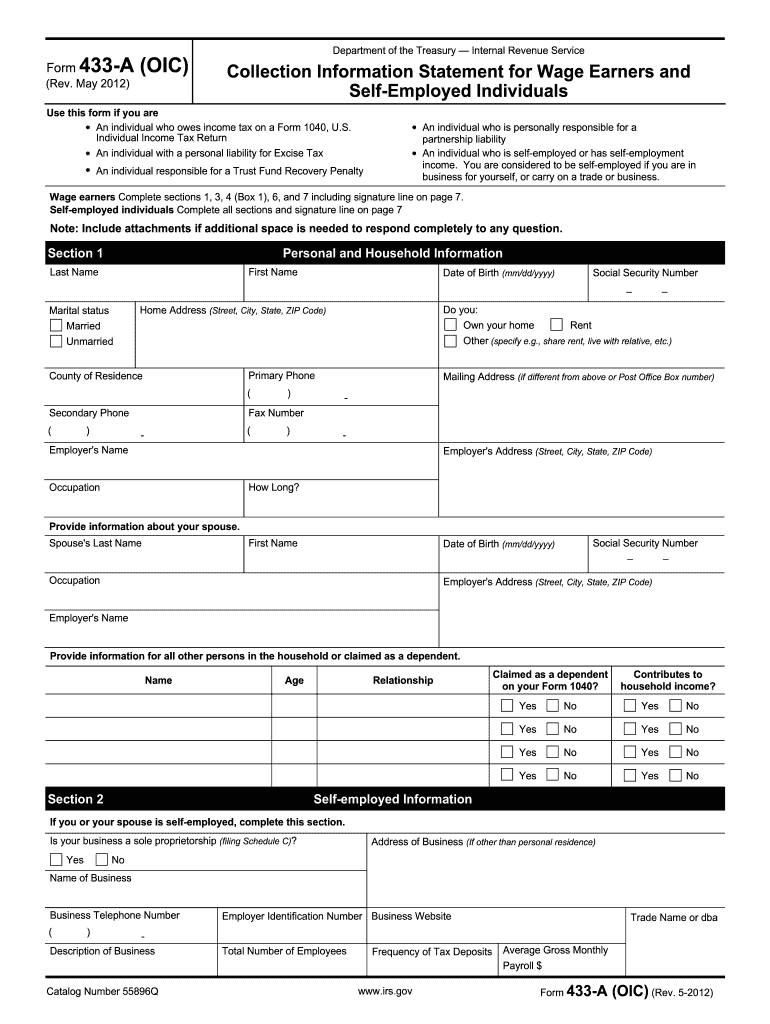

Offer In Compromise Form 656 - To be considered, generally you must make an appropriate offer based on what the irs considers your true ability to pay. The offer program provides eligible taxpayers with a path toward paying off their debt and getting a “fresh start.” You don´t need to pay someone to submit an offer for you. Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. Commissioner of internal revenue service irs received date in the following agreement, the pronoun we may be assumed in place of i when there are joint liabilities and both parties are signing this agreement. If so, you may be eligible to enter an agreement to settle your tax debt. Web an offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed. Web apply with the new form 656. Completed financial statements and required application fee and initial payment must be included with your form 656.

Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. You don´t need to pay someone to submit an offer for you. March 2017) offer in compromise to: The offer program provides eligible taxpayers with a path toward paying off their debt and getting a “fresh start.” Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. It´s called an offer in compromise. If you’re an employer before you apply, you must make federal tax deposits for the current and past 2 quarters. Commissioner of internal revenue service irs received date in the following agreement, the pronoun we may be assumed in place of i when there are joint liabilities and both parties are signing this agreement. If so, you may be eligible to enter an agreement to settle your tax debt.

Web an offer in compromise or offer is an agreement between you the taxpayer and the irs that settles a tax debt for less than the full amount owed. March 2017) offer in compromise to: Web an offer in compromise (offer) is an agreement between you (the taxpayer) and the irs that settles a tax debt for less than the full amount owed. I´m key from the irs. The offer program provides eligible taxpayers with a path toward paying off their debt and getting a “fresh start.” To be considered, generally you must make an appropriate offer based on what the irs considers your true ability to pay. It´s called an offer in compromise. Completed financial statements and required application fee and initial payment must be included with your form 656. If you’re an employer before you apply, you must make federal tax deposits for the current and past 2 quarters. You don´t need to pay someone to submit an offer for you.

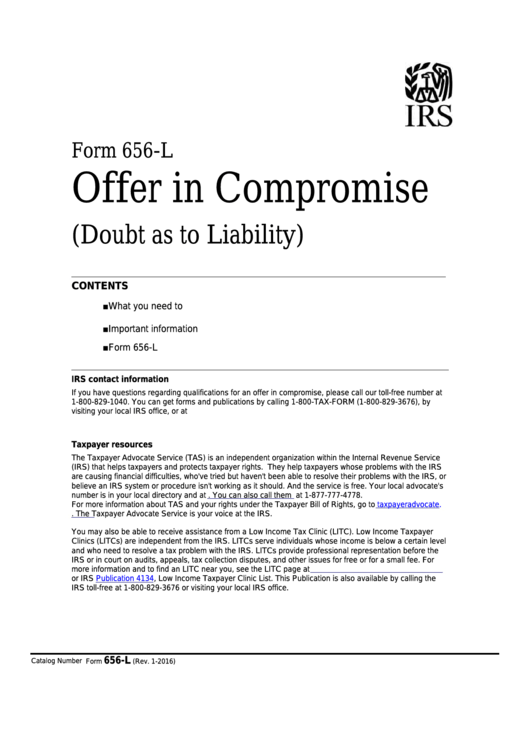

Form 656L Offer in Compromise (Doubt as to Liability) (2012) Free

Web an offer in compromise or offer is an agreement between you the taxpayer and the irs that settles a tax debt for less than the full amount owed. It´s called an offer in compromise. Web individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on.

Fillable Form 656A Certification For Offer In Compromise

To be considered, generally you must make an appropriate offer based on what the irs considers your true ability to pay. If so, you may be eligible to enter an agreement to settle your tax debt. Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. Completed financial statements and required.

Irs Offer In Compromise Form 656 Form Resume Examples 0g27jx0VPr

Web apply with the new form 656. It´s called an offer in compromise. To be considered, generally you must make an appropriate offer based on what the irs considers your true ability to pay. You don´t need to pay someone to submit an offer for you. Completed financial statements and required application fee and initial payment must be included with.

Form 656B, Offer in Compromise What is it? Community Tax

If you’re an employer before you apply, you must make federal tax deposits for the current and past 2 quarters. If so, you may be eligible to enter an agreement to settle your tax debt. Web form 656 department of the treasury — internal revenue service (rev. Web apply with the new form 656. You don´t need to pay someone.

How To Fill Out The IRS Offer In Compromise Form 656 Offer in

Completed financial statements and required application fee and initial payment must be included with your form 656. Web individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under the forms and pubs tab on www.irs.gov. It´s called an offer in compromise. If you’re an employer before you apply, you must make federal.

Irs Offer Compromise Form 656 L Form Resume Examples ojYqob52zl

Commissioner of internal revenue service irs received date in the following agreement, the pronoun we may be assumed in place of i when there are joint liabilities and both parties are signing this agreement. March 2017) offer in compromise to: Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or.

Form 656 B Rev 3 Form 656 Booklet Offer in Compromise Fill Out and

Commissioner of internal revenue service irs received date in the following agreement, the pronoun we may be assumed in place of i when there are joint liabilities and both parties are signing this agreement. March 2017) offer in compromise to: I´m key from the irs. You don´t need to pay someone to submit an offer for you. To be considered,.

Fillable Form 656L Offer In Compromise printable pdf download

Web an offer in compromise or offer is an agreement between you the taxpayer and the irs that settles a tax debt for less than the full amount owed. You don´t need to pay someone to submit an offer for you. Web individuals requesting consideration of an offer must use form 656‐b, offer in compromise, which may be found under.

Offer in compromise How to Get the IRS to Accept Your Offer Law

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. Commissioner of internal revenue service irs received date in the following agreement, the pronoun we may be assumed in place of i when there are joint liabilities and both parties.

Form 656L Offer in Compromise (Doubt as to Liability) (2012) Free

Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. March 2017) offer in compromise to: If so, you may be eligible to enter an agreement to settle your tax debt. To be considered, generally you must make an appropriate.

Web Form 656 Department Of The Treasury — Internal Revenue Service (Rev.

If you’re an employer before you apply, you must make federal tax deposits for the current and past 2 quarters. Web an offer in compromise or offer is an agreement between you the taxpayer and the irs that settles a tax debt for less than the full amount owed. Web apply with the new form 656. It´s called an offer in compromise.

Web An Offer In Compromise (Offer) Is An Agreement Between You (The Taxpayer) And The Irs That Settles A Tax Debt For Less Than The Full Amount Owed.

Do not submit both an offer under doubt as to liability and an offer under doubt as to collectibility or effective tax administration at the same time. Use form 656 when applying for an offer in compromise (oic), an agreement between you and the irs that settles your tax liabilities for less than the full amount owed. The offer program provides eligible taxpayers with a path toward paying off their debt and getting a “fresh start.” If so, you may be eligible to enter an agreement to settle your tax debt.

Web Individuals Requesting Consideration Of An Offer Must Use Form 656‐B, Offer In Compromise, Which May Be Found Under The Forms And Pubs Tab On Www.irs.gov.

March 2017) offer in compromise to: Web information about form 656, offer in compromise, including recent updates, related forms, and instructions on how to file. To be considered, generally you must make an appropriate offer based on what the irs considers your true ability to pay. Commissioner of internal revenue service irs received date in the following agreement, the pronoun we may be assumed in place of i when there are joint liabilities and both parties are signing this agreement.

I´m Key From The Irs.

You don´t need to pay someone to submit an offer for you. Completed financial statements and required application fee and initial payment must be included with your form 656.