Nra Form 990

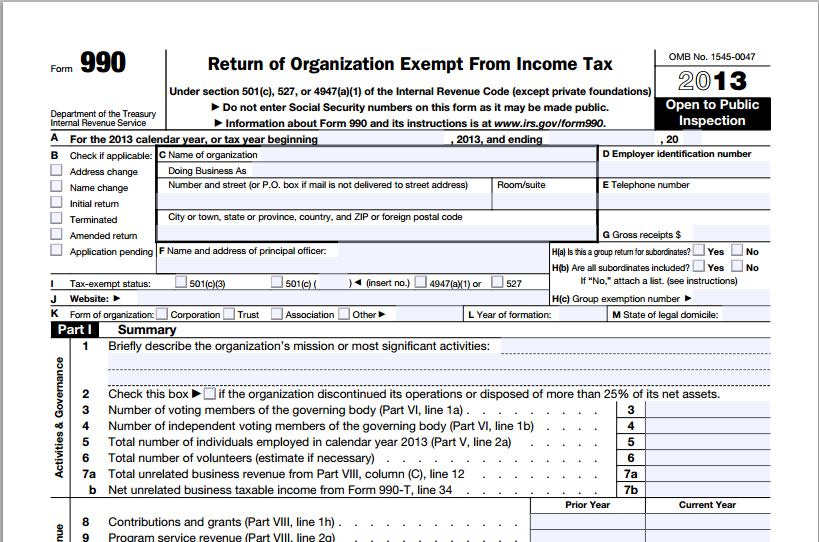

Nra Form 990 - Web irs form 990 is required to be filed and publicly disclosed by nonprofits. Foundations) do not enter social security. The national rifle association of america is the nra’s 501(c)(4) arm. The form changes some from year to year, so it can. Look up 501(c)(3) status, search 990s, create nonprofit organizations lists, and verify nonprofit information. Tax returns filed by nonprofit. Web generally, nra withholding describes the withholding regime that requires 30% withholding on a payment of u.s. Web the national rifle association of america’s irs form 990 filing for calendar year 2021. Web return of organization exempt from income tax. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal.

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. The form changes some from year to year, so it can. Source income and the filing of form 1042 and related form 1042. Web the national rifle association of america’s irs form 990 filing for calendar year 2021. Web nra 2019 990 contributed by daniel nass (the trace) p. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web the nra filed its irs 990 on november 19, 2021. Tax returns filed by nonprofit. Web november 10, 2022 filing summary the nra foundation’s irs form 990 filing for calendar year 2021. Look up 501(c)(3) status, search 990s, create nonprofit organizations lists, and verify nonprofit information.

Sign in or create an account to view form(s) 990 for 2020, 2020 and 2019. The national rifle association of america is the nra’s 501(c)(4) arm. Tax returns filed by nonprofit. Web november 10, 2022 filing summary the nra foundation’s irs form 990 filing for calendar year 2021. Foundations) do not enter social security. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Under section 501 (c), 527, or 4947 (a) (1) of the internal revenue code (except private. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501 (c), 527, or 4947 (a) (1) of the. Look up 501(c)(3) status, search 990s, create nonprofit organizations lists, and verify nonprofit information. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Web nra 2019 990 contributed by daniel nass (the trace) p. Source income and the filing of form 1042 and related form 1042. Tax returns filed by nonprofit. Key points the nra foundation is one of the nra’s 501 (c) (3). Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under.

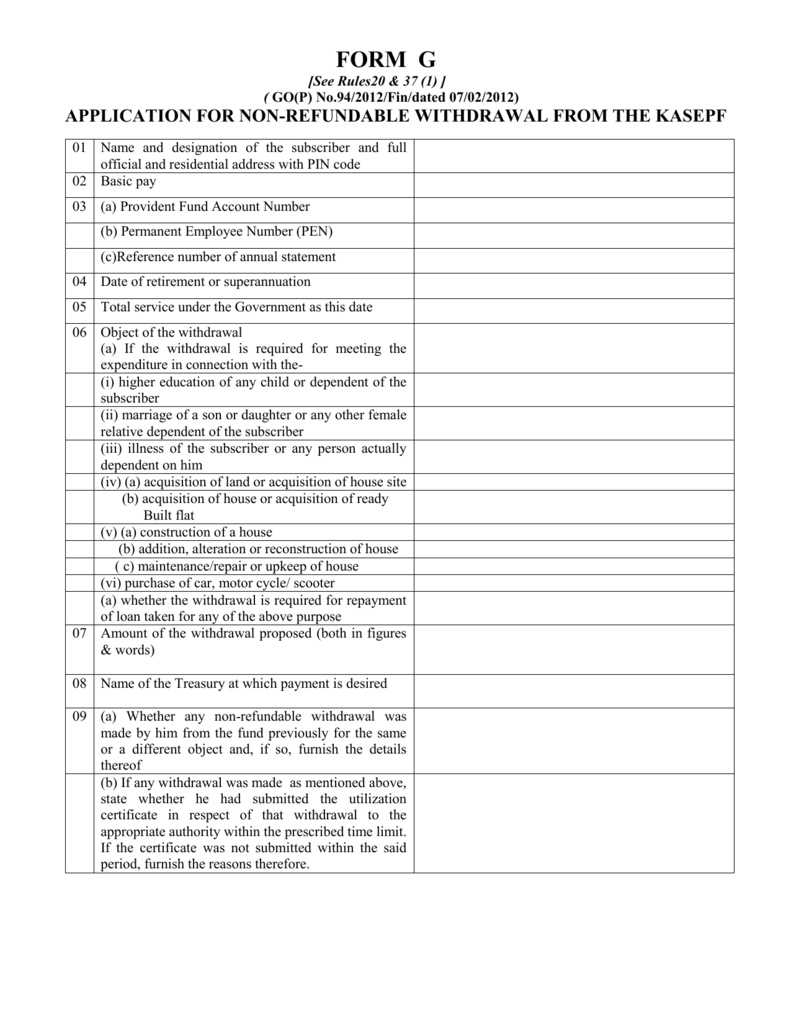

KASEPF NRA form G

Foundations) do not enter social security. The regulatory filing discloses a dramatic cut in nra spending, along with new details about executive compensation and excess. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web return of organization exempt from income tax. This.

What Is A 990 N E Postcard hassuttelia

Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501 (c), 527, or 4947 (a) (1) of the. Sign in or create an account to view form(s) 990 for 2020, 2020 and 2019. The regulatory filing discloses a dramatic cut in nra spending, along with new details about executive.

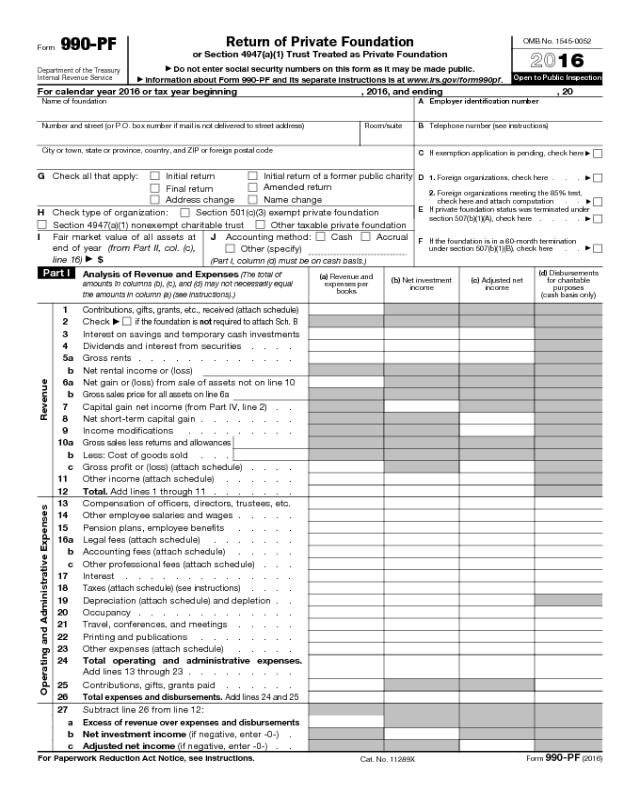

IRS Form 990PF Peacock Foundation, Inc.

Web national rifle association 2020 990 contributed by anna massoglia (opensecrets) p. Foundations) do not enter social security. Web under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. The form changes some from year to year, so it can. It.

NRA's IRS Form 990 For 2013

Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501 (c), 527, or 4947 (a) (1) of the. The national rifle association of america is the nra’s 501(c)(4) arm. This page contains irs 990 forms filed by the nra, along with the organization’s audited financial statements which are provided.

Form 990EZ Short Form Return of Organization Exempt from Tax

The regulatory filing discloses a dramatic cut in nra spending, along with new details about executive compensation and excess. Web nra 2019 990 contributed by daniel nass (the trace) p. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web national rifle association.

Form 990PF Edit, Fill, Sign Online Handypdf

Web november 10, 2022 filing summary the nra foundation’s irs form 990 filing for calendar year 2021. The form changes some from year to year, so it can. Web find and check a charity using candid's guidestar. The national rifle association of america is the nra’s 501(c)(4) arm. Web the national rifle association of america’s irs form 990 filing for.

2017 IRS Form 990 by Ozarks Food Harvest Issuu

Web under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Read the irs instructions for 990 forms. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and.

Audit shows NRA spending surged 100 million amidst proTrump push in

Look up 501(c)(3) status, search 990s, create nonprofit organizations lists, and verify nonprofit information. The national rifle association of america is the nra’s 501(c)(4) arm. Web irs form 990 is required to be filed and publicly disclosed by nonprofits. Tax returns filed by nonprofit. Read the irs instructions for 990 forms.

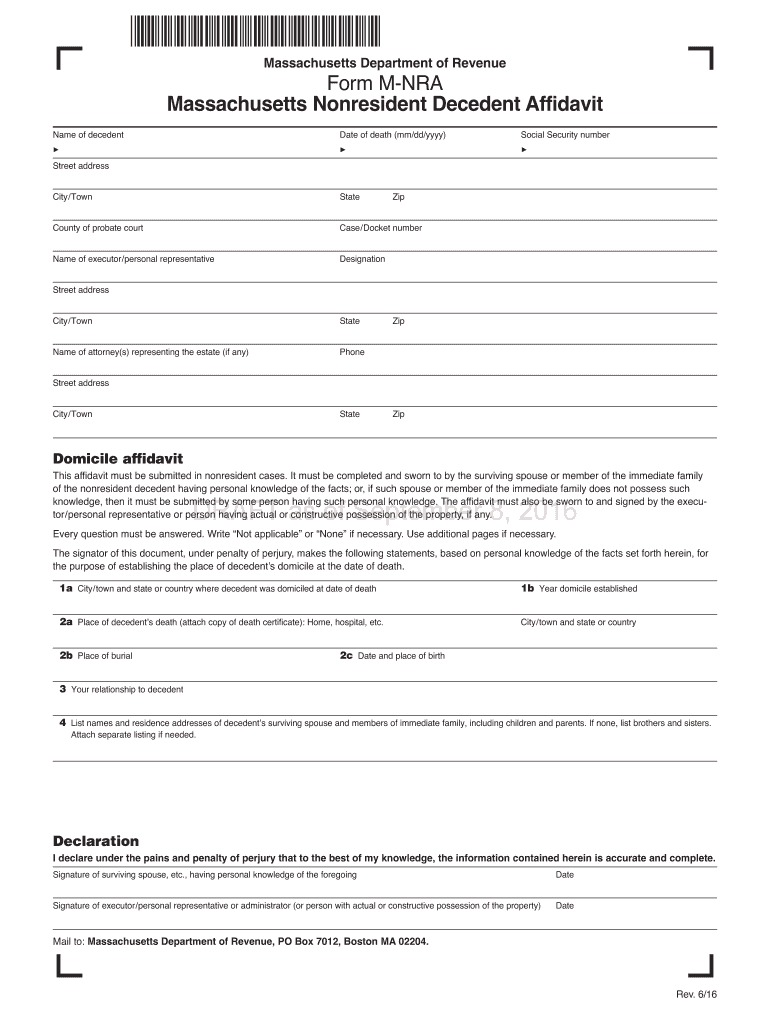

20162022 Form MA DoR MNRA Fill Online, Printable, Fillable, Blank

Web the national rifle association of america’s irs form 990 filing for calendar year 2019. Web return of organization exempt from income tax. Under section 501 (c), 527, or 4947 (a) (1) of the internal revenue code (except private. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501.

Under Section 501 (C), 527, Or 4947 (A) (1) Of The Internal Revenue Code (Except Private.

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web irs form 990 is required to be filed and publicly disclosed by nonprofits. Web find and check a charity using candid's guidestar. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501 (c), 527, or 4947 (a) (1) of the.

Source Income And The Filing Of Form 1042 And Related Form 1042.

Tax returns filed by nonprofit. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web november 10, 2022 filing summary the nra foundation’s irs form 990 filing for calendar year 2021. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501 (c), 527, or 4947 (a) (1) of the.

Key Points The Nra Foundation Is One Of The Nra’s 501 (C) (3).

Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web the national rifle association of america’s irs form 990 filing for calendar year 2019. Read the irs instructions for 990 forms. The national rifle association of america is the nra’s 501(c)(4) arm.

Look Up 501(C)(3) Status, Search 990S, Create Nonprofit Organizations Lists, And Verify Nonprofit Information.

It provides a useful look into an organization’s finances. Web under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. The regulatory filing discloses a dramatic cut in nra spending, along with new details about executive compensation and excess. Web nra 2019 990 contributed by daniel nass (the trace) p.