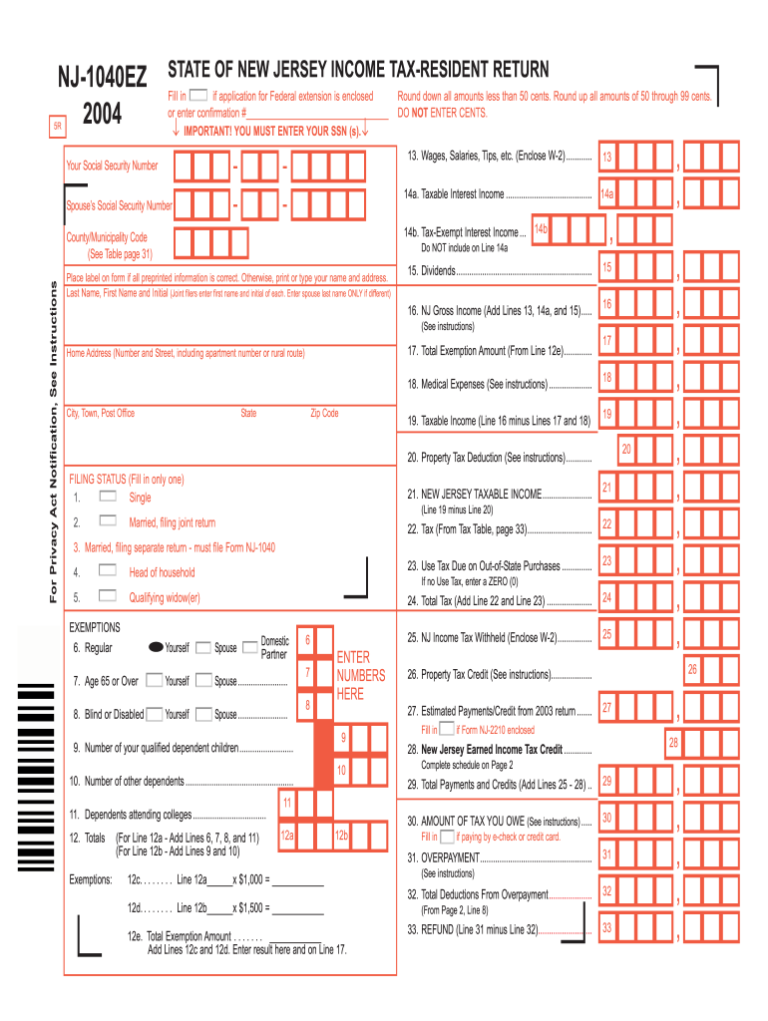

Nj Non Resident Tax Form

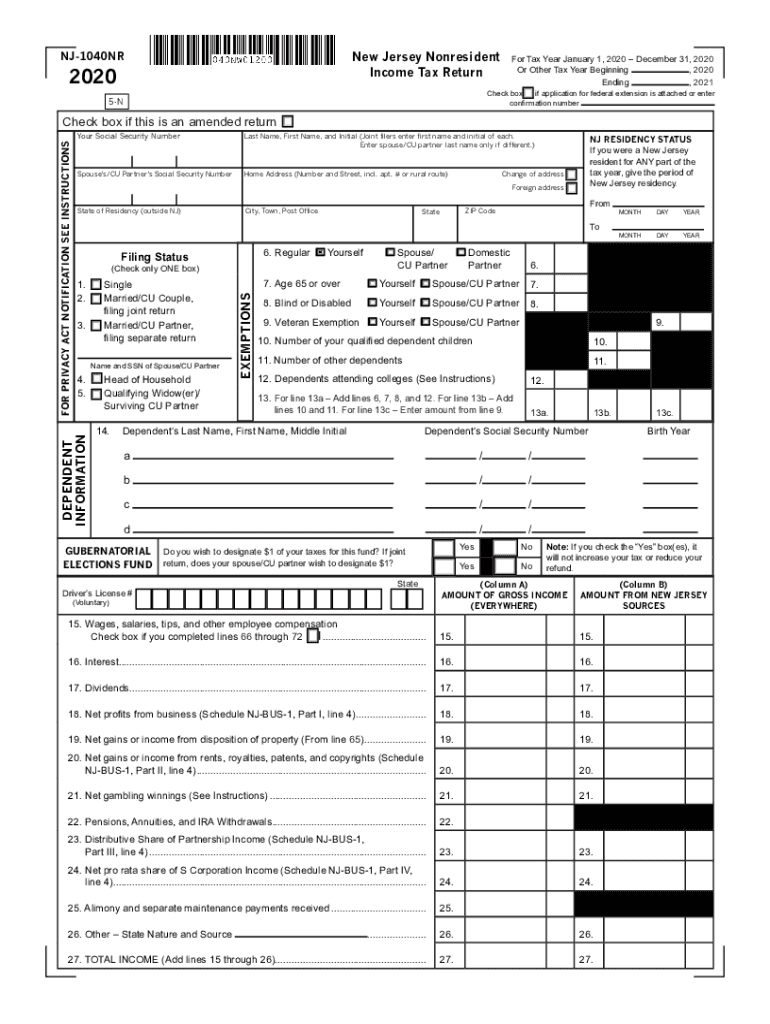

Nj Non Resident Tax Form - # or rural route) change of address foreign address. Estimated income tax payment voucher for 4th quarter 2022. Resident income tax return payment voucher. Which form to file military personnel and their spouses/civil union partners, see page 31. Web estimated income tax payment voucher for 2023. # or rural route) change of address foreign address Web you are required to have a copy of this form on file for each employee receiving compensation paid in new jersey and who is a resident of pennsylvania and claims exemption from withholding of new jersey gross income tax under the reciprocal agreement entered into between new jersey and pennsylvania or who claims. Last name, first name, and initial (joint filers enter first name and initial of each. If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status, you must file a new jersey nonresident tax return. (property tax reimbursement) alcoholic beverage tax.

Resident income tax return payment voucher. Last name, first name, and initial (joint filers enter first name and initial of each. # or rural route) change of address foreign address Enter spouse/cu partner last name only if different.) home address (number and street, incl. Completing and filing a return ; (property tax reimbursement) alcoholic beverage tax. Web if new jersey income tax was withheld from your wages, you must file a new jersey nonresident return to get a refund. Estimated income tax payment instructions. If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status, you must file a new jersey nonresident tax return. Underpayment of estimated tax by individuals and instructions.

# or rural route) change of address foreign address # or rural route) change of address foreign address. (property tax reimbursement) alcoholic beverage tax. Web inheritance and estate tax. Estimated income tax payment instructions. Estimated income tax payment voucher for 4th quarter 2022. Completing and filing a return ; Web estimated income tax payment voucher for 2023. Which form to file military personnel and their spouses/civil union partners, see page 31. Resident income tax return payment voucher.

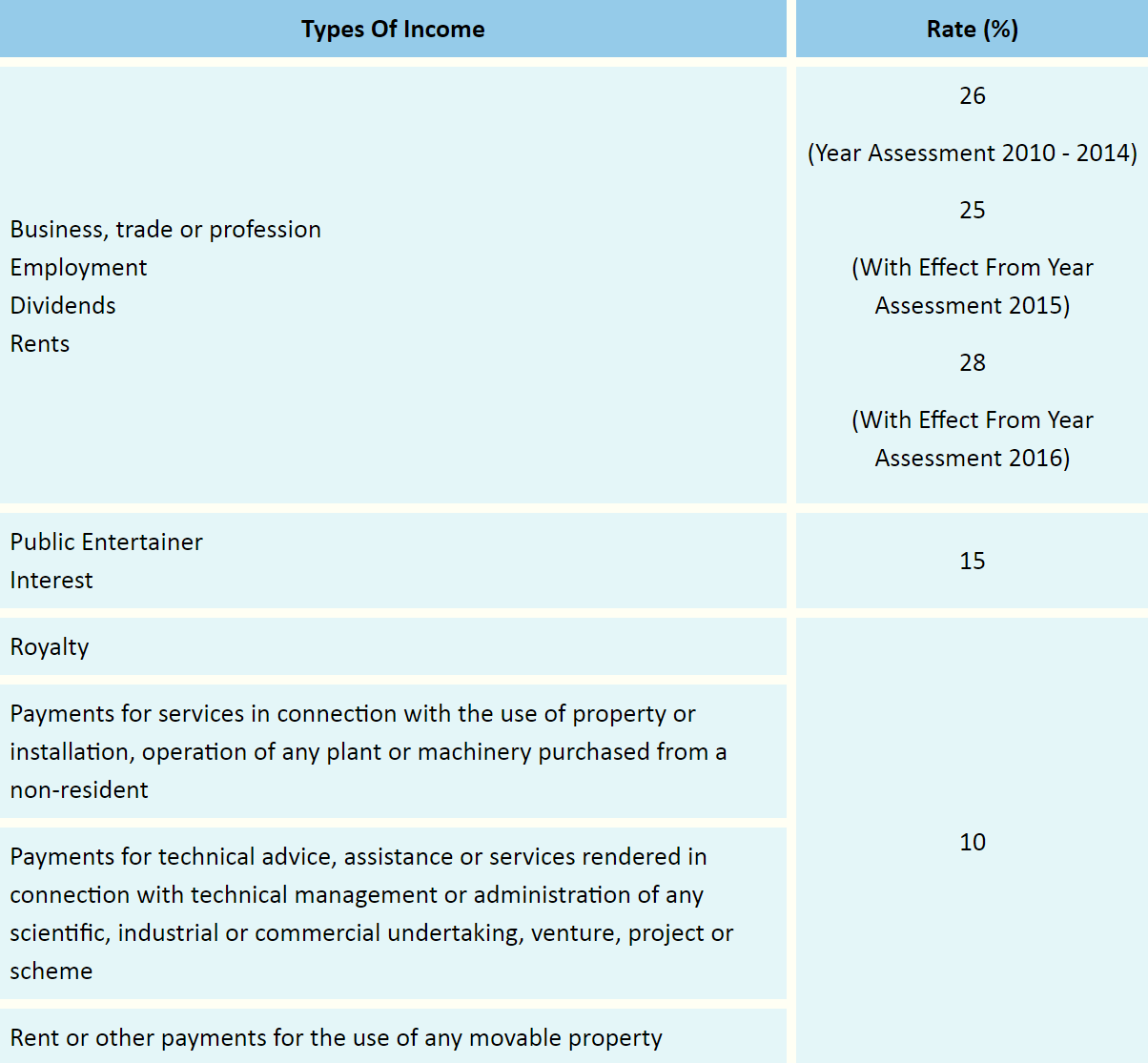

Tax from nonresidents in Spain, what is it and how to do it properly

Completing and filing a return ; Income tax resource center ; Estimated income tax payment voucher for 4th quarter 2022. Underpayment of estimated tax by individuals and instructions. Last name, first name, and initial (joint filers enter first name and initial of each.

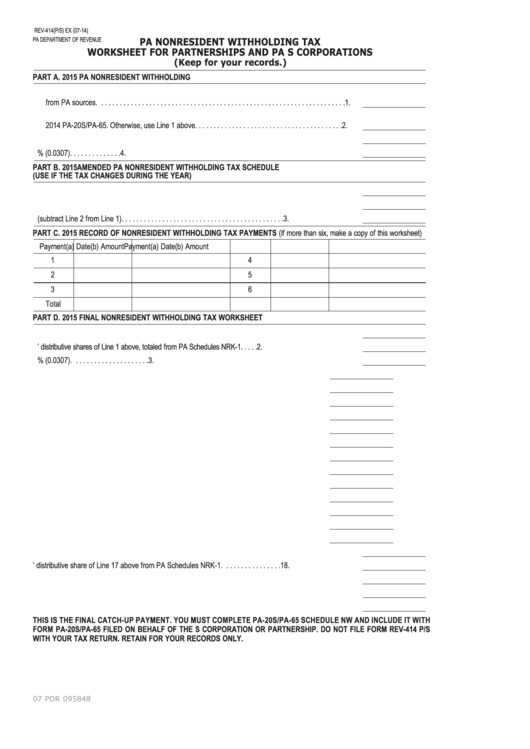

Rev414 Pa Nonresident Withholding Tax Worksheet For Partnerships And

Completing and filing a return ; Web inheritance and estate tax. Web you are required to have a copy of this form on file for each employee receiving compensation paid in new jersey and who is a resident of pennsylvania and claims exemption from withholding of new jersey gross income tax under the reciprocal agreement entered into between new jersey.

Delaware Individual Non Resident Tax Return Tax Walls

# or rural route) change of address foreign address Estimated income tax payment voucher for 4th quarter 2022. Completing and filing a return ; Enter spouse/cu partner last name only if different.) home address (number and street, incl. Estimated income tax payment instructions.

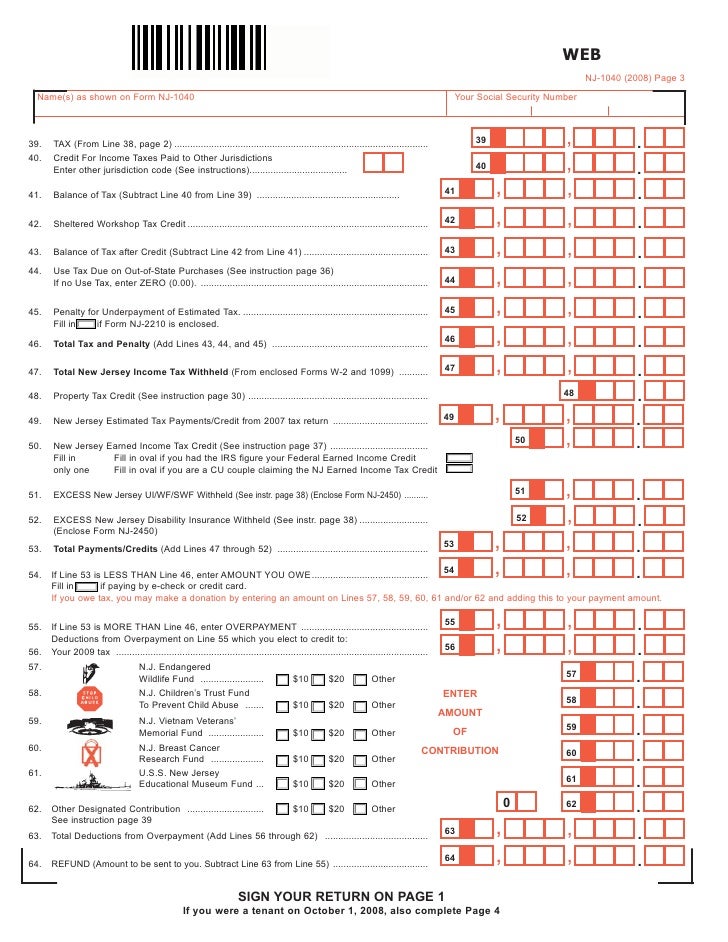

Nj 1040 Fill Online Printable Fillable Blank PDFfiller 1040 Form

# or rural route) change of address foreign address Underpayment of estimated tax by individuals and instructions. Last name, first name, and initial (joint filers enter first name and initial of each. Web inheritance and estate tax. Web if new jersey income tax was withheld from your wages, you must file a new jersey nonresident return to get a refund.

NJ Resident Tax Return

Web estimated income tax payment voucher for 2023. Resident income tax return payment voucher. Last name, first name, and initial (joint filers enter first name and initial of each. Completing and filing a return ; # or rural route) change of address foreign address

2020 Nj 1040Nr Fill Out and Sign Printable PDF Template signNow

Completing and filing a return ; Income tax resource center ; If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status, you must file a new jersey nonresident tax return. Enter spouse/cu partner last name only if different.) home address (number and street, incl. Estimated income tax.

Tax guide for expats in Malaysia ExpatGo

Estimated income tax payment voucher for 4th quarter 2022. Web inheritance and estate tax. # or rural route) change of address foreign address # or rural route) change of address foreign address. Underpayment of estimated tax by individuals and instructions.

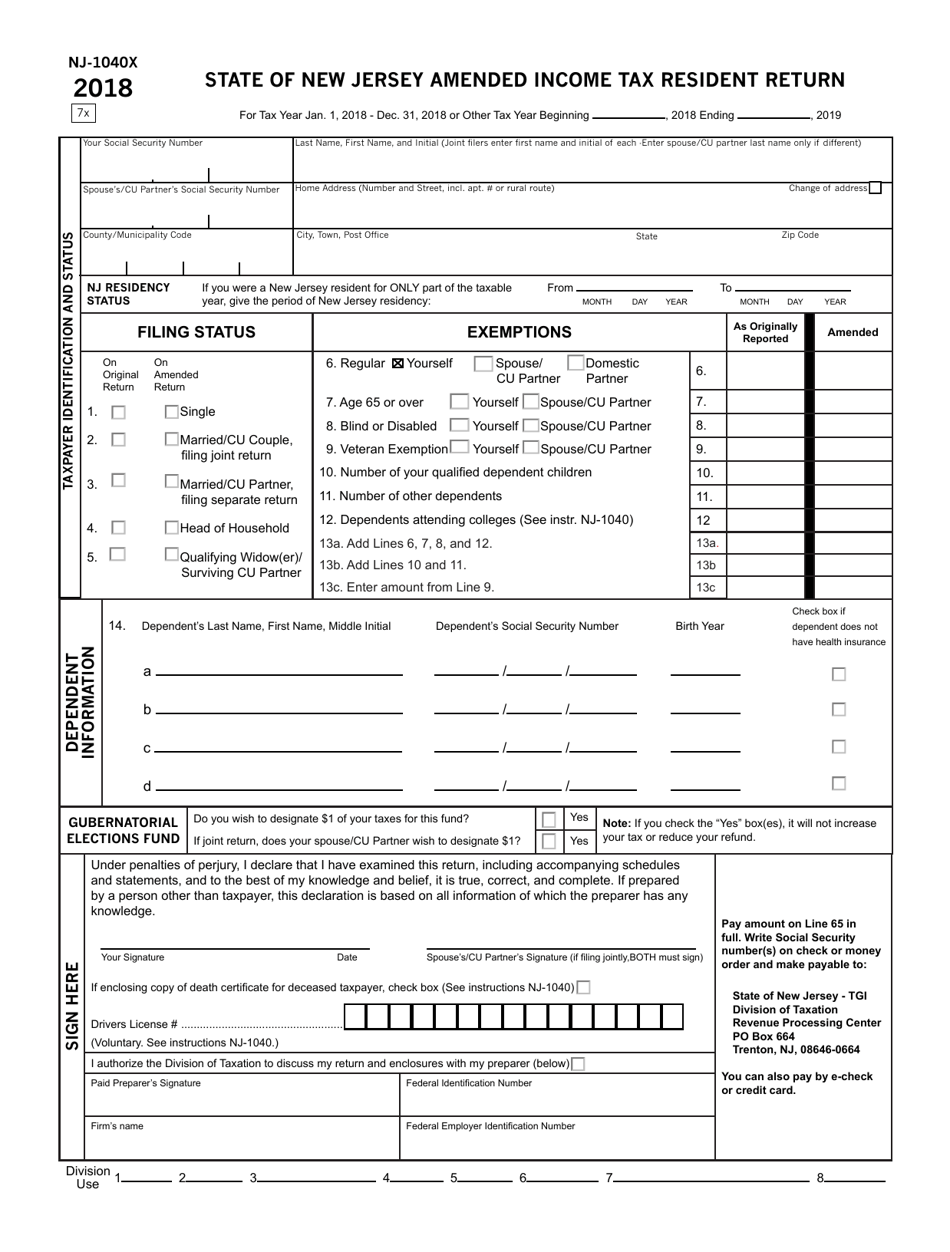

Form NJ1040X Download Fillable PDF or Fill Online Amended Tax

# or rural route) change of address foreign address Income tax resource center ; Which form to file military personnel and their spouses/civil union partners, see page 31. If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status, you must file a new jersey nonresident tax return..

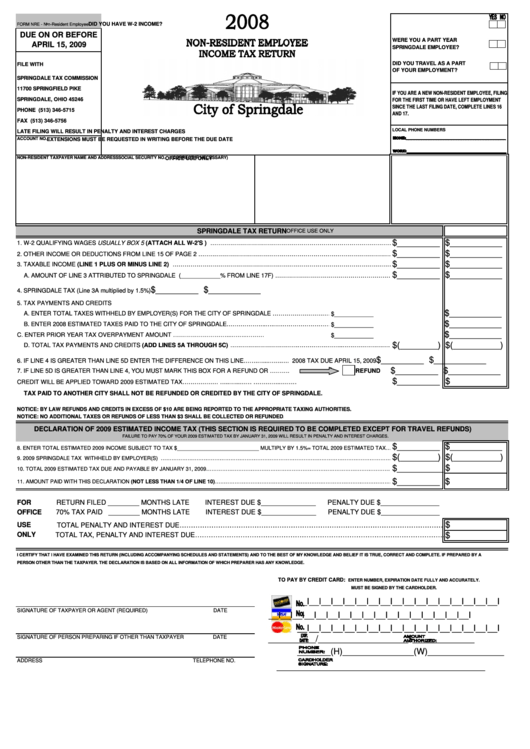

Form Nre NonResident Employee Tax Return 2008 printable pdf

Income tax resource center ; Estimated income tax payment voucher for 4th quarter 2022. Estimated income tax payment instructions. Enter spouse/cu partner last name only if different.) home address (number and street, incl. Underpayment of estimated tax by individuals and instructions.

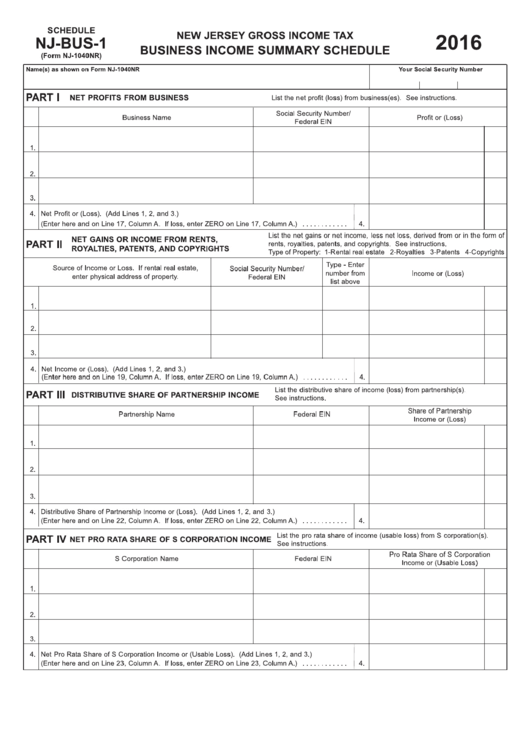

Fillable Form Nj1040nr NonResident Tax Return 2016

Enter spouse/cu partner last name only if different.) home address (number and street, incl. If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status, you must file a new jersey nonresident tax return. (property tax reimbursement) alcoholic beverage tax. Web inheritance and estate tax. Estimated income tax.

Underpayment Of Estimated Tax By Individuals And Instructions.

Web you are required to have a copy of this form on file for each employee receiving compensation paid in new jersey and who is a resident of pennsylvania and claims exemption from withholding of new jersey gross income tax under the reciprocal agreement entered into between new jersey and pennsylvania or who claims. Income tax resource center ; (property tax reimbursement) alcoholic beverage tax. Enter spouse/cu partner last name only if different.) home address (number and street, incl.

Enter Spouse/Cu Partner Last Name Only If Different.) Home Address (Number And Street, Incl.

Which form to file military personnel and their spouses/civil union partners, see page 31. Completing and filing a return ; Web estimated income tax payment voucher for 2023. Estimated income tax payment voucher for 4th quarter 2022.

Web Inheritance And Estate Tax.

Last name, first name, and initial (joint filers enter first name and initial of each. # or rural route) change of address foreign address Web if new jersey income tax was withheld from your wages, you must file a new jersey nonresident return to get a refund. Resident income tax return payment voucher.

Estimated Income Tax Payment Instructions.

# or rural route) change of address foreign address. If you are a nonresident and your income for the entire year was more than the filing threshold amount for your filing status, you must file a new jersey nonresident tax return.