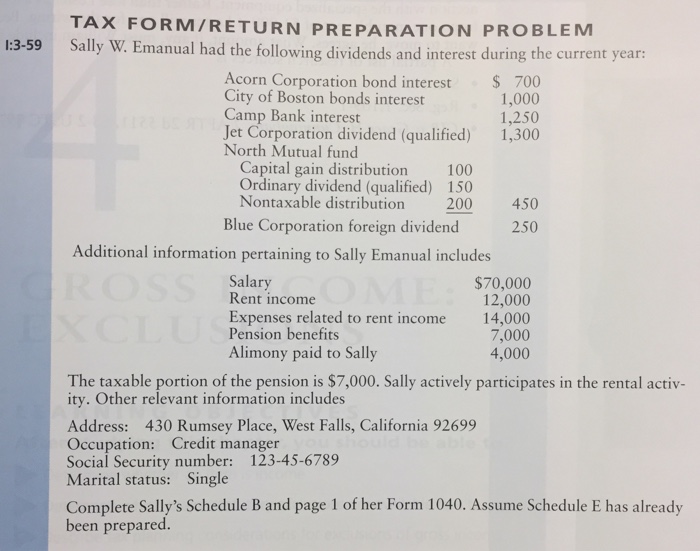

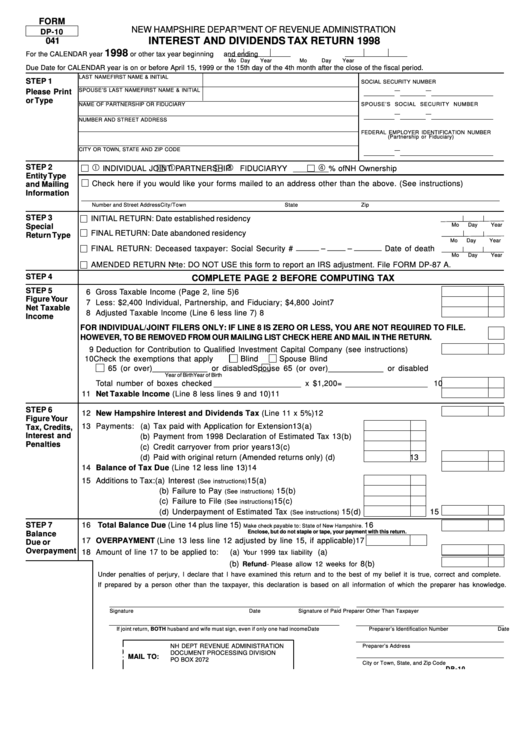

Nh Interest And Dividends Tax Form

Nh Interest And Dividends Tax Form - The tax is assessed on interest and dividend income at a rate of 5%. Web new hampshire — interest and dividends tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web to may also save the form as a pdf till your computer, complete an form, and after print and mail the form to the mailing publicly. The interest & dividends (i&d) tax was enacted in 1923. Web forms and instructions by tax type: Go save a pdf enter to owner computer: Web folded into the new state budget is a policy that will phase out new hampshire's tax on interest and dividend income. The interest & dividends (i&d) tax, which was first enacted in 1923, applied a tax based on the average rate of property taxation. It's widely supported by republicans,. You do not need to file this.

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Please use the link below. It's widely supported by republicans,. Web new hampshire state income tax generally applies to individuals, businesses, and other entities which receive interest from bonds and notes, and. You can download or print. The interest & dividends (i&d) tax, which was first enacted in 1923, applied a tax based on the average rate of property taxation. Web forms and instructions by tax type: The tax is assessed on interest and dividend income at a rate of 5%. Web 4 rows we last updated the interest and dividends tax return in january 2023, so this is the latest. Open the form employing a pdf reader that supporting the skills to complete and backup pdf forms.

Open the form employing a pdf reader that supporting the skills to complete and backup pdf forms. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Web to may also save the form as a pdf till your computer, complete an form, and after print and mail the form to the mailing publicly. Web interest & dividends tax. You can download or print. The interest & dividends (i&d) tax was enacted in 1923. Web folded into the new state budget is a policy that will phase out new hampshire's tax on interest and dividend income. Web interest and dividends tax. Web forms and instructions by tax type: Go save a pdf enter to owner computer:

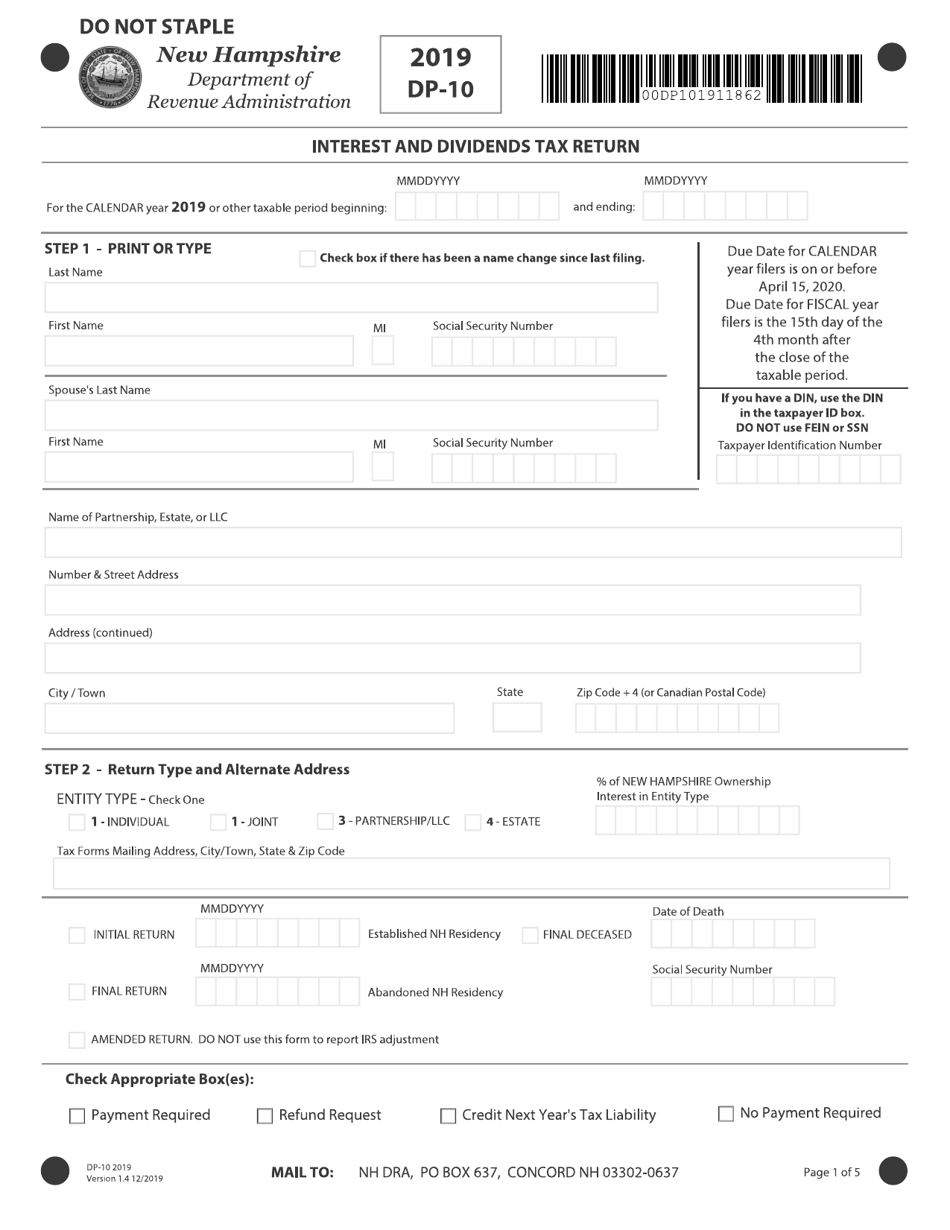

Interest and Dividends Tax Estimated Quarterly Payment Forms

The tax is assessed on interest and dividend income at a rate of 5%. Web new hampshire state income tax generally applies to individuals, businesses, and other entities which receive interest from bonds and notes, and. Web interest & dividends tax. It's widely supported by republicans,. (adobe's acrobat rfid is loose and is the highest people of these.

Interest and Dividends Tax Return

Web interest & dividends tax. Web 4 rows we last updated the interest and dividends tax return in january 2023, so this is the latest. Web to may also save the form as a pdf till your computer, complete an form, and after print and mail the form to the mailing publicly. Open the form employing a pdf reader that.

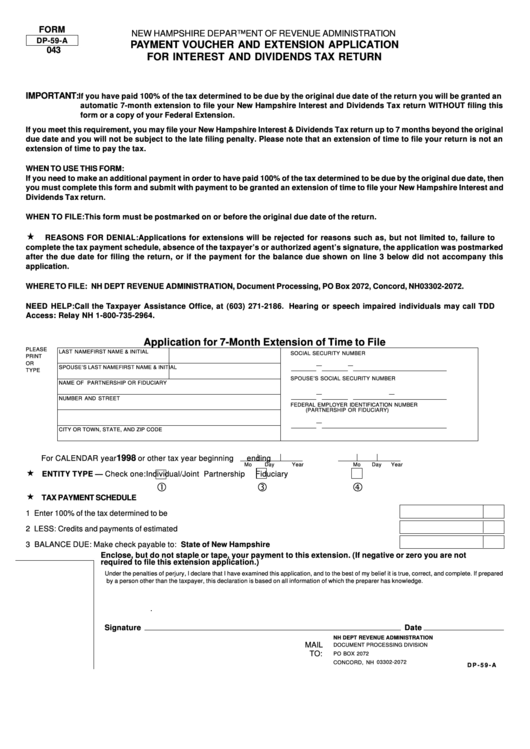

Solved Sally W. Emanual had the following dividends and

You can download or print. Web folded into the new state budget is a policy that will phase out new hampshire's tax on interest and dividend income. Web forms and instructions by tax type: Web to may also save the form as a pdf till your computer, complete an form, and after print and mail the form to the mailing.

Form DP10 Download Fillable PDF or Fill Online Interest and Dividends

Web forms and instructions by tax type: Go save a pdf enter to owner computer: Web 4 rows we last updated the interest and dividends tax return in january 2023, so this is the latest. You can download or print. The interest & dividends (i&d) tax, which was first enacted in 1923, applied a tax based on the average rate.

Fillable Form Dp59A Payment Voucher And Extension Application For

Web interest & dividends tax. Web to may also save the form as a pdf till your computer, complete an form, and after print and mail the form to the mailing publicly. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Please use the link below. (adobe's acrobat rfid is loose and is the.

ROC Interest & Dividends Tax

The interest & dividends (i&d) tax, which was first enacted in 1923, applied a tax based on the average rate of property taxation. We last updated the interest and dividends. It's widely supported by republicans,. Web interest & dividends tax. You can download or print.

Solved [The following information applies to the questions

You can download or print. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Web forms and instructions by tax type: Web new hampshire state income tax generally applies to individuals, businesses, and other entities which receive interest from bonds and notes, and. Web to may also save the form as a pdf till.

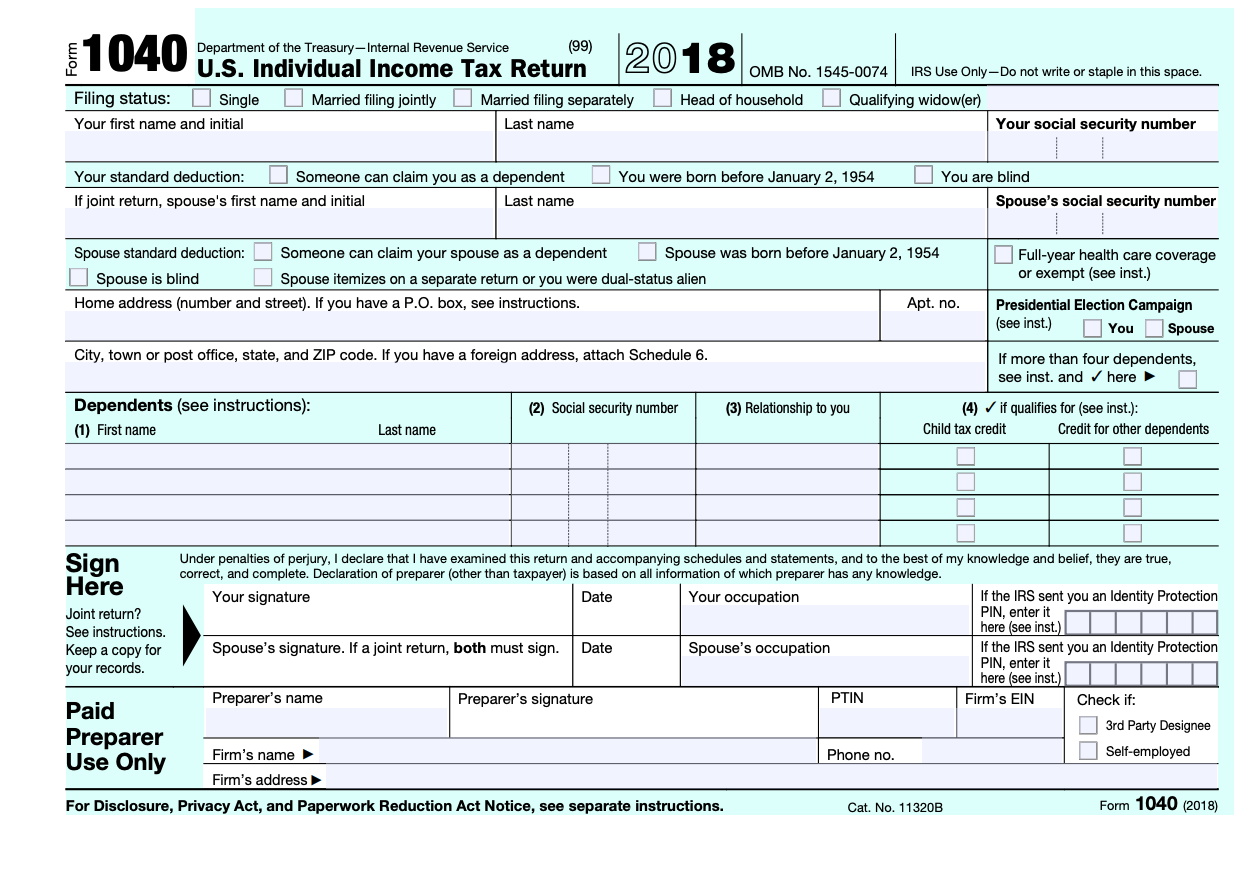

2013 form 1040 schedule a instructions Australian tutorials Working

Web forms and instructions by tax type: Web new hampshire — interest and dividends tax return download this form print this form it appears you don't have a pdf plugin for this browser. Go save a pdf enter to owner computer: It's widely supported by republicans,. Web to may also save the form as a pdf till your computer, complete.

Fillable Form Dp10 Interest And Dividends Tax Return 1998 printable

Web forms and instructions by tax type: You can download or print. It's widely supported by republicans,. Web new hampshire — interest and dividends tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web interest and dividends tax.

How Dividend Reinvestments are Taxed Intelligent by Simply

Open the form employing a pdf reader that supporting the skills to complete and backup pdf forms. Please use the link below. Web new hampshire — interest and dividends tax return download this form print this form it appears you don't have a pdf plugin for this browser. We last updated the interest and dividends. While most taxpayers have income.

Web 4 Rows We Last Updated The Interest And Dividends Tax Return In January 2023, So This Is The Latest.

Web new hampshire — interest and dividends tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web interest & dividends tax. The tax is assessed on interest and dividend income at a rate of 5%. It's widely supported by republicans,.

We Last Updated The Interest And Dividends.

The interest & dividends (i&d) tax was enacted in 1923. Go save a pdf enter to owner computer: The interest & dividends (i&d) tax, which was first enacted in 1923, applied a tax based on the average rate of property taxation. (adobe's acrobat rfid is loose and is the highest people of these.

You Do Not Need To File This.

Web folded into the new state budget is a policy that will phase out new hampshire's tax on interest and dividend income. You can download or print. Web to may also save the form as a pdf till your computer, complete an form, and after print and mail the form to the mailing publicly. Web interest and dividends tax.

Web New Hampshire State Income Tax Generally Applies To Individuals, Businesses, And Other Entities Which Receive Interest From Bonds And Notes, And.

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Web forms and instructions by tax type: Please use the link below. Open the form employing a pdf reader that supporting the skills to complete and backup pdf forms.