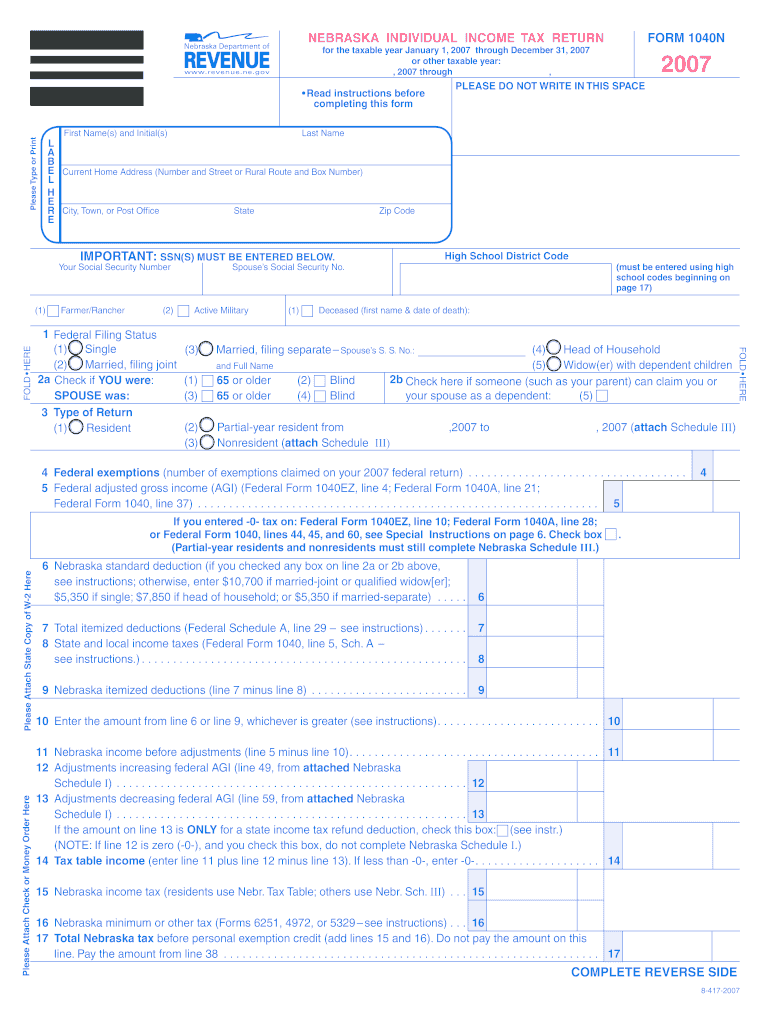

Nebraska Form 1040N

Nebraska Form 1040N - Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. If you file your 2021 nebraska individual income tax return, form 1040n, on or before march 1, 2022, and pay the total income. Ad download or email ne dor 1040n & more fillable forms, register and subscribe now It appears you don't have a pdf plugin for this browser. Do not reduce this amount. Web nebraska schedule iii — computation of nebraska tax 2022 form 1040n schedule iii • you must complete lines 1 through 14, form 1040n. Amounts on line 13 of the form 1040n are not allowed. If you have state, local, or federal. Web form 1040n is the general income tax return for nebraska residents. Complete, edit or print tax forms instantly.

You must file it on a yearly basis to calculate and pay any money dur to the nebraska department of. 2020 please do not write in this. Web nebraska schedule iii — computation of nebraska tax 2022 form 1040n schedule iii • you must complete lines 1 through 14, form 1040n. You can download or print. Web form 1040n is the general income tax return for nebraska residents. Nebraska itemized deductions (line 7 minus line 8) 10. Web the correct amount for line 5 of form 1040n for all other filing statuses is $43,820 or less. Do not reduce this amount. This form is for income earned in tax year 2022, with tax. If you have state, local, or federal.

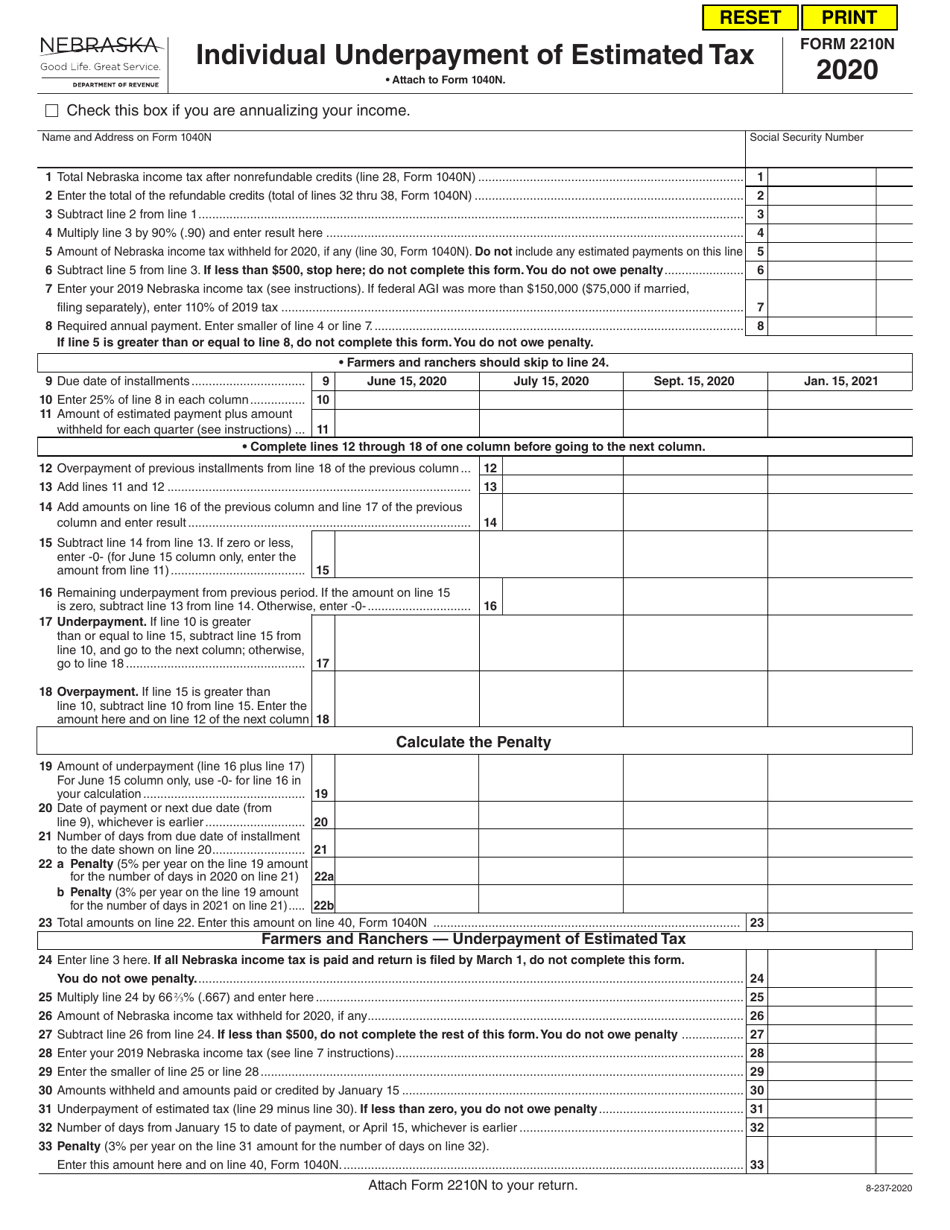

Web nebraska individual income tax return form 1040n for the taxable year january 1, 2020 through december 31, 2020 or other taxable year: The adjusted gross income amount for married, filing jointly returns is stated correctly. Web form 1040n is the general income tax return for nebraska residents. It appears you don't have a pdf plugin for this browser. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web nebraska schedule iii — computation of nebraska tax 2022 form 1040n schedule iii • you must complete lines 1 through 14, form 1040n. Amounts on line 13 of the form 1040n are not allowed. Download or email form 1040n & more fillable forms, register and subscribe now! Web penalty for underpayment of estimated income tax. 2020 please do not write in this.

NE 1040N Schedule I 2020 Fill out Tax Template Online US Legal Forms

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Ad download or email ne dor 1040n & more fillable forms, register and subscribe now 2020 please do not write in this. Nebraska itemized deductions (line 7 minus line 8) 10. Web form 1040n is the general income tax return for nebraska.

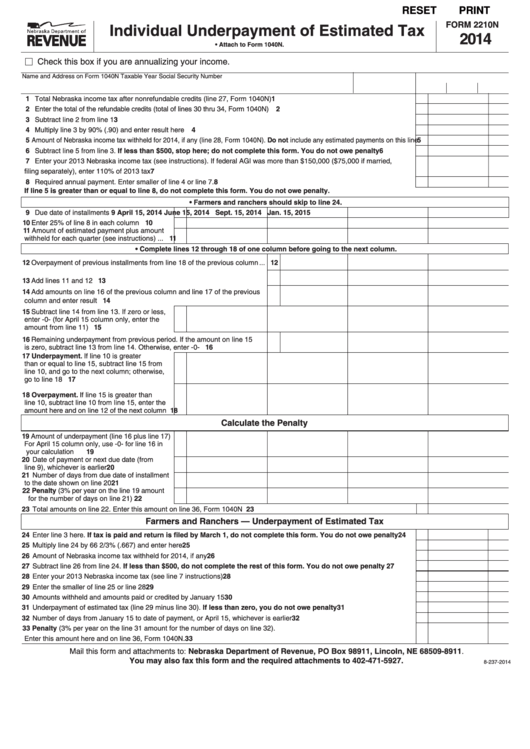

Fillable Form 2210n Nebraska Individual Underpayment Of Estimated Tax

You can download or print. Download or email form 1040n & more fillable forms, register and subscribe now! It appears you don't have a pdf plugin for this browser. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a.

Form 2210N Download Fillable PDF or Fill Online Individual Underpayment

Download or email form 1040n & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web form 1040n is the general income tax return for nebraska residents. You must file it on a yearly basis to calculate and pay any money dur to the nebraska department of. Web penalty for underpayment of estimated income tax.

Nebraska Form 1040NSchedules (Schedules I, II, and III) 2021

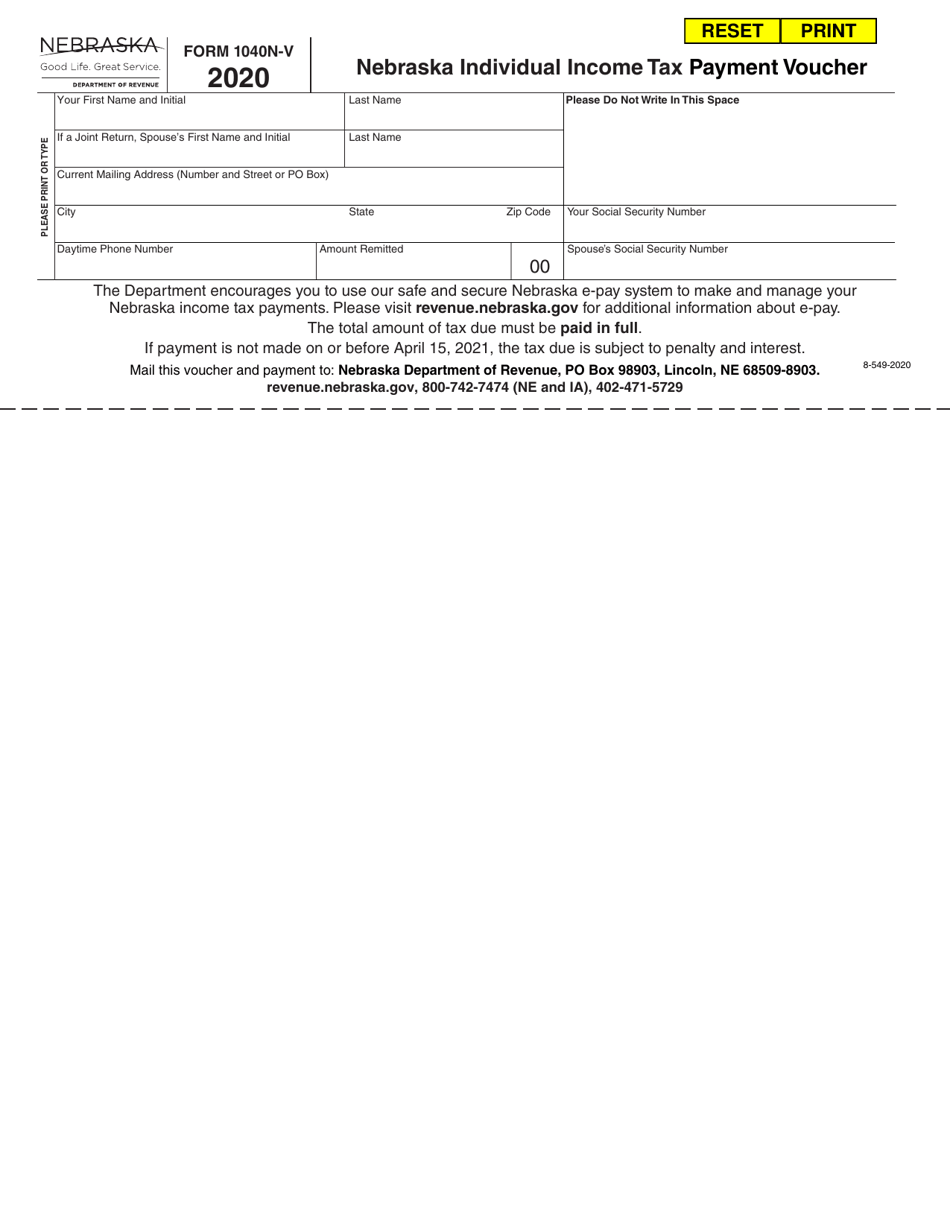

If you file your 2021 nebraska individual income tax return, form 1040n, on or before march 1, 2022, and pay the total income. Web the correct amount for line 5 of form 1040n for all other filing statuses is $43,820 or less. Do not reduce this amount. Web nebraska individual estimated income ax ayment vouchers included in this booklet: This.

Form 1040NV Download Fillable PDF or Fill Online Nebraska Individual

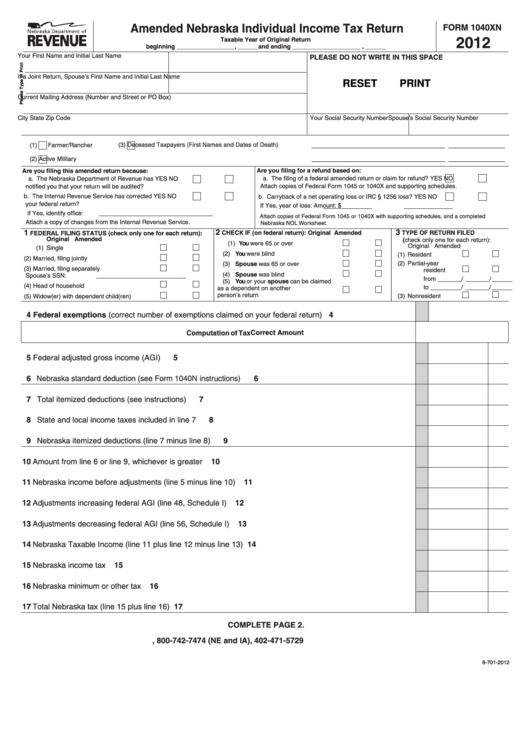

Ad download or email ne dor 1040n & more fillable forms, register and subscribe now Complete, edit or print tax forms instantly. Web we last updated the amended nebraska individual income tax return in april 2023, so this is the latest version of form 1040xn, fully updated for tax year 2022. If you file your 2021 nebraska individual income tax.

Form 1040N Nebraska Individual Tax Return YouTube

You must file it on a yearly basis to calculate and pay any money dur to the nebraska department of. Complete, edit or print tax forms instantly. Web increasing federal agi as shown on line 12, nebraska form 1040n. It appears you don't have a pdf plugin for this browser. This form is for income earned in tax year 2022,.

f 1040n booklet

Web nebraska individual income tax return form 1040n for the taxable year january 1, 2020 through december 31, 2020 or other taxable year: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. If you have state, local,.

Fillable Form 1040xn Amended Nebraska Individual Tax Return

If you have state, local, or federal. You must file it on a yearly basis to calculate and pay any money dur to the nebraska department of. Web form 1040n is the general income tax return for nebraska residents. Web nebraska individual income tax return form 1040n for the taxable year january 1, 2020 through december 31, 2020 or other.

Form 1040n Fill Online, Printable, Fillable, Blank PDFfiller

Web increasing federal agi as shown on line 12, nebraska form 1040n. Nebraska itemized deductions (line 7 minus line 8) 10. Web form 1040n is the general income tax return for nebraska residents. This form is for income earned in tax year 2022, with tax. This form is for income earned in tax year 2022, with tax returns due in.

Military Tax Break for Nebraska Residents 1040NMIL Callahan

Amounts on line 13 of the form 1040n are not allowed. Web increasing federal agi as shown on line 12, nebraska form 1040n. Web nebraska schedule iii — computation of nebraska tax 2022 form 1040n schedule iii • you must complete lines 1 through 14, form 1040n. Web form 1040n is the general income tax return for nebraska residents. Ad.

2020 Please Do Not Write In This.

Nebraska itemized deductions (line 7 minus line 8) 10. We will update this page with a new version of the form for 2024 as soon as it is made available. Web penalty for underpayment of estimated income tax. Web form 1040n is the general income tax return for nebraska residents.

Download Or Email Form 1040N & More Fillable Forms, Register And Subscribe Now!

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Do not reduce this amount. You must file it on a yearly basis to calculate and pay any money dur to the nebraska department of. You can download or print.

If You Have State, Local, Or Federal.

Web increasing federal agi as shown on line 12, nebraska form 1040n. Complete, edit or print tax forms instantly. Web the correct amount for line 5 of form 1040n for all other filing statuses is $43,820 or less. Web nebraska individual income tax return form 1040n for the taxable year january 1, 2020 through december 31, 2020 or other taxable year:

Web We Last Updated The Amended Nebraska Individual Income Tax Return In April 2023, So This Is The Latest Version Of Form 1040Xn, Fully Updated For Tax Year 2022.

Amounts on line 13 of the form 1040n are not allowed. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. The adjusted gross income amount for married, filing jointly returns is stated correctly. This form is for income earned in tax year 2022, with tax.