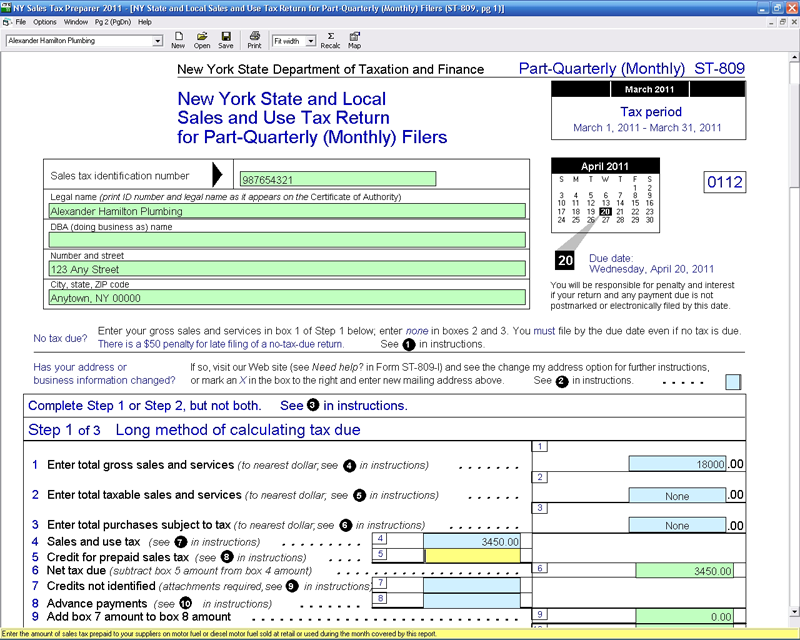

Mt 903 Form

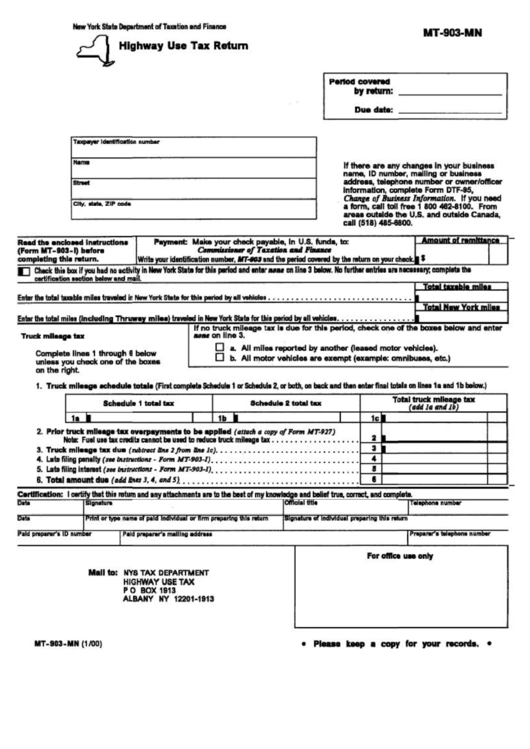

Mt 903 Form - $ check this box if you had no activity innew york state for this period and enternoneon line 3 below. The tax department will use the postmark date as the filing date for returns and payments. Web file by mail: Enjoy smart fillable fields and interactivity. For more information, see when to file and pay. Web for tax periods beginning on and after january 1, 2022, the thresholds for monthly, quarterly, and annual filing requirements increased, allowing many filers to report less frequently. Return on your check or. Follow the simple instructions below: How your highway use tax is determined Be sure to use the proper tables for your reporting method.

For more information, see when to file and pay. Web file by mail: Web 33 votes how to fill out and sign preprinted online? $ check this box if you had no activity innew york state for this period and enternoneon line 3 below. Web from areas outside the u.s. Return on your check or. Web for tax periods beginning on and after january 1, 2022, the thresholds for monthly, quarterly, and annual filing requirements increased, allowing many filers to report less frequently. If you have any questions, please see need help? Follow the simple instructions below: Enjoy smart fillable fields and interactivity.

Web from areas outside the u.s. The tax department will use the postmark date as the filing date for returns and payments. Get your online template and fill it in using progressive features. Return on your check or. Web file by mail: How your highway use tax is determined Web 33 votes how to fill out and sign preprinted online? For more information, see when to file and pay. Be sure to use the proper tables for your reporting method. If you have any questions, please see need help?

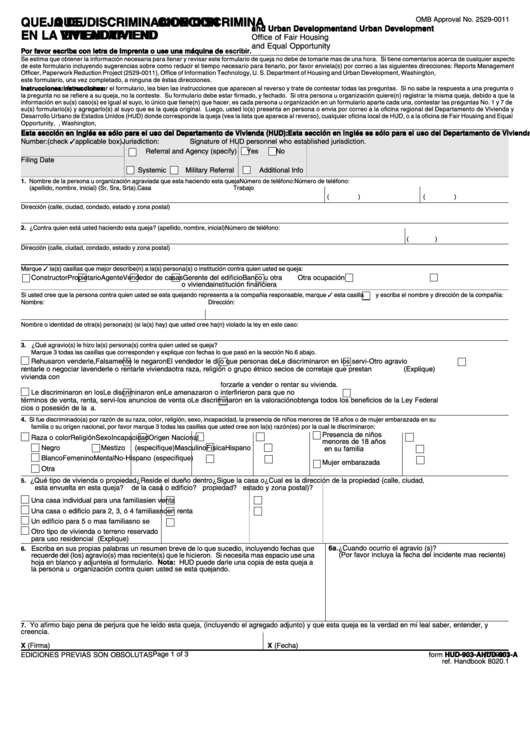

Fillable Form Hud903A Queja De Discriminacion En La Vivienda U.s

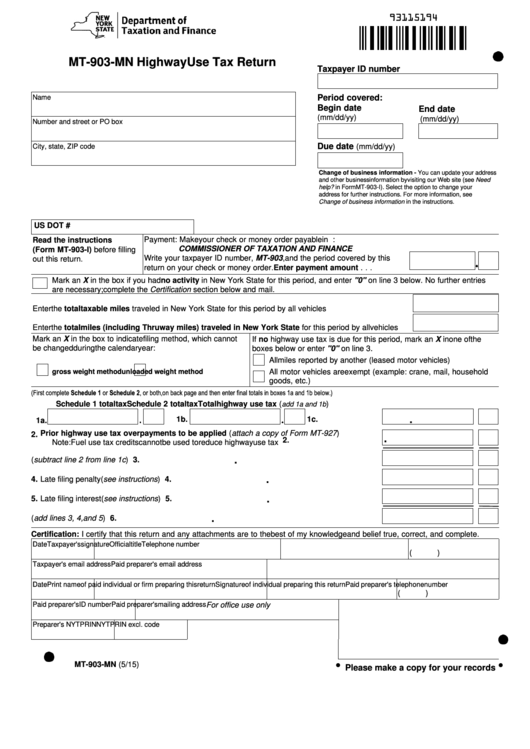

$ check this box if you had no activity innew york state for this period and enternoneon line 3 below. Enjoy smart fillable fields and interactivity. Web for tax periods beginning on and after january 1, 2022, the thresholds for monthly, quarterly, and annual filing requirements increased, allowing many filers to report less frequently. Be sure to use the proper.

Form Mt903Mn Highway Use Tax Return Department Of Taxation And

$ check this box if you had no activity innew york state for this period and enternoneon line 3 below. Enjoy smart fillable fields and interactivity. Return on your check or. For more information, see when to file and pay. Get your online template and fill it in using progressive features.

Fillable Form Mt903Mn Highway Use Tax Return printable pdf download

Follow the simple instructions below: The tax department will use the postmark date as the filing date for returns and payments. $ check this box if you had no activity innew york state for this period and enternoneon line 3 below. Web from areas outside the u.s. Enjoy smart fillable fields and interactivity.

Купить Угловая шлифмашина Maktec MT 903 Официальный представитель Makita

If you have any questions, please see need help? Follow the simple instructions below: The tax department will use the postmark date as the filing date for returns and payments. $ check this box if you had no activity innew york state for this period and enternoneon line 3 below. Web file by mail:

ATP MT903 Pocket ThermoHygrometer Rapid Online

Follow the simple instructions below: Web from areas outside the u.s. For more information, see when to file and pay. Be sure to use the proper tables for your reporting method. Enjoy smart fillable fields and interactivity.

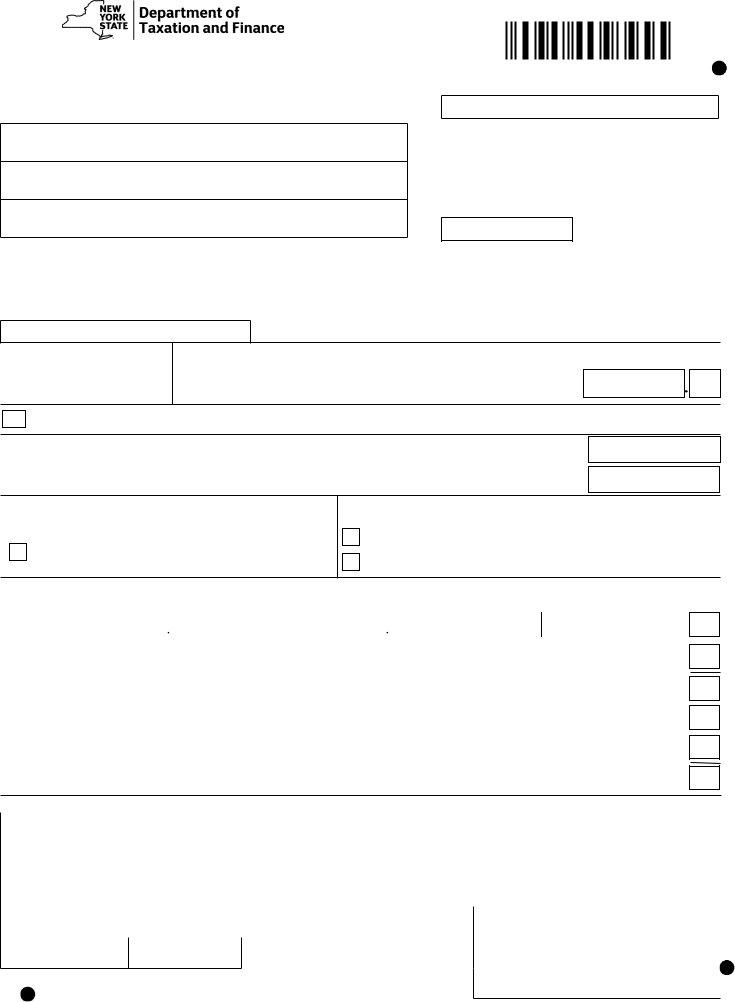

Mt 903 Mn Form ≡ Fill Out Printable PDF Forms Online

Be sure to use the proper tables for your reporting method. Get your online template and fill it in using progressive features. Web 33 votes how to fill out and sign preprinted online? $ check this box if you had no activity innew york state for this period and enternoneon line 3 below. The tax department will use the postmark.

MT903 Stůl chladicí 3D salátový GASTROOLOMOUC

The tax department will use the postmark date as the filing date for returns and payments. Get your online template and fill it in using progressive features. If you have any questions, please see need help? For more information, see when to file and pay. Be sure to use the proper tables for your reporting method.

New York State Mt 171 Fillable Fill and Sign Printable Template

If you have any questions, please see need help? The tax department will use the postmark date as the filing date for returns and payments. Follow the simple instructions below: Web from areas outside the u.s. Return on your check or.

Alena Hershberger

Get your online template and fill it in using progressive features. For more information, see when to file and pay. Web from areas outside the u.s. Enjoy smart fillable fields and interactivity. The tax department will use the postmark date as the filing date for returns and payments.

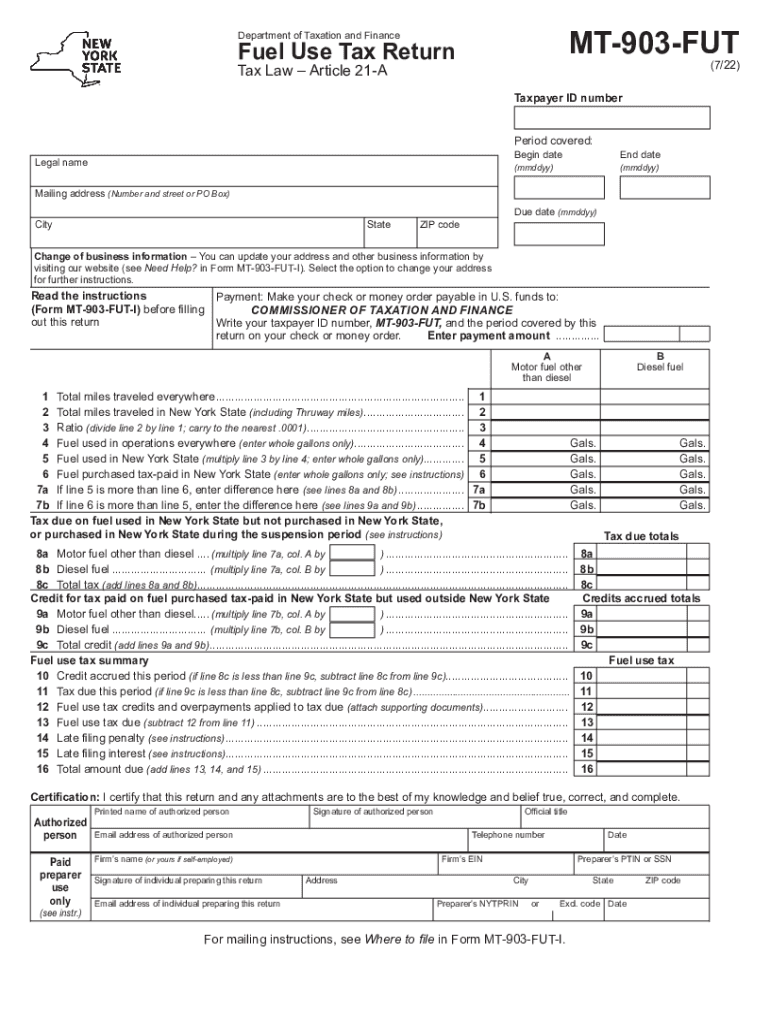

Form MT 903 FUT Fuel Use Tax Return Revised 722 Fill Out and Sign

How your highway use tax is determined Be sure to use the proper tables for your reporting method. Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Return on your check or.

Web From Areas Outside The U.s.

Follow the simple instructions below: $ check this box if you had no activity innew york state for this period and enternoneon line 3 below. Enjoy smart fillable fields and interactivity. How your highway use tax is determined

If You Have Any Questions, Please See Need Help?

Web file by mail: Make your check or money order payable in u.s. The tax department will use the postmark date as the filing date for returns and payments. Web for tax periods beginning on and after january 1, 2022, the thresholds for monthly, quarterly, and annual filing requirements increased, allowing many filers to report less frequently.

Be Sure To Use The Proper Tables For Your Reporting Method.

Return on your check or. For more information, see when to file and pay. Get your online template and fill it in using progressive features. Web 33 votes how to fill out and sign preprinted online?