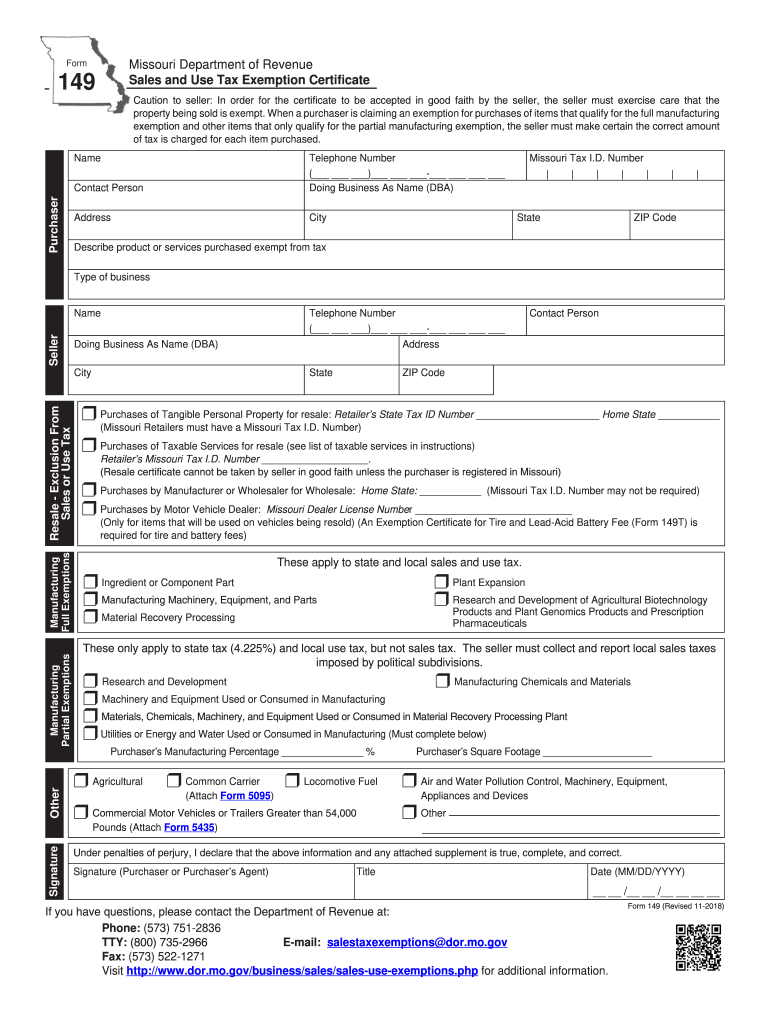

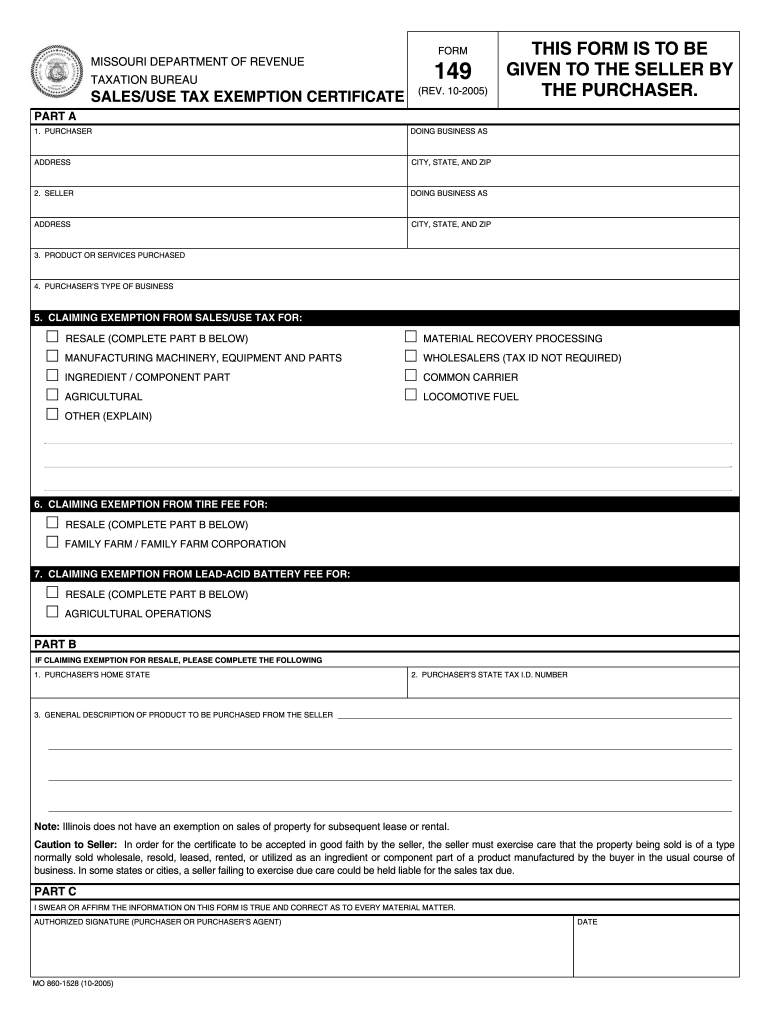

Mo Form 149

Mo Form 149 - Issue a missouri resale certificate to vendors for purchase of items for resale. Web generally, missouri taxes all retail sales of tangible personal property and certain taxable services. If you are the seller, you will need to collect the form 149 from the purchaser. However, there are a number of exemptions and exclusions from missouri's sales and use tax laws. Statement of vehicle taken without permission: Sales and use tax exemption certificate: Forms and manuals find your form. If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. Web missouri department of revenue,. Web missouri department of revenue,.

Sales and use tax exemption certificate: If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. Web missouri department of revenue,. Web missouri department of revenue,. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the missouri sales tax. Issue a missouri resale certificate to vendors for purchase of items for resale. Sales and use tax exemption certificate: If you are the seller, you will need to collect the form 149 from the purchaser. Sales and use tax exemption certificate: Forms and manuals find your form.

Sales and use tax exemption certificate: Web when you purchase tangible personal property to be resold to a retailer, you will need to provide the seller with your completed missouri form 149, sales/use tax exemption certificate. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the missouri sales tax. Sales and use tax exemption certificate: If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. Although exemptions and exclusions both result in an item not being taxed, they operate differently. Statement of vehicle taken without permission: Forms and manuals find your form. Download a sales tax exemption certificate in pdf format for future use. Web missouri form 149 | obtain a missouri resale certificate.

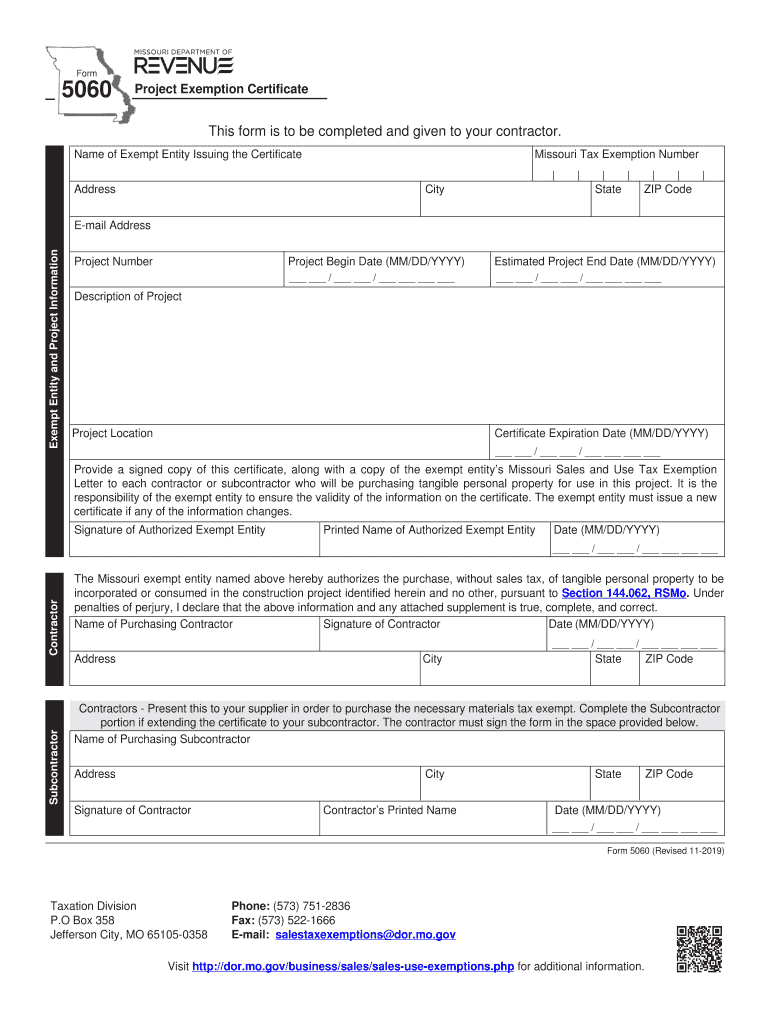

MO DoR 5060 20192021 Fill out Tax Template Online US Legal Forms

However, there are a number of exemptions and exclusions from missouri's sales and use tax laws. Download a sales tax exemption certificate in pdf format for future use. Although exemptions and exclusions both result in an item not being taxed, they operate differently. Form 2041 should only be used to accompany form 163 or 163b, sales/use tax protest affidavit. Issue.

Mo Form 149 Fill Out and Sign Printable PDF Template signNow

Sales and use tax exemption certificate: Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the missouri sales tax. However, there are a number of exemptions and exclusions from missouri's sales and use tax laws. Issue a missouri resale certificate to vendors for purchase of.

MO DoR 4572 2014 Fill out Tax Template Online US Legal Forms

Sales and use tax exemption certificate: Statement of vehicle taken without permission: Sales and use tax exemption certificate: If you are the seller, you will need to collect the form 149 from the purchaser. If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals.

2022 Form MO DoR 149 Fill Online, Printable, Fillable, Blank pdfFiller

Web missouri department of revenue,. Web when you purchase tangible personal property to be resold to a retailer, you will need to provide the seller with your completed missouri form 149, sales/use tax exemption certificate. Web missouri department of revenue,. If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. Although exemptions and.

Form 149 Sales And Use Tax Exemption Certificate Edit, Fill, Sign

Issue a missouri resale certificate to vendors for purchase of items for resale. However, there are a number of exemptions and exclusions from missouri's sales and use tax laws. Web generally, missouri taxes all retail sales of tangible personal property and certain taxable services. Sales and use tax exemption certificate: Sales and use tax exemption certificate:

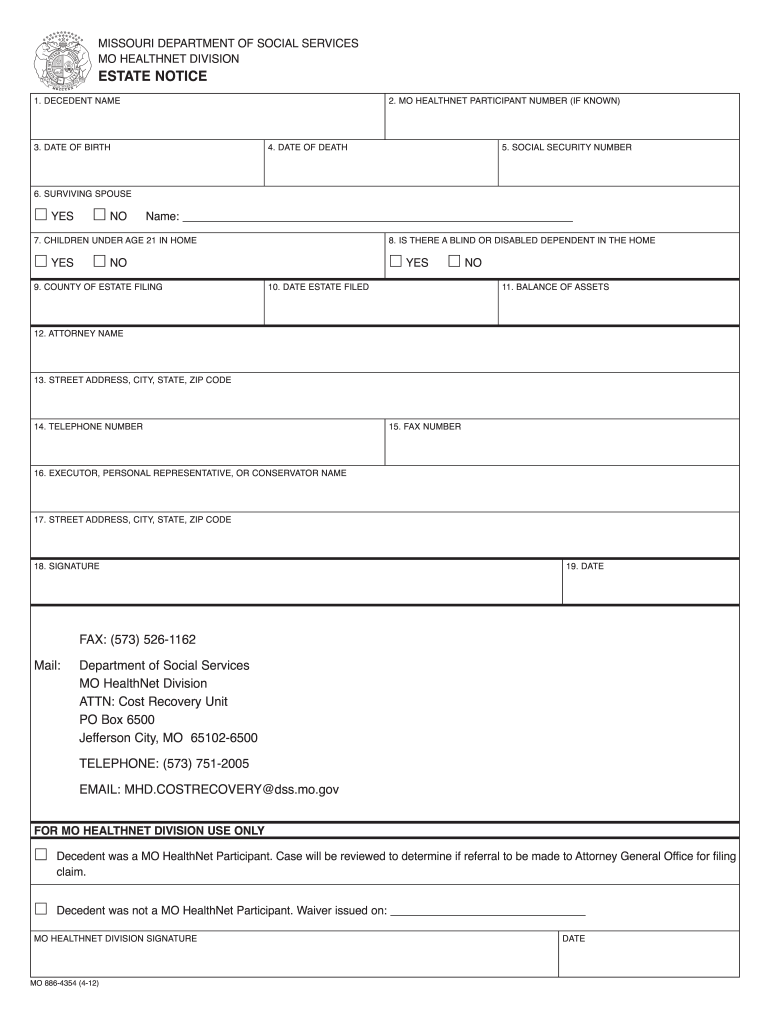

Dss Mo Fill Online, Printable, Fillable, Blank pdfFiller

Web missouri department of revenue,. Web generally, missouri taxes all retail sales of tangible personal property and certain taxable services. Statement of vehicle taken without permission: Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the missouri sales tax. Sales and use tax exemption certificate:

2020 MO Form 4669 Fill Online, Printable, Fillable, Blank pdfFiller

Statement of vehicle taken without permission: Issue a missouri resale certificate to vendors for purchase of items for resale. Sales and use tax exemption certificate: Sales and use tax exemption certificate: If you are the seller, you will need to collect the form 149 from the purchaser.

2014 Form MO DoR 2827 Fill Online, Printable, Fillable, Blank pdfFiller

If you are the seller, you will need to collect the form 149 from the purchaser. Web missouri department of revenue,. Although exemptions and exclusions both result in an item not being taxed, they operate differently. Form 2041 should only be used to accompany form 163 or 163b, sales/use tax protest affidavit. Web generally, missouri taxes all retail sales of.

2005 Form MO DoR 149 Fill Online, Printable, Fillable, Blank pdfFiller

Web when you purchase tangible personal property to be resold to a retailer, you will need to provide the seller with your completed missouri form 149, sales/use tax exemption certificate. Forms and manuals find your form. Web missouri form 149 | obtain a missouri resale certificate. However, there are a number of exemptions and exclusions from missouri's sales and use.

MO MO1041 2016 Fill out Tax Template Online US Legal Forms

If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the missouri sales tax. Sales and use tax exemption certificate: Statement of vehicle taken without permission: Form 2041 should.

If You Are The Seller, You Will Need To Collect The Form 149 From The Purchaser.

Form 2041 should only be used to accompany form 163 or 163b, sales/use tax protest affidavit. Forms and manuals find your form. Web when you purchase tangible personal property to be resold to a retailer, you will need to provide the seller with your completed missouri form 149, sales/use tax exemption certificate. Sales and use tax exemption certificate:

If Yes, Visit Dor.mo.gov/Military/ To See The Services And Benefits We Offer To All Eligible Military Individuals.

Download a sales tax exemption certificate in pdf format for future use. Issue a missouri resale certificate to vendors for purchase of items for resale. Sales and use tax exemption certificate: Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the missouri sales tax.

Web Missouri Department Of Revenue,.

Web missouri department of revenue,. Web missouri form 149 | obtain a missouri resale certificate. However, there are a number of exemptions and exclusions from missouri's sales and use tax laws. Although exemptions and exclusions both result in an item not being taxed, they operate differently.

Sales And Use Tax Exemption Certificate:

Statement of vehicle taken without permission: Web generally, missouri taxes all retail sales of tangible personal property and certain taxable services.