Mn Frontline Worker Pay Tax Form

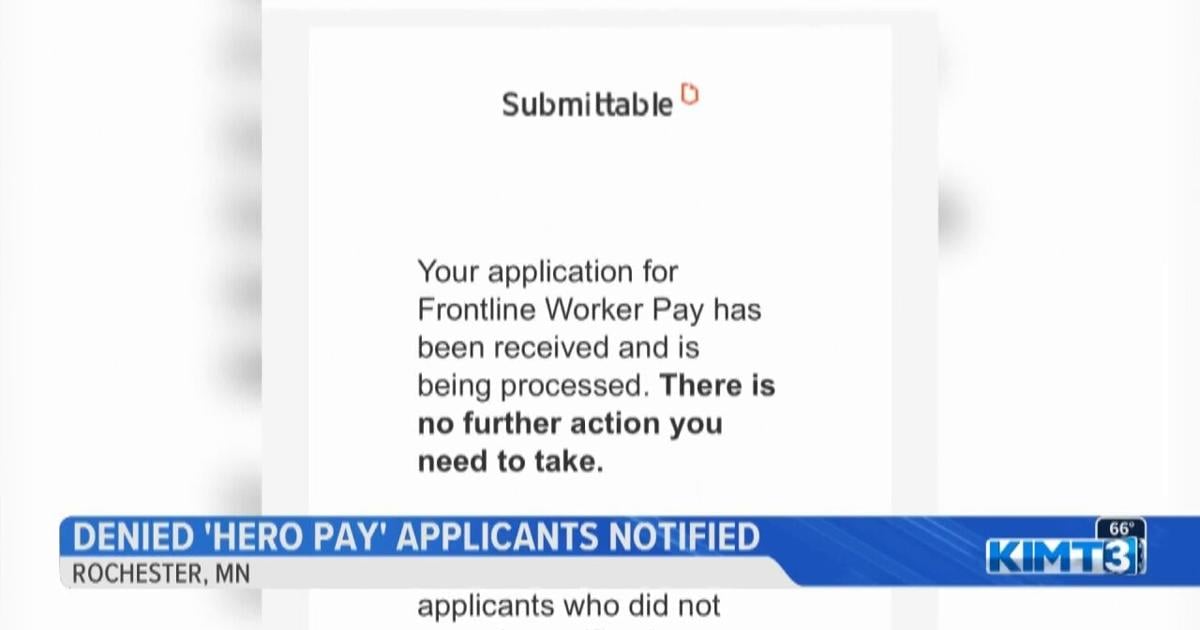

Mn Frontline Worker Pay Tax Form - Web application period begins for minnesota frontline worker bonus payment program. · applicants whose application was denied, could appeal the decision during a 15. Report the payment as “other income” using line 8z of federal schedule 1. Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue. Documents on this page are in adobe (pdf), word (doc), word (docx), and excel (xls) formats. 2022 w4mn, minnesota withholding allowance/exemption certificate. We are reviewing other changes and will. Web the frontline worker pay application was open june 8 through july 22, 2022. Eligible workers had 45 days to apply for frontline worker pay. Uncodified sections in 2022 laws, ch.

Web for eligibility and other details, go to direct tax rebate payments. Here's how to enter your minnesota frontline. The minnesota department of labor and industry has. Data submission methods and file formats; Under the whats new in 2022 link there is info on the minnesota frontline workers pay it’s says “ minnesota frontline worker pay. Web tax considerations for state frontline worker pay august 24, 2021 overview federal taxability of state payments is determined by the internal revenue. Web yes it is for minnesota. 2022 w4mn, minnesota withholding allowance/exemption certificate. Report the payment as “other income” using line 8z of federal schedule 1. If you received a frontline worker payment of.

Web yes it is for minnesota. Documents on this page are in adobe (pdf), word (doc), word (docx), and excel (xls) formats. Web sign in to your submittable account. Web the frontline worker pay application was open june 8 through july 22, 2022. Data submission methods and file formats; Uncodified sections in 2022 laws, ch. Web · the frontline worker pay application was open for 45 days, june 8 through july 22, 2022. Frontline worker payments on minnesota tax return. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. We are reviewing other changes and will.

Minnesota’s New Frontline Worker Pay Law Requirements for Employers

Web application period begins for minnesota frontline worker bonus payment program. Is taxable on your federal income tax return. Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue. Uncodified sections in 2022 laws, ch. Web the frontline worker pay application was open june 8 through july 22,.

Minnesota Frontline Worker pay Video

Web on june 7, 2022, the state issued guidance on the requirements of the law. Documents on this page are in adobe (pdf), word (doc), word (docx), and excel (xls) formats. We are reviewing other changes and will. Web yes it is for minnesota. Here's how to enter your minnesota frontline.

[Listen] Farmers Eligible for MN Frontline Worker Pay Program?

Web on june 7, 2022, the state issued guidance on the requirements of the law. Covered employers need to take action before june 23, 2022. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. Eligible workers had 45 days.

How To File Minnesota Property Tax Refund

Web the payment is taxable on your federal return, but isn't taxable in minnesota, nor included in your household income. 2022 w4mn, minnesota withholding allowance/exemption certificate. Here's how to enter your minnesota frontline. The minnesota department of labor and industry has. If you received a frontline worker payment of.

1.1 Million Applications Sent In For Minnesota's Frontline Worker Pay

Eligible workers had 45 days to apply for frontline worker pay. · applicants whose application was denied, could appeal the decision during a 15. Is taxable on your federal income tax return. Web on june 7, 2022, the state issued guidance on the requirements of the law. Report the payment as “other income” using line 8z of federal schedule 1.

Minnesota Frontline Worker Pay Applications Open

Web up to $40 cash back get the free 2022 minnesota form. Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue. Web on june 7, 2022, the state issued guidance on the requirements of the law. We are reviewing other changes and will. Web the payment is.

MN Frontline Worker Pay details expected to be released next week

Uncodified sections in 2022 laws, ch. Web · the frontline worker pay application was open for 45 days, june 8 through july 22, 2022. Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue. Web businesses tax professionals governments law change updates we've published new updates about this.

MN Frontline Worker Pay Scam Minnesota Frontline Worker Pay Howard

Is taxable on your federal income tax return. Web this program will provide relief to those who were frontline workers in minnesota during the pandemic. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. Under the whats new in.

Minnesota pandemic pay panel likely to miss Monday deadline

2022 w4mn, minnesota withholding allowance/exemption certificate. Uncodified sections in 2022 laws, ch. Web frontline worker payments on minnesota tax return if you received a frontline worker payment of $487.45 in 2022, it is taxable on your federal income tax return but not. Web this program will provide relief to those who were frontline workers in minnesota during the pandemic. Federal.

The Minnesota Legislature approved 250 million for pandemic worker

Web this program will provide relief to those who were frontline workers in minnesota during the pandemic. Federal unemployment tax act (futa) credit;. Web up to $40 cash back get the free 2022 minnesota form. Minnesota has a state income tax that ranges between 5.35% and 9.85% , which is administered by the minnesota department of revenue. We are reviewing.

Web The Frontline Worker Pay Application Was Open June 8 Through July 22, 2022.

Frontline worker payments on minnesota tax return. Data submission methods and file formats; · applicants whose application was denied, could appeal the decision during a 15. Is taxable on your federal income tax return.

If You Received A Frontline Worker Payment Of.

The minnesota department of labor and industry has. Covered employers need to take action before june 23, 2022. Web · the frontline worker pay application was open for 45 days, june 8 through july 22, 2022. Web the payment is taxable on your federal return, but isn't taxable in minnesota, nor included in your household income.

Here's How To Enter Your Minnesota Frontline.

Web up to $40 cash back get the free 2022 minnesota form. Uncodified sections in 2022 laws, ch. 2022 w4mn, minnesota withholding allowance/exemption certificate. Under the whats new in 2022 link there is info on the minnesota frontline workers pay it’s says “ minnesota frontline worker pay.

Eligible Workers Had 45 Days To Apply For Frontline Worker Pay.

Web on june 7, 2022, the state issued guidance on the requirements of the law. Federal unemployment tax act (futa) credit;. The payments will be of approximately $750.00 and the application. Web application period begins for minnesota frontline worker bonus payment program.

![[Listen] Farmers Eligible for MN Frontline Worker Pay Program?](https://townsquare.media/site/67/files/2022/01/attachment-GettyImages-117855607.jpg?w=980&q=75)