Mileage Claim Form

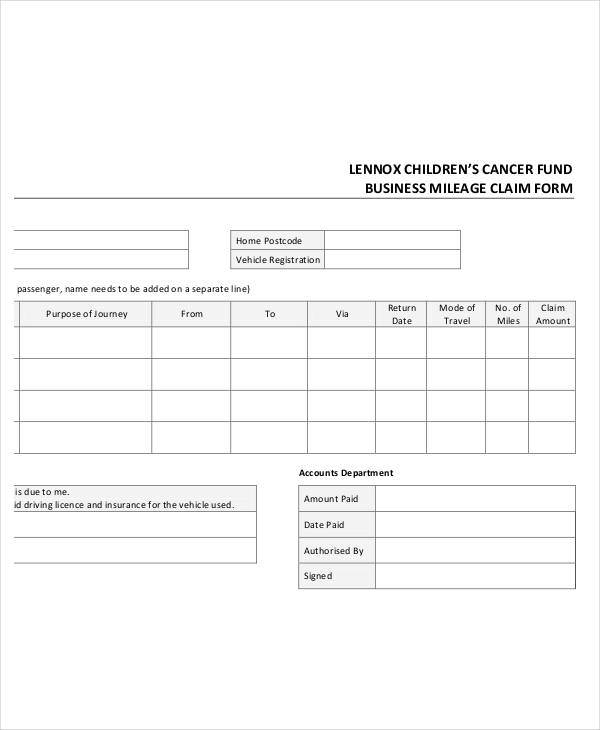

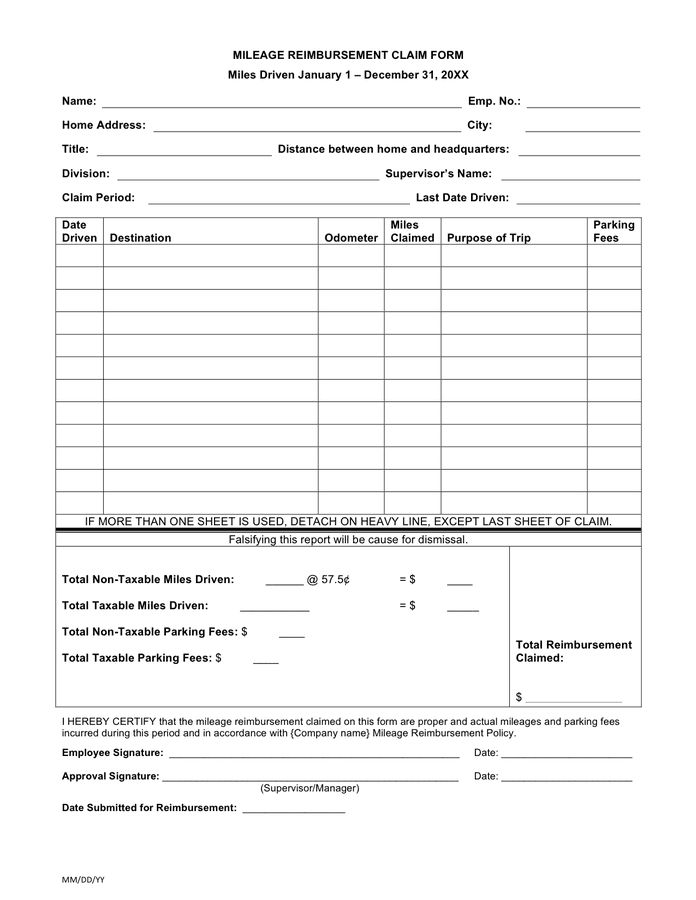

Mileage Claim Form - This means that if an employee has used their own rather than a company vehicle to make business journeys, they need to be reimbursed via mileage expenses. With this form, employers can reimburse employees and document traveling details such as traveling distances and destinations. Apply a check mark to indicate the answer wherever demanded. Web a mileage reimbursement form enables the organization to reimburse the traveling expenses incurred by its employees. Free for personal or commercial use. 405 sw 5th street, suite c. Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Mileage reimbursement trip log and claim form. Web mileage reimbursement is the amount a company pays an employee to cover the costs of driving a personal vehicle for business purposes. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more.

Ad pdffiller allows users to edit, sign, fill and share all type of documents online. Web mileage reimbursement is the amount a company pays an employee to cover the costs of driving a personal vehicle for business purposes. Intended to track mileage and medical expenses for a law firm, or for clients entitled to be repaid for travel costs, the mileage reimbursement request form is free and printable. Apply a check mark to indicate the answer wherever demanded. To start the form, utilize the fill camp; Enter your official identification and contact details. A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. This documentation may be used to collect reimbursement from an employer or to claim mileage as a tax deduction. Hmrc requires you to keep records of all transactions, including car use claims. Web a mileage log provides a record of vehicle miles traveled for business over a given time period.

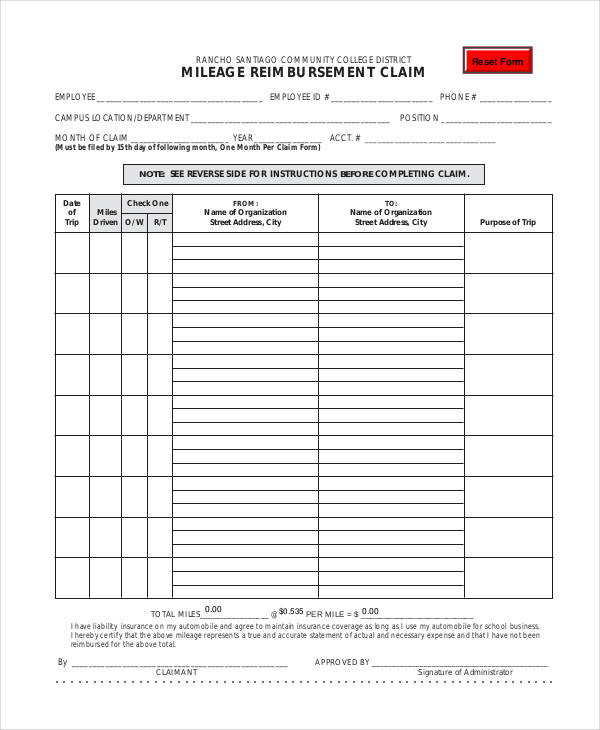

The mileage rate is 56 cents ($0.56) per mile. A blank mileage reimbursement form is a type of a form which helps an individual to claim the amount spent on traveling over a distance for some purpose. Per the internal revenue service (irs) , companies can choose to reimburse the actual amount an employee incurred on the trip or use a specific rate for each mile the employee drove, usually less than $1. This particular form is used by every person working under an organization in. Claimant's name (last, first, mi.): It assists in tracking the employees traveling expenses and help to minimize unnecessary travel. It also helps in recording the traveling details like destinations and the traveling distances. A mileage claim form is designed to help employees request for reimbursement for travelling expenses incurred for business purposes. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. It’s printable, customizable, and downloadable in pdf.

Mileage Form PDF IRS Mileage Rate 2021

Sign online button or tick the preview image of the blank. It has a table for addresses, medical providers, and round trip mileage. Web mileage reimbursement request form. Web download our free mileage claim template form as an excel spreadsheet, to help you record the details of each work trip, or track the miles you travel for your business using.

FREE 47+ Claim Forms in PDF

You must file within of the appointment or of when you become eligible for reimbursement. Web (getty images) claiming a deduction for mileage can be a good way to reduce how much you owe uncle sam, but not everyone is eligible to write off their travel as a tax deduction. It also helps in recording the traveling details like destinations.

11 Expense Claim form Template Excel Excel Templates

The mileage rate is 56 cents ($0.56) per mile. This documentation may be used to collect reimbursement from an employer or to claim mileage as a tax deduction. Web how to complete the blank mileage form online: Web download our free mileage claim template form as an excel spreadsheet, to help you record the details of each work trip, or.

Mileage Claim Form Template

Sign online button or tick the preview image of the blank. This particular form is used by every person working under an organization in. Edit pdfs, create forms, collect data, collaborate with your team, secure docs and more. Web download our free mileage claim template form as an excel spreadsheet, to help you record the details of each work trip,.

FREE 32+ Claim Form Templates in PDF Excel MS Word

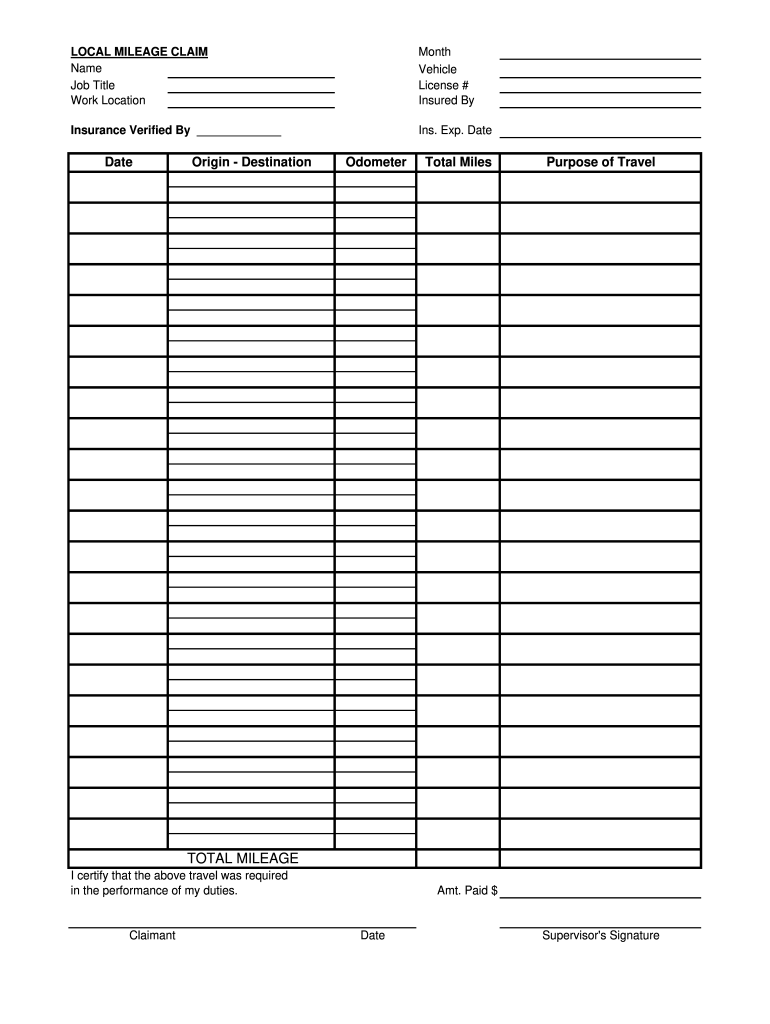

Web a mileage log provides a record of vehicle miles traveled for business over a given time period. Be sure to file your claim on time. Web local mileage claim month name vehicle job title license # work location insured by insurance verified by _____ ins. The mileage rate is 56 cents ($0.56) per mile. This template tries to include.

Mileage Claim Form Template Nz

A mileage claim form is designed to help employees request for reimbursement for travelling expenses incurred for business purposes. Web a mileage reimbursement form is a document that is given to the accounting department for reimbursement of the traveling costs. A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for.

FREE 50+ Sample Claim Forms in PDF MS Word

405 sw 5th street, suite c. Web beginning november 2, 2020, veterans, caregivers, and beneficiaries who are eligible for reimbursement of mileage and other travel expenses to and from approved health care appointments can now enter claims in. Web in the uk, you can claim back up to 45p per mile for the first 10,000 miles and then 25p per.

FREE 32+ Claim Form Templates in PDF Excel MS Word

The advanced tools of the editor will guide you through the editable pdf template. It’s printable, customizable, and downloadable in pdf. Travel forms and mileage rate | comptroller general travel forms and mileage rate. Web mileage reimbursement request form. The mileage rate is 56 cents ($0.56) per mile.

Mileage reimbursement claim form in Word and Pdf formats

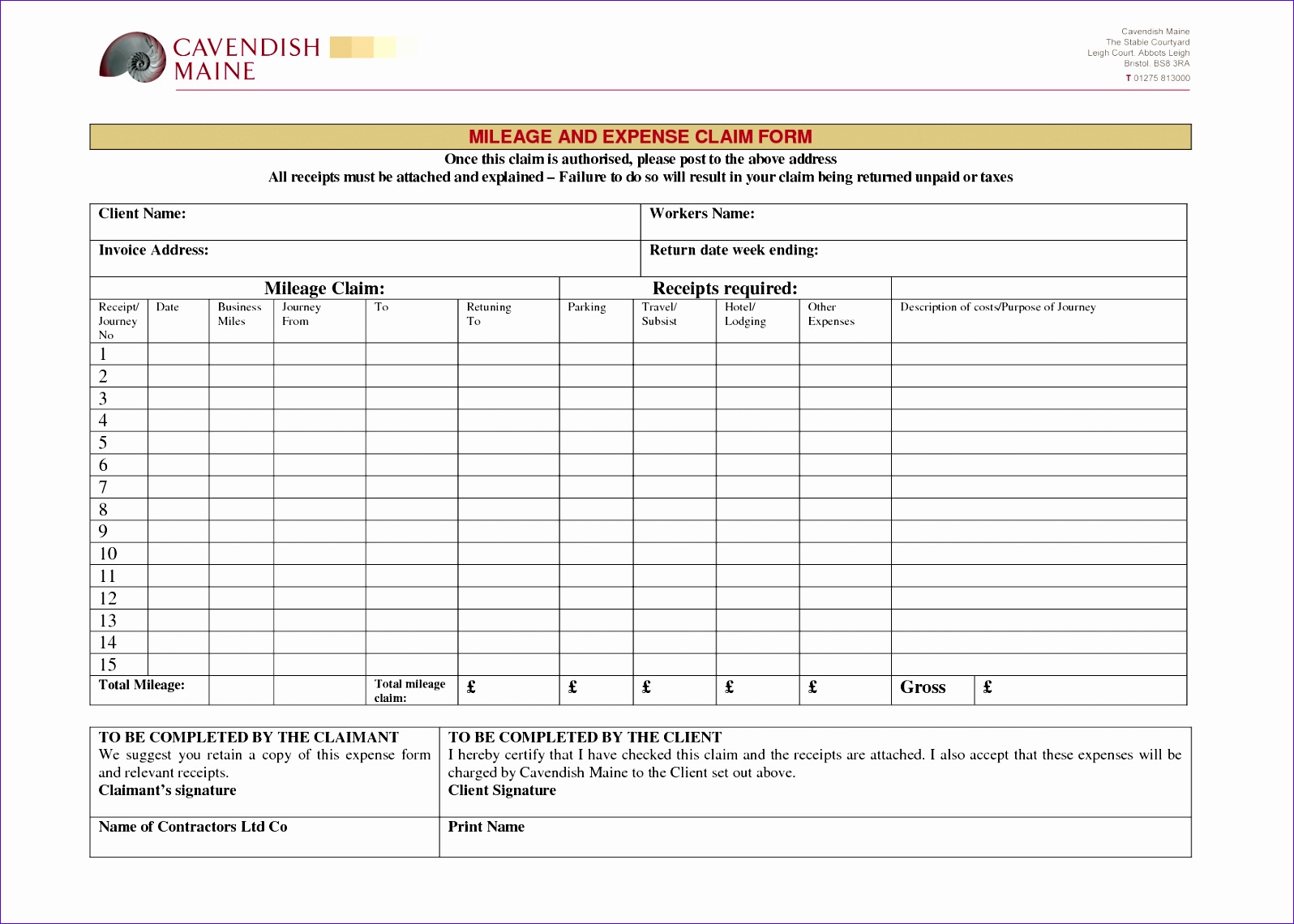

Intended to track mileage and medical expenses for a law firm, or for clients entitled to be repaid for travel costs, the mileage reimbursement request form is free and printable. Ideal for workers compensation cases. This mileage reimbursement form asks for employee information, covered dates, mileage calculation, the rate per mile, and total. It has a table for addresses, medical.

FREE 49+ Claim Forms in PDF

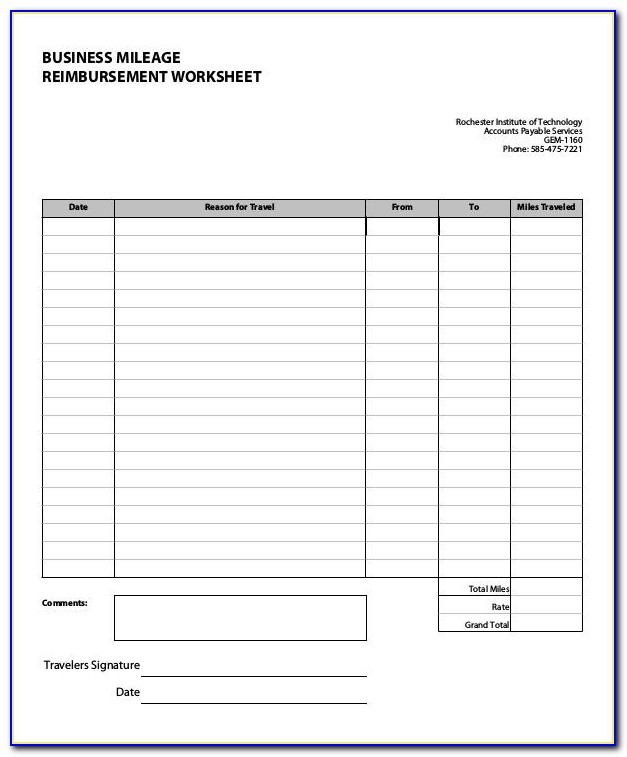

Web download our free mileage claim template form as an excel spreadsheet, to help you record the details of each work trip, or track the miles you travel for your business using pandle. Web in the uk, you can claim back up to 45p per mile for the first 10,000 miles and then 25p per mile. The advanced tools of.

Seeing As There Is No Way To Properly Calculate The True Cost Of Performing The Trip By The Employee, The Irs Announces These Rates On An Annual Basis For Employers.

It has a table for addresses, medical providers, and round trip mileage. Travel forms and mileage rate | comptroller general travel forms and mileage rate. Web this form should be used for medically related travel covered by the federal employees' compensation act, the black lung benefits act and the energy employees occupational illness compensation program act of 2000. Web in the uk, you can claim back up to 45p per mile for the first 10,000 miles and then 25p per mile.

File A New Claim For Each Appointment.

Web (getty images) claiming a deduction for mileage can be a good way to reduce how much you owe uncle sam, but not everyone is eligible to write off their travel as a tax deduction. It also helps in recording the traveling details like destinations and the traveling distances. Free for personal or commercial use. It’s printable, customizable, and downloadable in pdf.

Per The Internal Revenue Service (Irs) , Companies Can Choose To Reimburse The Actual Amount An Employee Incurred On The Trip Or Use A Specific Rate For Each Mile The Employee Drove, Usually Less Than $1.

Apply a check mark to indicate the answer wherever demanded. Web a mileage log provides a record of vehicle miles traveled for business over a given time period. Enter your official identification and contact details. Web this mileage reimbursement form can be used to calculate your mileage expenses on a specific period.

Hmrc Requires You To Keep Records Of All Transactions, Including Car Use Claims.

This mileage reimbursement form asks for employee information, covered dates, mileage calculation, the rate per mile, and total. Claimant's name (last, first, mi.): With this form, employers can reimburse employees and document traveling details such as traveling distances and destinations. When to use this form.