Michigan Tax Form Schedule 1

Michigan Tax Form Schedule 1 - This is the amount from your u.s. Web michigan department of treasury 3423 (rev. Web we last updated michigan schedule 1 in february 2023 from the michigan department of treasury. Schedule 1 listing the amounts received and the issuing agency. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Instructions are with each form. Web commonly used michigan income tax forms are also available at michigan department of treasury offices, most public libraries, northern michigan post offices, and michigan. Capital gains from the sale of u.s. 1 include military and michigan national guard retirement benefits here and on schedule w, table 2. You must attach copies of federal schedules that.

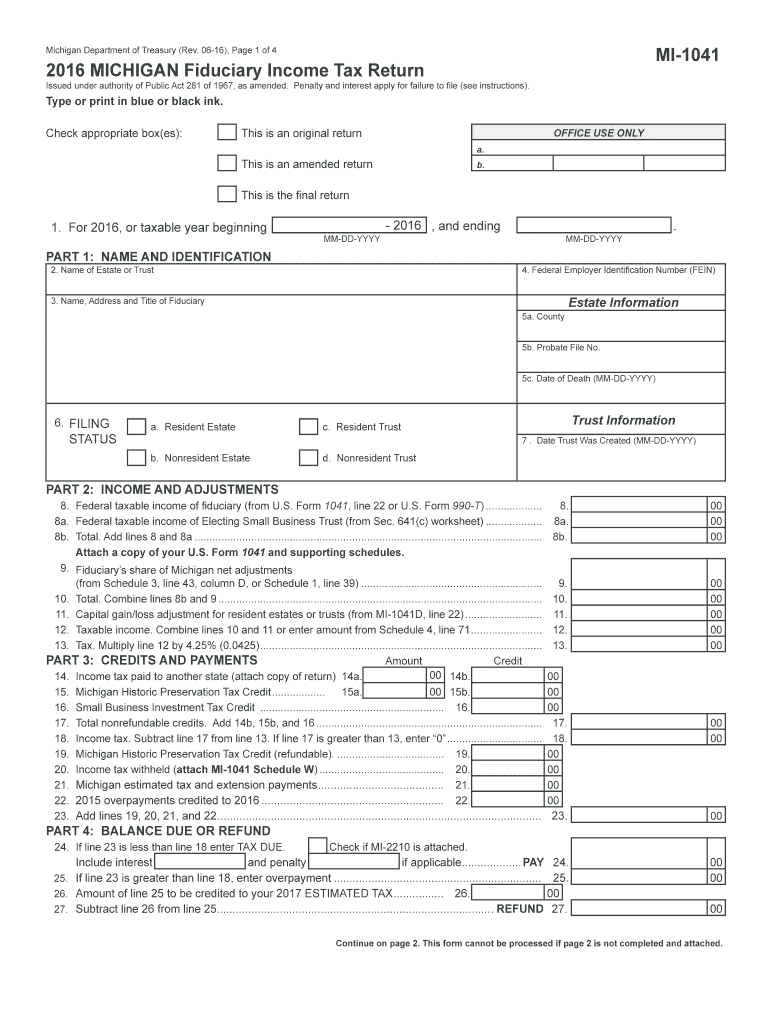

Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. Schedule 1 listing the amounts received and the issuing agency. Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Tax year 2016 corporate, partnership and fiduciary (estates & trusts) annual returns; Web michigan department of treasury 3423 (rev. 1 include military and michigan national guard retirement benefits here and on schedule w, table 2. Web commonly used michigan income tax forms are also available at michigan department of treasury offices, most public libraries, northern michigan post offices, and michigan. This form is for income earned in tax year 2022, with tax returns due in april. Web 2021 michigan schedule 1 additions and subtractions michigan department of treasury 3423 (rev. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings.

Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. 2020 michigan schedule 1 additions and subtractions. Tax year 2016 corporate, partnership and fiduciary (estates & trusts) annual returns; More about the michigan schedule 1 instructions. Also report any taxable tier 1 and tier 2 railroad. You must attach copies of federal schedules that. Web we last updated michigan schedule 1 in february 2023 from the michigan department of treasury. Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. 1 include military and michigan national guard retirement benefits here and on schedule w, table 2. Web we maintain tax forms for the following tax years/tax types:

Michigan Schedule 1 Form Fill Out and Sign Printable PDF Template

This form is for income earned in tax year 2022, with tax returns due in april. Also report any taxable tier 1 and tier 2 railroad. Enter losses from a business or property. Capital gains from the sale of u.s. Web commonly used michigan income tax forms are also available at michigan department of treasury offices, most public libraries, northern.

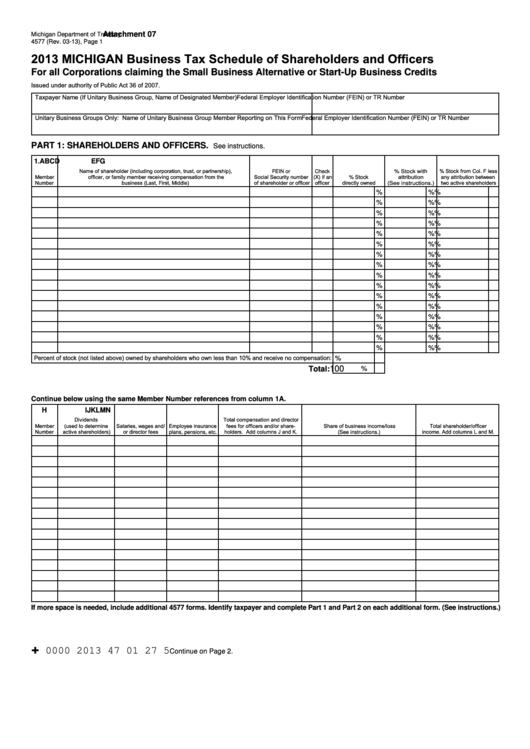

Form 4577 Michigan Business Tax Schedule Of Shareholders And Officers

Web enter your agi from your federal return. Enter losses from a business or property. Also report any taxable tier 1 and tier 2 railroad. Web 2021 michigan schedule 1 additions and subtractions michigan department of treasury 3423 (rev. Web michigan department of treasury 3423 (rev.

Michigan 1040ez Tax Form Universal Network

Capital gains from the sale of u.s. Schedule 1 listing the amounts received and the issuing agency. 2020 michigan schedule 1 additions and subtractions. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Instructions are with each form.

Schedule K1 Tax Form What Is It and Who Needs to Know?

Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. Web 2021 michigan schedule 1 additions and subtractions michigan department of treasury 3423 (rev. This form is for income earned in tax.

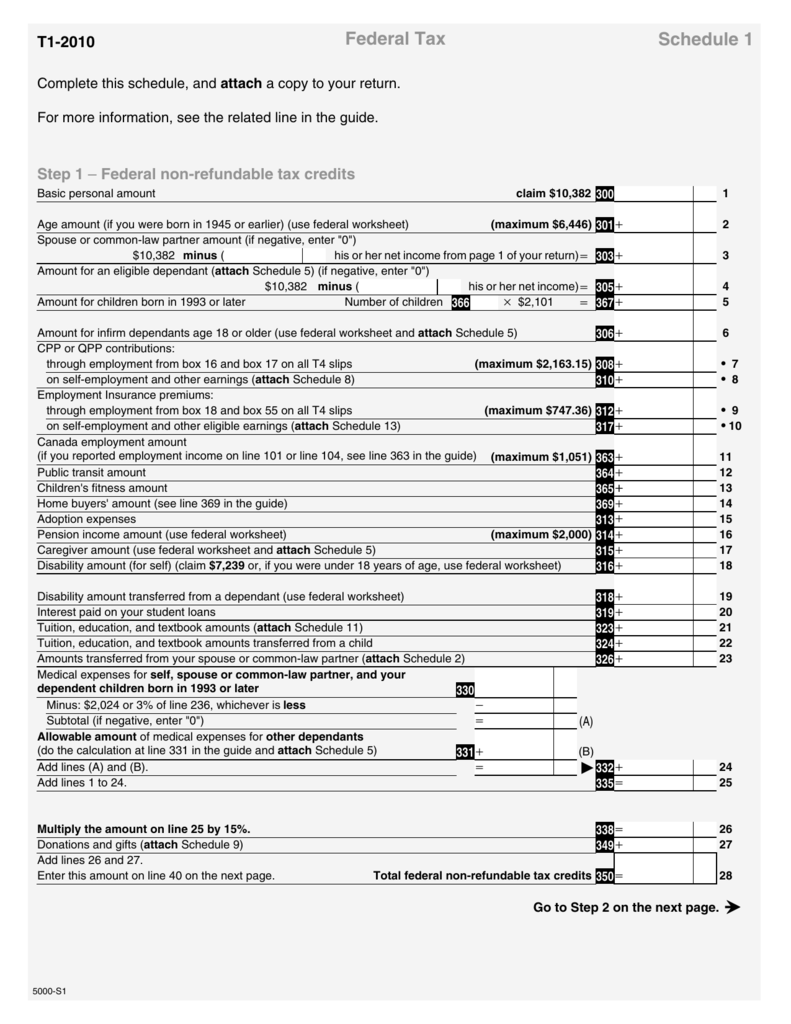

Schedule 1 Federal Tax

Web michigan department of treasury 3423 (rev. This form is for income earned in tax year 2022, with tax returns due in april. Enter losses from a business or property. This is the amount from your u.s. Web commonly used michigan income tax forms are also available at michigan department of treasury offices, most public libraries, northern michigan post offices,.

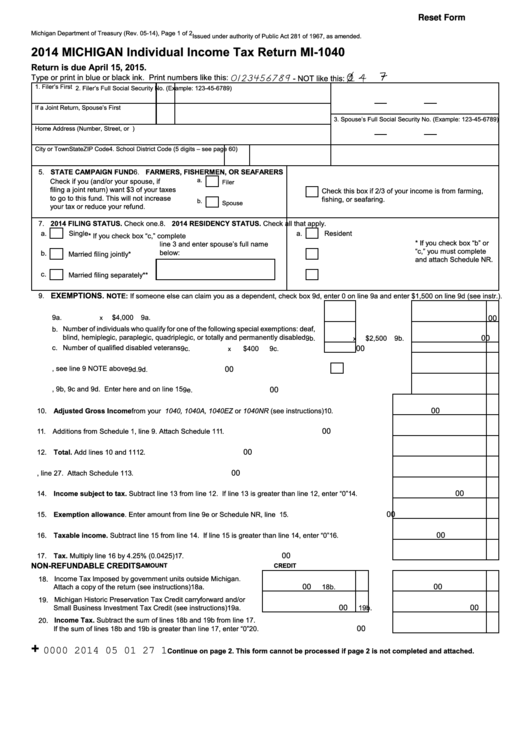

Michigan 1040 Tax Form ctrlcdesigns

Instructions are with each form. Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないた. Capital gains from the sale of u.s. Web enter your agi from your federal return. More about the michigan schedule 1 instructions.

006 Page1 1200Px State And Local Sales Tax Rates Pdf Michigan Form

Capital gains from the sale of u.s. Web 2021 michigan schedule 1 additions and subtractions michigan department of treasury 3423 (rev. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. Web commonly used michigan income tax forms are also.

Tax Form 1040 Schedule 1 Form Resume Examples MoYoo1BYZB

Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022. Issued under authority of public act 281 of 1967,. Web commonly used michigan income tax forms are also available at michigan department of treasury offices, most public libraries, northern michigan.

Michigan State Tax Form 2020 23 Tips That Will Make You Influential

Enter losses from a business or property. Web we last updated michigan schedule 1 in february 2023 from the michigan department of treasury. Web enter your agi from your federal return. Issued under authority of public act 281 of 1967,. This is the amount from your u.s.

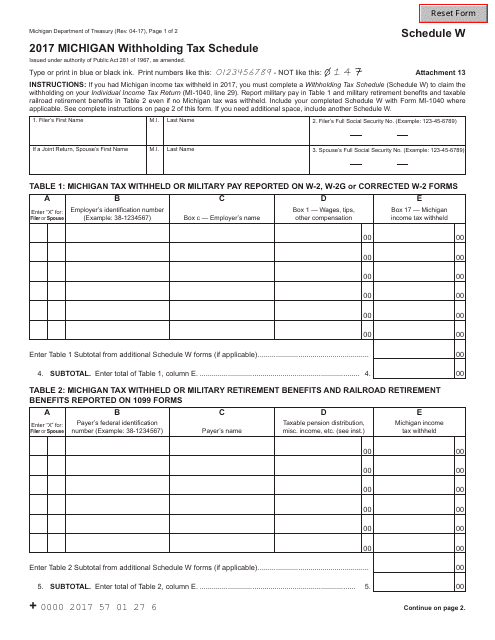

Schedule W Download Fillable PDF or Fill Online Michigan Withholding

This form is for income earned in tax year 2022, with tax returns due in april. 2020 michigan schedule 1 additions and subtractions. Web michigan department of treasury 3423 (rev. Web we maintain tax forms for the following tax years/tax types: Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest.

Web We Last Updated Michigan Schedule 1 In February 2023 From The Michigan Department Of Treasury.

Web commonly used michigan income tax forms are also available at michigan department of treasury offices, most public libraries, northern michigan post offices, and michigan. Web we maintain tax forms for the following tax years/tax types: Instructions are with each form. Web michigan department of treasury 3423 (rev.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

You must attach copies of federal schedules that. 2020 michigan schedule 1 additions and subtractions. Capital gains from the sale of u.s. More about the michigan schedule 1 instructions.

Schedule 1 Listing The Amounts Received And The Issuing Agency.

Web enter your agi from your federal return. Issued under authority of public act 281 of 1967,. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule amd (form 5530) amended return explanation of changes:

Also Report Any Taxable Tier 1 And Tier 2 Railroad.

1 include military and michigan national guard retirement benefits here and on schedule w, table 2. Web 2021 michigan schedule 1 additions and subtractions michigan department of treasury 3423 (rev. This is the amount from your u.s. Web we last updated the schedule 1 instructions (additions and subtractions) in february 2023, so this is the latest version of schedule 1 instructions, fully updated for tax year 2022.