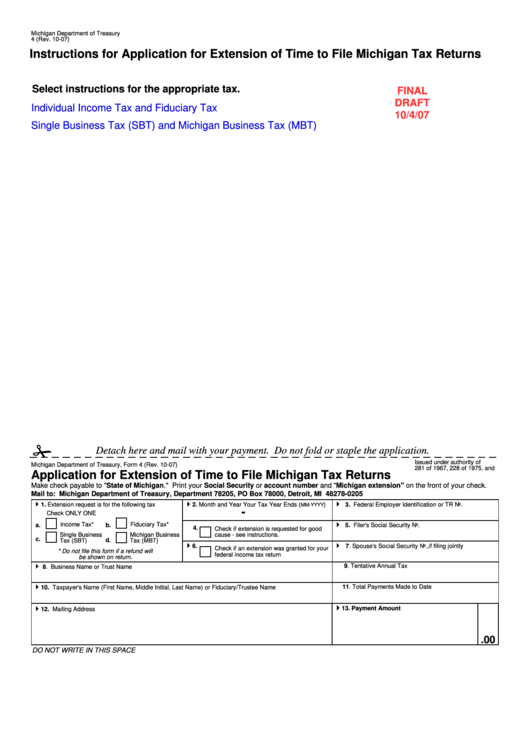

Michigan Form 4 Extension

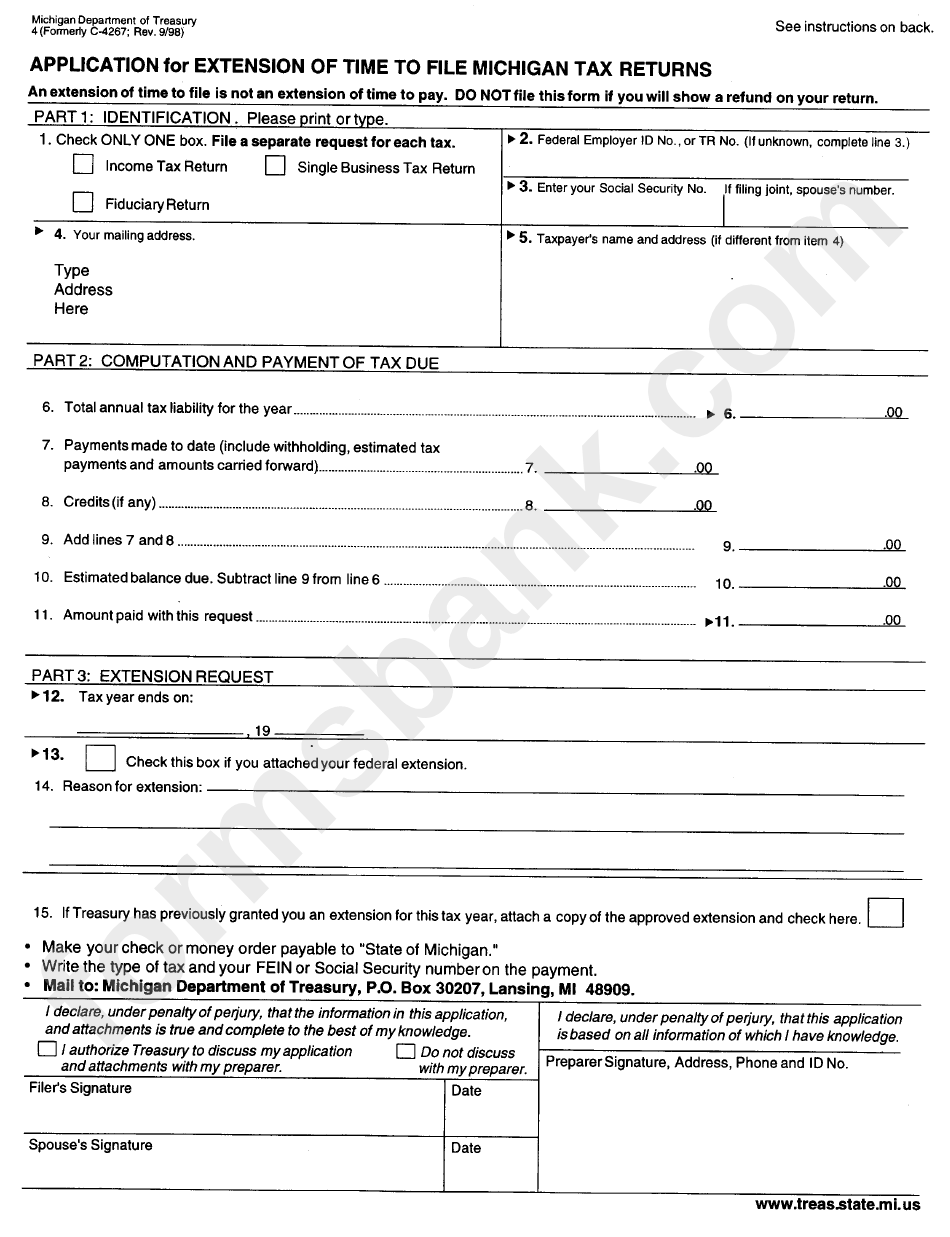

Michigan Form 4 Extension - If you cannot file by that date, you can request a state tax extension. An extension of time to file the federal return automatically extends the time to file the michigan return to the new federal due. Web michigan individual income tax extension (form 4) the dropdown menu will identify the specific tax year and payment type currently available. Web michigan personal income tax returns are due by april 15, in most years. Web common questions about michigan extensions. Web 2022 individual income tax forms and instructions need a different form? Solved•by intuit•updated july 14, 2022. The michigan extension cannot be electronically filed. Web the michigan general business corporation tax extension form 4 is due within 4 months and 30 days following the end of the corporation's. What will i need to make a.

Web common questions about michigan extensions. Web michigan tax extension form: Web file form 4 or a copy of your federal extension. More about the michigan form 4 extension we last. Web 2022 individual income tax forms and instructions need a different form? An extension of time to file the federal return automatically extends the time to file the. The michigan extension cannot be electronically filed. Explore more file form 4868 and extend your 1040 deadline. Web 2018 fiduciary tax forms. The federal extension may be sent.

Web the taxpayer will need to file form 4, instructions for application for extension of time to file michigan tax returns, include a copy of the federal extension request and pay tax. To apply for a michigan personal. More about the michigan form 4 extension we last. Web 2022 individual income tax forms and instructions need a different form? Web 2018 fiduciary tax forms. An extension of time to file the federal return automatically extends the time to file the michigan return to the new federal due. What will i need to make a. Web the michigan general business corporation tax extension form 4 is due within 4 months and 30 days following the end of the corporation's. Web common questions about michigan extensions. If you cannot file by that date, you can request a state tax extension.

DSC_0230 Michigan State University Extension educators reg… Flickr

An extension of time to file the federal return automatically extends the time to file the michigan return to the new federal due. Web common questions about michigan extensions. Web the michigan general business corporation tax extension form 4 is due within 4 months and 30 days following the end of the corporation's. The federal extension may be sent. Web.

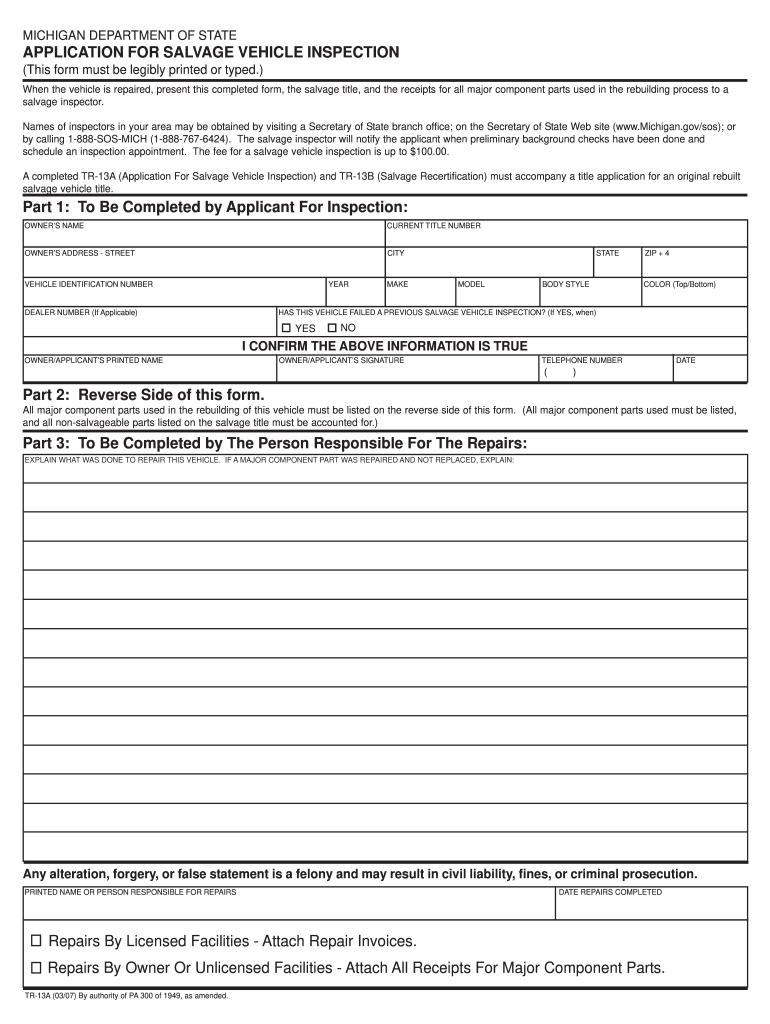

Michigan Tr13a Fill Online, Printable, Fillable, Blank pdfFiller

Web a fiscal year taxpayer may request an additional extension on form 4, application for extension of time to file michigan tax returns, if the extension to april 30, 2013,. Web common questions about michigan extensions. Web if you do not have a federal extension, file an application for extension of time to file michigan tax returns ( form 4).

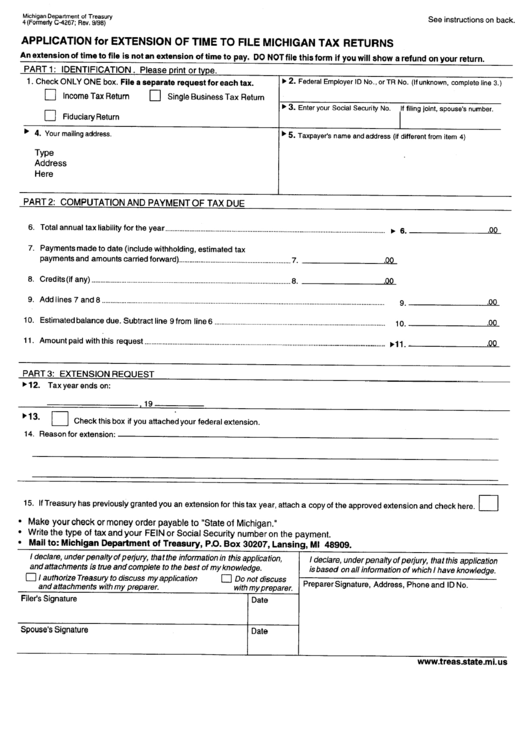

Fillable Form 4 Application For Extension Of Time To File Michigan

If you cannot file by that date, you can request a state tax extension. Web file form 4 or a copy of your federal extension. Web the taxpayer will need to file form 4, instructions for application for extension of time to file michigan tax returns, include a copy of the federal extension request and pay tax. Web a fiscal.

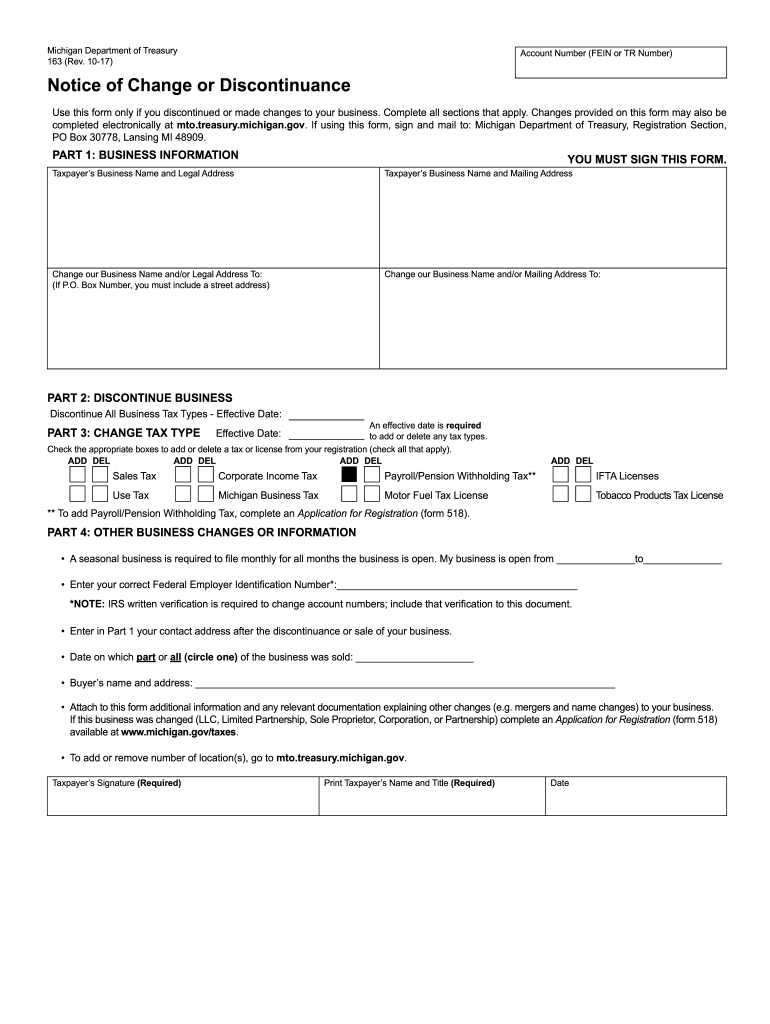

2017 Form MI DoT 163 Fill Online, Printable, Fillable, Blank pdfFiller

Web the michigan general business corporation tax extension form 4 is due within 4 months and 30 days following the end of the corporation's. Web common questions about michigan extensions. More about the michigan form 4 extension we last. Web 2018 fiduciary tax forms. What will i need to make a.

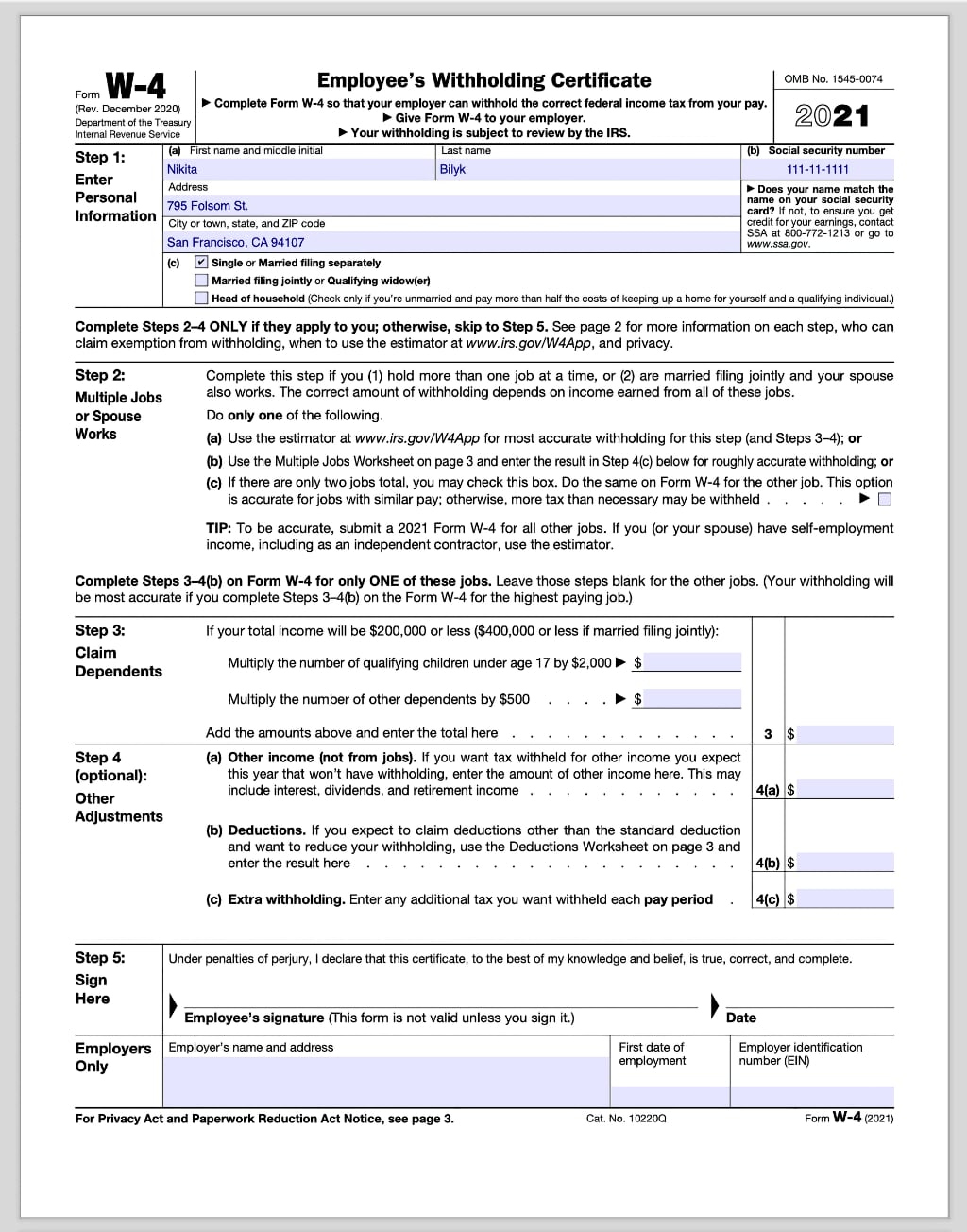

Michigan W 4 2021 2022 W4 Form

Form 4 must be filed to obtain a state extension if you. Web file form 4 or a copy of your federal extension. Web individual and fiduciary filers submit form 4 or a copy of your federal extension. Web 2022 individual income tax forms and instructions need a different form? To apply for a michigan personal.

State Of Michigan Form 151 Fill Online, Printable, Fillable, Blank

Web to request an extension of time to file the state of michigan tax form, please follow the instructions for form 4, instructions for application for extension of. The michigan extension cannot be electronically filed. What will i need to make a. If you cannot file by that date, you can request a state tax extension. Treasury will not notify.

Form 4 (Final Draft) Application For Extension Of Time To File

Web file form 4 or a copy of your federal extension. Solved•by intuit•updated july 14, 2022. Web common questions about michigan extensions. The federal extension may be sent. Web to request an extension of time to file the state of michigan tax form, please follow the instructions for form 4, instructions for application for extension of.

Fillable Form 4 Application For Extension Of Time To File Michigan

Form 4 must be filed to obtain a state extension if you. Look for forms using our forms search or view a list of income tax forms by year. Treasury will not notify you of. Web michigan personal income tax returns are due by april 15, in most years. Explore more file form 4868 and extend your 1040 deadline.

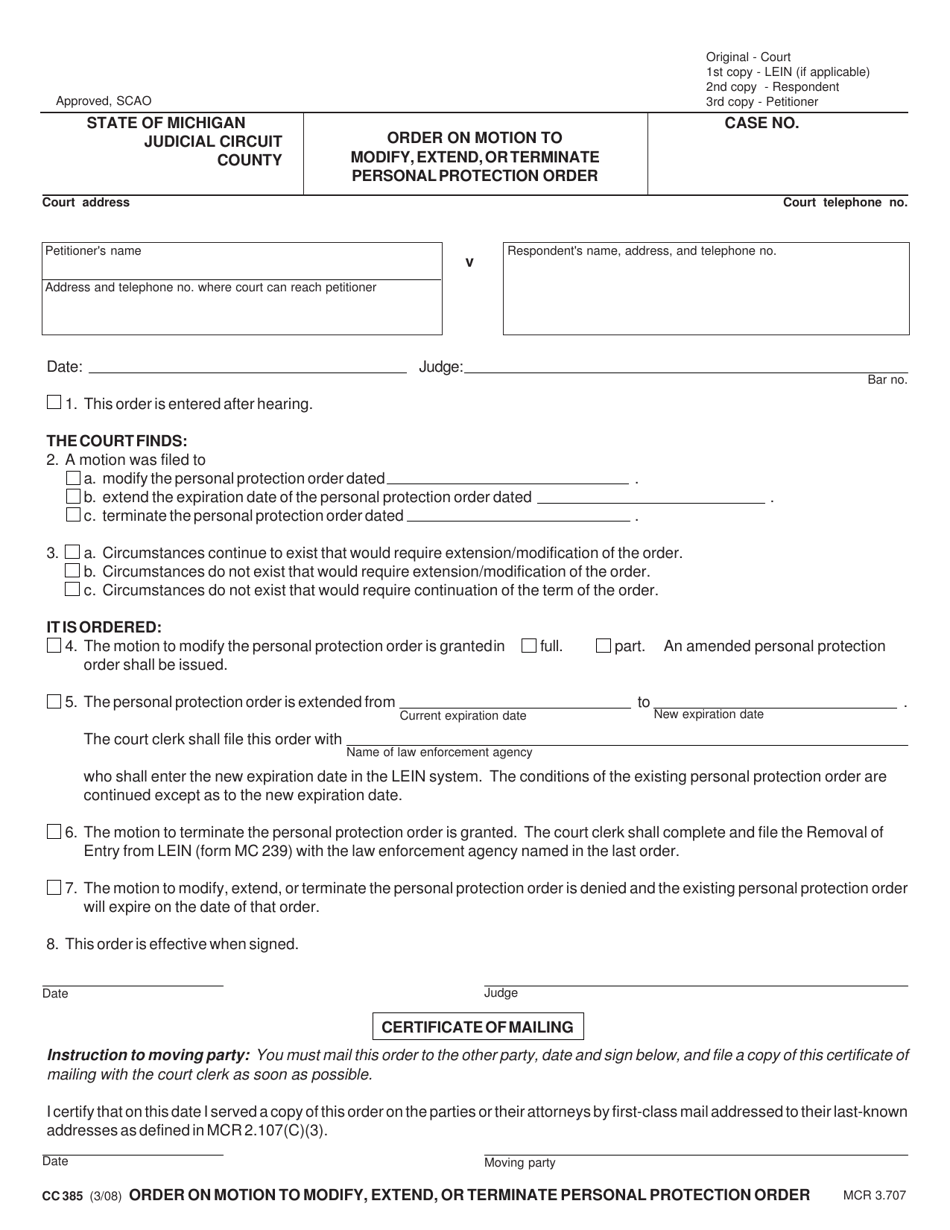

Form CC385 Download Fillable PDF or Fill Online Order on Motion to

Web file form 4 or a copy of your federal extension. Look for forms using our forms search or view a list of income tax forms by year. Web the michigan general business corporation tax extension form 4 is due within 4 months and 30 days following the end of the corporation's. An extension of time to file the federal.

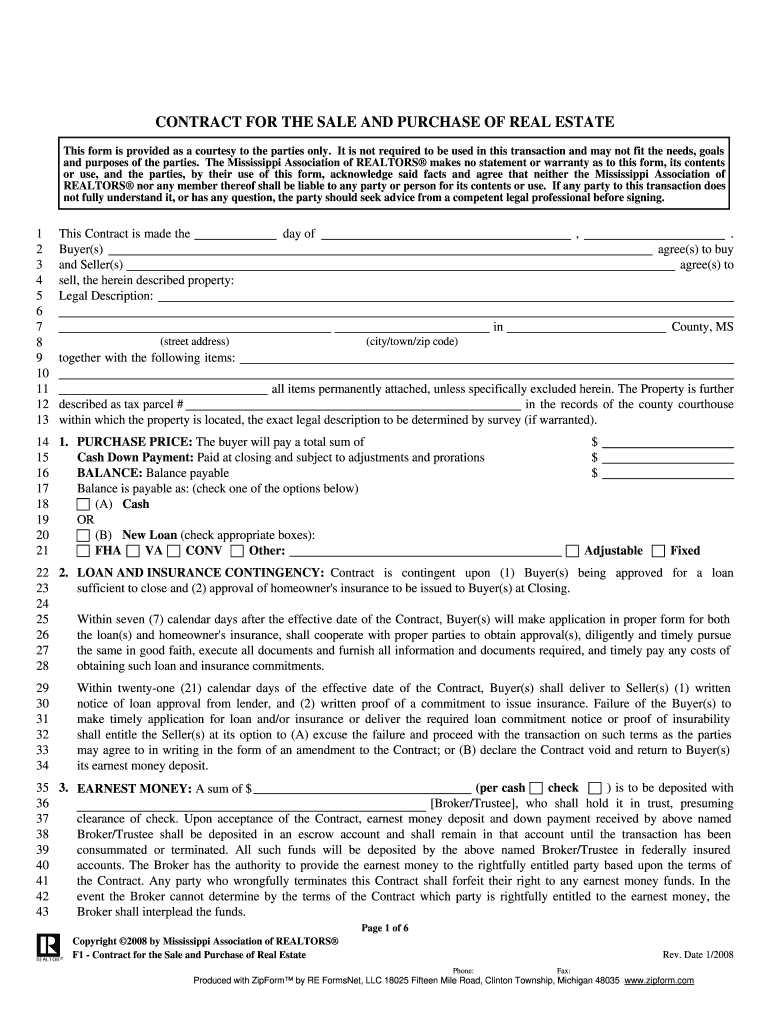

Purchase Agreement Michigan Form Fill Out and Sign Printable PDF

Web michigan individual income tax extension (form 4) the dropdown menu will identify the specific tax year and payment type currently available. Web if you do not have a federal extension, file an application for extension of time to file michigan tax returns ( form 4) with your payment. Treasury will not notify you of. If you cannot file by.

Web The Taxpayer Will Need To File Form 4, Instructions For Application For Extension Of Time To File Michigan Tax Returns, Include A Copy Of The Federal Extension Request And Pay Tax.

Web if you do not have a federal extension, file an application for extension of time to file michigan tax returns ( form 4) with your payment. Solved•by intuit•updated july 14, 2022. Web the michigan general business corporation tax extension form 4 is due within 4 months and 30 days following the end of the corporation's. The michigan extension cannot be electronically filed.

An Extension Of Time To File The Federal Return Automatically Extends The Time To File The Michigan Return To The New Federal Due.

Web 2018 fiduciary tax forms. Explore more file form 4868 and extend your 1040 deadline. Web michigan tax extension form: To apply for a michigan personal.

Web A Fiscal Year Taxpayer May Request An Additional Extension On Form 4, Application For Extension Of Time To File Michigan Tax Returns, If The Extension To April 30, 2013,.

The federal extension may be sent. Form 4 must be filed to obtain a state extension if you. An extension of time to file the federal return automatically extends the time to file the. Web to request an extension of time to file the state of michigan tax form, please follow the instructions for form 4, instructions for application for extension of.

Web Michigan Individual Income Tax Extension (Form 4) The Dropdown Menu Will Identify The Specific Tax Year And Payment Type Currently Available.

Look for forms using our forms search or view a list of income tax forms by year. Web michigan personal income tax returns are due by april 15, in most years. Web individual and fiduciary filers submit form 4 or a copy of your federal extension. Web common questions about michigan extensions.