Mdc 1098 T Form

Mdc 1098 T Form - Complete, edit or print tax forms instantly. 5 years ago in about. Ad complete irs tax forms online or print government tax documents. Try it for free now! Upload, modify or create forms. 4 years ago in general , view all faqs tags: For internal revenue service center. Spring, summer and fall for the reporting calendar year, plus any payments made by december 31 of the reporting year for. Web contact us who do i contact for my 1098 t form? Only the amount of tuition paid by the above sources are included in box.

Once the change has been. Total amount of payments received, minus refunds, for tuition during the reporting calendar year for credit. Try it for free now! Log into mdconnect using your mymdc account username and password, scroll down to the finances. This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax liability for the year of the refund). 4 years ago in general , view all faqs tags: You must file for each student you enroll and for whom a reportable transaction is made. Web the 1098t will be available for viewing and printing on the mdc student portal on or after january 31st of the year following the tax year reported. Upload, modify or create forms. Web contact us who do i contact for my 1098 t form?

Persons with a hearing or speech disability with access to. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. Log into mdconnect using your mymdc account username and password, scroll down to the finances. Try it for free now! Once the change has been. Online/by mail/or my printing it from mdconnect. Contact the registration office to update the address and/or social security number. Total amount of payments received, minus refunds, for tuition during the reporting calendar year for credit. Ad complete irs tax forms online or print government tax documents. Upload, modify or create forms.

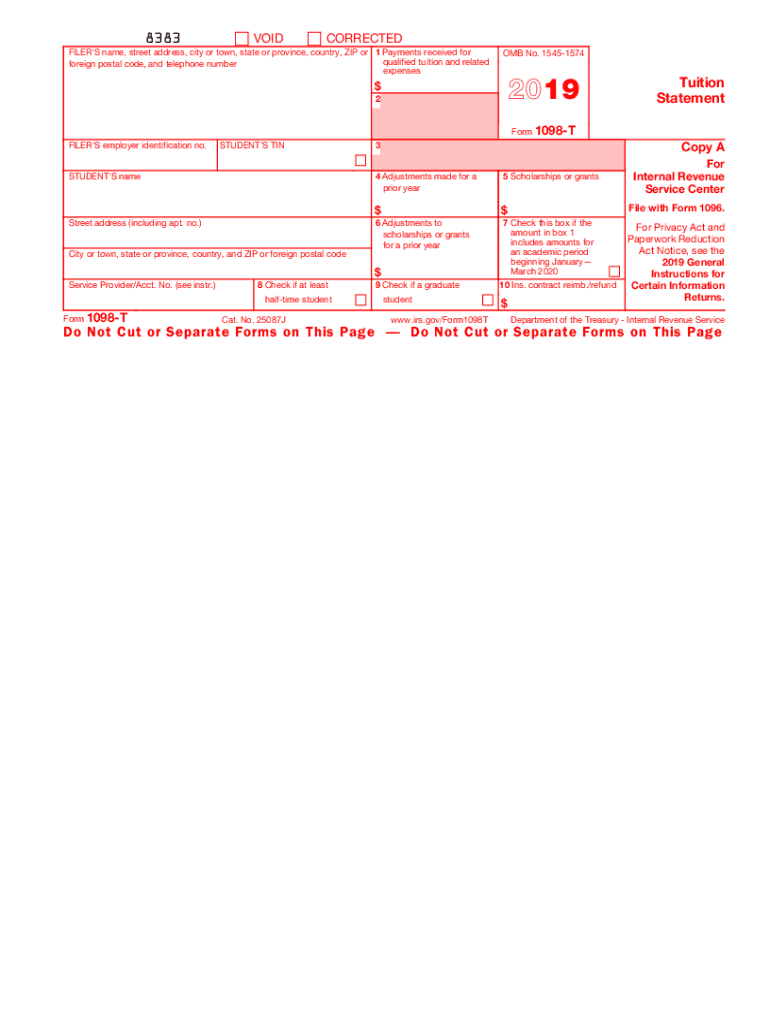

2020 Form IRS 1098T Fill Online, Printable, Fillable, Blank pdfFiller

Receiving a form does not necessarily mean the. Only the amount of tuition paid by the above sources are included in box. Any student who paid tuition during the calendar year for college credit or postsecondary vocational classes. Try it for free now! Total amount of payments received, minus refunds, for tuition during the reporting calendar year for credit.

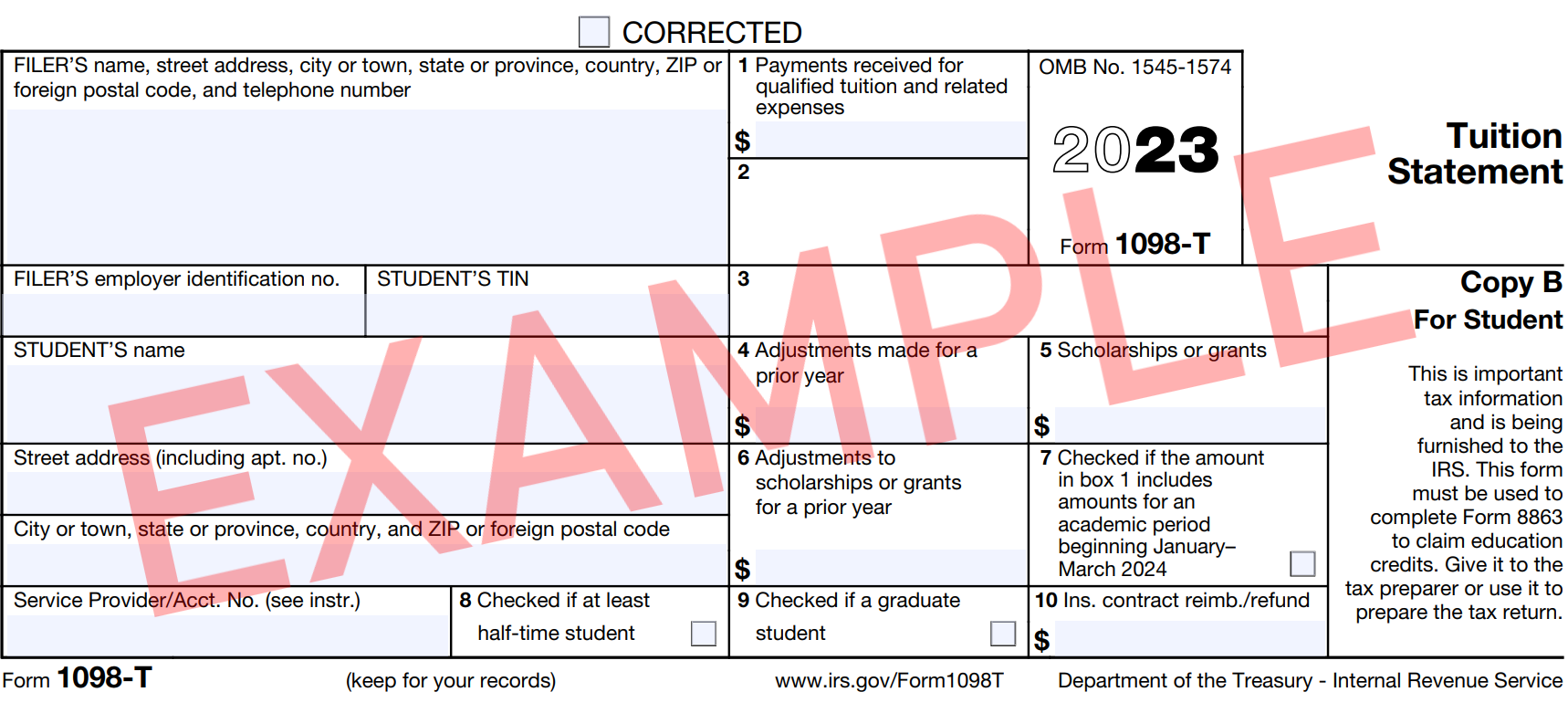

Claim your Educational Tax Refund with IRS Form 1098T

Ad complete irs tax forms online or print government tax documents. Are federal direct loan(s), nelnet payments and collection payments. Contact the registration office to update the address and/or social security number. Total amount of payments received, minus refunds, for tuition during the reporting calendar year for credit. It is used to assist students in determining whether they are eligible.

Form 1098T Information Student Portal

Upload, modify or create forms. Web contact us who do i contact for my 1098 t form? 4 years ago in general , view all faqs tags: Complete, edit or print tax forms instantly. Try it for free now!

Irs Form 1098 T Box 4 Universal Network

Web the 1098t will be available for viewing and printing on the mdc student portal on or after january 31st of the year following the tax year reported. Any student who paid tuition during the calendar year for college credit or postsecondary vocational classes. For internal revenue service center. Contact the registration office to update the address and/or social security.

Form 1098T Still Causing Trouble for Funded Graduate Students

Any student who paid tuition during the calendar year for college credit or postsecondary vocational classes. Try it for free now! Total amount of payments received, minus refunds, for tuition during the reporting calendar year for credit. 4 years ago in general , view all faqs tags: You must file for each student you enroll and for whom a reportable.

Irs Form 1098 T Explanation Universal Network

5 years ago in about. Only the amount of tuition paid by the above sources are included in box. Any student who paid tuition during the calendar year for college credit or postsecondary vocational classes. This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax liability for the.

Form 1098T Information Student Portal

Ad complete irs tax forms online or print government tax documents. Any student who paid tuition during the calendar year for college credit or postsecondary vocational classes. You must file for each student you enroll and for whom a reportable transaction is made. Web contact us who do i contact for my 1098 t form? Contact the registration office to.

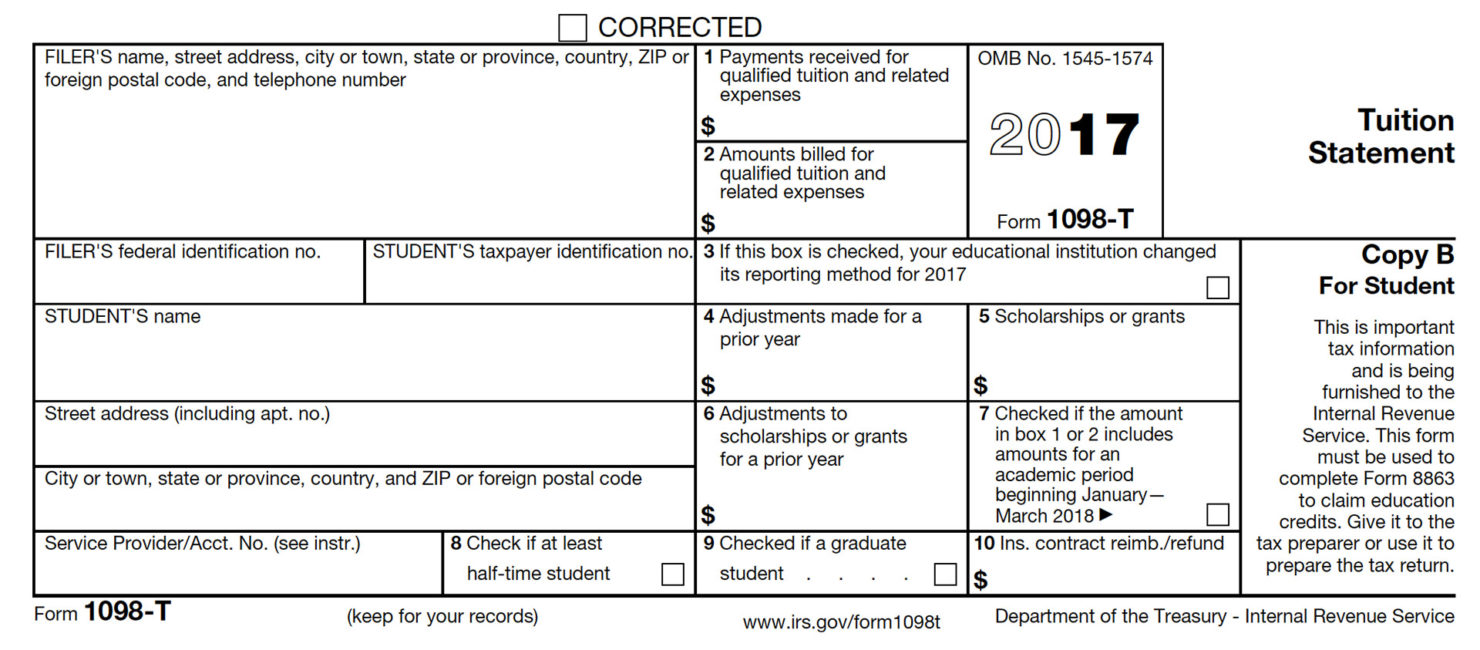

Form 1098T Everything you need to know Go TJC

Web the 1098t will be available for viewing and printing on the mdc student portal on or after january 31st of the year following the tax year reported. Contact the registration office to update the address and/or social security number. Only the amount of tuition paid by the above sources are included in box. Spring, summer and fall for the.

1098 T Form Morehouse Fill Online, Printable, Fillable, Blank pdfFiller

Are federal direct loan(s), nelnet payments and collection payments. Ad complete irs tax forms online or print government tax documents. Receiving a form does not necessarily mean the. Online/by mail/or my printing it from mdconnect. Any student who paid tuition during the calendar year for college credit or postsecondary vocational classes.

1098T Ventura County Community College District

Total amount of payments received, minus refunds, for tuition during the reporting calendar year for credit. 5 years ago in about. Any student who paid tuition during the calendar year for college credit or postsecondary vocational classes. Web contact us who do i contact for my 1098 t form? Log into mdconnect using your mymdc account username and password, scroll.

Are Federal Direct Loan(S), Nelnet Payments And Collection Payments.

5 years ago in about. Ad complete irs tax forms online or print government tax documents. Web the 1098t will be available for viewing and printing on the mdc student portal on or after january 31st of the year following the tax year reported. Once the change has been.

Any Student Who Paid Tuition During The Calendar Year For College Credit Or Postsecondary Vocational Classes.

It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. Log into mdconnect using your mymdc account username and password, scroll down to the finances. Online/by mail/or my printing it from mdconnect. Contact the registration office to update the address and/or social security number.

Try It For Free Now!

You must file for each student you enroll and for whom a reportable transaction is made. Persons with a hearing or speech disability with access to. Upload, modify or create forms. Total amount of payments received, minus refunds, for tuition during the reporting calendar year for credit.

This Amount May Reduce Any Allowable Education Credit That You Claimed For The Prior Year (May Result In An Increase In Tax Liability For The Year Of The Refund).

Spring, summer and fall for the reporting calendar year, plus any payments made by december 31 of the reporting year for. For internal revenue service center. Only the amount of tuition paid by the above sources are included in box. Complete, edit or print tax forms instantly.