Md 1099 Form

Md 1099 Form - Annually, federal 1099 reports are informational forms filed with the internal revenue service (irs). Ad success starts with the right supplies. Web submit your completed form along with a copy of your photo identification by email to: Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. Web maryland department of labor The request for mail order forms may be used to order one copy or. It is not a bill. Ad get ready for tax season deadlines by completing any required tax forms today. Prior to your submission to combined federal/state filing, the 1099 file must. 7 by the state comptroller’s office.

Annually, federal 1099 reports are informational forms filed with the internal revenue service (irs). Maryland requires a 1099g, 1099r, 1099s and w. Web maryland’s 2022 form 1099 filing specifications were released nov. Ad get ready for tax season deadlines by completing any required tax forms today. It is not a bill. While there were no changes to the record layout in either publication, forms must be filed online by employers with at least 25 forms and the office no longer accepts. If you file 1099s by paper, you must submit form mw508 (annual employer withholding reconciliation. The request for mail order forms may be used to order one copy or. Web maryland department of labor A copy of the 1099 is sent to the taxpayer.

Prior to your submission to combined federal/state filing, the 1099 file must. The request for mail order forms may be used to order one copy or. Find them all in one convenient place. Please retain a copy of this form and to be able present. A copy of the 1099 is sent to the taxpayer. Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at [email protected] or by phone at 410. Ad success starts with the right supplies. Web maryland department of labor Web maryland’s 2022 form 1099 filing specifications were released nov. Maryland requires a 1099g, 1099r, 1099s and w.

How Not To Deal With A Bad 1099

Complete, edit or print tax forms instantly. Annually, federal 1099 reports are informational forms filed with the internal revenue service (irs). The request for mail order forms may be used to order one copy or. Additionally, retirees who turnedage 59 ½ in calendar. A copy of the 1099 is sent to the taxpayer.

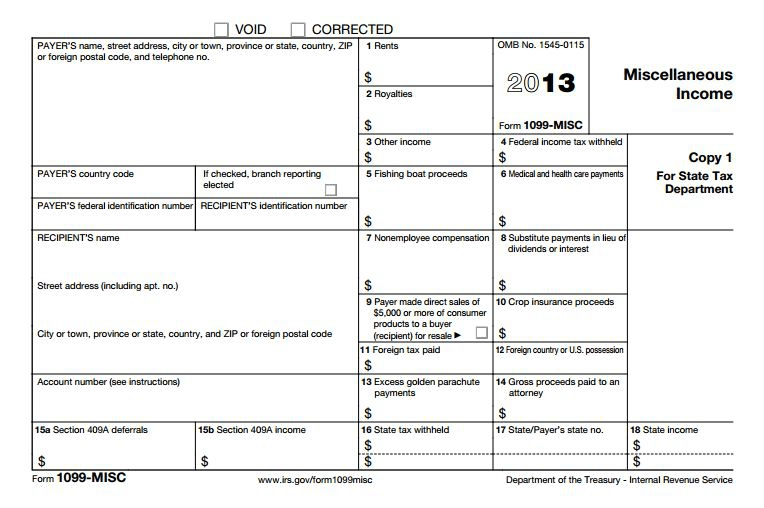

What is a 1099Misc Form? Financial Strategy Center

Web submit your completed form along with a copy of your photo identification by email to: It is not a bill. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. Please retain a copy of this.

1099 Archives Deb Evans Tax Company

It is not a bill. Annually, federal 1099 reports are informational forms filed with the internal revenue service (irs). Maryland requires a 1099g, 1099r, 1099s and w. This refund, offset or credit may be taxable income. Please retain a copy of this form and to be able present.

Form 1099 Misc Fillable Universal Network

Web maryland department of labor Ad get ready for tax season deadlines by completing any required tax forms today. Please retain a copy of this form and to be able present. The request for mail order forms may be used to order one copy or. While there were no changes to the record layout in either publication, forms must be.

How To File Form 1099NEC For Contractors You Employ VacationLord

Additionally, retirees who turnedage 59 ½ in calendar. Complete, edit or print tax forms instantly. Annually, federal 1099 reports are informational forms filed with the internal revenue service (irs). The fastest way to obtain a. It is not a bill.

What is a 1099 & 5498? uDirect IRA Services, LLC

It is not a bill. Maryland requires a 1099g, 1099r, 1099s and w. Prior to your submission to combined federal/state filing, the 1099 file must. Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at [email protected] or by phone at 410. Complete, edit or print tax forms instantly.

1099 Form Changes for 2013 and Dynamics AX 2012 Stoneridge Software

A copy of the 1099 is sent to the taxpayer. If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. 7 by the state comptroller’s office. Ad success starts with the right supplies. It is not a bill.

Free Printable 1099 Misc Forms Free Printable

Complete, edit or print tax forms instantly. Maryland requires a 1099g, 1099r, 1099s and w. Ad success starts with the right supplies. It is not a bill. Find them all in one convenient place.

1099 IRS Tax Form

Web maryland’s 2022 form 1099 filing specifications were released nov. Maryland requires a 1099g, 1099r, 1099s and w. Prior to your submission to combined federal/state filing, the 1099 file must. From the latest tech to workspace faves, find just what you need at office depot®! While there were no changes to the record layout in either publication, forms must be.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

7 by the state comptroller’s office. If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. The fastest way to obtain a. Find them all in one convenient place. Please retain a copy of this form and to be able present.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Find them all in one convenient place. Annually, federal 1099 reports are informational forms filed with the internal revenue service (irs). Web form 1099g is a report of income you received from your maryland state taxes as a refund, offset or credit. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax.

Please Retain A Copy Of This Form And To Be Able Present.

7 by the state comptroller’s office. This refund, offset or credit may be taxable income. If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. Complete, edit or print tax forms instantly.

Web Submit Your Completed Form Along With A Copy Of Your Photo Identification By Email To:

Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at [email protected] or by phone at 410. Web maryland department of labor The request for mail order forms may be used to order one copy or. A copy of the 1099 is sent to the taxpayer.

Ad Success Starts With The Right Supplies.

Web maryland’s 2022 form 1099 filing specifications were released nov. It is not a bill. Web the state of maryland requires additional forms to be submitted with 1099s. Prior to your submission to combined federal/state filing, the 1099 file must.