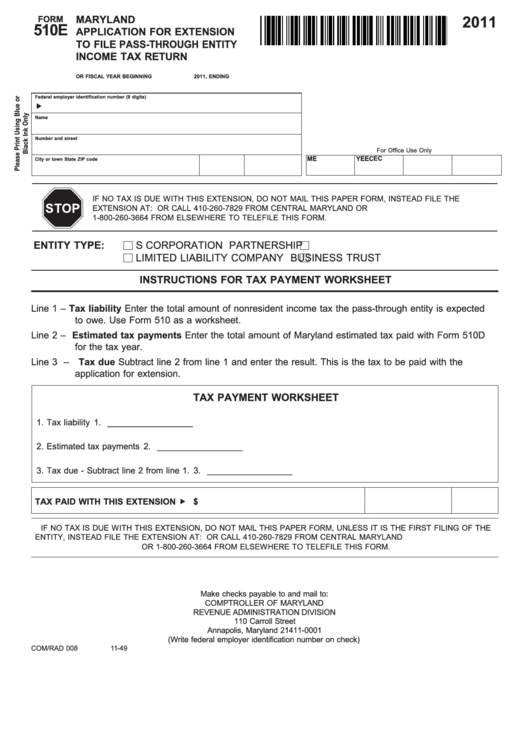

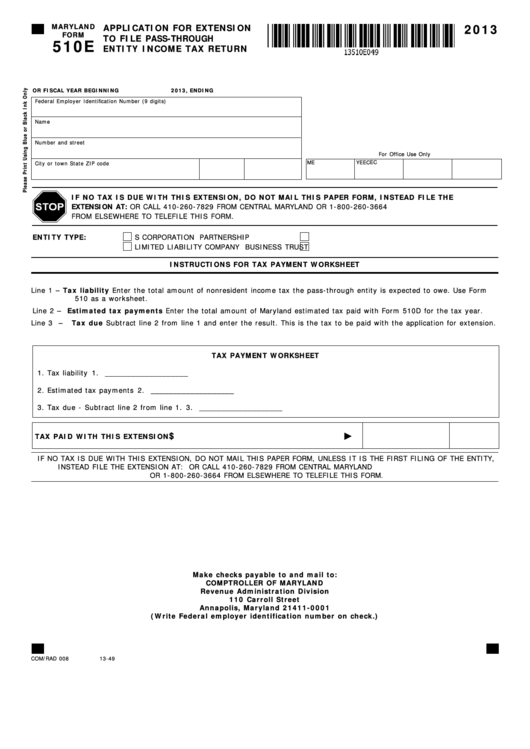

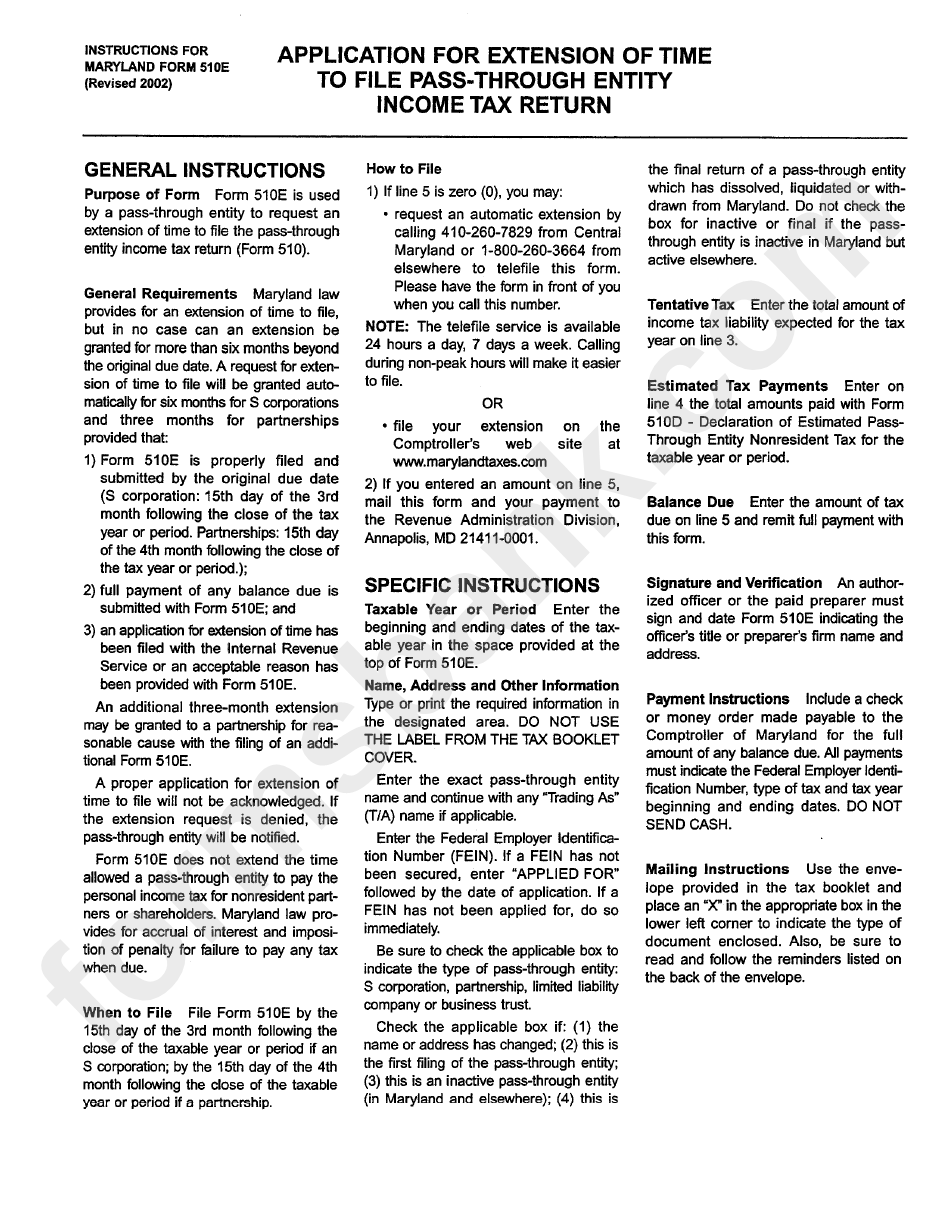

Maryland Form 510E

Maryland Form 510E - You can download or print current. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Web we last updated maryland form 510e in november 2022 from the maryland comptroller of maryland. When and where to filefile form 510e by the 15th day of the 3rd month Use form 510e to remit. An automatic extension will be granted if filed by the due date. If line 3 is zero, file in one of the following ways: Web maryland law provides for accrual of interest and imposition of penalty for failure to pay any tax when due. Use form 510e to remit. Web this system allows instant online electronic filing of the 500e/510e forms.

This form is for income earned in tax year 2022, with tax returns due in april. Web maryland law provides for accrual of interest and imposition of penalty for failure to pay any tax when due. When and where to filefile form 510e by the 15th day of the 3rd month Businesses can file the 500e or 510e online if they have previously filed form. Use form 510e to remit any tax that may be due. Web be used for form 510e. Web we last updated maryland form 510e in november 2022 from the maryland comptroller of maryland. Also use form 510e if this is the first. Web this system allows instant online electronic filing of the 500e/510e forms. If line 3 is zero, file in one of the following ways:

Web this system allows instant online electronic filing of the 500e/510e forms. This form is for income earned in tax year 2022, with tax returns due in april. When and where to filefile form 510e by the 15th day of the 3rd month Use form 510e to remit any tax that may be due. Web corporations can make a maryland extension payment with form 500e. Web submitted with form 510e; Use form 510e to remit. This form is for income earned in tax year 2022, with tax returns due in april. If line 3 is zero, file in one of the following ways: Also use form 510e if this is the first.

Maryland Form 502d Fill Online, Printable, Fillable, Blank pdfFiller

Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. A 7 month extension can be granted for. You can download or print current. Web this system allows instant online electronic filing of the 500e/510e forms. Web we last updated maryland form 510 in january 2023 from.

Fillable Maryland Form 510e Application For Extension To File Pass

Web this system allows instant online electronic filing of the 500e/510e forms. Also use form 510e if this is the first. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. How to file complete the tax payment worksheet. Web we.

ProForm 510E Elliptical Machine with iFit for Sale in Biscayne Park

Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web the extension request filing system allows businesses to instantly file for an extension online. If line 3 is zero, file in one of the following ways: Use form 510e to remit. A 7 month extension can be granted for.

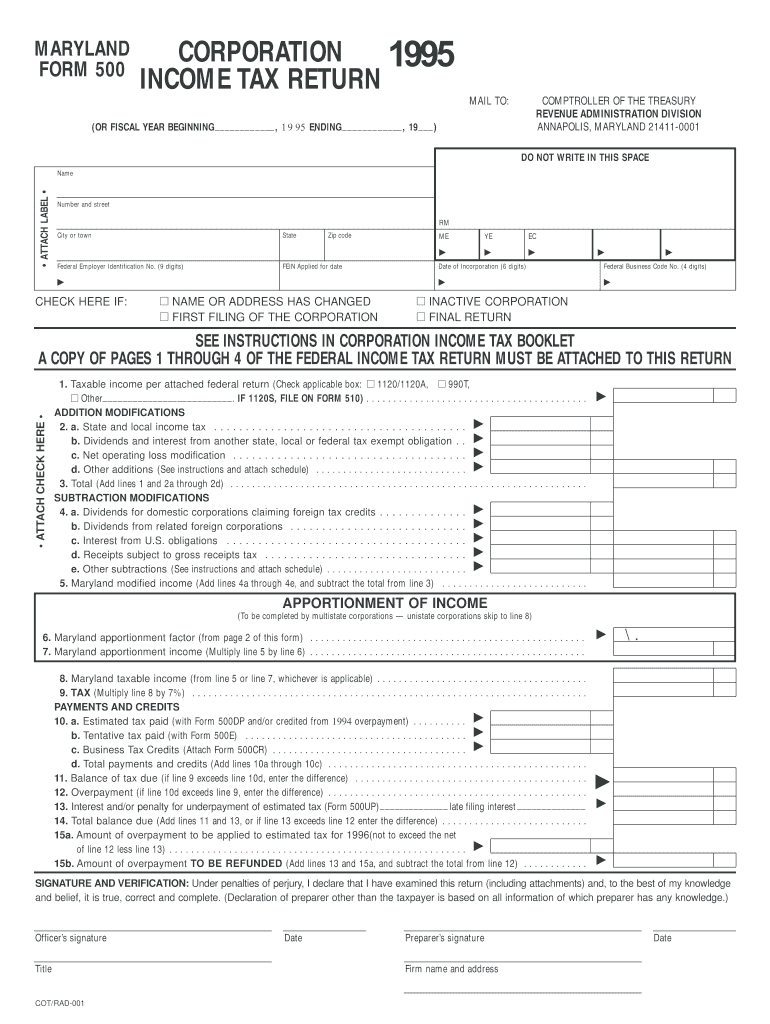

Maryland Form 500 Fill Online, Printable, Fillable, Blank PDFfiller

This form is for income earned in tax year 2022, with tax returns due in april. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web we last updated maryland form 510e in november 2022 from the maryland comptroller of.

Instructions For Maryland Form 510e Application For Extension Oftime

Web maryland law provides for accrual of interest and imposition of penalty for failure to pay any tax when due. And 3) an application for extension of time has been filed with the internal revenue service or an acceptable reason has been provided with form. This form is for income earned in tax year 2022, with tax returns due in.

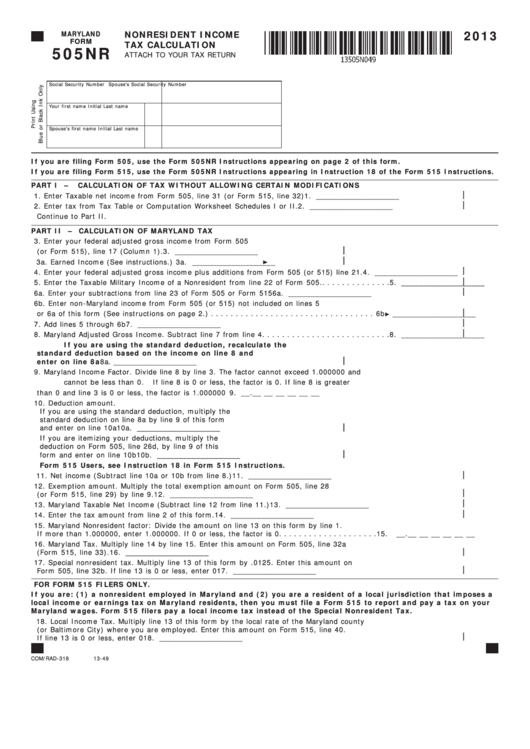

Fillable Maryland Form 505nr Nonresident Tax Calculation

You can download or print current. Use form 510e to remit any tax that may be due. Web corporations can make a maryland extension payment with form 500e. Web this system allows instant online electronic filing of the 500e/510e forms. Web the extension request filing system allows businesses to instantly file for an extension online.

elliemeyersdesigns Maryland Form 510

An automatic extension will be granted if filed by the due date. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Web submitted with form 510e; You can download or print current. A 7 month extension can be granted for.

[ベスト] mw 507 495852Mw 507 Gambarsaeo4p

You can download or print current. Web corporations can make a maryland extension payment with form 500e. Web be used for form 510e. Web this system allows instant online electronic filing of the 500e/510e forms. This form is for income earned in tax year 2022, with tax returns due in april.

Fillable Form 510e Maryland Application For Extension To File Pass

Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. And 3) an application for extension of time has been filed with the internal revenue service or an acceptable reason has been provided with form. This form is for income earned in tax year 2022, with tax returns due in april. Web maryland law.

PROFORM 510E MANUAL Pdf Download ManualsLib

When and where to filefile form 510e by the 15th day of the 3rd month Web corporations can make a maryland extension payment with form 500e. This form is for income earned in tax year 2022, with tax returns due in april. Also use form 510e if this is the first. Web this system allows instant online electronic filing of.

You Can Download Or Print Current.

Web the extension request filing system allows businesses to instantly file for an extension online. An automatic extension will be granted if filed by the due date. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web we last updated maryland form 510e in november 2022 from the maryland comptroller of maryland.

1) Telefile Request An Automatic Extension By Calling 1.

Use form 510e to remit. Businesses can file the 500e or 510e online if they have previously filed form. Web maryland law provides for accrual of interest and imposition of penalty for failure to pay any tax when due. This form is for income earned in tax year 2022, with tax returns due in april.

How To File Complete The Tax Payment Worksheet.

If line 3 is zero, file in one of the following ways: Web be used for form 510e. Web corporations can make a maryland extension payment with form 500e. When and where to filefile form 510e by the 15th day of the 3rd month

Use Form 510E To Remit.

Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Web submitted with form 510e; This form is for income earned in tax year 2022, with tax returns due in april.

![[ベスト] mw 507 495852Mw 507 Gambarsaeo4p](https://www.speedytemplate.com/maryland-form-mw-507_000002.png)