Maryland Form 502E

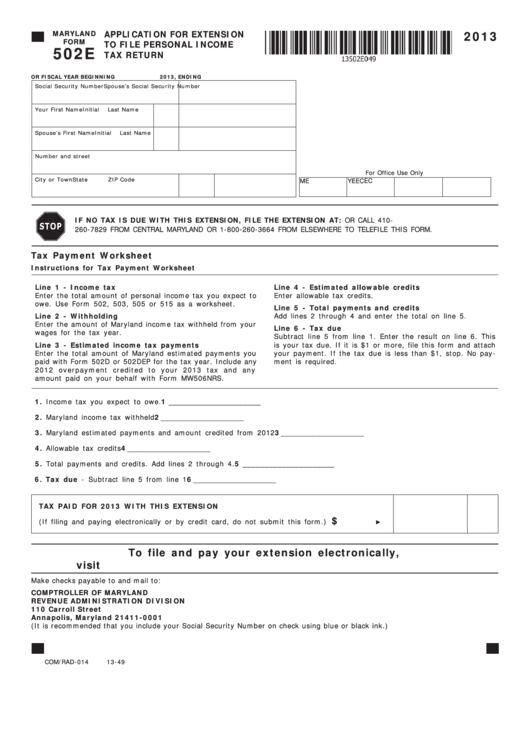

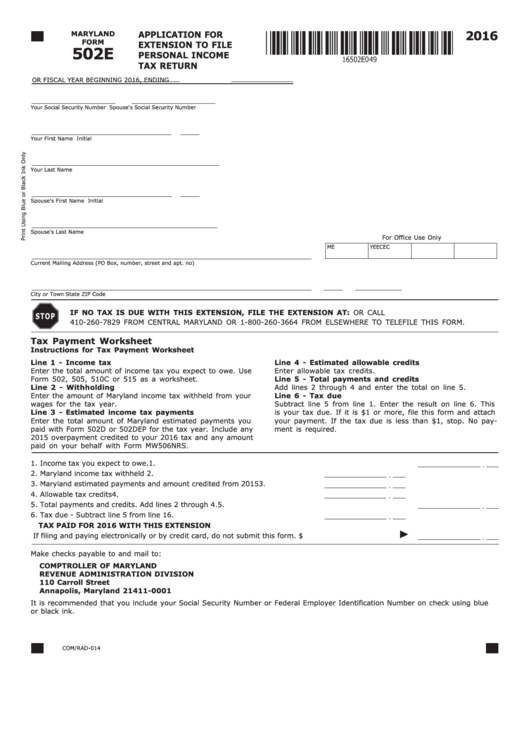

Maryland Form 502E - Web we last updated the maryland subtraction for income derived within an entertainment district in january 2023, so this is the latest version of form 502ae, fully updated for tax year 2022. If you cannot complete and file your form 502, 503, 505 or 515 by the due date, you should complete the tax payment worksheet to determine if you must file form 502e. Payment of the expected tax due is required with form pv by april 18, 2023. Maryland physical address of taxing area as of december 31, 2021 or last day of the taxable year for fiscal year taxpayers. For more information about the maryland income tax, see the maryland income tax page. Web we last updated maryland form 502e in march 2021 from the maryland comptroller of maryland. Web form 502e is a maryland individual income tax form. For office use only me ye ec ec print using blue or black ink only You should file form 502e only if you are making a payment with your extension request or otherwise, do not file form 502e if no tax is due with your maryland extension. Web form 502e—application for extension to file for personal income tax form 502h*—heritage structure rehabilitation tax credit form 502inj—injured spouse claim form.

Web 10 rows form and instructions for a fiduciary to file and pay estimated taxes for tax year 2021 if the fiduciary is required to file a maryland fiduciary income tax return and the taxable income is expected to develop a tax of more than $500. Web we last updated maryland form 502e in march 2021 from the maryland comptroller of maryland. Web filing this form extends the time to file your return, but does not extend the time to pay your taxes. Web printable maryland income tax form 502e. Web maryland physical address line 1 (street no. Web form 502e is a maryland individual income tax form. Application for extension to file fiduciary return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web form and instructions for claiming subtraction for artwork created by qualifying persons and donated to a maryland museum. Payment of the expected tax due is required with form pv by april 18, 2023.

We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web form and instructions for claiming subtraction for artwork created by qualifying persons and donated to a maryland museum. If you cannot complete and file your form 502, 503, 505 or 515 by the due date, you should complete the tax payment worksheet to determine if you must file form 502e. Do not use form 502e if your maryland tax liability is zero. This form is for income earned in tax year 2022, with tax returns due in april 2023. You should file form 502e only if you are making a payment with your extension request or otherwise, do not file form 502e if no tax is due with your maryland extension. Web form 502e—application for extension to file for personal income tax form 502h*—heritage structure rehabilitation tax credit form 502inj—injured spouse claim form. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Application for extension to file fiduciary return. Web maryland tax forms & instruction booklet for nonresidents.

[ベスト] mw 507 495852Mw 507 Gambarsaeo4p

Web maryland physical address line 1 (street no. And street name) (no po box) maryland physical address line 2 (apt no., suite no., floor no.) (no po box) city state zip code + 4 maryland county required: Do not use form 502e if your maryland tax liability is zero. You should file form 502e only if you are making a.

Fill Free fillable forms Comptroller of Maryland

Web maryland physical address line 1 (street no. Maryland forms and schedules form 500—corporation income tax return form 500cr—business income tax credits Web form 502e is a maryland individual income tax form. Use form 502e to apply for an extension of time to file your taxes. Web formmaryland application for 2012502eextension to file personal income tax return instructions who must.

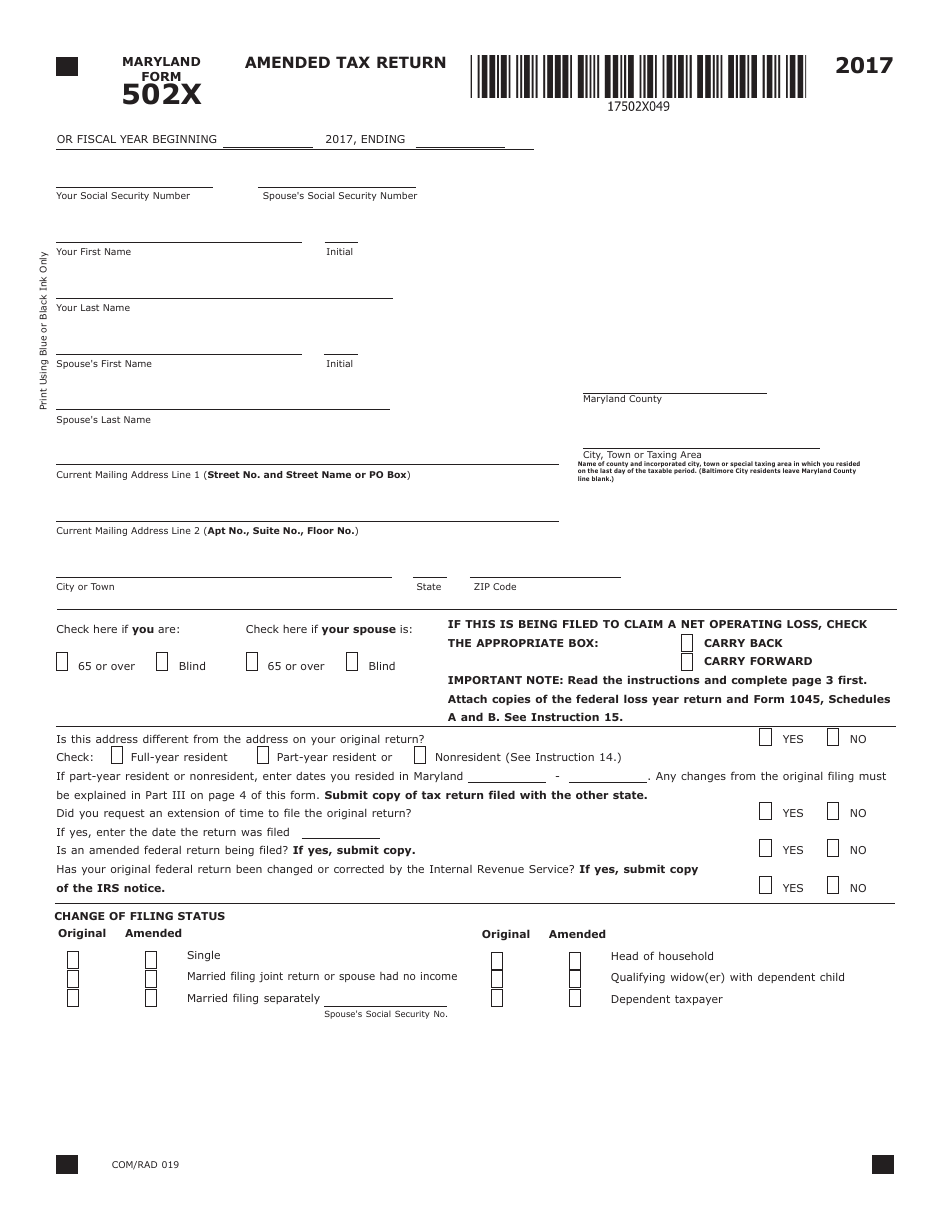

Form 502X Download Fillable PDF or Fill Online Amended Tax Return

We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web 10 rows form and instructions for a fiduciary to file and pay estimated taxes for tax year 2021 if the fiduciary is required to file a maryland fiduciary income tax return and the taxable.

Fillable Maryland Form 502e Application For Extension To File

If you cannot complete and file your form 502, 503, 505 or 515 by the due date, you should complete the tax payment worksheet to determine if you must file form 502e. For more information about the maryland income tax, see the maryland income tax page. This form is for income earned in tax year 2022, with tax returns due.

502e Maryland Tax Forms And Instructions printable pdf download

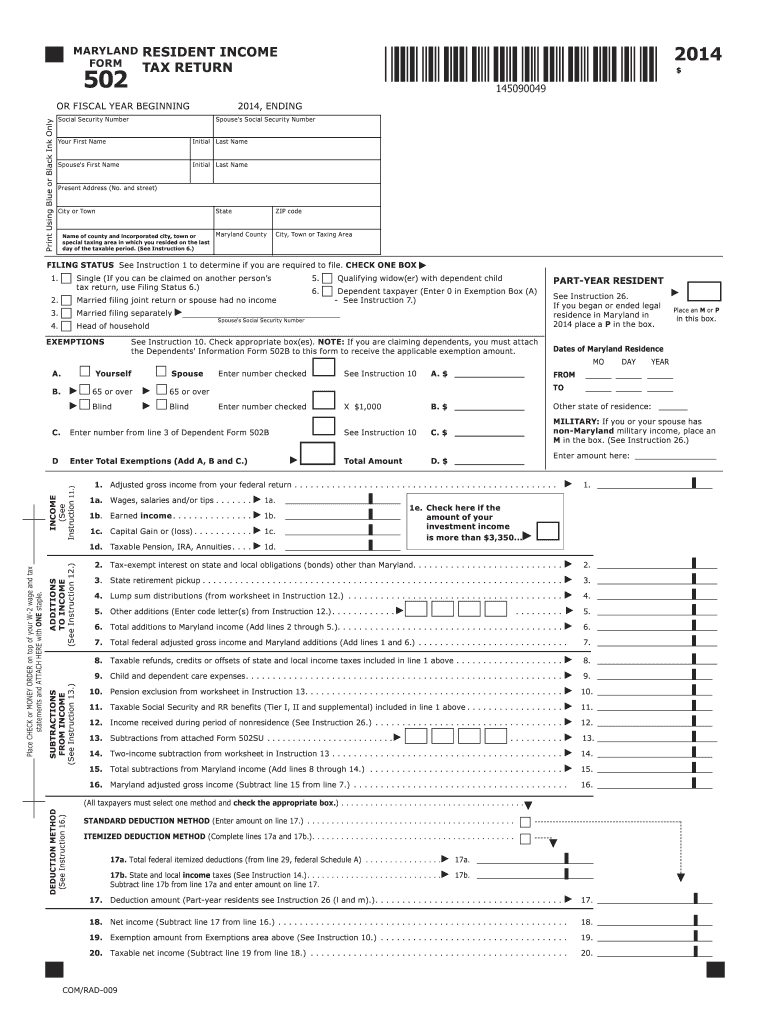

If you are claiming dependents, you must attach the dependents' information form 502b to this We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web maryland physical address line 1 (street no. Web formmaryland application for 2012502eextension to file personal income tax return instructions.

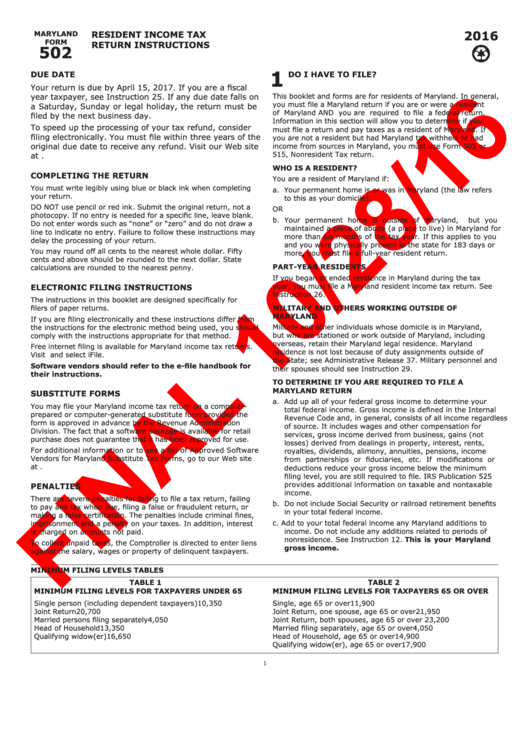

Instructions For Resident Tax Return (Maryland Form 502

If you are claiming dependents, you must attach the dependents' information form 502b to this Do not use form 502e if your maryland tax liability is zero. Web we last updated the maryland subtraction for income derived within an entertainment district in january 2023, so this is the latest version of form 502ae, fully updated for tax year 2022. Web.

Fill Free fillable forms Comptroller of Maryland

For office use only me ye ec ec print using blue or black ink only Maryland physical address of taxing area as of december 31, 2021 or last day of the taxable year for fiscal year taxpayers. Web form 502e is a maryland individual income tax form. Do not use form 502e if your maryland tax liability is zero. You.

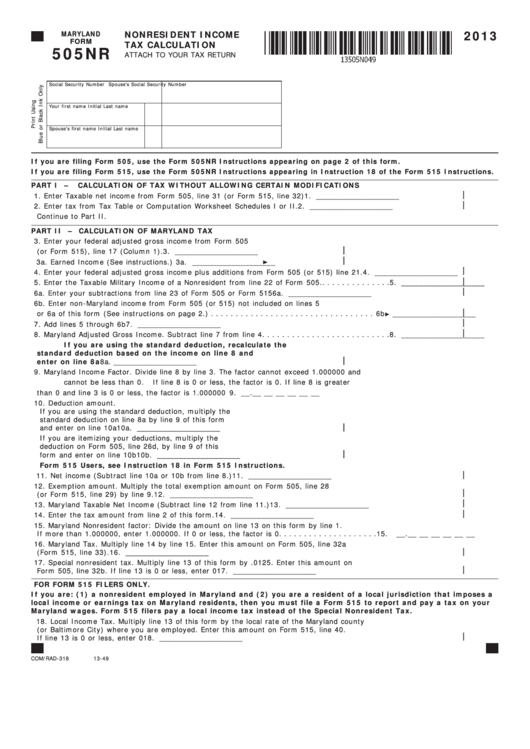

Fillable Maryland Form 505nr Nonresident Tax Calculation

2022 use of vehicle for charitable purposes. Web maryland physical address line 1 (street no. Web we last updated the maryland subtraction for income derived within an entertainment district in january 2023, so this is the latest version of form 502ae, fully updated for tax year 2022. Web printable maryland income tax form 502e. For office use only me ye.

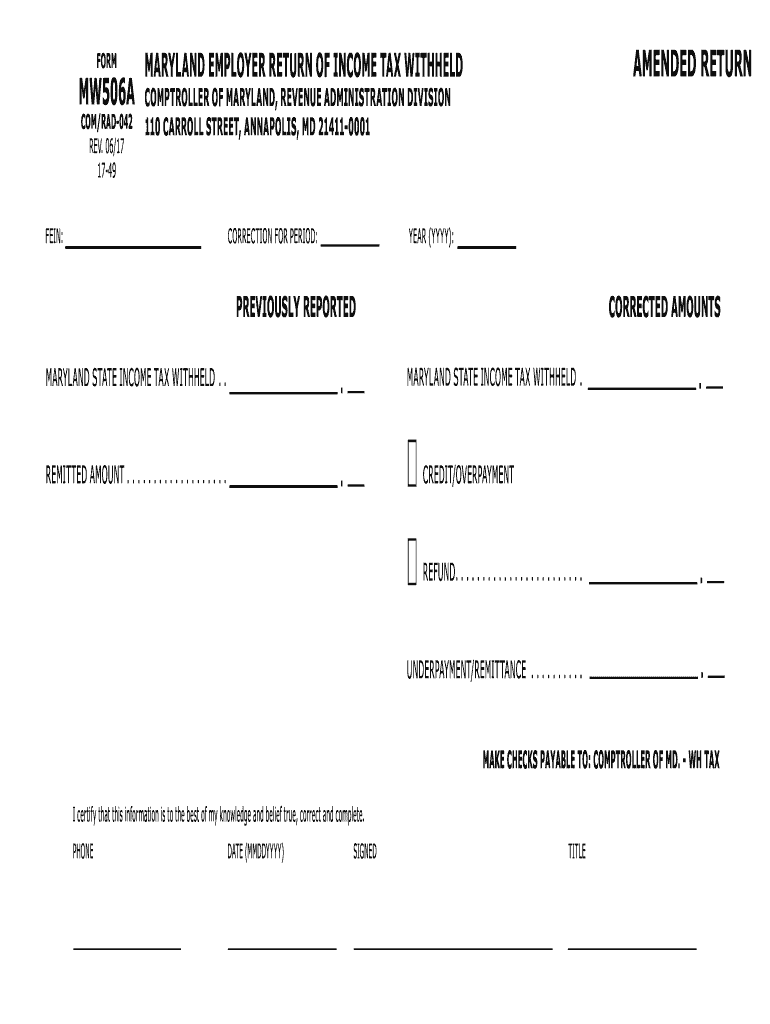

2017 Form MD Comptroller MW506A Fill Online, Printable, Fillable, Blank

You should file form 502e only if you are making a payment with your extension request or otherwise, do not file form 502e if no tax is due with your maryland extension. Web maryland tax forms & instruction booklet for nonresidents. Web maryland physical address line 1 (street no. 502ae maryland subtraction for income derived within an arts and entertainment.

Maryland Form 502 Fill Out and Sign Printable PDF Template signNow

Maryland forms and schedules form 500—corporation income tax return form 500cr—business income tax credits And street name) (no po box) maryland physical address line 2 (apt no., suite no., floor no.) (no po box) city state zip code + 4 maryland county required: This form is for income earned in tax year 2022, with tax returns due in april 2023..

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web maryland physical address line 1 (street no. Form 402e is also used to pay the tax balance due for your maryland extension. Web you can make an extension payment with form 502e (application for extension to file personal income tax return).

You Should File Form 502E Only If You Are Making A Payment With Your Extension Request Or Otherwise, Do Not File Form 502E If No Tax Is Due With Your Maryland Extension.

Web printable maryland income tax form 502e. For office use only me ye ec ec print using blue or black ink only Web maryland tax forms & instruction booklet for nonresidents. Do not use form 502e if your maryland tax liability is zero.

If You Cannot Complete And File Your Form 502, 503, 505 Or 515 By The Due Date, You Should Complete The Tax Payment Worksheet To Determine If You Must File Form 502E.

Web form 502e—application for extension to file for personal income tax form 502h*—heritage structure rehabilitation tax credit form 502inj—injured spouse claim form. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web maryland physical address line 1 (street no. Use form 502e to apply for an extension of time to file your taxes.

Web Formmaryland Application For 2012502Eextension To File Personal Income Tax Return Instructions Who Must File Form 502E?

Web we last updated maryland form 502e in march 2021 from the maryland comptroller of maryland. And street name) (no po box) maryland physical address line 2 (apt no., suite no., floor no.) (no po box) city state zip code + 4 maryland county required: Maryland physical address of taxing area as of december 31, 2020 or last day of the taxable year for fiscal year taxpayers. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs

![[ベスト] mw 507 495852Mw 507 Gambarsaeo4p](https://www.speedytemplate.com/maryland-form-mw-507_000002.png)