Maryland 2022 Form 1

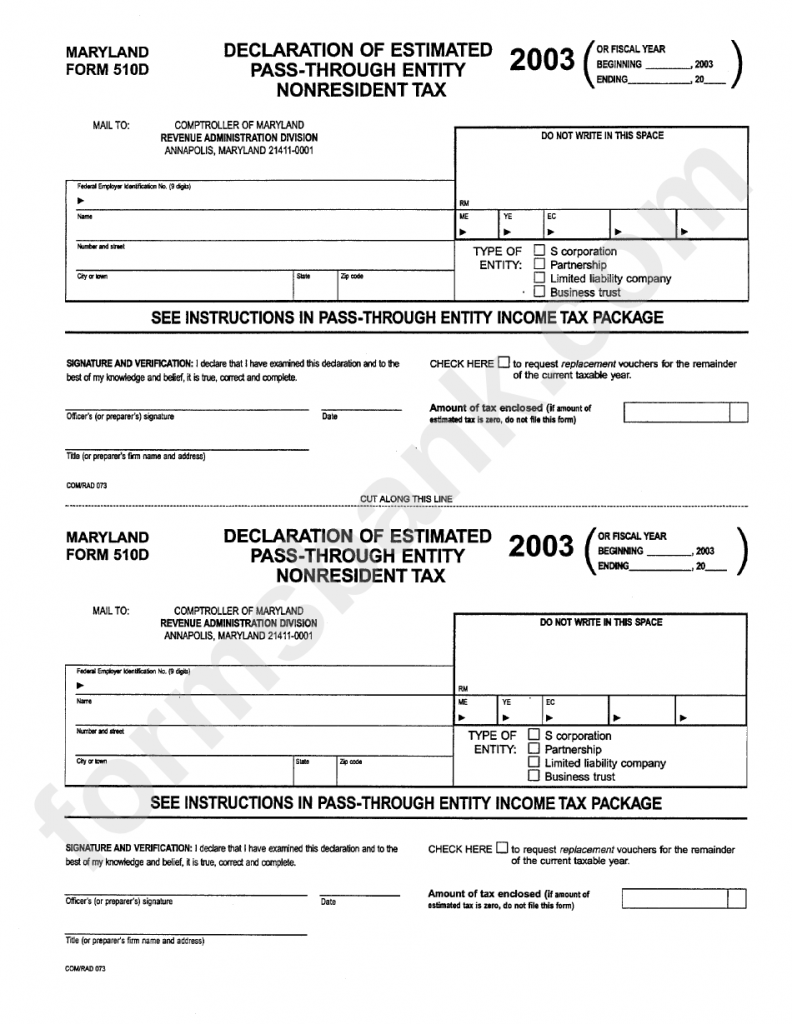

Maryland 2022 Form 1 - Web two tickets acquired in maryland and tennessee matched all five numbers except for the powerball worth $500,000. Form used to report the total amount of withholding tax received during the reporting period from the sale or transfer of. Annual report maryland state department of (state of maryland) on average this form. If you began or ended legal residence in maryland in 2022 place a p in the. For apportioning income to the state for corporate income tax purposes, a single sales factor apportionment formula has been. Web one ticket in california matched all five numbers and the powerball. Maryland income tax form instructions for corporations. Web form met 1 rev. Web use fill to complete blank online state of maryland (md) pdf forms for free. 06/23 use this area for date stamps revenue administration divisionp.o.

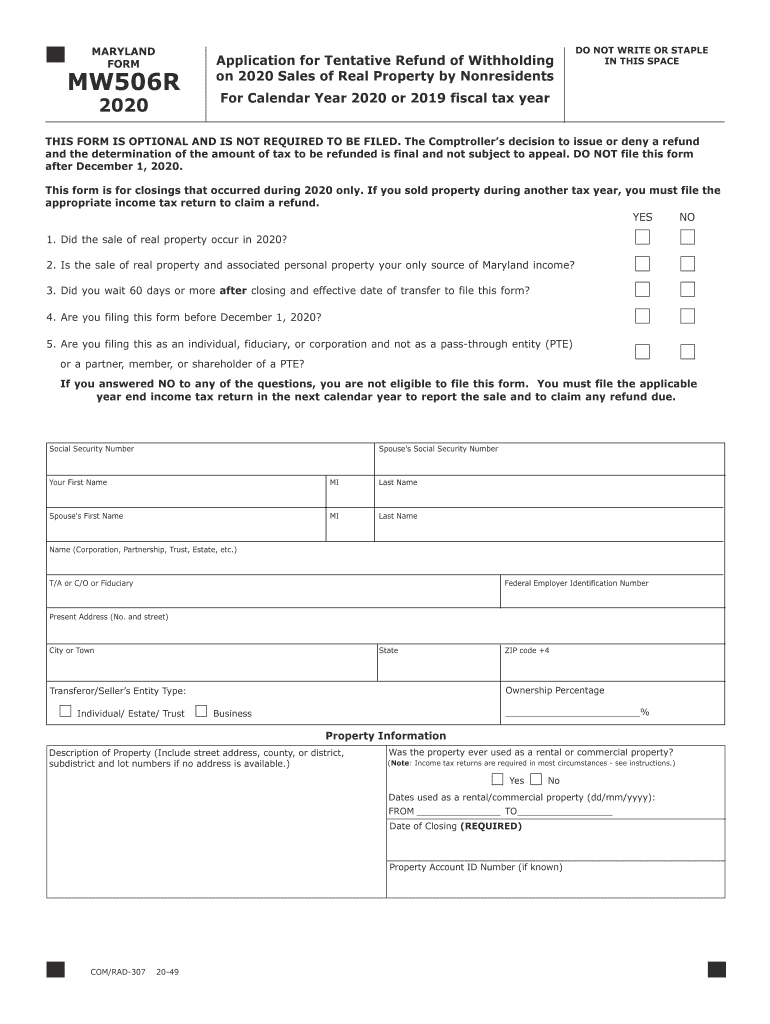

For forms, visit the 2022 individual tax forms or business tax forms. Web new for 2022 single sales factor apportionment. Once completed you can sign your fillable form or send for signing. Web use fill to complete blank online state of maryland (md) pdf forms for free. Instructions for filing corporation income tax returns for the calendar year or any other tax. Web form mw506r may not be filed after december 1, 2022. For nonresidents employed in maryland who reside in jurisdictions that impose a local income or earnings tax. Web one ticket in california matched all five numbers and the powerball. Web form met 1 rev. Web in order to successfully file your maryland annual report, you’ll need to complete the following steps:

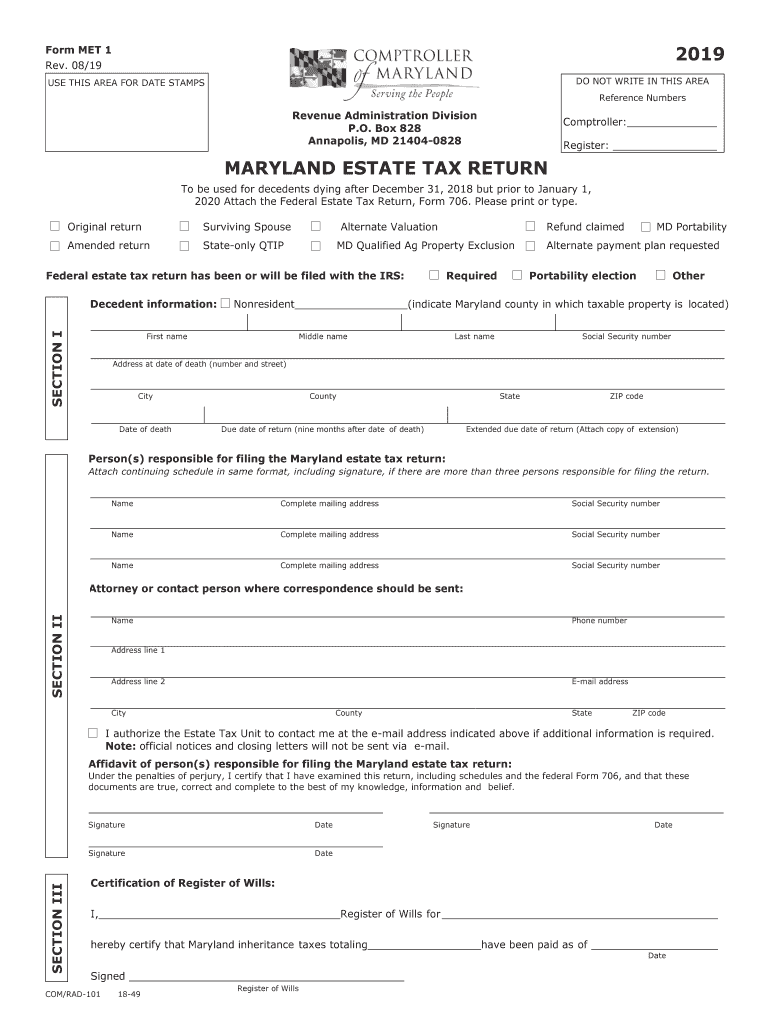

If you answered yes, but your entity* is exempt, or has been granted an. Web fy 2024 strategic goals. Forms are available for downloading in the resident individuals income tax forms section. Web form and instructions for filing a maryland estate tax return for decedents dying after december 31, 2020 and before january 1, 2022. 06/23 use this area for date stamps revenue administration divisionp.o. For apportioning income to the state for corporate income tax purposes, a single sales factor apportionment formula has been. Web 2022 $ md dates of maryland residence (mm dd yyyy) from to other state of residence: The instruction booklets listed here do not include forms. For nonresidents employed in maryland who reside in jurisdictions that impose a local income or earnings tax. Web tax year 2022 instruction booklets home 2022 instruction booklets 2022 instruction booklets note:

Program Deadlines Global Maryland, University of Maryland

Web form and instructions for filing a maryland estate tax return for decedents dying after december 31, 2020 and before january 1, 2022. Web speaking on the latest episode of the martin lewis podcast on bbc sounds, martin said: For forms, visit the 2022 individual tax forms or business tax forms. Maryland income tax form instructions for corporations. Forms are.

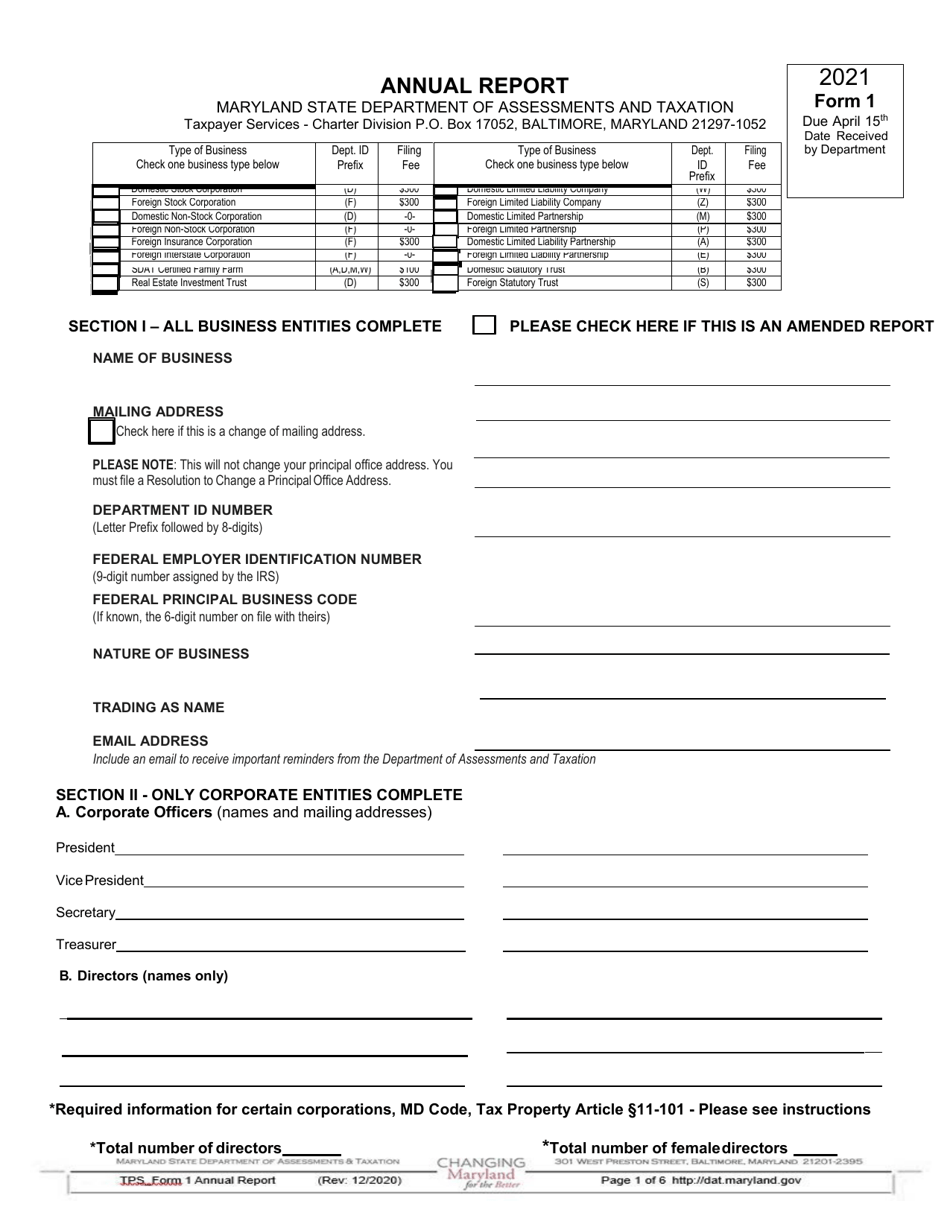

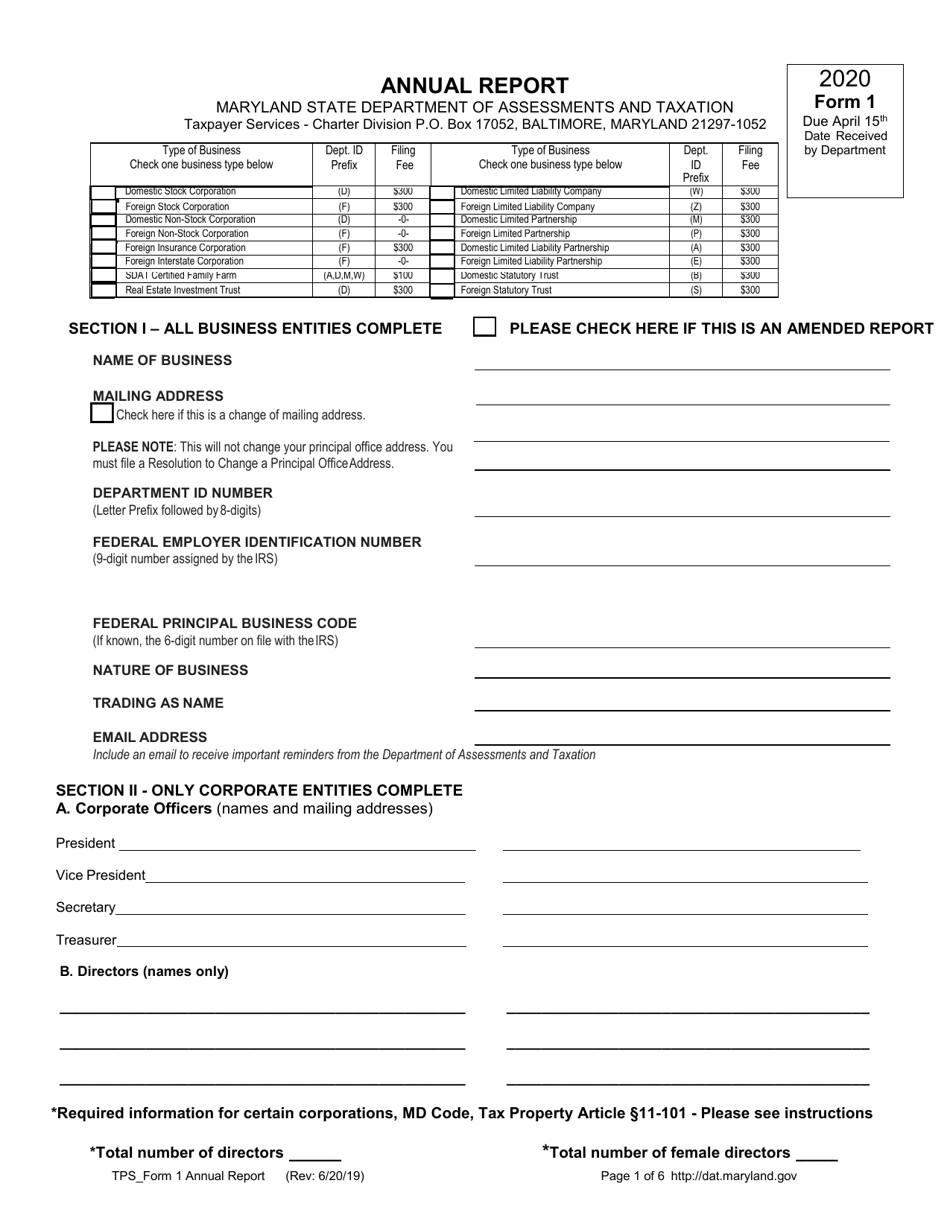

Form 1 Download Fillable PDF or Fill Online Annual Report 2021

A “state benefit” means (1) a state capital grant funding totaling $1.00 million or more in a single fiscal year; Once completed you can sign your fillable form or send for signing. Provide the actual, physical location of all personal property in maryland. Web tax year 2022 instruction booklets home 2022 instruction booklets 2022 instruction booklets note: Instructions for filing.

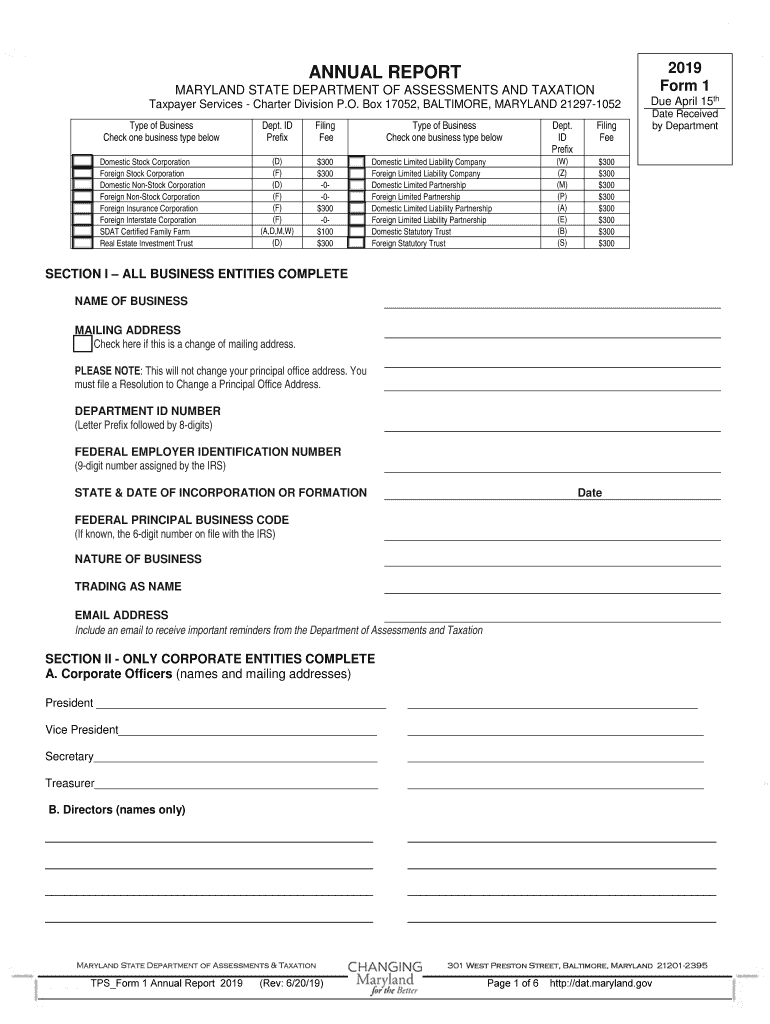

2019 Form MD SDAT 1 Fill Online, Printable, Fillable, Blank PDFfiller

(2) state tax credits totaling $1.00 million or. Annual report maryland state department of (state of maryland) on average this form. Web form 1 annual report does the business own, lease, or use personal property located in maryland? Web tax year 2022 instruction booklets home 2022 instruction booklets 2022 instruction booklets note: Web two tickets acquired in maryland and tennessee.

Maryland adds opponents to 2021, 2022 schedules

A “state benefit” means (1) a state capital grant funding totaling $1.00 million or more in a single fiscal year; Maryland income tax form instructions for corporations. ‘it’s time for millions to reopen cash isas. Web tax year 2022 instruction booklets home 2022 instruction booklets 2022 instruction booklets note: Provide the actual, physical location of all personal property in maryland.

Maryland Met 1 Instructions Fill Out and Sign Printable PDF Template

Maryland income tax form instructions for corporations. Instructions for filing corporation income tax returns for the calendar year or any other tax. Web form mw506r may not be filed after december 1, 2022. Provide the actual, physical location of all personal property in maryland. Web use fill to complete blank online state of maryland (md) pdf forms for free.

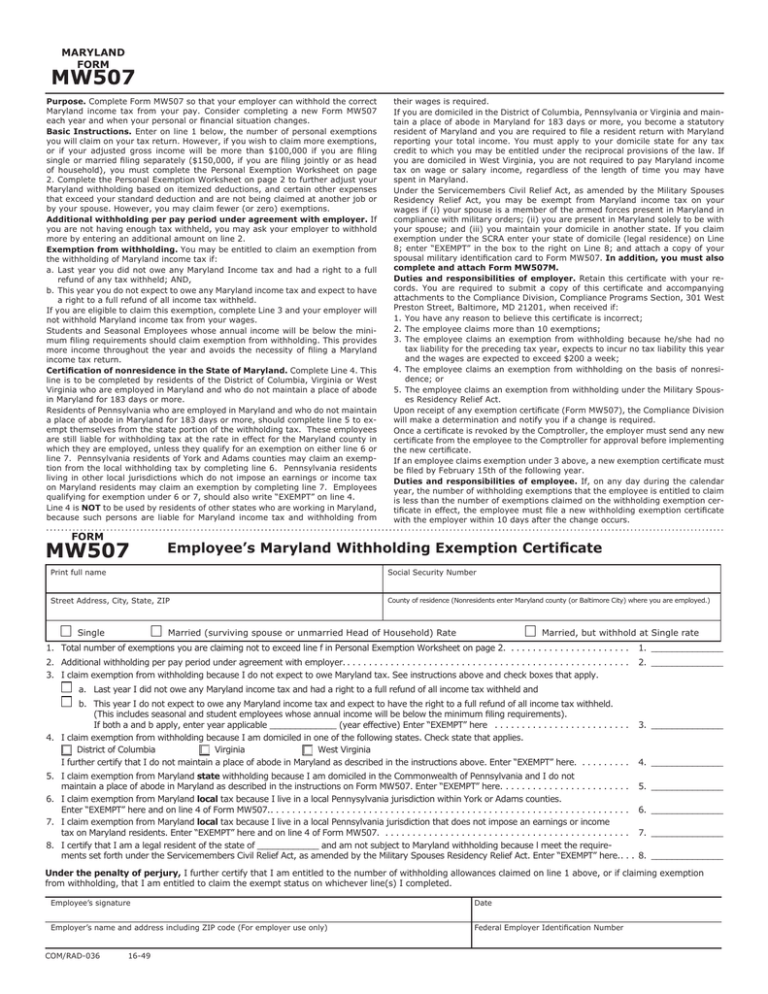

MW507 MARYLAND FORM

Determine your business’s due date and filing fee. Web form 1 annual report does the business own, lease, or use personal property located in maryland? If you began or ended legal residence in maryland in 2022 place a p in the. Web in order to successfully file your maryland annual report, you’ll need to complete the following steps: Web two.

TX 2022 20112022 Fill and Sign Printable Template Online US Legal

Web form met 1 rev. Web in order to successfully file your maryland annual report, you’ll need to complete the following steps: Form used to report the total amount of withholding tax received during the reporting period from the sale or transfer of. Annual report maryland state department of (state of maryland) on average this form. (2) state tax credits.

Form 1 Download Fillable PDF or Fill Online Annual Report and Personal

Web form met 1 rev. Web new for 2022 single sales factor apportionment. Web one ticket in california matched all five numbers and the powerball. Annual report maryland state department of (state of maryland) on average this form. For apportioning income to the state for corporate income tax purposes, a single sales factor apportionment formula has been.

Mw506R Fill Out and Sign Printable PDF Template signNow

For apportioning income to the state for corporate income tax purposes, a single sales factor apportionment formula has been. Annual report maryland state department of (state of maryland) on average this form. Web in order to successfully file your maryland annual report, you’ll need to complete the following steps: Web fy 2024 strategic goals. Maryland income tax form instructions for.

Maryland Printable Tax Forms Printable Form 2022

Web speaking on the latest episode of the martin lewis podcast on bbc sounds, martin said: Web use fill to complete blank online state of maryland (md) pdf forms for free. Web an application may be subjected to an audit at any time and applicant may be requested to submit additional verification or other evidence of income in order to..

Determine Your Business’s Due Date And Filing Fee.

Web speaking on the latest episode of the martin lewis podcast on bbc sounds, martin said: If you began or ended legal residence in maryland in 2022 place a p in the. Instructions for filing corporation income tax returns for the calendar year or any other tax. Web form 1 annual report does the business own, lease, or use personal property located in maryland?

For Forms, Visit The 2022 Individual Tax Forms Or Business Tax Forms.

06/23 use this area for date stamps revenue administration divisionp.o. Web in order to successfully file your maryland annual report, you’ll need to complete the following steps: ‘it’s time for millions to reopen cash isas. Web form met 1 rev.

Forms Are Available For Downloading In The Resident Individuals Income Tax Forms Section.

For apportioning income to the state for corporate income tax purposes, a single sales factor apportionment formula has been. Maryland income tax form instructions for corporations. If you answered yes, but your entity* is exempt, or has been granted an. (2) state tax credits totaling $1.00 million or.

Web Use Fill To Complete Blank Online State Of Maryland (Md) Pdf Forms For Free.

Once completed you can sign your fillable form or send for signing. Annual report maryland state department of (state of maryland) on average this form. Form used to report the total amount of withholding tax received during the reporting period from the sale or transfer of. ‘the top pay 5.7%, and with rates.