Ma Abatement Form

Ma Abatement Form - You can also download it, export it or print it out. Web request a motor vehicle sales or use tax abatement. Web motor vehicle excise tax abatement applicationsmassachusetts general laws, chapter 60a in addition to filing an abatement application,. Web to apply for an abatement (or refund if excise has been paid), complete this form, below, and provide the specified documentation. You can download or print current or past. Web motor vehicle abatement form. The owner believes the assessment is incorrect, or. An abatement is a reduction of a property tax based upon a reduction of. Web an abatement is a reduction in the tax assessed on your property for the fiscal year. To dispute your valuation or assessment or to correct any other billing problem or error that.

Web motor vehicle excise tax abatement applicationsmassachusetts general laws, chapter 60a in addition to filing an abatement application,. Web send 2019 massachusetts tax forms via email, link, or fax. Personal property tax an abatement is a reduction in your property taxes. If you bought a motor vehicle, you might be eligible to receive a sales or use tax refund. Web abatement applications can be filed if: Assessors must receive your excise abatement application within three years. If the vehicle was traded, or. Web to apply for an abatement (or refund if excise has been paid), complete this form, below, and provide the specified documentation. An abatement is a reduction of a property tax based upon a reduction of. Web request a motor vehicle sales or use tax abatement.

If the vehicle was sold during the. Web motor vehicle abatement form. An abatement is a reduction of a property tax based upon a reduction of. This period normally runs from. Web • if you wish to apply for an abatement of your excise tax bill, please fi ll out the information at right. Web although payment of a bill is not a precondition for an abatement an owner risks incurring late fees and penalties if an abatement is not granted. To apply for an abatement (or refund if excise has been paid), complete this form and provide all the specified documentation. Web request a motor vehicle sales or use tax abatement. The owner believes the assessment is incorrect, or. If the vehicle was traded, or.

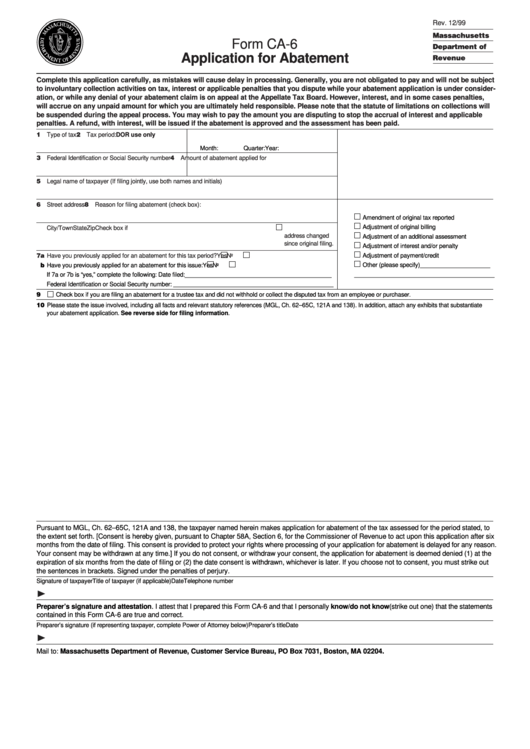

Form Ca6 Application For Abatement 1999 printable pdf download

Assessors must receive your excise abatement application within three years. Web real and personal property abatement forms below can only be filed during the abatement period after the third quarter tax bill is mailed. The tax rate is $25.00 per thousand $ of value. You can also download it, export it or print it out. Personal property tax an abatement.

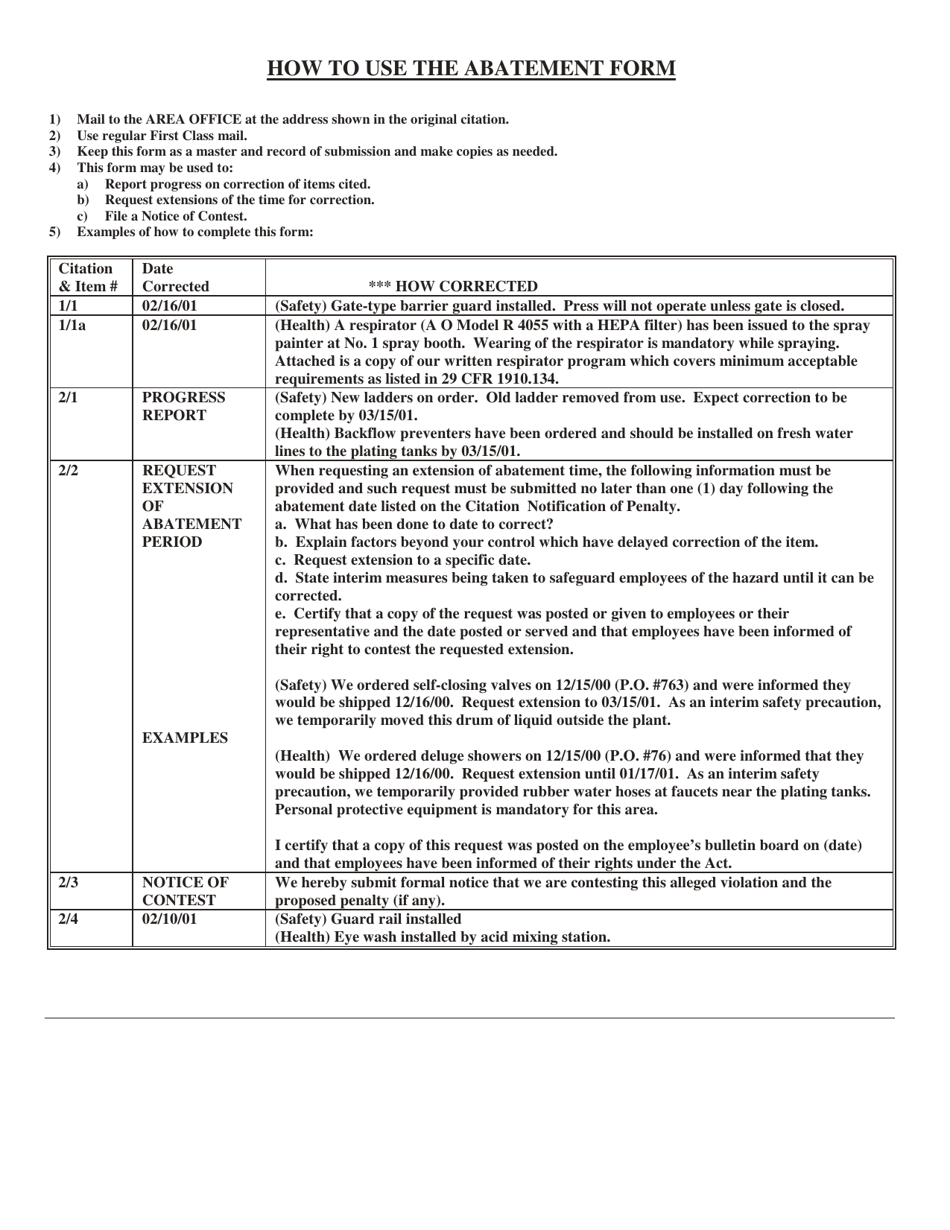

Car Tax Application Form Massachusetts Free Download

Learn how to request an abatement. Web abatement applications can be filed if: This notice explains the procedure for obtaining an abatement of property tax. Personal property tax an abatement is a reduction in your property taxes. Web request a motor vehicle sales or use tax abatement.

Form 21 Download Fillable PDF or Fill Online Request for Abatement of

The owner believes the assessment is incorrect, or. Check reason(s) you are applying and provide the specified. If the vehicle was stolen, or. Web real and personal property abatement forms below can only be filed during the abatement period after the third quarter tax bill is mailed. Edit your massachusetts state return online.

Tennessee Abatement Form Download Printable PDF Templateroller

If the vehicle was sold during the. Tax year issue date / / bill. Web we last updated the application for abatement in january 2023, so this is the latest version of form abt, fully updated for tax year 2022. Web file now with turbotax we last updated massachusetts form abt in january 2023 from the massachusetts department of revenue..

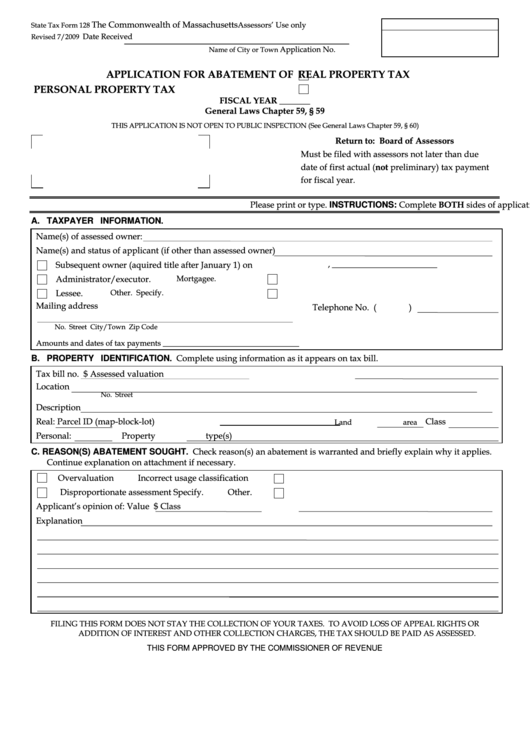

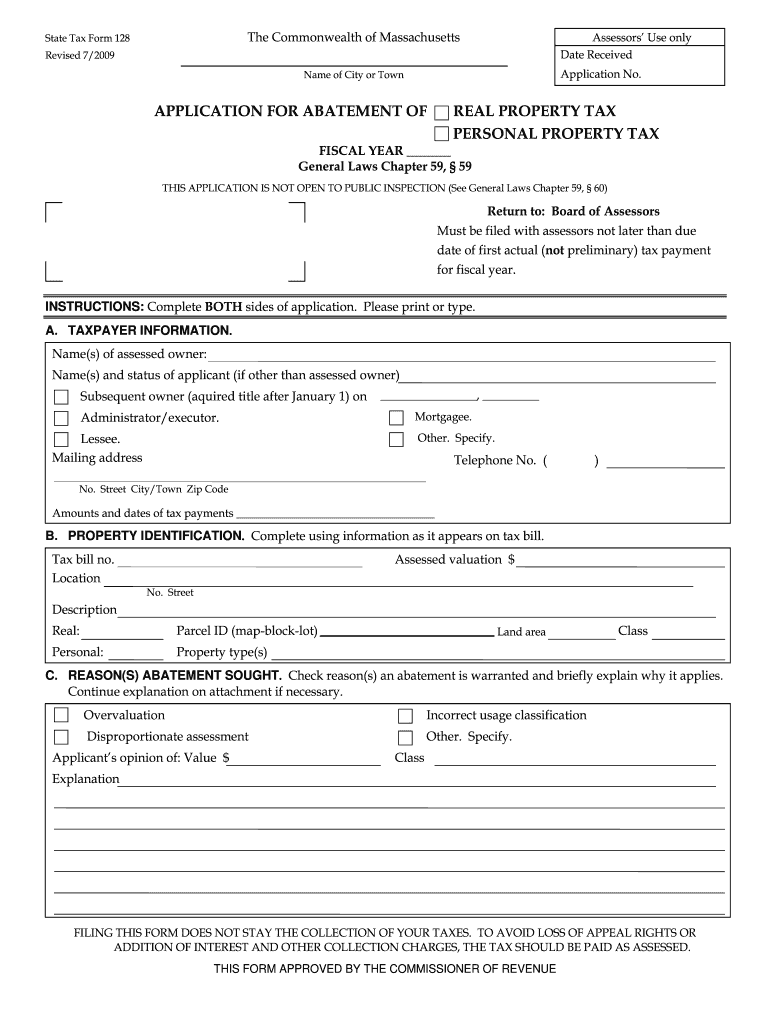

Fillable Form 128 Application For Abatement Of Real Property Tax Or

Web real and personal property abatement forms below can only be filed during the abatement period after the third quarter tax bill is mailed. Web we last updated the application for abatement in january 2023, so this is the latest version of form abt, fully updated for tax year 2022. Web although payment of a bill is not a precondition.

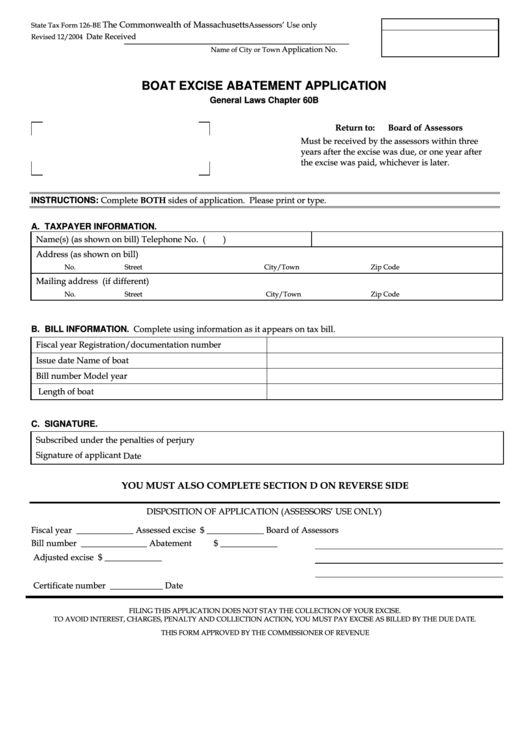

Fillable State Tax Form 126Be Boat Excise Abatement Application

Web motor vehicle abatement form. The owner believes the assessment is incorrect, or. If the vehicle was sold during the. Web abatement applications can be filed if: Edit your massachusetts state return online.

BIR Abatement Form Taxes Government Finances

Check reason(s) you are applying and provide the specified. To apply for an abatement (or refund if excise has been paid), complete this form and provide all the specified documentation. Web ma general laws chapter 60a. Web we last updated the application for abatement in january 2023, so this is the latest version of form abt, fully updated for tax.

Motor Vehicle Excise Abatement & Form Shrewsbury, MA

Check reason(s) you are applying and provide the specified. The owner believes the assessment is incorrect, or. The tax rate is $25.00 per thousand $ of value. Assessors must receive your excise abatement application within three years. If the vehicle was sold during the.

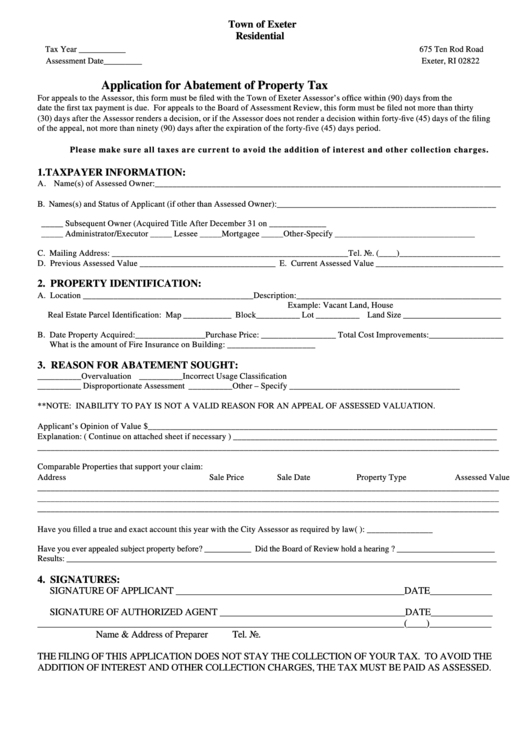

Application Form For Abatement Of Property Tax printable pdf download

Web request a motor vehicle sales or use tax abatement. If you bought a motor vehicle, you might be eligible to receive a sales or use tax refund. Web send 2019 massachusetts tax forms via email, link, or fax. Learn how to request an abatement. If the vehicle was sold during the.

2009 MA State Tax Form 128 Fill Online, Printable, Fillable, Blank

Web request a motor vehicle sales or use tax abatement. Assessors must receive your excise abatement application within three years. You can also download it, export it or print it out. This period normally runs from. This form is for income earned in tax year.

You Can Also Download It, Export It Or Print It Out.

Web send 2019 massachusetts tax forms via email, link, or fax. You can download or print current or past. Web massachusetts form abt taxpayer name (if business, enter full legal name) application for abatement type of identification number: Web motor vehicle excise tax abatement applicationsmassachusetts general laws, chapter 60a in addition to filing an abatement application,.

Web An Abatement Is A Reduction In The Tax Assessed On Your Property For The Fiscal Year.

Web • if you wish to apply for an abatement of your excise tax bill, please fi ll out the information at right. Web we last updated the application for abatement in january 2023, so this is the latest version of form abt, fully updated for tax year 2022. If the vehicle was sold during the. Web real and personal property abatement forms below can only be filed during the abatement period after the third quarter tax bill is mailed.

Learn How To Request An Abatement.

Web file now with turbotax we last updated massachusetts form abt in january 2023 from the massachusetts department of revenue. Web ma general laws chapter 60a. If the vehicle was stolen, or. Check reason(s) you are applying and provide the specified.

To Dispute Your Valuation Or Assessment Or To Correct Any Other Billing Problem Or Error That.

The tax rate is $25.00 per thousand $ of value. Web abatement applications can be filed if: This notice explains the procedure for obtaining an abatement of property tax. Assessors must receive your excise abatement application within three years.