Loan Payoff Form

Loan Payoff Form - Web loan payoff form 1. Web public service loan forgiveness, or pslf, can wipe out the federal student loan debt for borrowers after 10 years of employment for qualifying nonprofit and governmental organizations. Web payoff statements are statements prepared by lenders or creditors identifying an exact amount necessary for full payment of a loan, a mortgage, student loan debt, or other debt. This q&a contains general statements of policy under the administrative procedure act issued to advise the public prospectively of the manner in which the u.s. The payoff statement shows the remaining loan balance and number of payments and the. The revised form requires the loan servicer to state the loan. Web retirement and benefit services provided by merrill. Web this is just the tip of the iceberg. Participant identification please print walmart 401(k) plan #609450 social security number ( required ) you will be required to wait 15 calendar days after the final payment of a loan balance before requesting another loan under the plan. Web the current balance on your monthly loan statement is not the same as the payoff amount, which is the amount necessary to completely satisfy the loan and close it out.

Last four digits of ssn: Web to create a sample loan payoff letter that will lay out all of the details necessary for a borrower to complete in order to pay off a loan in full, you will want to include the following information: Web get the auto loan payoff form you want. A group of congressional democrats has introduced legislation to eliminate interest rates on all current federal student loans—and. Web updated february 20, 2023 a promissory note release is given to a borrower after the final payment on a loan to release them of all further liabilities and obligations. Engaged parties names, places of residence and numbers etc. Any loan payments submitted using other sba forms on pay.gov will be rejected. Web date of next payment? The average loan carried a 11 percent. This q&a contains general statements of policy under the administrative procedure act issued to advise the public prospectively of the manner in which the u.s.

Web a loan payoff request letter is a letter written by a consumer asking for the amount required to pay the balance of a loan off by a certain date. Change the template with smart fillable fields. Web updated february 20, 2023 a promissory note release is given to a borrower after the final payment on a loan to release them of all further liabilities and obligations. Web 1 day agobest loans to refinance credit card debt. The payoff statement shows the remaining loan balance and number of payments and the. Web the 1201 borrower payment form is being phased out and borrowers should utilize the mysba loan portal to make payments. Department of education (ed) and federal student aid (fsa) propose to exercise their discretion as a result of and in response to the lawfully and duly declared covid. Participant identification please print walmart 401(k) plan #609450 social security number ( required ) you will be required to wait 15 calendar days after the final payment of a loan balance before requesting another loan under the plan. Web this is just the tip of the iceberg. Web public service loan forgiveness, or pslf, can wipe out the federal student loan debt for borrowers after 10 years of employment for qualifying nonprofit and governmental organizations.

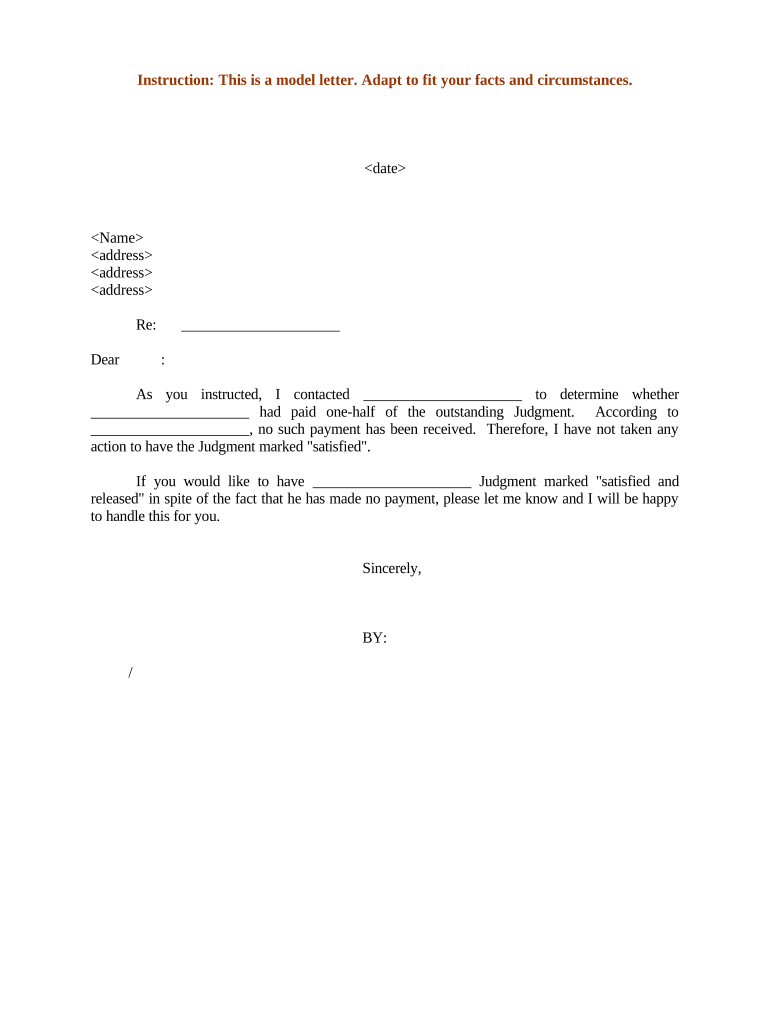

payoff letter template Doc Template pdfFiller

Your organization's logo and contact information as the header of the page. If you have the funds to pay off an installment loan early, request a payoff letter from your lender. They’re often used in refinancing, consolidation loans, debts in collections, and other situations wherein a lender wants to know how much must be paid. Web the plan's supporters say.

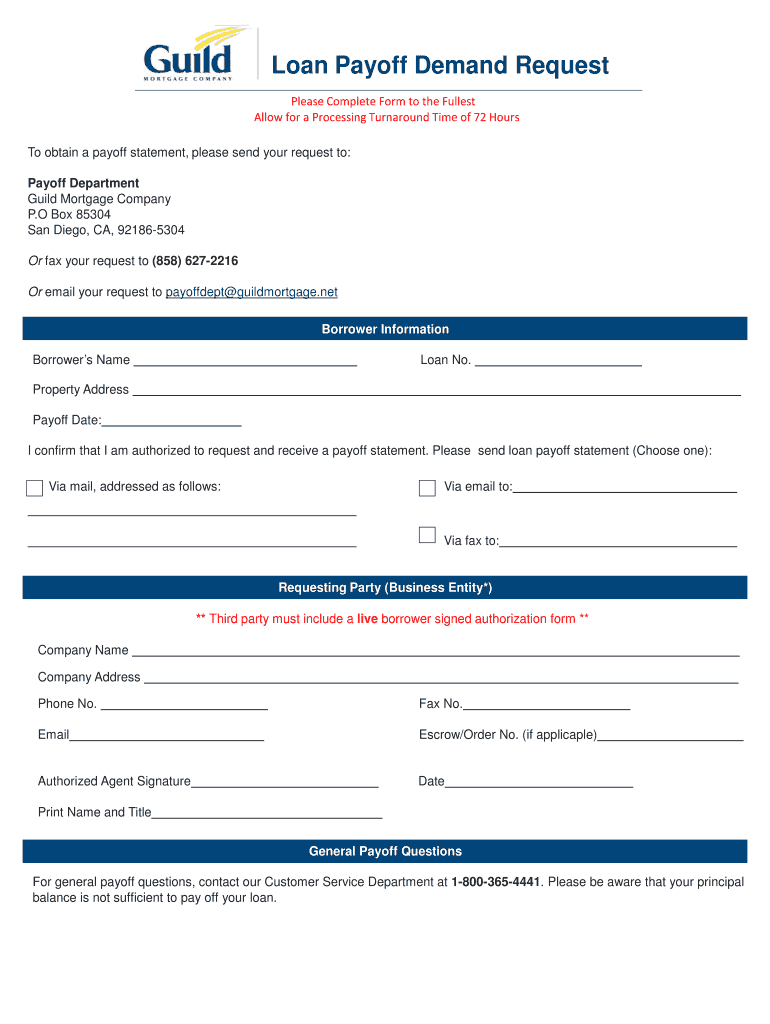

Guild Mortgage Payoff Form Fill Out and Sign Printable PDF Template

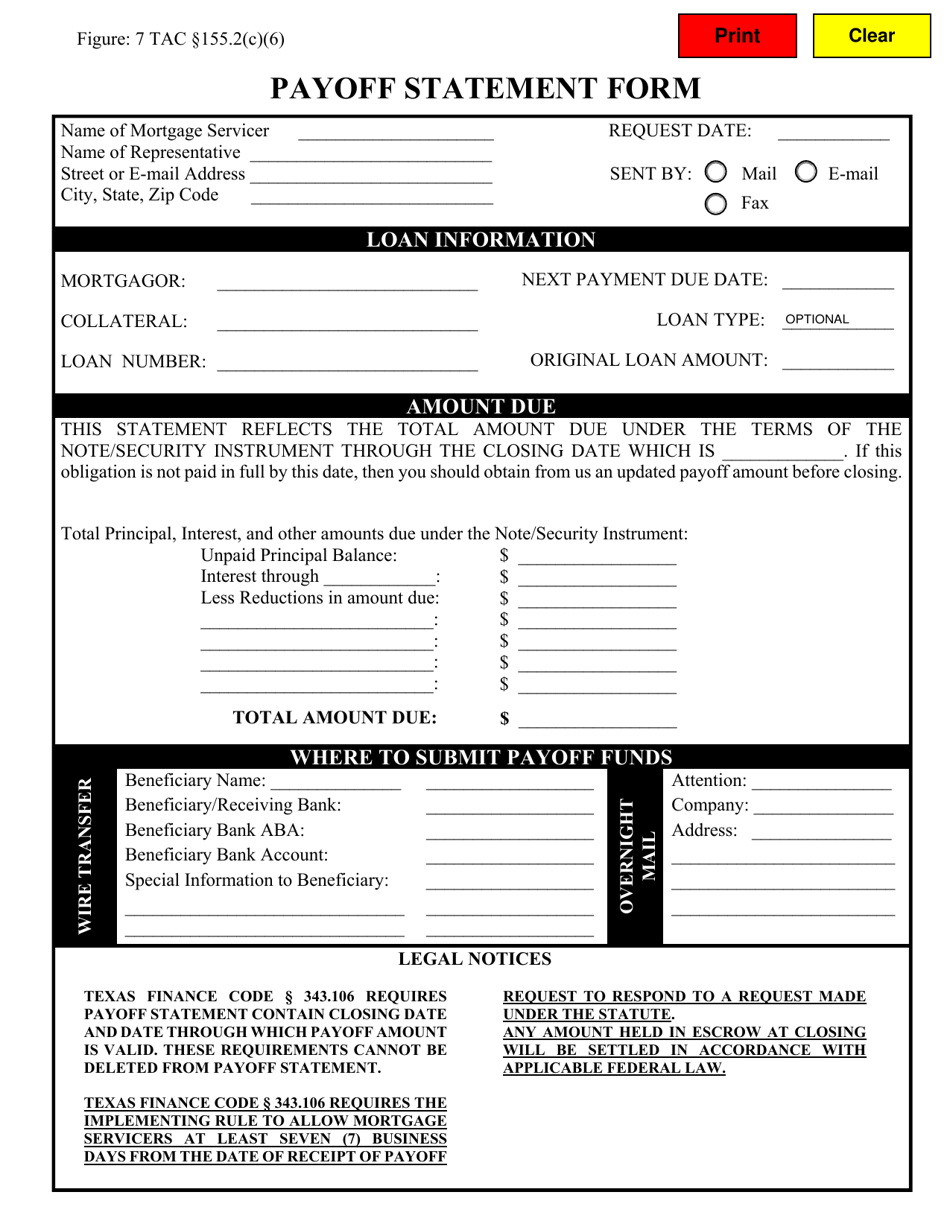

The amendments revised the loan payoff statement form loan servicers are required to use when reporting the payoff figure for a mortgage loan. Login is currently unavailable, please check back again soon. More than 4.4 million borrowers have been repaying their loans for at least 20 years, and 2.3 million of these borrowers have never defaulted or been. This q&a.

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

Last four digits of ssn: Web a payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off your mortgage loan. Change the template with smart fillable fields. The payoff amount isn’t just your outstanding balance; Engaged parties names, places of residence and numbers.

Payoff Verification Form US Auto Supplies US AUTO SUPPLIES

If you have the funds to pay off an installment loan early, request a payoff letter from your lender. Do not submit sba loan payments using other sba forms on pay.gov. (must be a business day) reason for payoff (must select one): Web “for someone with $5,000 in credit card debt on a card with a 22.16% [rate] and a.

Payoff form Form, Form name, Payoff

It tells you the amount due, where to send the money, how to. A group of congressional democrats has introduced legislation to eliminate interest rates on all current federal student loans—and. Web a payoff statement for a mortgage, sometimes referred to as a payoff letter, is a document that details the exact amount of money needed to fully pay off.

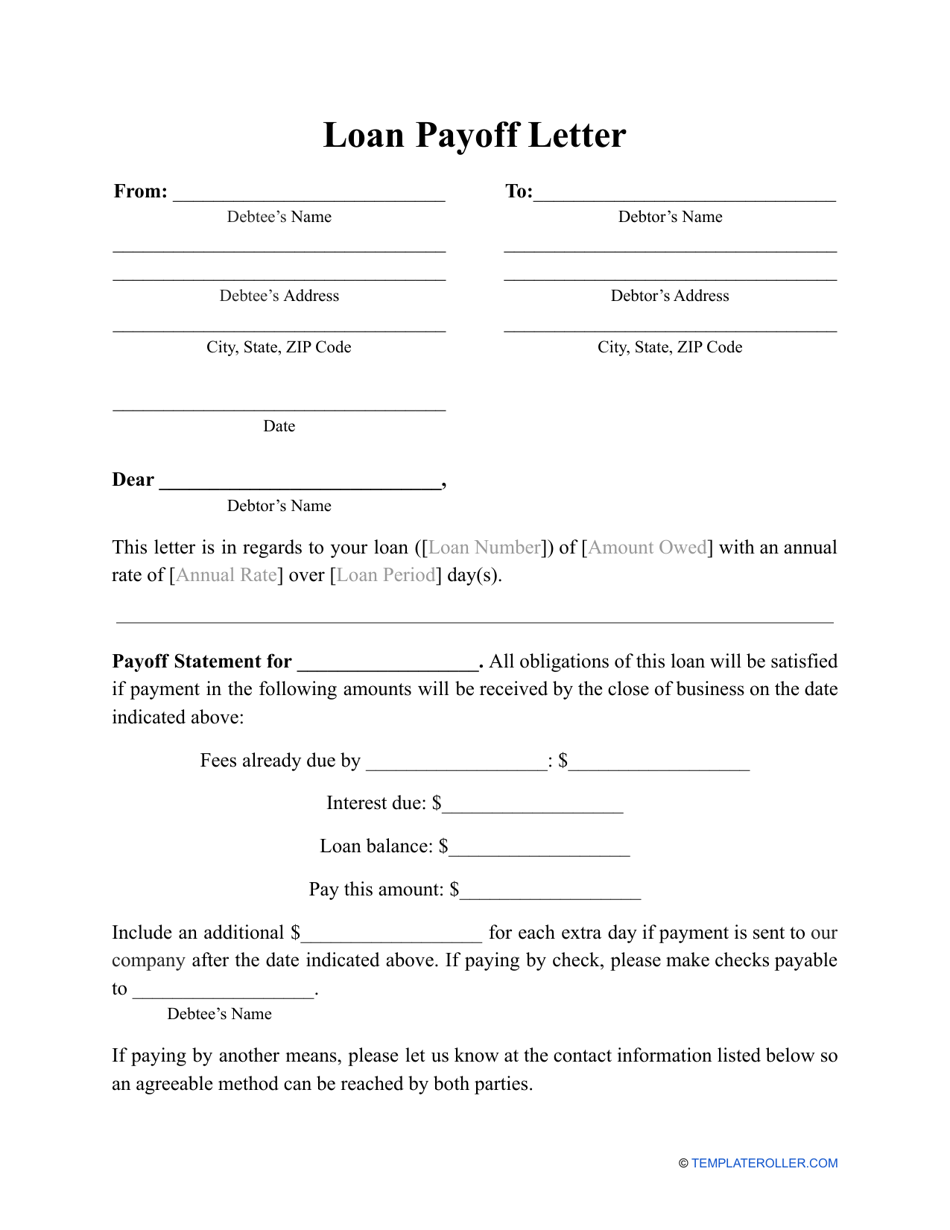

Loan Payoff Letter Template Download Printable PDF Templateroller

Web mail your payment. The payoff statement shows the remaining loan balance and number of payments and the. The signature wizard will help you add your. Web “for someone with $5,000 in credit card debt on a card with a 22.16% [rate] and a $250 monthly payment, they will pay $1,298 in total interest and take 26 months to pay.

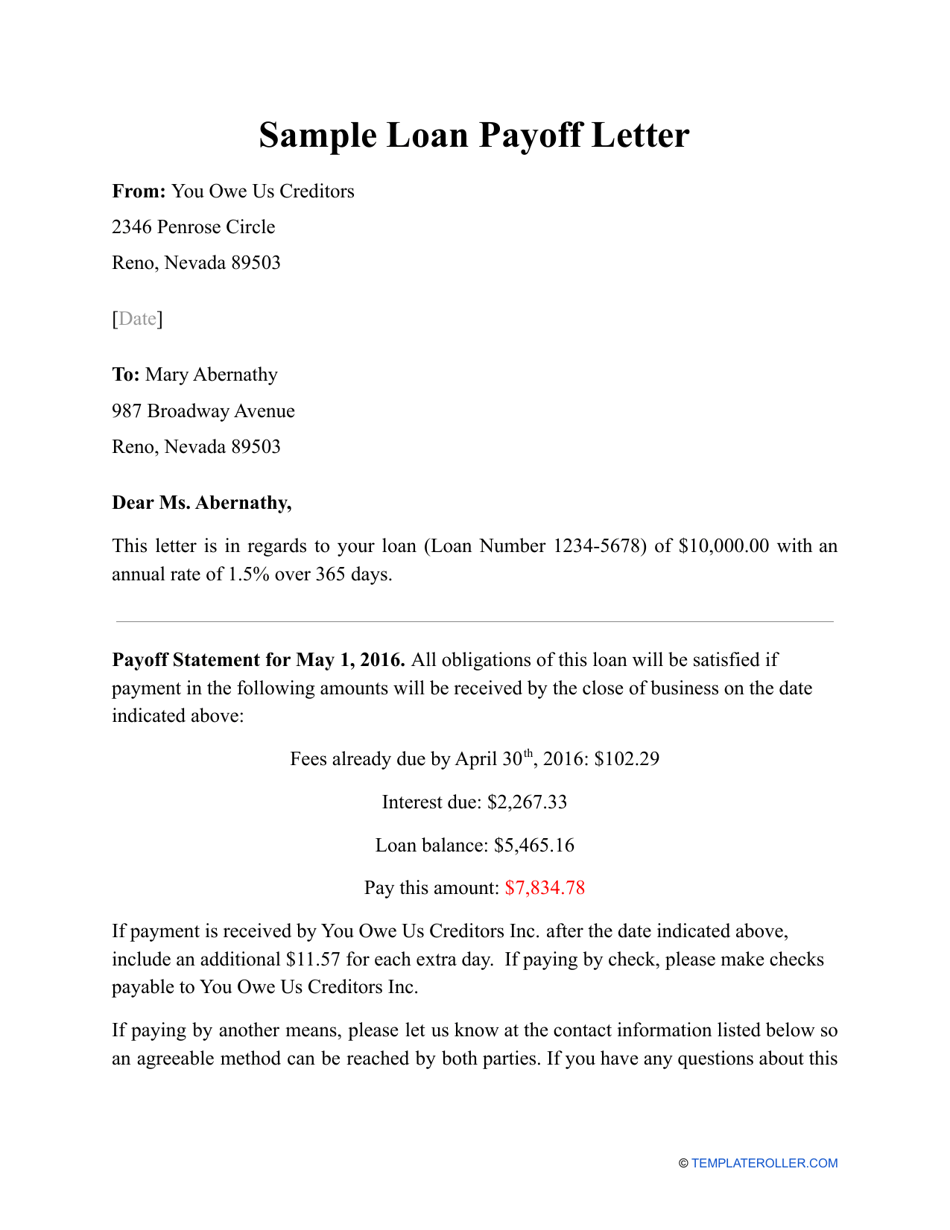

Sample Loan Payoff Letter Download Printable PDF Templateroller

Web updated february 20, 2023 a promissory note release is given to a borrower after the final payment on a loan to release them of all further liabilities and obligations. I further authorize associated bank to close this account to any future advances if it is a Engaged parties names, places of residence and numbers etc. Web the following tips.

Vehicle Payoff Letter Template Fill Online, Printable, Fillable

The revised form requires the loan servicer to state the loan. Web a loan payoff request letter is a letter written by a consumer asking for the amount required to pay the balance of a loan off by a certain date. Web the current balance on your monthly loan statement is not the same as the payoff amount, which is.

Mortgage Payoff Letter Template Examples Letter Template Collection

Web the following tips will allow you to fill out loan payoff form easily and quickly: Web a payoff letter is a document that provides detailed instructions on how to pay off a loan. Web the average rate on new car loans in june was 7.2 percent, up slightly from the start of the year, according to edmunds.com. Web payoff.

Texas Payoff Statement Form Download Fillable PDF Templateroller

The payoff amount isn’t just your outstanding balance; The signature wizard will help you add your. It tells you the amount due, where to send the money, how to. Web the plan's supporters say it won't push costs onto taxpayers. Web loan payoff form 1.

If You Have The Funds To Pay Off An Installment Loan Early, Request A Payoff Letter From Your Lender.

I further authorize associated bank to close this account to any future advances if it is a Web retirement and benefit services provided by merrill. They’re often used in refinancing, consolidation loans, debts in collections, and other situations wherein a lender wants to know how much must be paid. A statement prepared by a lender showing the remaining terms on a mortgage or other loan.

Interest May Accrue On A Loan Every Day Between The Statement Date And The.

Department of education (ed) and federal student aid (fsa) propose to exercise their discretion as a result of and in response to the lawfully and duly declared covid. It tells you the amount due, where to send the money, how to. Web a payoff statement or a mortgage payoff letter that is prepared by the lender for the borrower mentioning the amount that the borrower has to pay back to close the loan. Best loans with fast funding.

The Amendments Revised The Loan Payoff Statement Form Loan Servicers Are Required To Use When Reporting The Payoff Figure For A Mortgage Loan.

Web the 1201 borrower payment form is being phased out and borrowers should utilize the mysba loan portal to make payments. Web to create a sample loan payoff letter that will lay out all of the details necessary for a borrower to complete in order to pay off a loan in full, you will want to include the following information: Web get the auto loan payoff form you want. Web on august 21, 2020, the finance commission adopted amendments to 7 tac §155.2, concerning payoff statements forms.

Change The Template With Smart Fillable Fields.

The payoff amount will almost always be higher than your statement balance because of interest. Any loan payments submitted using other sba forms on pay.gov will be rejected. This q&a contains general statements of policy under the administrative procedure act issued to advise the public prospectively of the manner in which the u.s. Web payoff statements are statements prepared by lenders or creditors identifying an exact amount necessary for full payment of a loan, a mortgage, student loan debt, or other debt.