Landlord W9 Form 2022

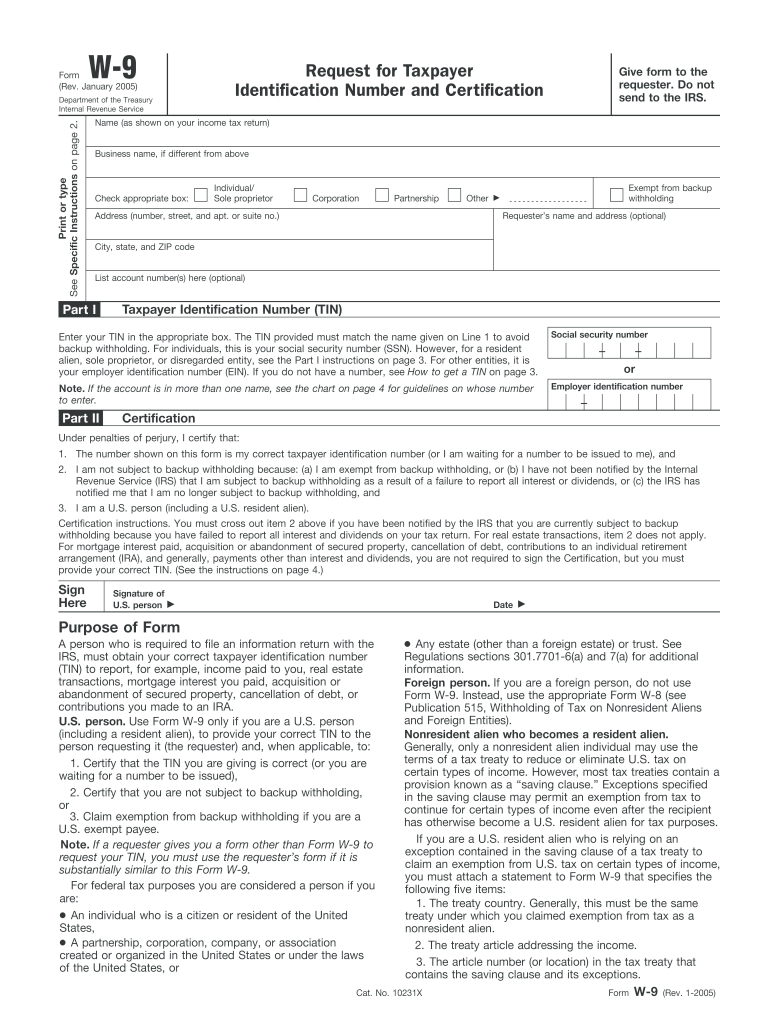

Landlord W9 Form 2022 - The w9 form is a legal document used for tax purposes. Web landlord w9 form 2022. If you are a u.s. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Download is available until [expire_date] version download 119; Complete, edit or print tax forms instantly. Get ready for this year's tax season quickly and safely with pdffiller! Person (including a resident alien) and to request certain certifications and claims for exemption. If you are running a sole proprietorship you would enter your name. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin.

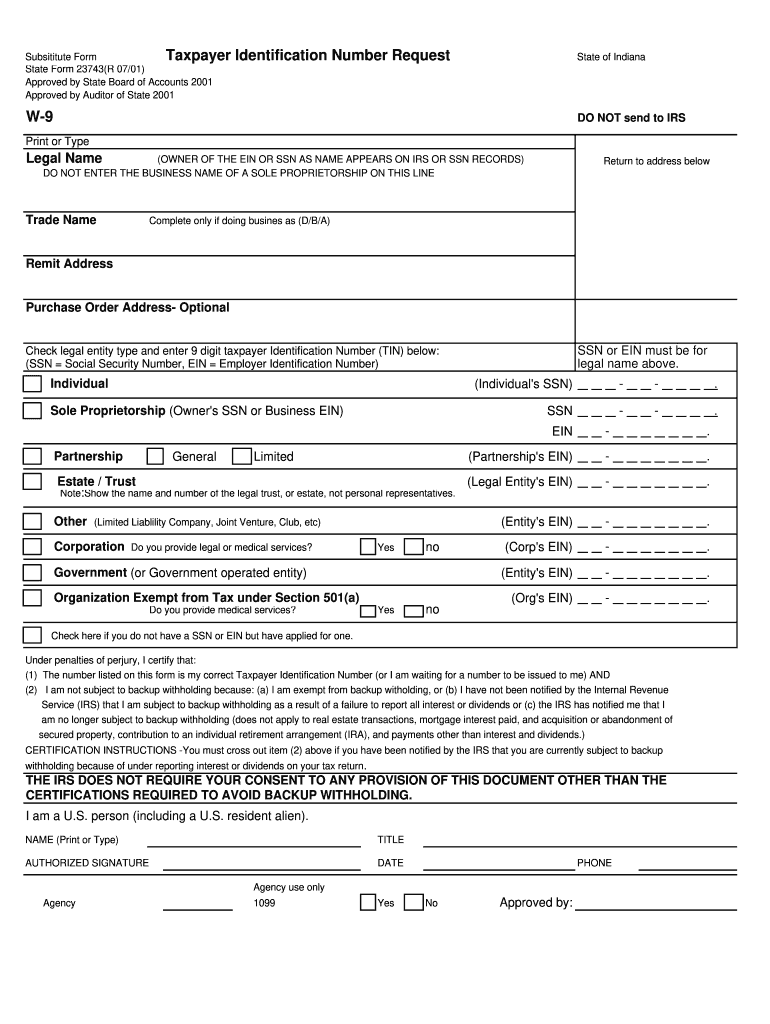

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. The instructions for filling out the form differ depending on the taxpayer’s. Get ready for this year's tax season quickly and safely with pdffiller! The w9 form is a legal document used for tax purposes. Web landlord w9 form. Web the w9 form is very easy and simple to fill in. If you are running a sole proprietorship you would enter your name. Individual property owner = social security number corporation, partnership, or llc property owner = employer identification number property. January 13, 2022 [featured_image] download. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin.

January 13, 2022 [featured_image] download. Get everything done in minutes. Download is available until [expire_date] version download 119; The w9 form is a legal document used for tax purposes. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin. Tax identification number(tin) federal tax classification and/ or any. If you are a u.s. Web the w9 form is very easy and simple to fill in. Web landlord w9 form. Web w9 form fillable online application.

Free Fillable W9 Form W9 Invoice Template Attending W11 pertaining to

If you are a u.s. If you are running a sole proprietorship you would enter your name. Get everything done in minutes. To utilize in verifying their social security or tax identification number to other entities. Download is available until [expire_date] version download 119;

Blank W9 Form 20202022 Fill and Sign Printable Template Online US

Web landlord w9 form 2022. Tax identification number(tin) federal tax classification and/ or any. Get ready for this year's tax season quickly and safely with pdffiller! January 13, 2022 [featured_image] download. Web landlord w9 form.

Applicant's AMI and the Landlord and W9 Forms eLogic Genesis

Complete, edit or print tax forms instantly. Tax identification number(tin) federal tax classification and/ or any. Download is available until [expire_date] version download 119; The instructions for filling out the form differ depending on the taxpayer’s. Web the w9 form is very easy and simple to fill in.

Indiana Taxpayer Id Number Fill Online, Printable, Fillable, Blank

Ad access irs tax forms. Web the w9 form is very easy and simple to fill in. Download is available until [expire_date] version download 119; Web landlord w9 form 2022. Web w9 form fillable online application.

Blank W9 Form Fill Online, Printable, Fillable, Blank within Free W 9

Download is available until [expire_date] version download 119; Ad access irs tax forms. To utilize in verifying their social security or tax identification number to other entities. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin. Web w9 form fillable.

W9

The instructions for filling out the form differ depending on the taxpayer’s. Certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web the primary purpose of the w 9.

Form W 9 Fillable Version Printable Forms Free Online

The w9 form is a legal document used for tax purposes. Web the w9 form is very easy and simple to fill in. Certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. Web the primary purpose of the w 9 form 2022 printable is to provide an employer.

2015 Professional Development Convention

Get ready for this year's tax season quickly and safely with pdffiller! Complete, edit or print tax forms instantly. To utilize in verifying their social security or tax identification number to other entities. Web landlord w9 form. Get everything done in minutes.

Blank W9 Tax Form W9 Form Printable, Fillable 2021 throughout W 9

The w9 form is a legal document used for tax purposes. The instructions for filling out the form differ depending on the taxpayer’s. Tax identification number(tin) federal tax classification and/ or any. Web landlord w9 form 2022. If you are running a sole proprietorship you would enter your name.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

The w9 form is a legal document used for tax purposes. Person (including a resident alien) and to request certain certifications and claims for exemption. Web landlord w9 form. Ad access irs tax forms. January 13, 2022 [featured_image] download.

Web The W9 Form Is Very Easy And Simple To Fill In.

If you are a u.s. January 13, 2022 [featured_image] download. Download is available until [expire_date] version download 119; Get everything done in minutes.

Person (Including A Resident Alien) And To Request Certain Certifications And Claims For Exemption.

Web landlord w9 form. Web w9 form fillable online application. Tax identification number(tin) federal tax classification and/ or any. Complete, edit or print tax forms instantly.

Individual Property Owner = Social Security Number Corporation, Partnership, Or Llc Property Owner = Employer Identification Number Property.

If you are running a sole proprietorship you would enter your name. Web landlord w9 form 2022. To utilize in verifying their social security or tax identification number to other entities. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.

Get Ready For This Year's Tax Season Quickly And Safely With Pdffiller!

The instructions for filling out the form differ depending on the taxpayer’s. Web the primary purpose of the w 9 form 2022 printable is to provide an employer with such crucial information about the individual contractor as name, address, and tin. The w9 form is a legal document used for tax purposes. Certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct.