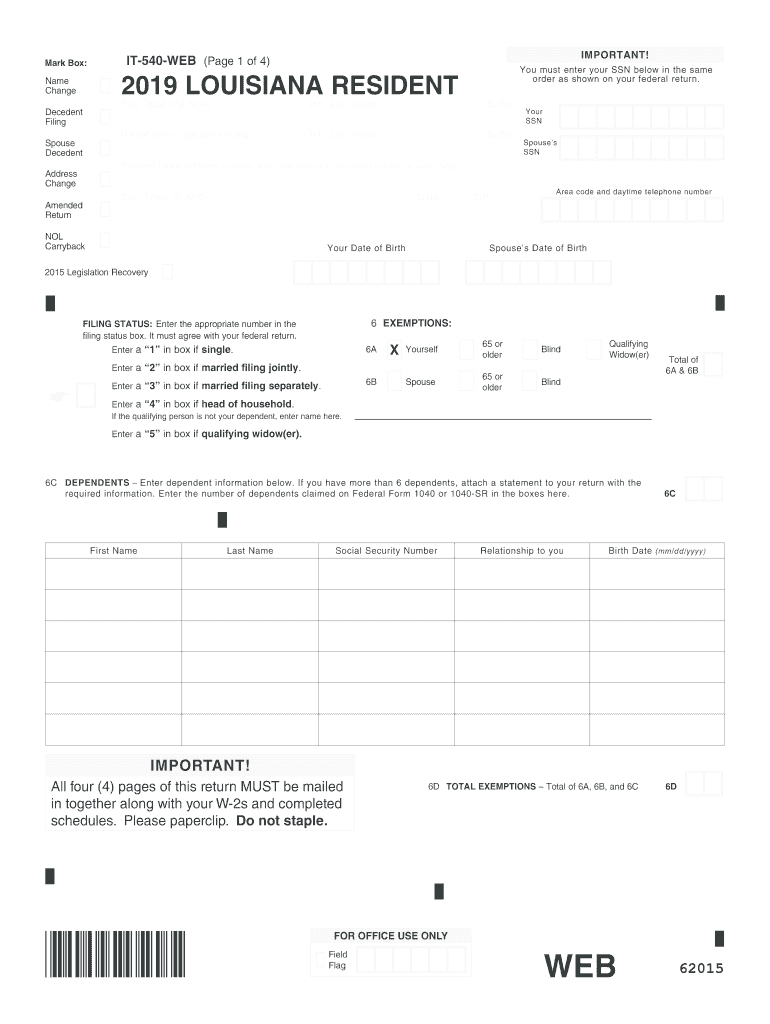

La Tax Form It 540

La Tax Form It 540 - If you are married and both you and your spouse are residents of the state of louisiana, you should file a resident return. Web complete your federal income tax return form 1040, u.s. A 00 b first bracket: Web 2022 california resident income tax return 540 check here if this is an amended return. Web form 1040a, line 30, or federal form 1040, line 47. Complete, edit or print tax forms instantly. Web tax computation worksheet (keep this worksheet for your records.) a taxable income: 6c first name last name social security number relationship to you. Web enter the total number from federal form 1040a, line 6c, or federal form 1040, line 6c, in the boxes here. Enter the appropriate number in the ling.

Web 2022 california resident income tax return 540 check here if this is an amended return. Web louisiana resident income tax booklet check your refund status at revenue.louisiana.gov/refund or by calling 1.888.829.3071 or 225.922.3270, available 24. Enter month of year end: Web enter the total number from federal form 1040a, line 6c, or federal form 1040, line 6c, in the boxes here. Please use the link below. Complete, edit or print tax forms instantly. Tax return for seniors, before you begin your form 540, california. If you are married and both you and your spouse are residents of the state of louisiana, you should file a resident return. Web report error it appears you don't have a pdf plugin for this browser. 6c first name last name social security number relationship to you.

Web form 1040a, line 30, or federal form 1040, line 47. Web report error it appears you don't have a pdf plugin for this browser. Complete, edit or print tax forms instantly. Please use the link below. A 00 b first bracket: Web enter the total number from federal form 1040a, line 6c, or federal form 1040, line 6c, in the boxes here. Tax return for seniors, before you begin your form 540, california. Web tax computation worksheet (keep this worksheet for your records.) a taxable income: Web 2022 california resident income tax return 540 check here if this is an amended return. 6c first name last name social security number relationship to you.

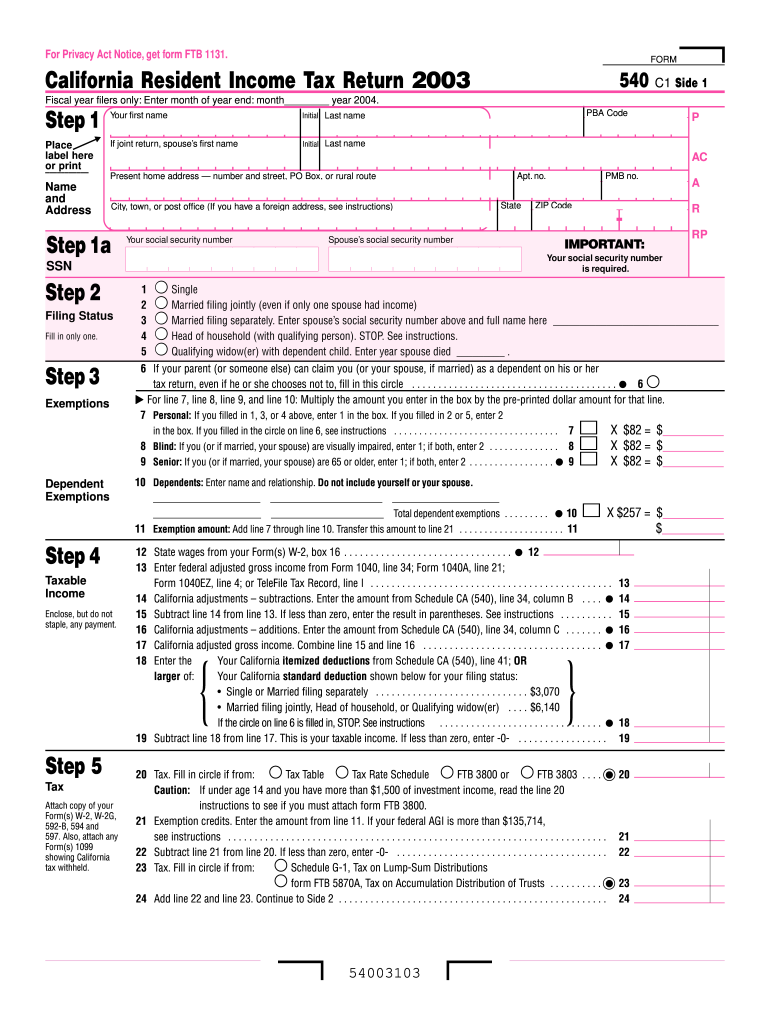

CA FTB 540 2003 Fill out Tax Template Online US Legal Forms

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Complete, edit or print tax forms instantly. Tax return for seniors, before you begin your form 540, california. Web 2022 california resident income tax return 540 check here.

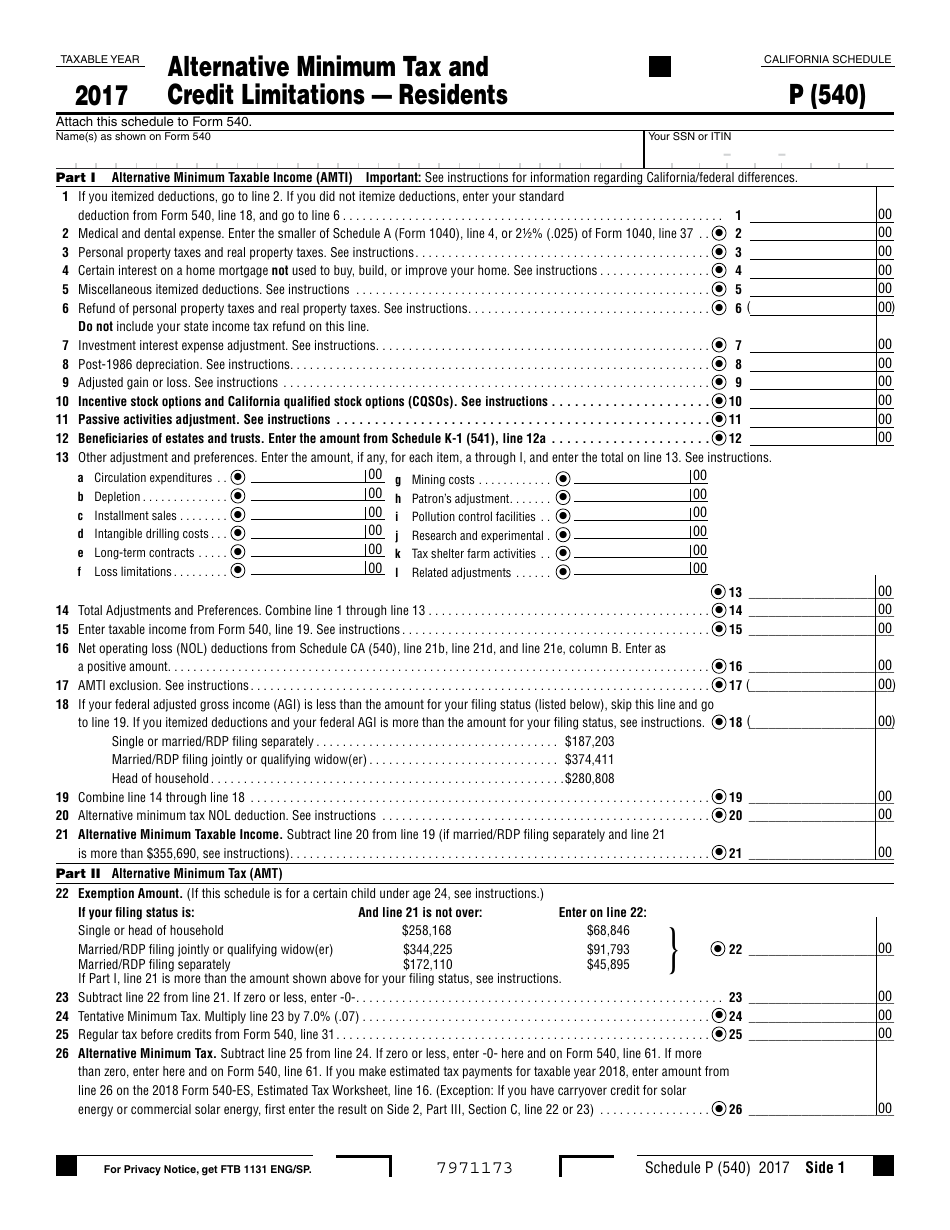

Form 540 Schedule P Download Fillable PDF or Fill Online Alternative

Enter the appropriate number in the ling. Get ready for tax season deadlines by completing any required tax forms today. Enter month of year end: Web form 1040a, line 30, or federal form 1040, line 47. Web enter the total number from federal form 1040a, line 6c, or federal form 1040, line 6c, in the boxes here.

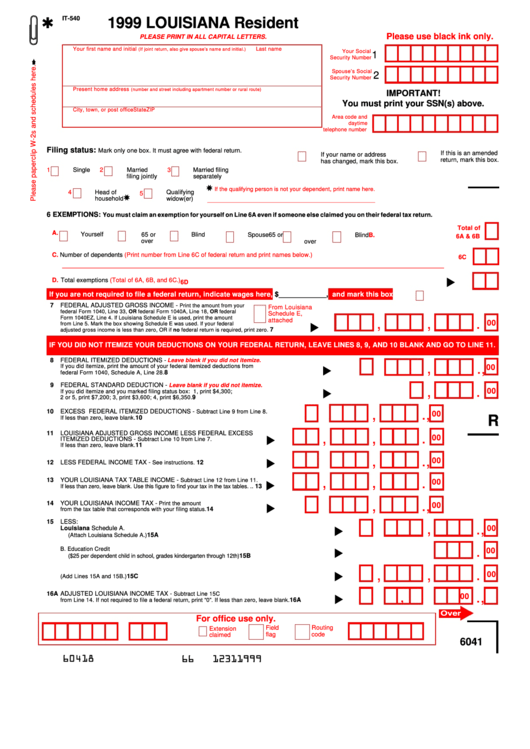

Form It540 1999 Louisiana Resident printable pdf download

Please use the link below. Web form 1040a, line 30, or federal form 1040, line 47. Web complete your federal income tax return form 1040, u.s. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Complete, edit.

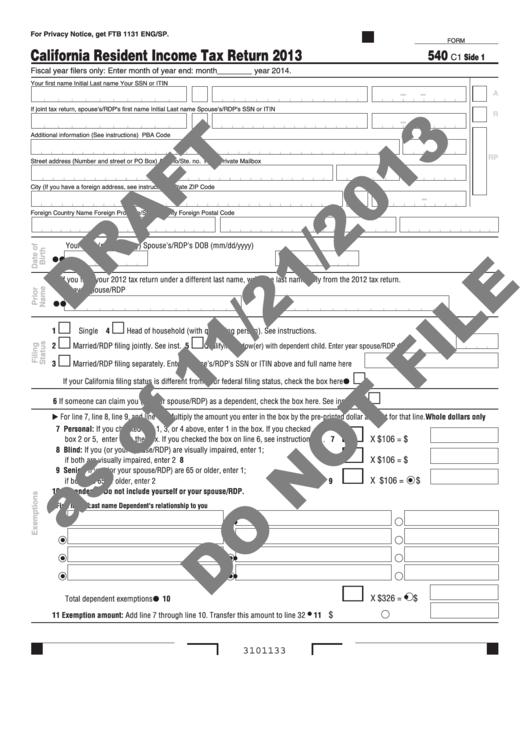

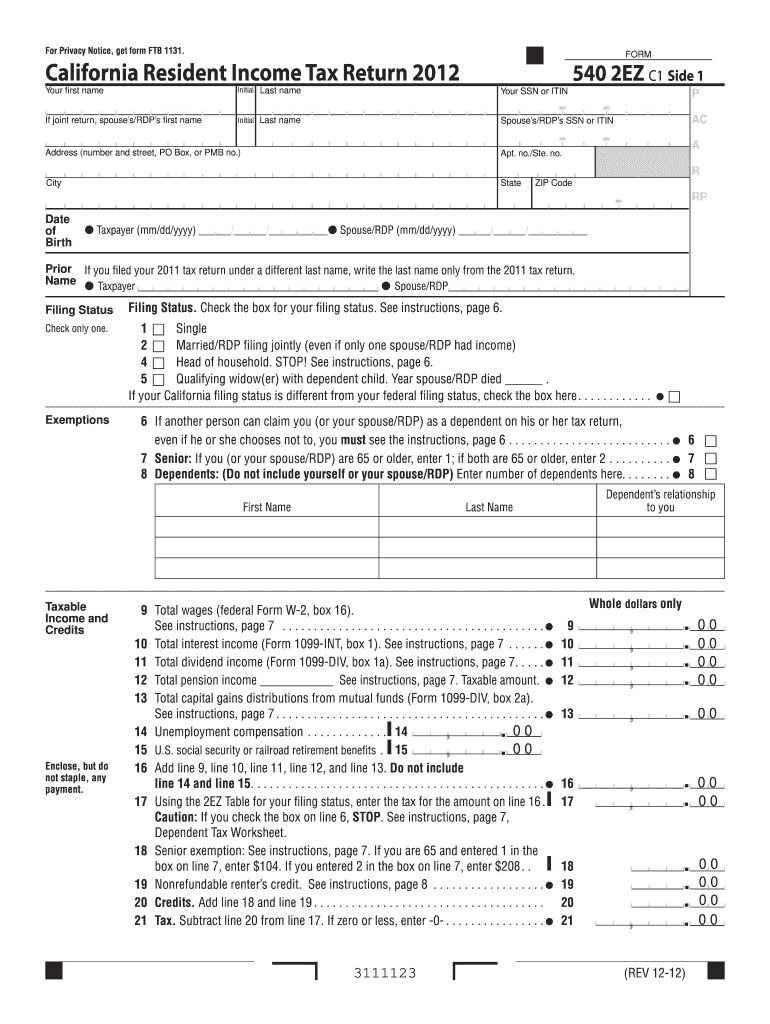

Form 540 C1 Draft California Resident Tax Return 2013

If line a is greater. Tax return for seniors, before you begin your form 540, california. If you are married and both you and your spouse are residents of the state of louisiana, you should file a resident return. Enter the appropriate number in the ling. Please use the link below.

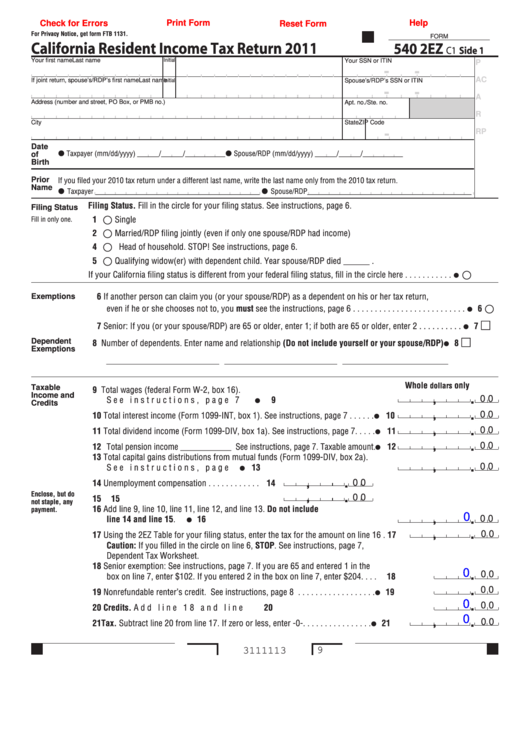

Fillable Form 540 2ez California Resident Tax Return 2011

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. A 00 b first bracket: Web 2022 california resident income tax return 540 check here if this is an amended return. Please use the link below. Web tax.

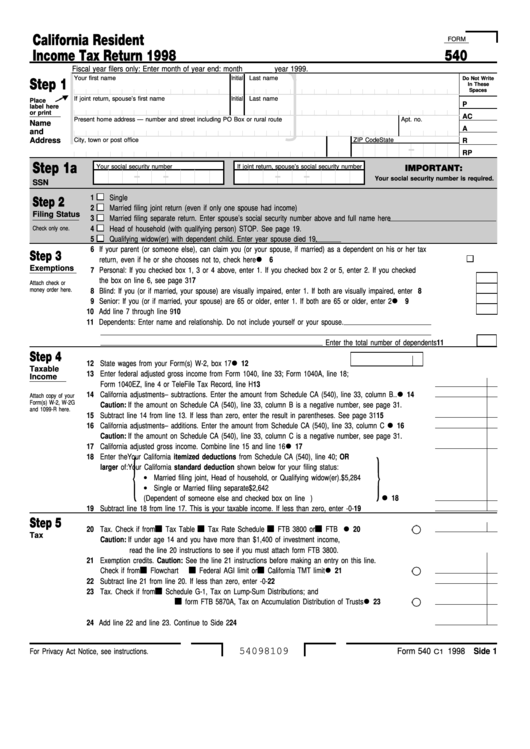

Form 540 California Resident Tax Return 1998 printable pdf

Enter the appropriate number in the ling. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web form 1040a, line 30, or federal form 1040, line 47. A 00 b first bracket: Web louisiana resident income tax.

2019 Form LA IT540 Fill Online, Printable, Fillable, Blank pdfFiller

Web complete your federal income tax return form 1040, u.s. Please use the link below. If you are married and both you and your spouse are residents of the state of louisiana, you should file a resident return. If line a is greater. 6c first name last name social security number relationship to you.

540ez 2010 Tax Table

If line a is greater. Web form 1040a, line 30, or federal form 1040, line 47. Web complete your federal income tax return form 1040, u.s. Please use the link below. 6c first name last name social security number relationship to you.

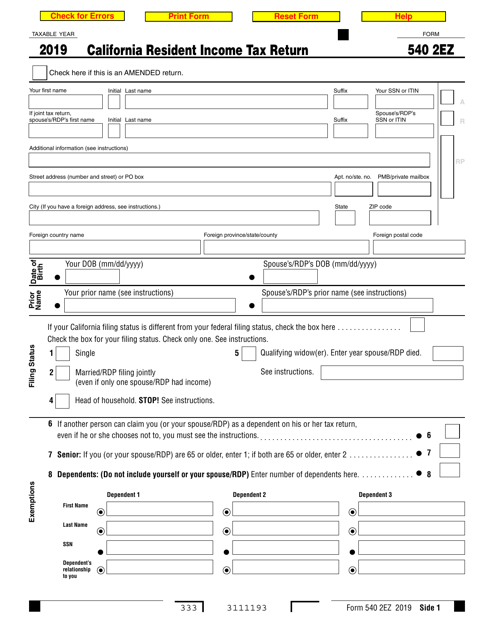

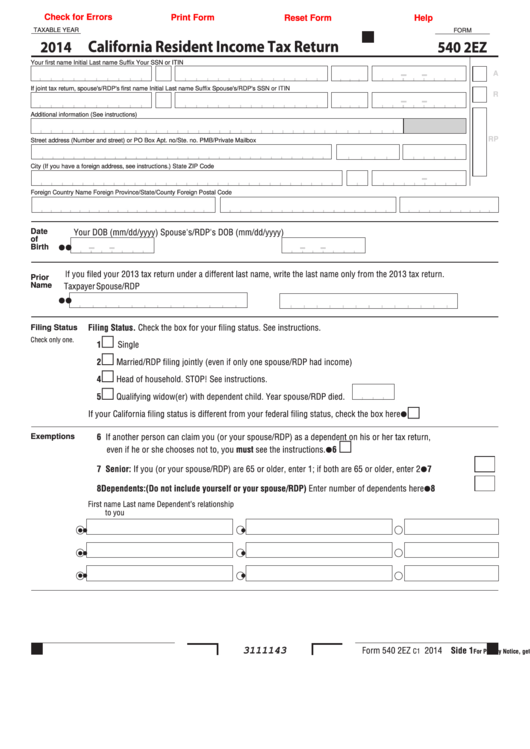

Fillable Form 540 2ez California Resident Tax Return 2014

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. If you are married and both you and your spouse are residents of the state of louisiana, you should file a resident return. Web complete your federal income.

Form 540 Fill Out and Sign Printable PDF Template signNow

6c first name last name social security number relationship to you. Web tax computation worksheet (keep this worksheet for your records.) a taxable income: If line a is greater. Enter the appropriate number in the ling. Get ready for tax season deadlines by completing any required tax forms today.

Web Complete Your Federal Income Tax Return Form 1040, U.s.

Get ready for tax season deadlines by completing any required tax forms today. Enter month of year end: Web form 1040a, line 30, or federal form 1040, line 47. Please use the link below.

Complete, Edit Or Print Tax Forms Instantly.

A 00 b first bracket: Enter the appropriate number in the ling. Web louisiana resident income tax booklet check your refund status at revenue.louisiana.gov/refund or by calling 1.888.829.3071 or 225.922.3270, available 24. Web 2022 california resident income tax return 540 check here if this is an amended return.

Web Tax Computation Worksheet (Keep This Worksheet For Your Records.) A Taxable Income:

6c first name last name social security number relationship to you. Web enter the total number from federal form 1040a, line 6c, or federal form 1040, line 6c, in the boxes here. Tax return for seniors, before you begin your form 540, california. If line a is greater.

If You Are Married And Both You And Your Spouse Are Residents Of The State Of Louisiana, You Should File A Resident Return.

Web report error it appears you don't have a pdf plugin for this browser. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.