Ky Tax Form 740

Ky Tax Form 740 - Web kentucky kentucky itemized deductions schedule a (740) pdf form content report error it appears you don't have a pdf plugin for this browser. Refund checks are available through ky file; We last updated the form 740 individual full year. Web this form may be used by both individuals and corporations requesting an income tax refund. Web 740 2020 commonwealth of kentucky department of revenue form check if applicable: 27 28 add lines 26 and 27. This form is for income earned in tax year 2022, with tax returns due in april. Form 740 is the kentucky income tax. Web form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate return), your deduction is limited and you must use the. Web previous 1 2 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april.

Web this form may be used by both individuals and corporations requesting an income tax refund. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Amended (enclose copy of 1040x, if applicable.) check if deceased: Web this free booklet contains instructions on how to fill out and file your income tax form 740, for general individual income taxes. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. However, direct deposit is not available. Web users can file the current year tax return, as well as tax years 2020 and 2019.

Web form 740 is the kentucky income tax return for use by all taxpayers. Sign it in a few clicks draw your signature, type it,. 27 28 add lines 26 and 27. This form is for income earned in tax year 2022, with tax returns due in april. Web users can file the current year tax return, as well as tax years 2020 and 2019. Complete, edit or print tax forms instantly. Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. Web form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate return), your deduction is limited and you must use the. Get ready for tax season deadlines by completing any required tax forms today. Form 740 is the kentucky income tax.

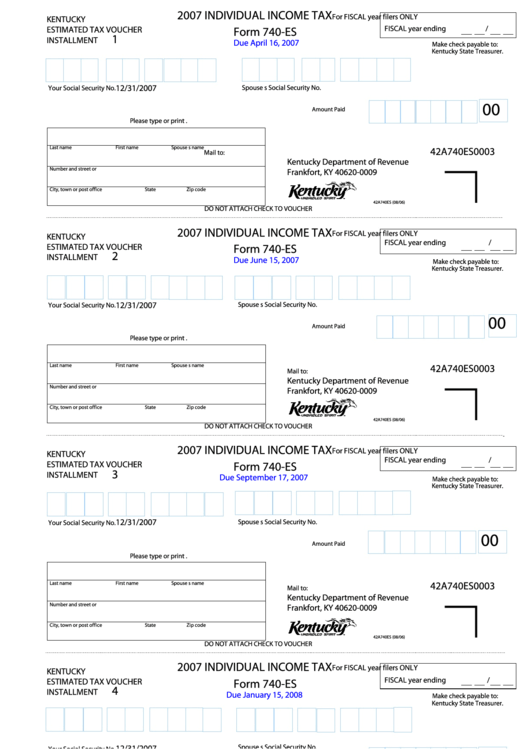

Fillable Form 740Es Individual Tax 2007 printable pdf download

Sign it in a few clicks draw your signature, type it,. Ky file users should familiarize themselves with kentucky. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

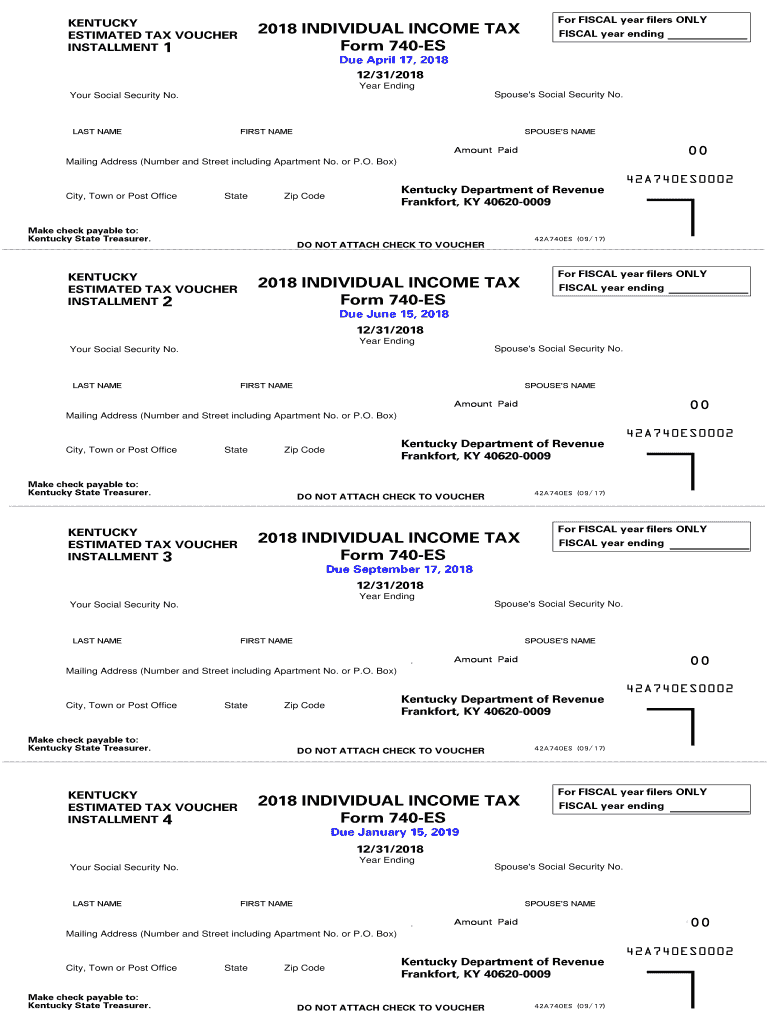

KY DoR 740ES 2019 Fill out Tax Template Online US Legal Forms

Web users can file the current year tax return, as well as tax years 2020 and 2019. Web kentucky kentucky itemized deductions schedule a (740) pdf form content report error it appears you don't have a pdf plugin for this browser. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Refund checks are available through.

Form 740 X Amended Kentucky Individual Tax Return YouTube

Refund checks are available through ky file; Sign it in a few clicks draw your signature, type it,. Web previous 1 2 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april. Edit your form 740 online type text, add images,.

2013 Form KY DoR 740NPWHES Fill Online, Printable, Fillable, Blank

Amended (enclose copy of 1040x, if applicable.) check if deceased: However, direct deposit is not available. This form is for income earned in tax year 2022, with tax returns due in april. Web form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate return), your deduction is limited and you must use.

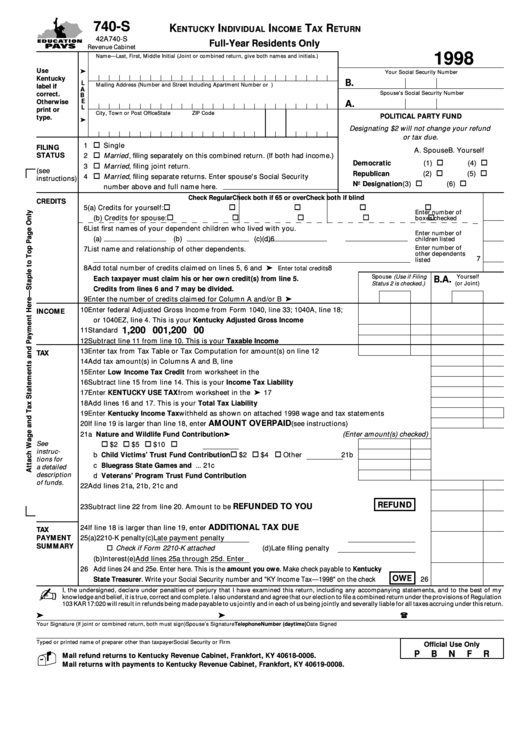

Fillable Form 740S Kentucky Individual Tax Return FullYear

27 28 add lines 26 and 27. Amended (enclose copy of 1040x, if applicable.) check if deceased: Web form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate return), your deduction is limited and you must use the. Ky file users should familiarize themselves with kentucky. Refund checks are available through ky.

KY DoR 740ES 2018 Fill out Tax Template Online US Legal Forms

However, direct deposit is not available. Web kentucky kentucky itemized deductions schedule a (740) pdf form content report error it appears you don't have a pdf plugin for this browser. Ky file users should familiarize themselves with kentucky. Web users can file the current year tax return, as well as tax years 2020 and 2019. Edit your form 740 online.

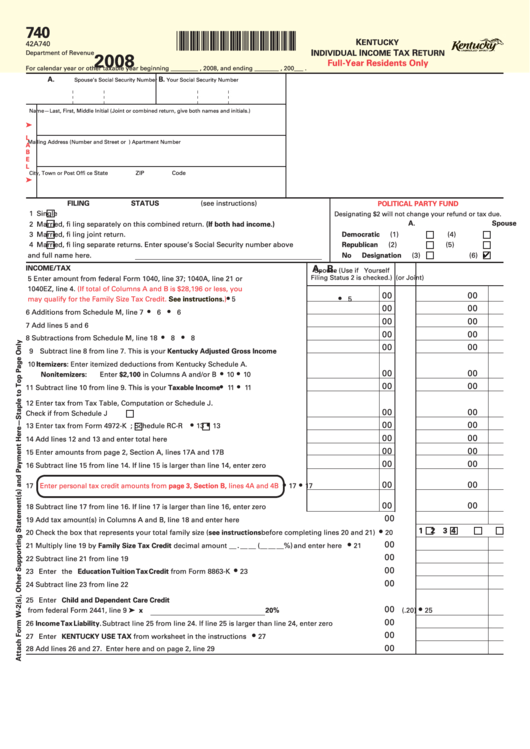

Fillable Form 740 Kentucky Individual Tax Return FullYear

Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type it,. However, direct deposit is not available. Ky file users should familiarize themselves with kentucky. Web form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or.

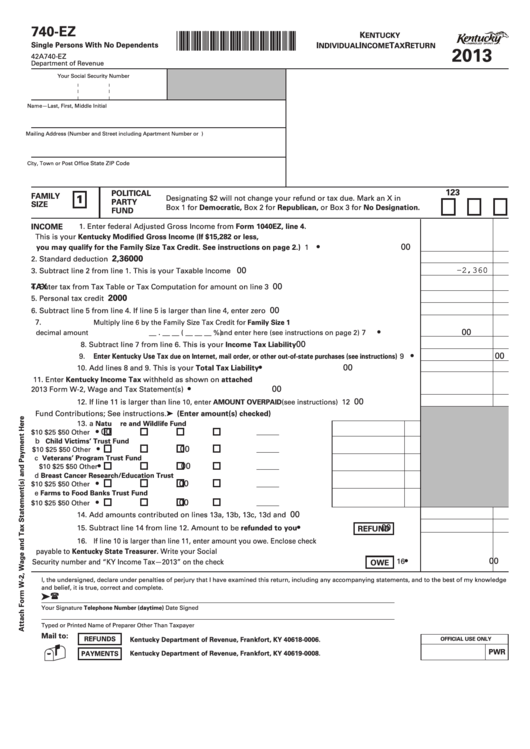

Fillable Form 740Ez Kentucky Individual Tax Return 2013

Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Form 740 is the kentucky income tax. Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year.

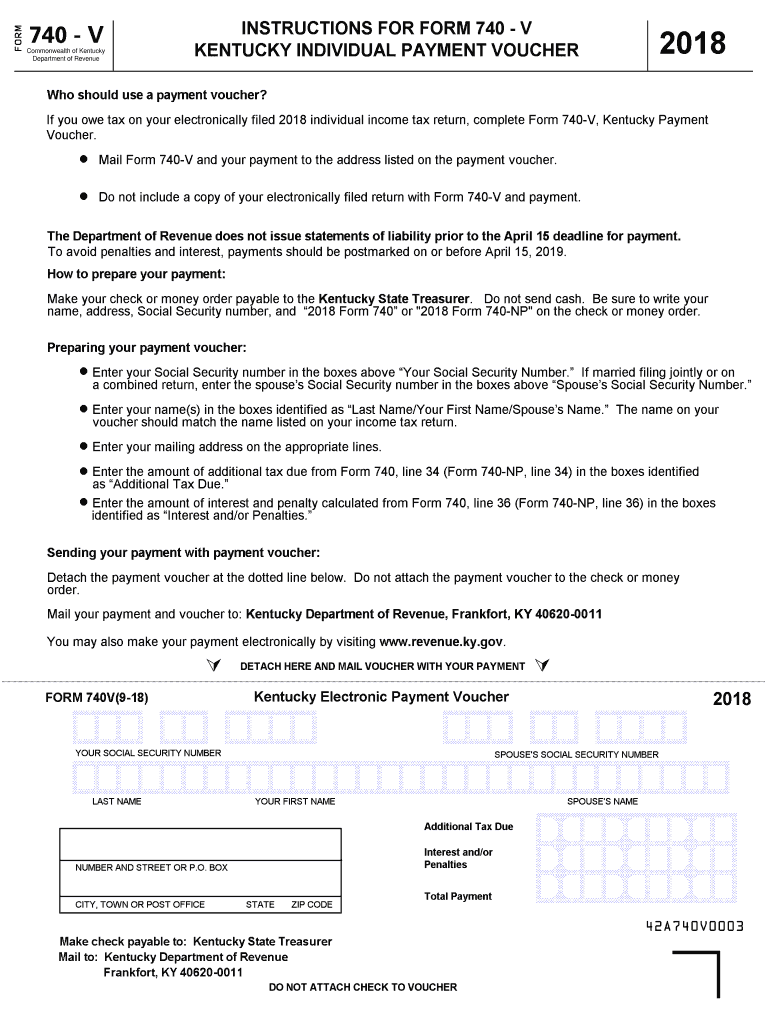

2018 Form KY 740V Fill Online, Printable, Fillable, Blank pdfFiller

Web 740 2020 commonwealth of kentucky department of revenue form check if applicable: Web this form may be used by both individuals and corporations requesting an income tax refund. Web users can file the current year tax return, as well as tax years 2020 and 2019. Complete, edit or print tax forms instantly. We last updated the form 740 individual.

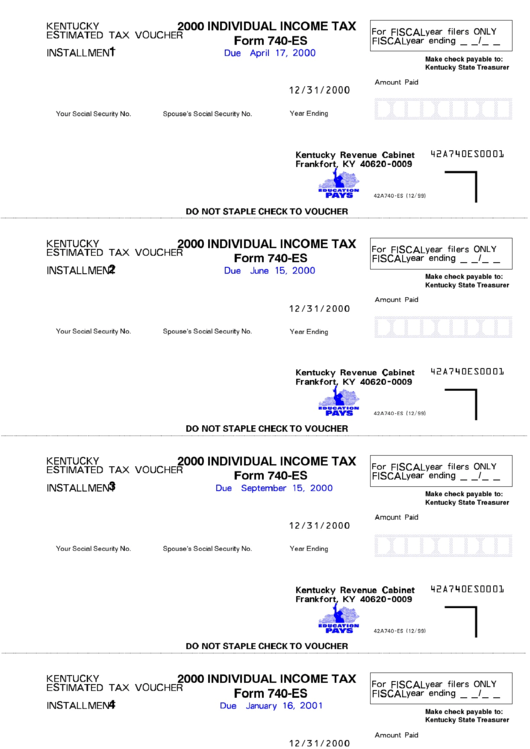

Form 740Es Individual Tax 2000 printable pdf download

Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. Complete, edit or print tax forms instantly. Web this form may be used by both individuals and corporations requesting an income tax refund. Sign it in a few clicks draw your signature, type it,. We last updated the form 740 individual full year.

27 28 Add Lines 26 And 27.

Amended (enclose copy of 1040x, if applicable.) check if deceased: However, direct deposit is not available. Web 740 2020 commonwealth of kentucky department of revenue form check if applicable: This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one.

Web Kentucky Kentucky Itemized Deductions Schedule A (740) Pdf Form Content Report Error It Appears You Don't Have A Pdf Plugin For This Browser.

Sign it in a few clicks draw your signature, type it,. Web users can file the current year tax return, as well as tax years 2020 and 2019. Please use the link below. Refund checks are available through ky file;

Web This Form May Be Used By Both Individuals And Corporations Requesting An Income Tax Refund.

Web previous 1 2 next you may also want to visit the federal income tax forms page to print any irs forms you need for filing your federal income tax return in april. Web form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate return), your deduction is limited and you must use the. Web form 740 is the kentucky income tax return for use by all taxpayers. Form 740 is the kentucky income tax.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Ky file users should familiarize themselves with kentucky. We last updated the form 740 individual full year. Complete, edit or print tax forms instantly. Web this free booklet contains instructions on how to fill out and file your income tax form 740, for general individual income taxes.