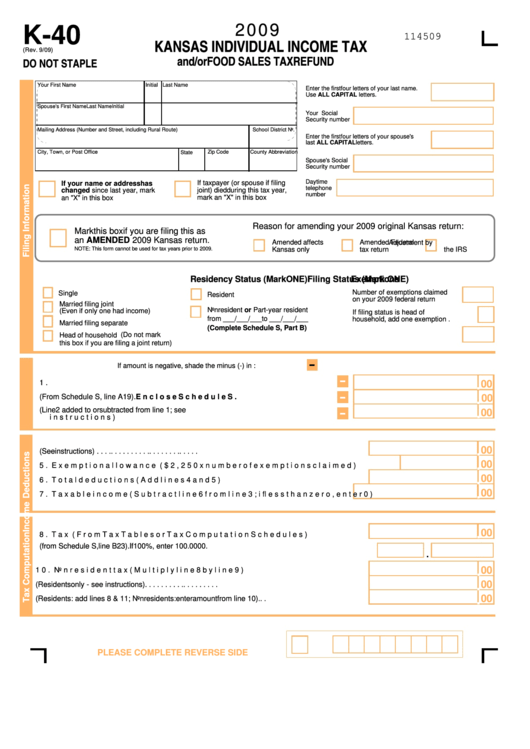

K 40 Tax Form

K 40 Tax Form - Enter the requested information for all persons claimed as dependents. This form is for income earned in tax. Instead, it will be returned to you. Web to qualify you must have been a resident of kansas the entire year of 2017 and own your home. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. You can download or print current or. Do not include you or your spouse. Name (please print) date of birth (mmddyy ) relationship social security number food. However, you must file a kansas individual income tax return to receive any refund of taxes withheld,. If you are a surviving spouse requesting a.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. With a request to submit your information on the proper form. 719) do not staple 2019 kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. Enclose separate schedule if necessary. Web to qualify you must have been a resident of kansas the entire year of 2017 and own your home. Web fill online, printable, fillable, blank form 2021: This form is for income earned in tax. However, you must file a kansas individual income tax return to receive any refund of taxes withheld,. This form is for income earned in tax year 2022, with tax returns due in april. If you are a surviving spouse requesting a.

Web if you use this form for a tax year other than is intended, it. Enclose separate schedule if necessary. Enter the requested information for all persons claimed as dependents. Do not include you or your spouse. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. This form is for income earned in tax year 2022, with tax returns due in april. If you are a surviving spouse requesting a. 719) do not staple 2019 kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. However, you must file a kansas individual income tax return to receive any refund of taxes withheld,. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it.

Fillable Form K40 Kansas Individual Tax And/or Food Sales Tax

However, you must file a kansas individual income tax return to receive any refund of taxes withheld,. Web fill online, printable, fillable, blank form 2021: Web if you use this form for a tax year other than is intended, it. You can download or print current. If you are a surviving spouse requesting a.

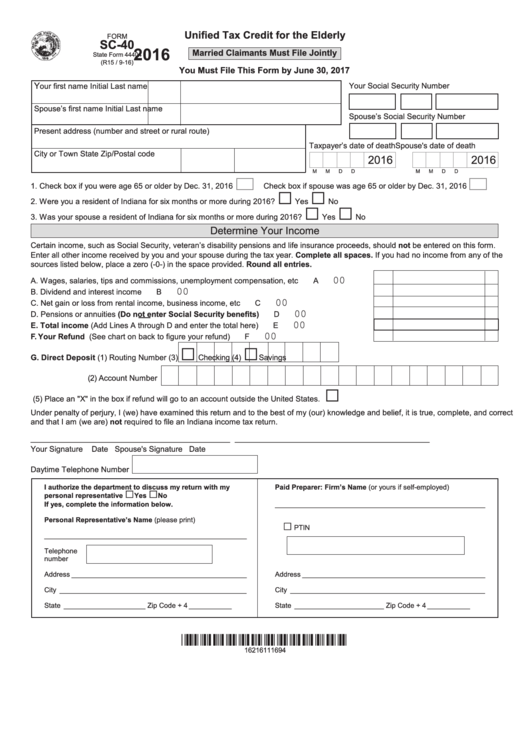

Fillable Form Sc40 Unified Tax Credit For Rhe Elderly 2015

If you are a surviving spouse requesting a. Do not include you or your spouse. We last updated the homestead claim in january 2023,. With a request to submit your information on the proper form. 719) do not staple 2019 kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters.

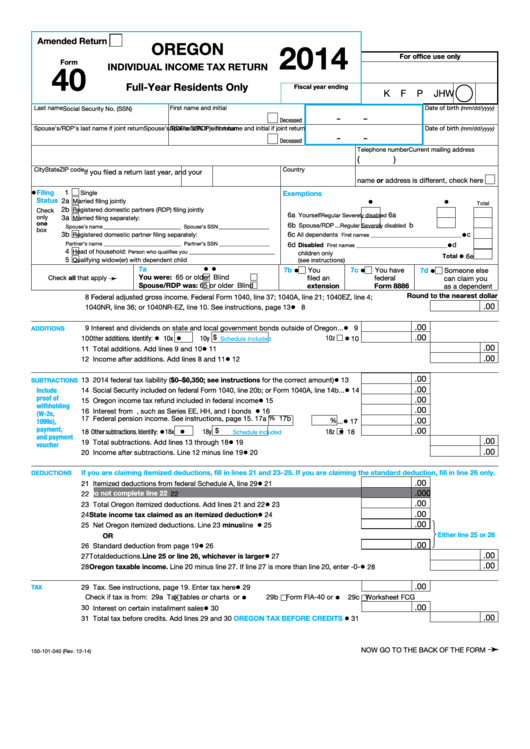

Fillable Form 40 Oregon Individual Tax Return 2014 printable

Web to qualify you must have been a resident of kansas the entire year of 2017 and own your home. You can download or print current or. 719) do not staple 2019 kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. You can download or print current. If you are a surviving.

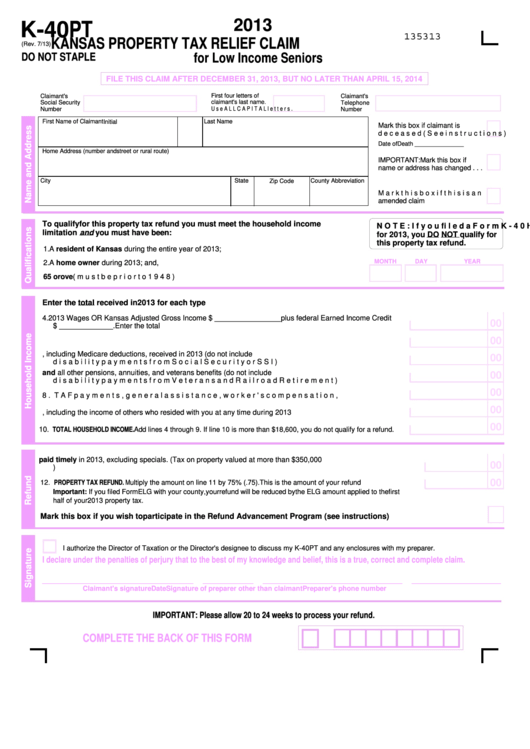

Fillable Form K40pt Kansas Property Tax Relief Claim For Low

Do not include you or your spouse. This form is for income earned in tax. This form is for income earned in tax year 2022, with tax returns due in april. 719) do not staple 2019 kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. We last updated the homestead claim in.

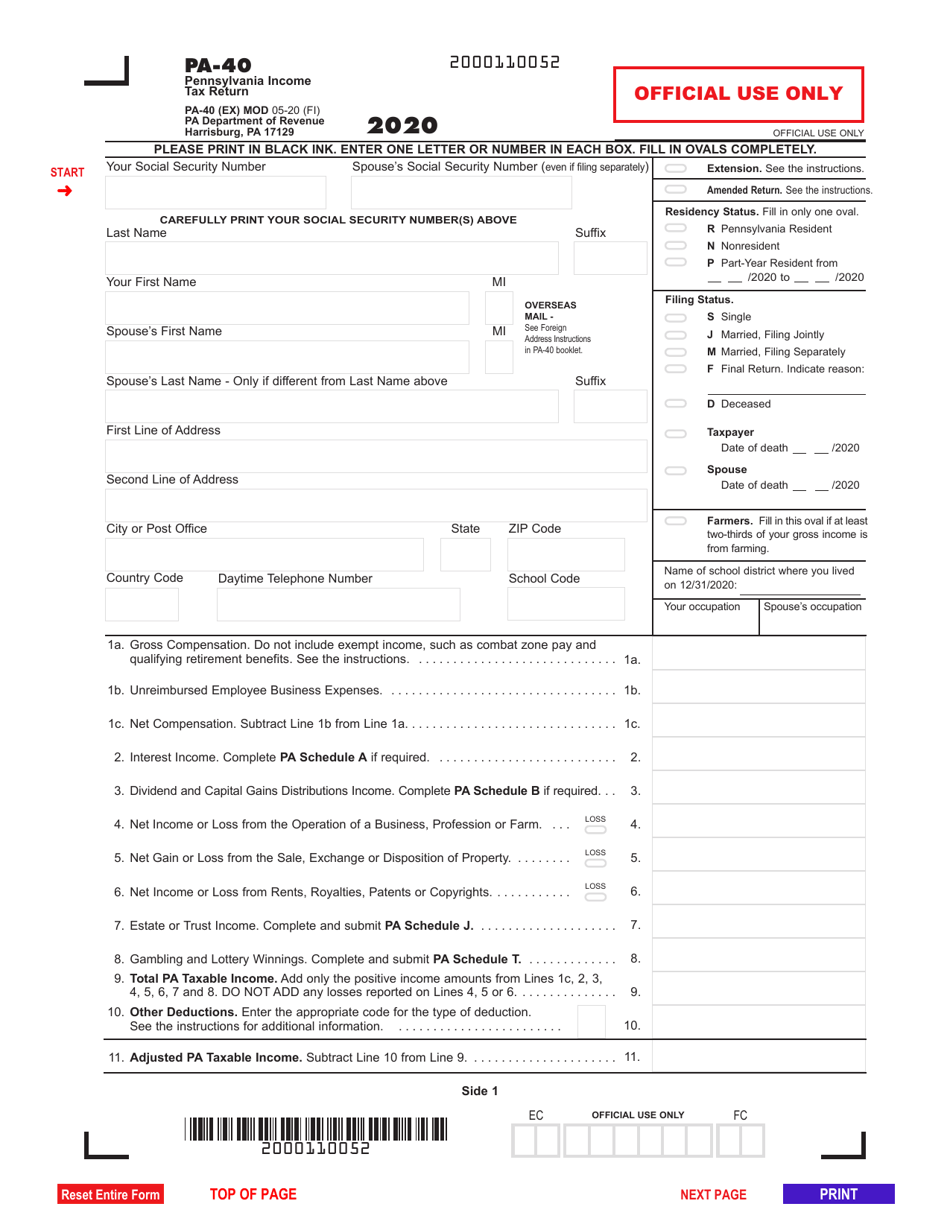

Form PA40 Download Fillable PDF or Fill Online Pennsylvania Tax

We last updated the homestead claim in january 2023,. If you are a surviving spouse requesting a. Enter the requested information for all persons claimed as dependents. Web fill online, printable, fillable, blank form 2021: Web to qualify you must have been a resident of kansas the entire year of 2017 and own your home.

Calculate Completing A 1040 Answer Key / Personal Finance Project

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. If you are a surviving spouse requesting a. Web to qualify you must have been a resident of kansas the entire year of 2017 and own your home. You can prepare a 2022 kansas tax amendment form on efile.com, however you.

2018 Form KS DoR K40 Fill Online, Printable, Fillable, Blank PDFfiller

If you are a surviving spouse requesting a. We last updated the homestead claim in january 2023,. 719) do not staple 2019 kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. Instead, it will be returned to you. You can download or print current or.

Pa Schedule Ue 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Name (please print) date of birth (mmddyy ) relationship social security number food. This form is for income earned in tax year 2022, with tax returns due in april. Web if you use this form for a tax year other than is intended, it. Enter the requested information for all persons claimed as dependents. You can prepare a 2022 kansas.

2021 PA Form PA40 ES (I) Fill Online, Printable, Fillable, Blank

You can download or print current. Web to qualify you must have been a resident of kansas the entire year of 2017 and own your home. With a request to submit your information on the proper form. This form is for income earned in tax. Enclose separate schedule if necessary.

Form K 40 Kansas Individual Tax YouTube

You can download or print current. Web if you use this form for a tax year other than is intended, it. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Name (please print) date of birth (mmddyy ) relationship social security number food. Web to qualify you must have been.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Do not include you or your spouse. 719) do not staple 2019 kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. This form is for income earned in tax. You can download or print current or.

Web To Qualify You Must Have Been A Resident Of Kansas The Entire Year Of 2017 And Own Your Home.

Web fill online, printable, fillable, blank form 2021: Enter the requested information for all persons claimed as dependents. Enclose separate schedule if necessary. You can download or print current.

Name (Please Print) Date Of Birth (Mmddyy ) Relationship Social Security Number Food.

Instead, it will be returned to you. With a request to submit your information on the proper form. You can prepare a 2022 kansas tax amendment form on efile.com, however you can not submit it. However, you must file a kansas individual income tax return to receive any refund of taxes withheld,.

If You Are A Surviving Spouse Requesting A.

We last updated the homestead claim in january 2023,. Web if you use this form for a tax year other than is intended, it. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.