Is Form 3921 Taxable

Is Form 3921 Taxable - Web this is important tax information and is being furnished to the irs. One form needs to be filed for each transfer of stock that. Web a form 3921 is not required for the exercise of an incentive stock option by an employee who is a nonresident alien (as defined in section 7701(b)) and to whom the corporation is. Web irs form 3921 is a tax form used to provide employees with information relating to incentive stock options that were exercised during the year. Web find out about form 3921 and how employee granted iso is taxed by william perez updated on december 24, 2022 reviewed by lea d. Form 3921 is an informational report, similar to 1099s, that lets the irs know that certain. Web form 3921, exercise of an incentive stock option under section 422 (b), is a form provided to a taxpayer when they exercise an incentive stock option (iso). Web a form 3922 is not required for the first transfer of legal title of a share of stock by an employee who is a nonresident alien (as defined in section 7701(b)) and to. Your employer must give you. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso.

Web the amount to include on this line is the total fair market value of the stock when you exercised the option minus any amount you paid to acquire the stock or acquire the. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Form 3921 is an informational report, similar to 1099s, that lets the irs know that certain. Although this information is not taxable unless. Web adjunct products include secure hosting and services for information processing, printing, filing and penalty abatement. Your employer must give you. One form needs to be filed for each transfer of stock that. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). What is 3921 tax form? Internal revenue service center where the.

Web to learn more, see form 6251 instructions at www.irs.gov. Web this is important tax information and is being furnished to the irs. Internal revenue service center where the. Web adjunct products include secure hosting and services for information processing, printing, filing and penalty abatement. Web form 3921 is a form that companies have to file with the irs when an existing or former employee exercises an iso. Web irs form 3921 is a tax form used to provide employees with information relating to incentive stock options that were exercised during the year. Web in drake tax, there is no specific data entry screen for form 3921. Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter amounts. 1099 pro is a microsoft certified partner, mbe certified and. A preparer must determine if an entry is needed based on the facts of the transfer.

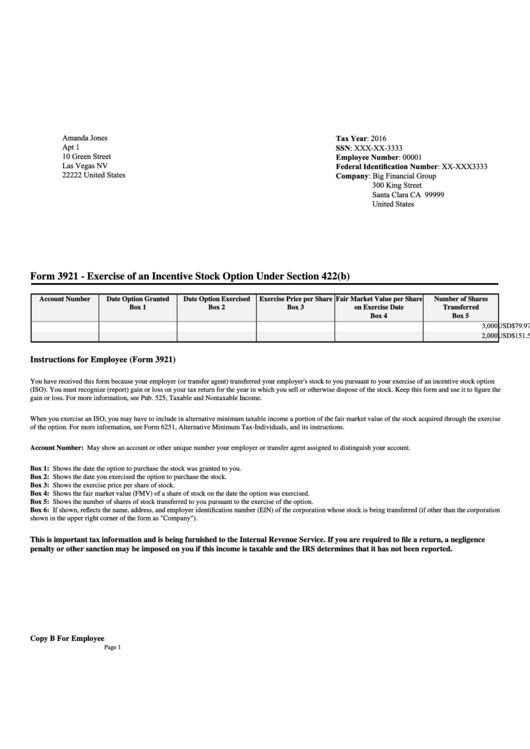

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

Web the amount to include on this line is the total fair market value of the stock when you exercised the option minus any amount you paid to acquire the stock or acquire the. Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. What.

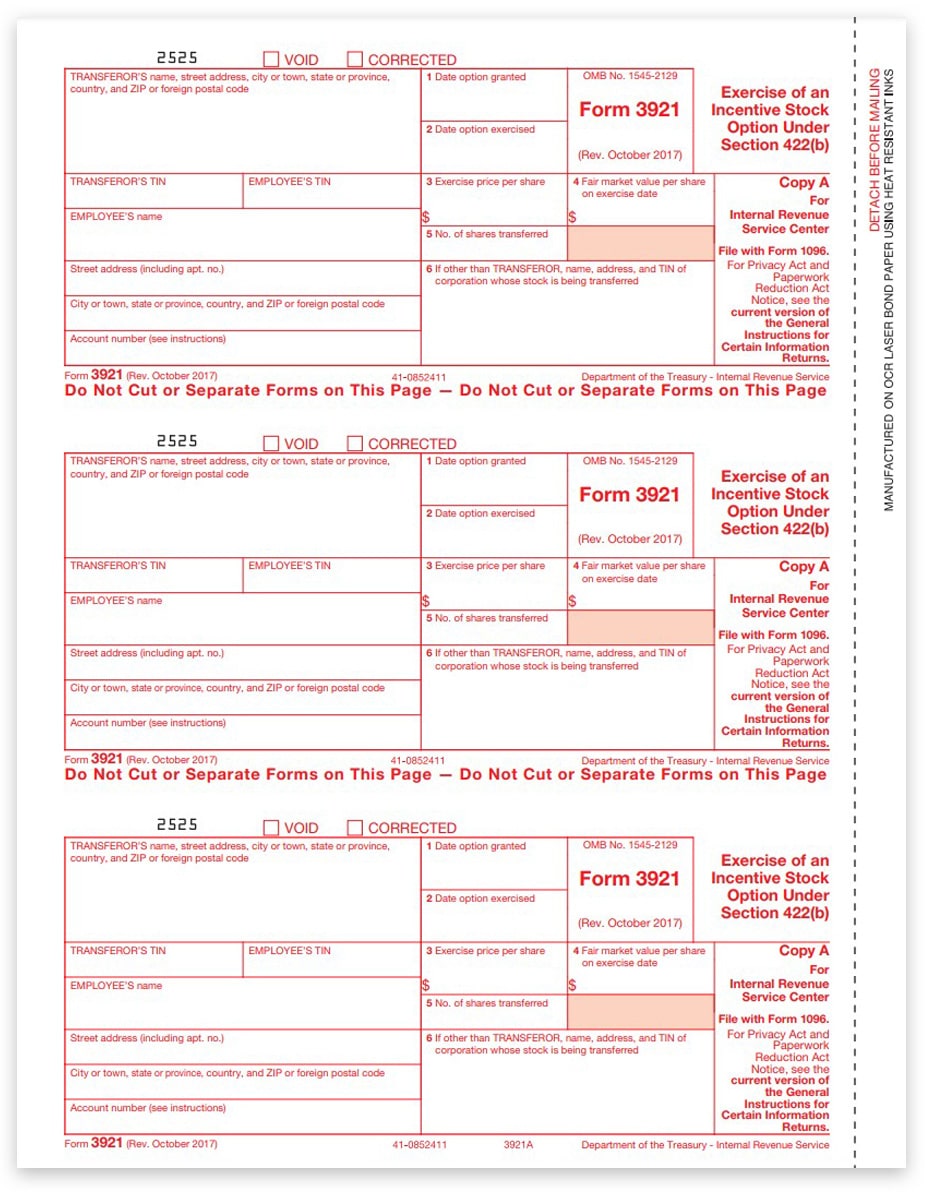

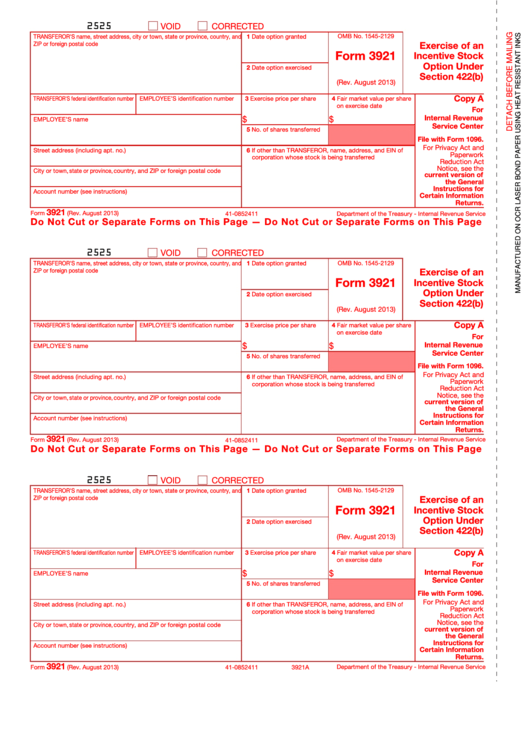

3921 IRS Tax Form Copy A Free Shipping

Irs form 3921 is used to report specific information about stock incentive options that a corporation offers during a calendar year. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Each copy goes to a different recipient: The inflation reduction act.

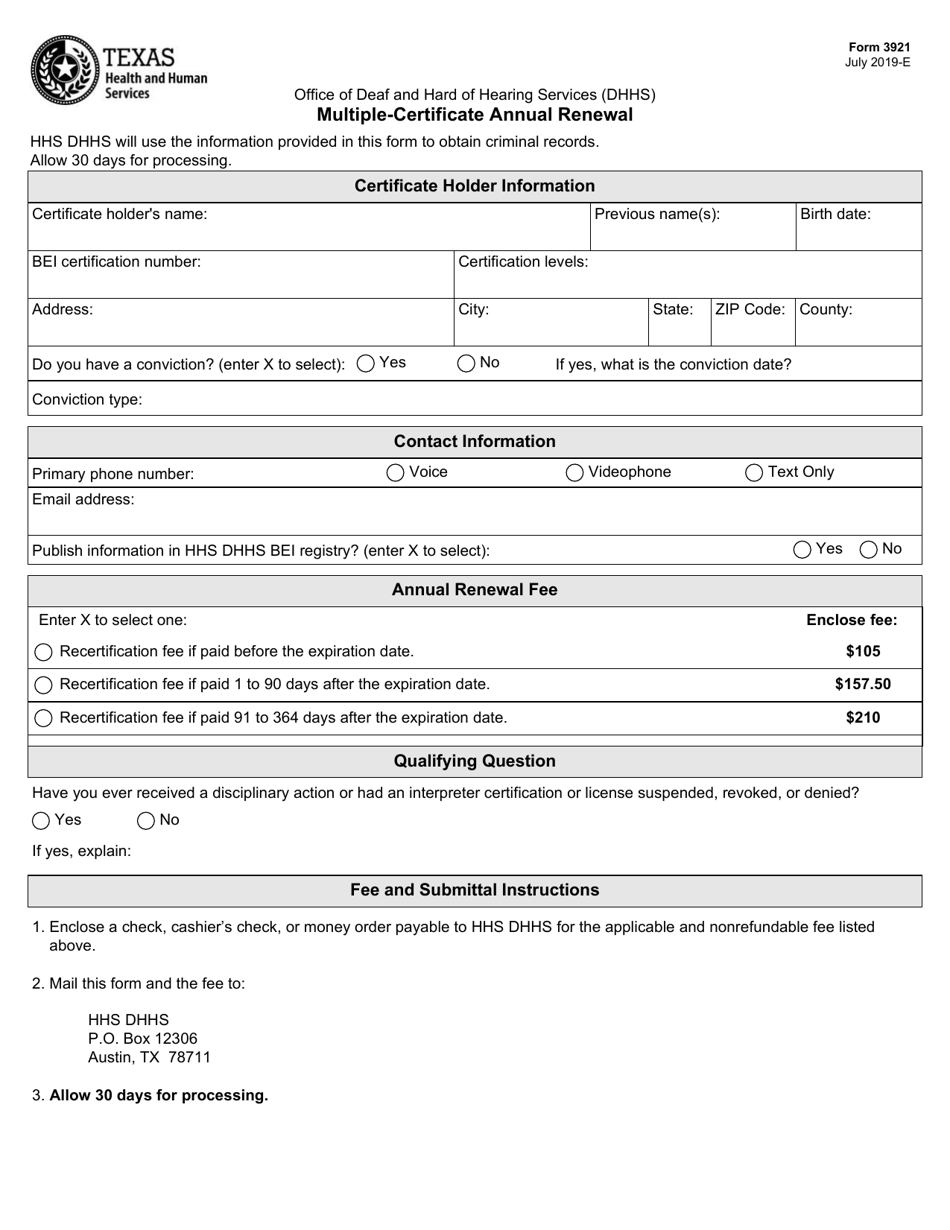

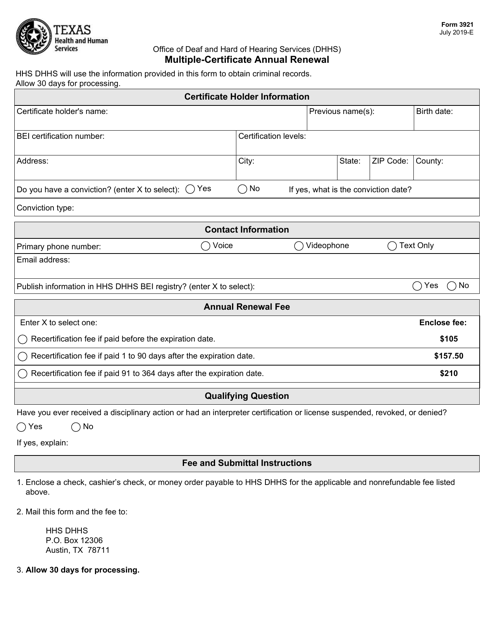

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Web form 3921, exercise of an incentive stock option under section 422 (b), is a form provided to a taxpayer when they exercise an incentive stock option (iso). Web no, the startup will not owe any taxes on the employees exercise of isos and form 3921. Web form 3921 exercise of an incentive stock option under section 422 (b), is.

3921 Tax Forms for Incentive Stock Option, IRS Copy A DiscountTaxForms

Although this information is not taxable unless. It added income limits, price caps and. Web a form 3921 is not required for the exercise of an incentive stock option by an employee who is a nonresident alien (as defined in section 7701(b)) and to whom the corporation is. Irs form 3921 is used to report specific information about stock incentive.

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Web to learn more, see form 6251 instructions at www.irs.gov. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Web form 3921 exercise of an incentive.

3921, Tax Reporting Instructions & Filing Requirements for Form 3921

Web to learn more, see form 6251 instructions at www.irs.gov. Web no, the startup will not owe any taxes on the employees exercise of isos and form 3921. One form needs to be filed for each transfer of stock that. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. If.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422(B

Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. To help figure any amt on the.

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Your employer must give you. Web form 3921, exercise of an incentive stock option under section 422 (b), is a form provided to a taxpayer when they exercise an incentive stock option (iso). Web to learn more, see form 6251 instructions at www.irs.gov. Web this is important tax information and is being furnished to the irs. 1099 pro is a.

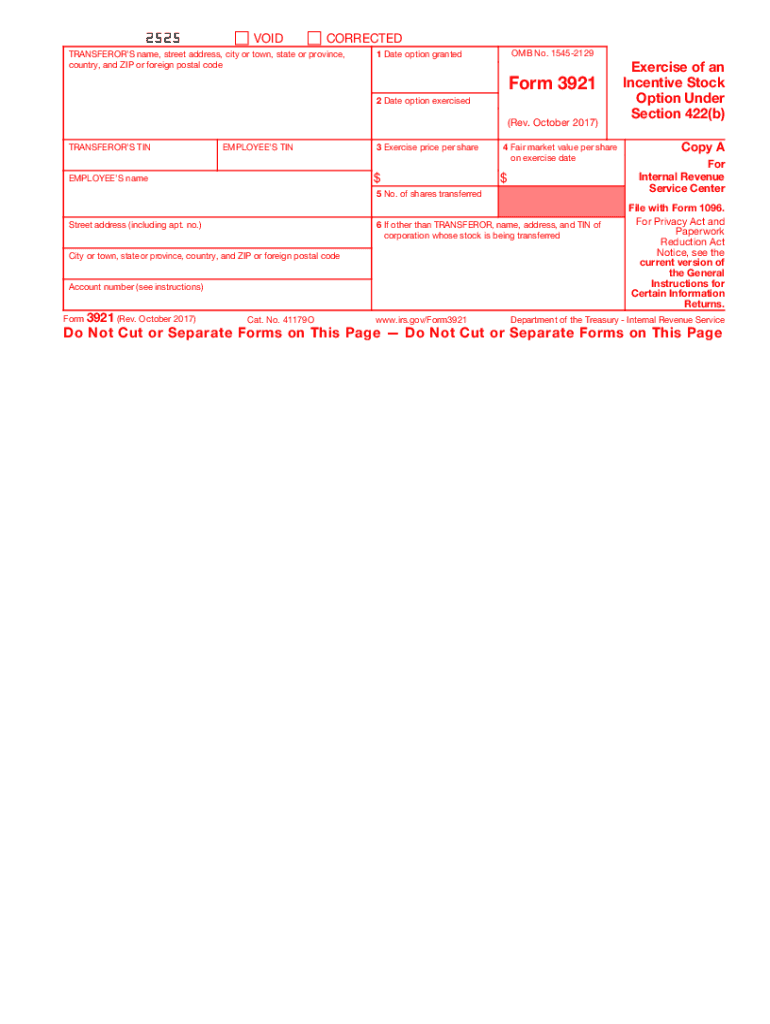

20172022 Form IRS 3921 Fill Online, Printable, Fillable, Blank pdfFiller

Web to learn more, see form 6251 instructions at www.irs.gov. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Web a form 3922 is not required for the first transfer of legal title of a share of stock by an employee who is a nonresident alien (as defined in section 7701(b)) and to. Your.

IRS Form 3921

Web form 3921, exercise of an incentive stock option under section 422 (b), is a form provided to a taxpayer when they exercise an incentive stock option (iso). It added income limits, price caps and. Web this is important tax information and is being furnished to the irs. Web entering amounts from form 3921 in the individual module of lacerte.

1099 Pro Is A Microsoft Certified Partner, Mbe Certified And.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is. A preparer must determine if an entry is needed based on the facts of the transfer. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso).

Web To Learn More, See Form 6251 Instructions At Www.irs.gov.

Web form 3921 exercise of an incentive stock option under section 422 (b), is for informational purposes only and should be kept with your records. Web the amount to include on this line is the total fair market value of the stock when you exercised the option minus any amount you paid to acquire the stock or acquire the. Although this information is not taxable unless. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500.

Web A Form 3921 Is Not Required For The Exercise Of An Incentive Stock Option By An Employee Who Is A Nonresident Alien (As Defined In Section 7701(B)) And To Whom The Corporation Is.

Web in drake tax, there is no specific data entry screen for form 3921. Web form 3921 is generally informational unless stock acquired through an incentive stock option is sold or otherwise disposed. To help figure any amt on the exercise of your iso, see your form 3921. Web there are 4 copies of form 3921, which the employer must file.

Web Find Out About Form 3921 And How Employee Granted Iso Is Taxed By William Perez Updated On December 24, 2022 Reviewed By Lea D.

Web entering amounts from form 3921 in the individual module of lacerte solved • by intuit • 283 • updated july 19, 2022 this article will help you enter amounts. Each copy goes to a different recipient: What is 3921 tax form? Web a form 3922 is not required for the first transfer of legal title of a share of stock by an employee who is a nonresident alien (as defined in section 7701(b)) and to.