Irs Mileage Tracking Form

Irs Mileage Tracking Form - Depreciation limits on cars, trucks, and vans. Then keep track of your business miles and expenses for each business trip using this detailed template. Web this mileage tracker app knows everything other mileage trackers know. Web for the latest developments related to form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Download pdf [541 kb] download jpg [647 kb] What's new standard mileage rate. Web mileage reimbursement form | 2022 irs rates. A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Web when you visit the irs’s website in search of the mileage log requirements, you’ll notice that there are two ways to report mileage. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer.

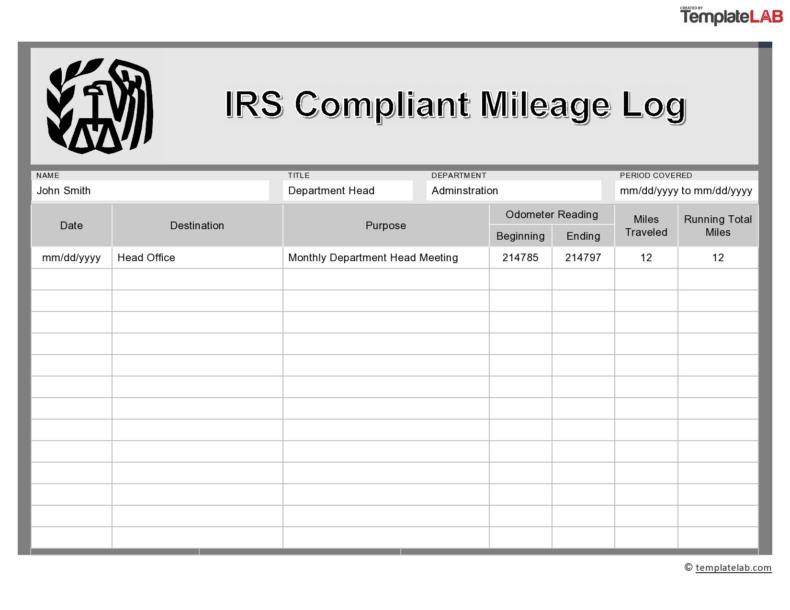

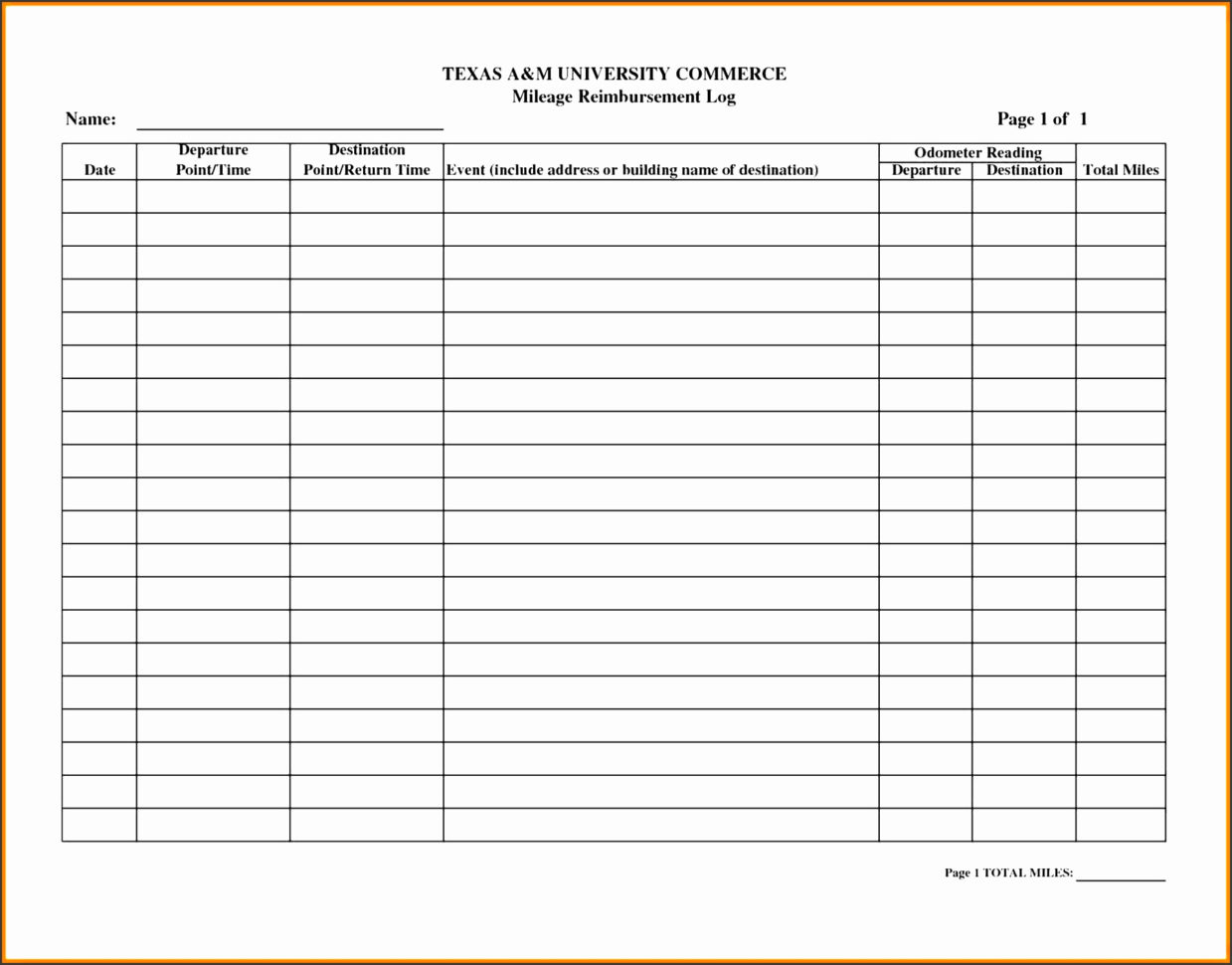

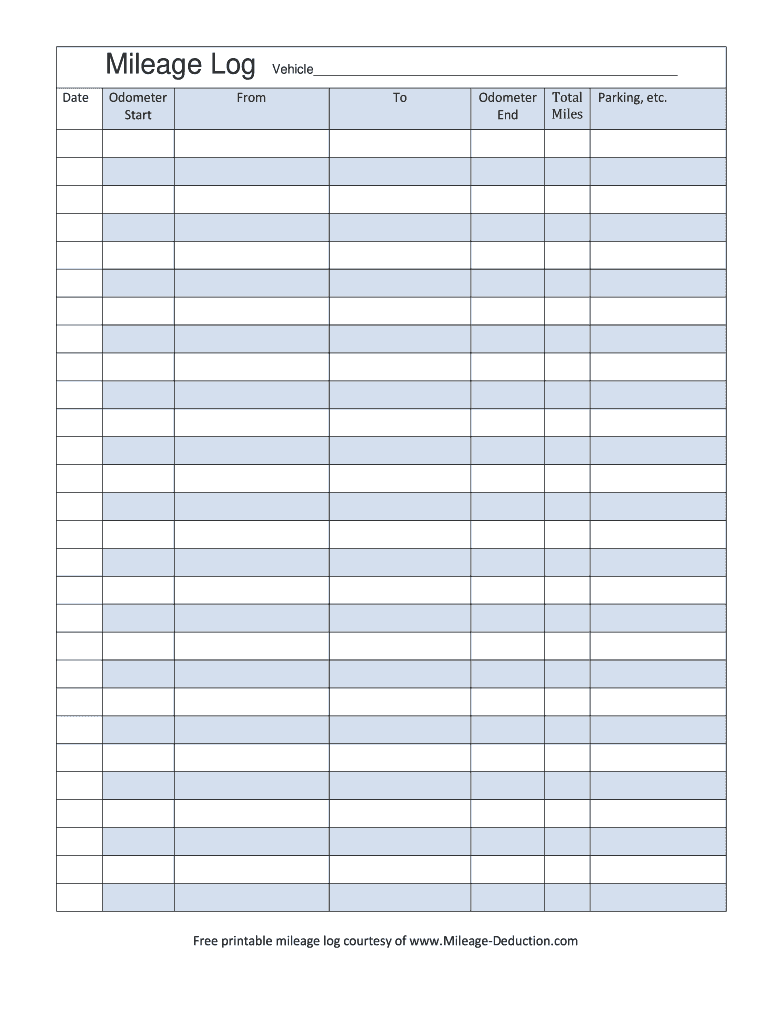

Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs standard mileage rates. Then keep track of your business miles and expenses for each business trip using this detailed template. Remember to use the 2022 irs mileage rate if you log trips for. What's new standard mileage rate. Web business mileage tracker form. Car expenses and use of the standard mileage rate are explained in chapter 4. The first way is by reporting mileage using the standard mileage rate. Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. Web when you visit the irs’s website in search of the mileage log requirements, you’ll notice that there are two ways to report mileage. The other is by reporting actual expenses, also known as the actual expenses method.

Remember to use the 2022 irs mileage rate if you log trips for. A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Depreciation limits on cars, trucks, and vans. Then keep track of your business miles and expenses for each business trip using this detailed template. Web mileage reimbursement form | 2022 irs rates. Web when you visit the irs’s website in search of the mileage log requirements, you’ll notice that there are two ways to report mileage. Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Download pdf [541 kb] download jpg [647 kb] All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer.

Irs Mileage Log Excel Excel Templates

Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web this mileage tracker app knows everything other mileage trackers know. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims. Enter your personal, company and vehicle details at the top of this business mileage tracker.

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Car expenses and use of the standard mileage rate are explained in chapter 4. Then keep track of your business miles and expenses for each business trip using this detailed template. What's new standard mileage rate. Web for the latest developments related to form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Web.

25 Printable Irs Mileage Tracking Templates Gofar With Mileage Report

Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs standard mileage rates. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Car expenses and use of the standard mileage rate are.

Irs Mileage Tracking Form Form Resume Examples qeYzGzWV8X

All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. The first way is by reporting mileage using the standard mileage rate. Download pdf [541 kb] download jpg [647 kb] The other is by reporting actual expenses, also known as the actual expenses method. A mileage reimbursement.

Mileage Spreadsheet For Irs Best Of Free Irs Mileage Log Template

Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. Depreciation limits on cars, trucks, and vans. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web business mileage tracker form. The other is by reporting actual.

25 Printable Irs Mileage Tracking Templates Gofar Inside Best Vehicle

Web this mileage tracker app knows everything other mileage trackers know. Web mileage reimbursement form | 2022 irs rates. Web when you visit the irs’s website in search of the mileage log requirements, you’ll notice that there are two ways to report mileage. Depreciation limits on cars, trucks, and vans. Web business mileage tracker form.

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

Depreciation limits on cars, trucks, and vans. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims. What's new standard mileage rate. Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. Web for the latest developments related to form.

Search Results Irs Mileage Log Template BestTemplatess

The first way is by reporting mileage using the standard mileage rate. Web this mileage tracker app knows everything other mileage trackers know. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims. Download pdf [541 kb] download jpg [647 kb] Car expenses and use of the standard mileage rate are explained in chapter.

Free PDF Mileage Logs Printable IRS Mileage Rate 2021

The first way is by reporting mileage using the standard mileage rate. Remember to use the 2022 irs mileage rate if you log trips for. Depreciation limits on cars, trucks, and vans. Web mileage reimbursement form | 2022 irs rates. Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking.

Peerless Google Sheets Mileage Template Best Powerpoint Templates 2018 Free

Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Depreciation limits on cars, trucks, and vans. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims. Web this mileage tracker app knows everything other mileage trackers know. All in all, it’s a perfect solution for.

All In All, It’s A Perfect Solution For Your Own Taxes — Or For Requesting A Mileage Reimbursement From A Customer Or Employer.

Web when you visit the irs’s website in search of the mileage log requirements, you’ll notice that there are two ways to report mileage. The first way is by reporting mileage using the standard mileage rate. Depreciation limits on cars, trucks, and vans. A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use.

Download Pdf [541 Kb] Download Jpg [647 Kb]

Remember to use the 2022 irs mileage rate if you log trips for. The other is by reporting actual expenses, also known as the actual expenses method. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web for the latest developments related to form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106.

Then Keep Track Of Your Business Miles And Expenses For Each Business Trip Using This Detailed Template.

Web mileage reimbursement form | 2022 irs rates. Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs standard mileage rates. Web this mileage tracker app knows everything other mileage trackers know. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims.

Web Business Mileage Tracker Form.

Car expenses and use of the standard mileage rate are explained in chapter 4. Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. What's new standard mileage rate.