Irs Form Ssa 44

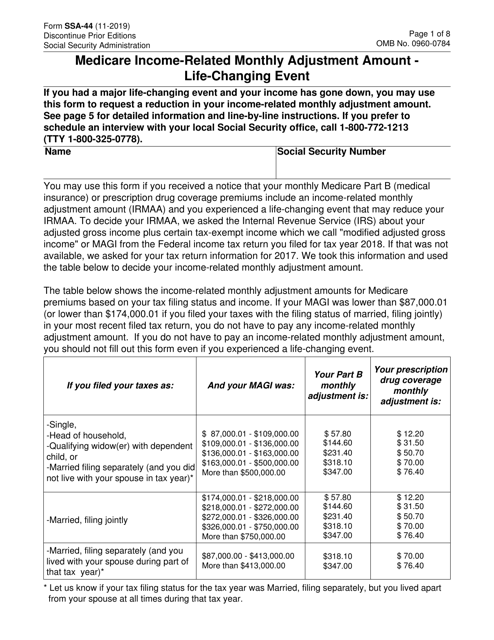

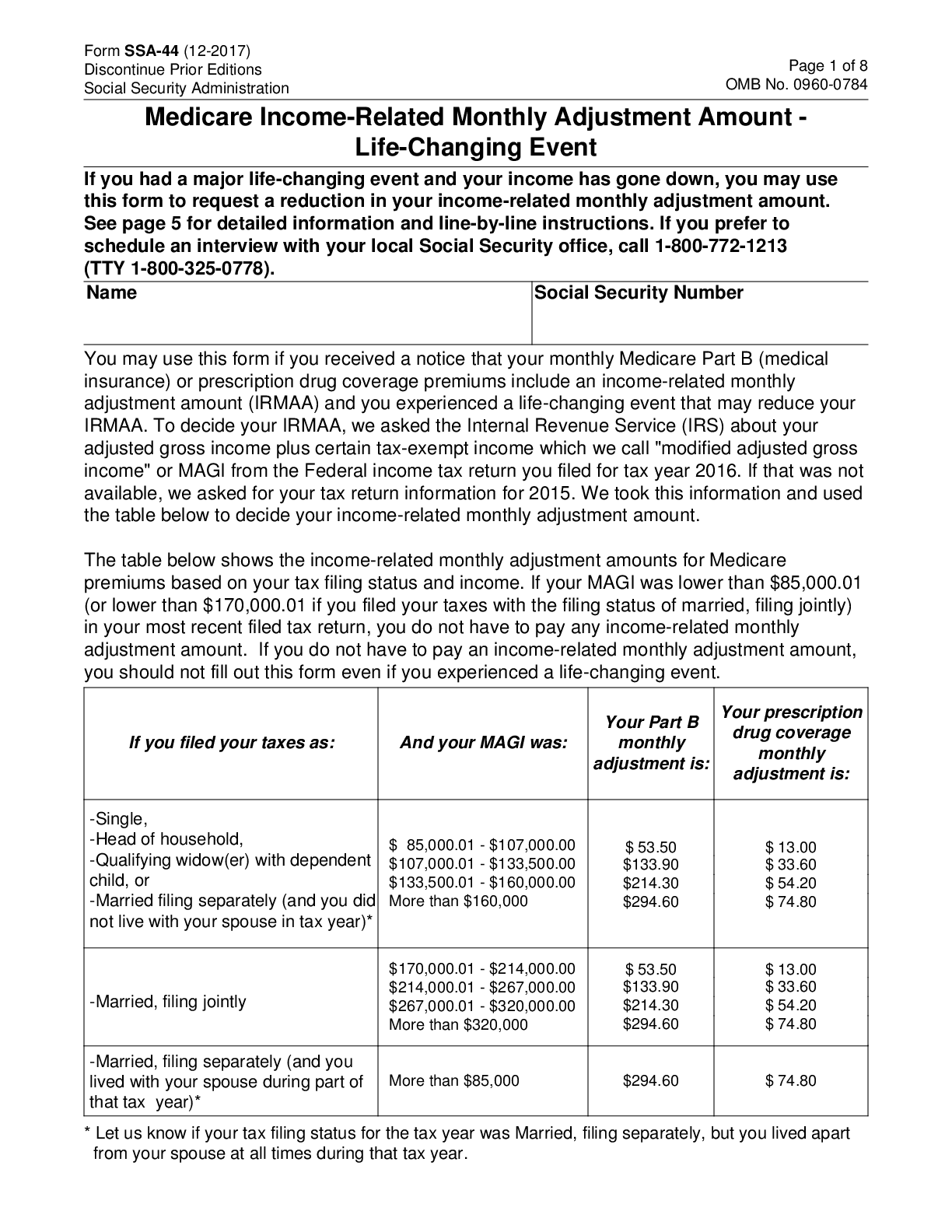

Irs Form Ssa 44 - You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. Fax or mail your completed form and evidence to a social security office. Page 1 of 8 omb no. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Such a request can be triggered when an individual encounters a significant life. Authorization for the social security administration to release social security number (ssn) verification: Keep in mind standard medicare premiums can, and typically do, go up from year to year. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium.

Keep in mind standard medicare premiums can, and typically do, go up from year to year. Authorization for the social security administration to release social security number (ssn) verification: In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. Fax or mail your completed form and evidence to a social security office. Page 1 of 8 omb no. Such a request can be triggered when an individual encounters a significant life.

Fax or mail your completed form and evidence to a social security office. Such a request can be triggered when an individual encounters a significant life. Authorization for the social security administration to release social security number (ssn) verification: You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. Keep in mind standard medicare premiums can, and typically do, go up from year to year. Page 1 of 8 omb no.

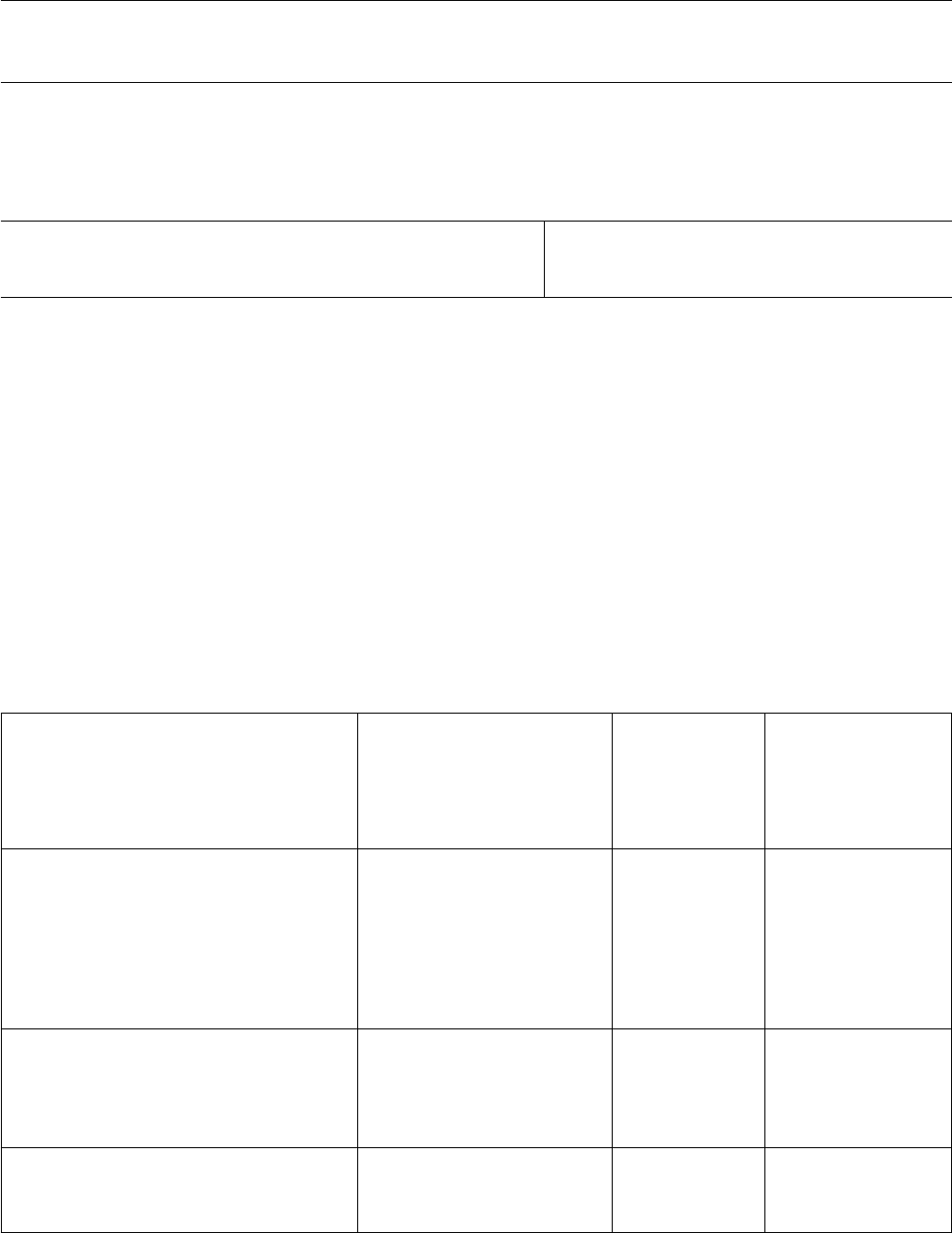

Form SSA44 Fill Out, Sign Online and Download Fillable PDF

Fax or mail your completed form and evidence to a social security office. Such a request can be triggered when an individual encounters a significant life. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Authorization for the social security administration to release social security number (ssn) verification: In other.

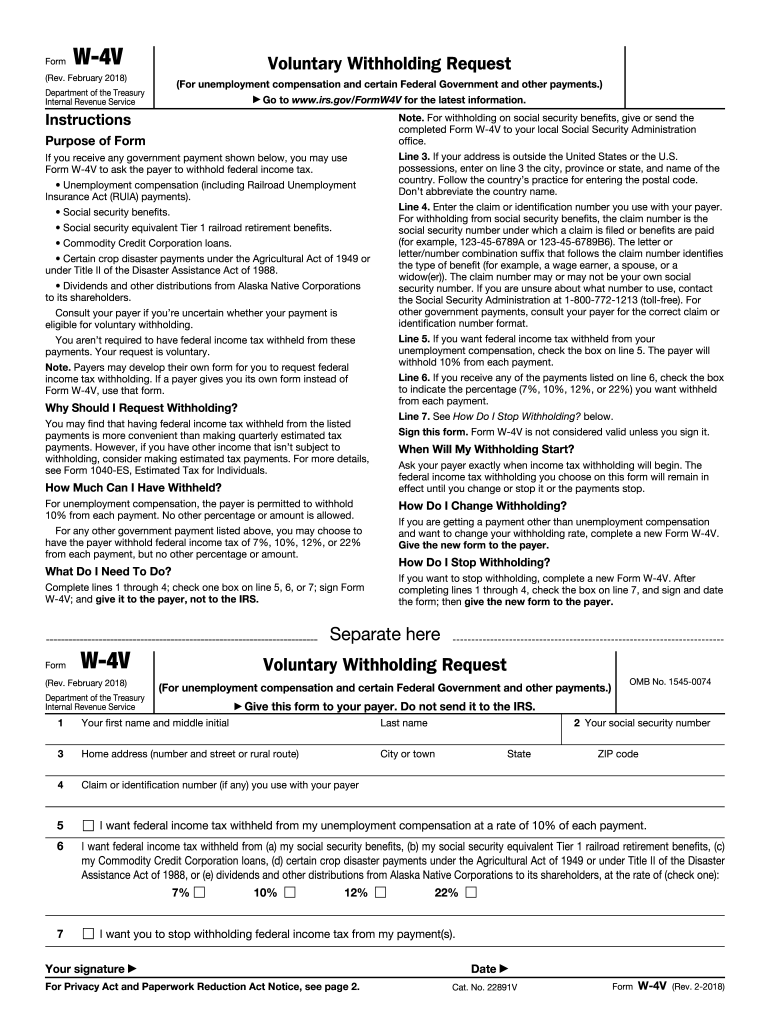

Can You Change Social Security Tax Withholding Online Fill Out and

Authorization for the social security administration to release social security number (ssn) verification: In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report.

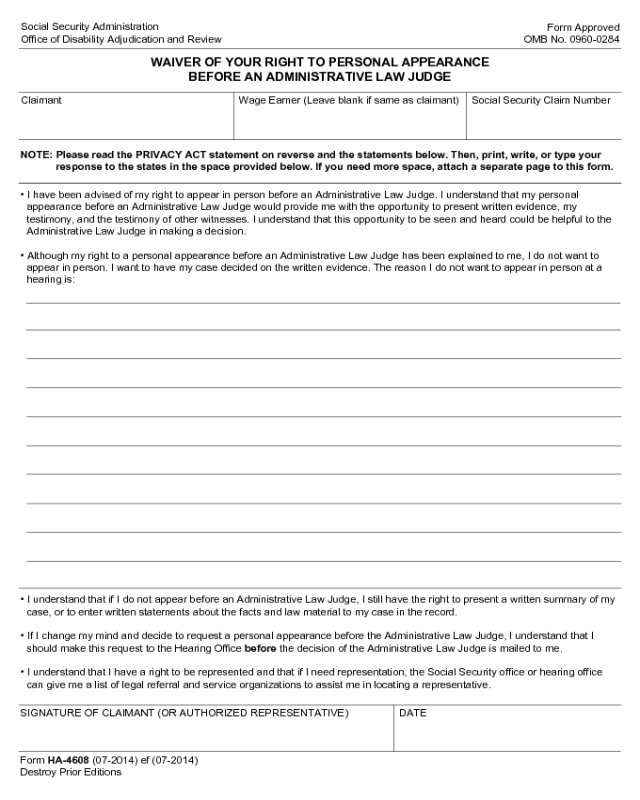

2023 SSA Gov Forms Fillable, Printable PDF & Forms Handypdf

Such a request can be triggered when an individual encounters a significant life. You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. Keep in mind standard medicare premiums can, and typically do, go up from year to year. In other words, the united.

SSA44 A Step By Step Guide For 2022

You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. Fax or mail your completed form and evidence to a social security office. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Authorization for.

2023 SSA Gov Forms Fillable, Printable PDF & Forms Handypdf

Such a request can be triggered when an individual encounters a significant life. Fax or mail your completed form and evidence to a social security office. Page 1 of 8 omb no. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. Authorization for the social.

2022 SSA Gov Forms Fillable, Printable PDF & Forms Handypdf

Fax or mail your completed form and evidence to a social security office. Such a request can be triggered when an individual encounters a significant life. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. In other words, the united states government uses your tax returns to determine whether you.

Ssa 44 Printable Form Printable Form 2022

However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Such a request can be triggered when an individual encounters a significant life. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. Fax or mail your.

Fill Free fillable Form SSA44 Medicare Monthly

Page 1 of 8 omb no. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Fax or mail your completed form and evidence to a social.

2019 SSA Gov Forms Fillable, Printable PDF & Forms Handypdf

Authorization for the social security administration to release social security number (ssn) verification: Fax or mail your completed form and evidence to a social security office. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. Such a request can be triggered when an individual encounters a significant life. In other.

Form SSA44 Edit, Fill, Sign Online Handypdf

Authorization for the social security administration to release social security number (ssn) verification: You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs. Such a request can be triggered when an individual encounters a significant life. Keep in mind standard medicare premiums can, and.

Keep In Mind Standard Medicare Premiums Can, And Typically Do, Go Up From Year To Year.

Fax or mail your completed form and evidence to a social security office. However, the standard part b rate fell 3 percent in 2023, from the current $170.10 a month to $164.90. In other words, the united states government uses your tax returns to determine whether you should pay more for medicare than the standard premium. Such a request can be triggered when an individual encounters a significant life.

Page 1 Of 8 Omb No.

Authorization for the social security administration to release social security number (ssn) verification: You’ll pay monthly part b premiums equal to 35%, 50%, 65%, 80%, or 85% of the total cost, depending on what you report to the irs.