Irs Form 8915F

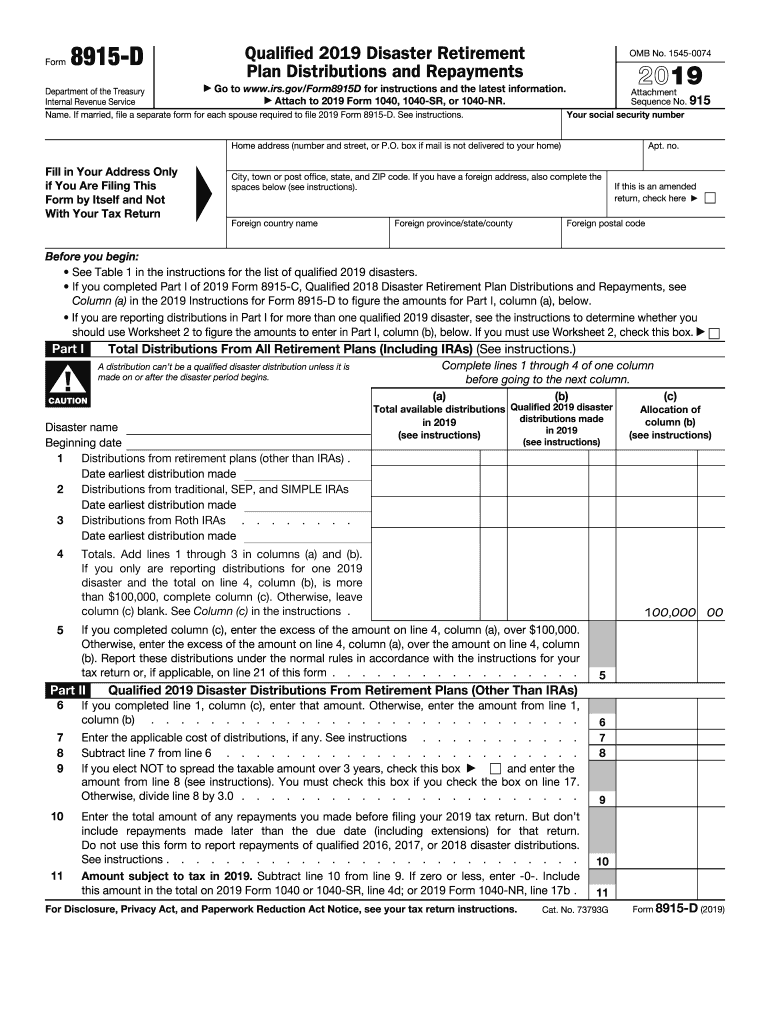

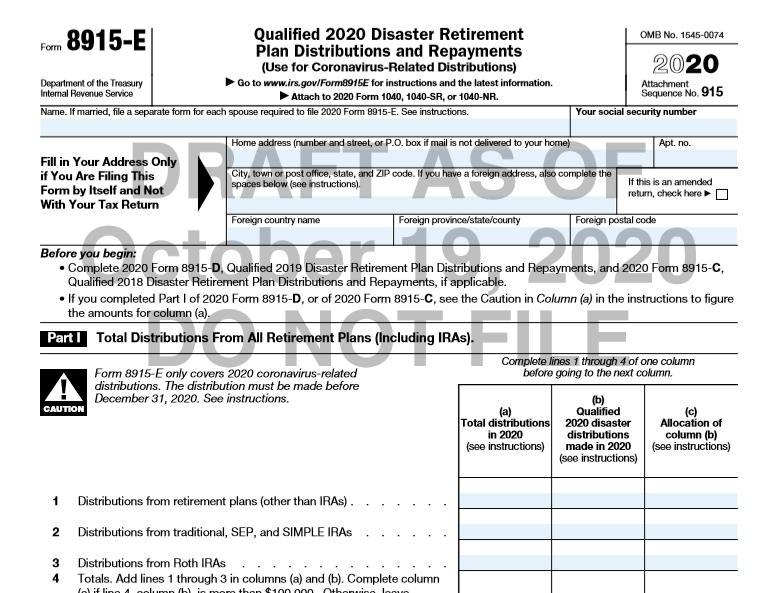

Irs Form 8915F - Repayments of current and prior year qualified disaster distributions. How can that be when the irs has not released the form yet. 501 page is at irs.gov/pub501; For instructions and the latest information. This could be any of the following: Department of the treasury internal revenue service. The withdrawal must come from an eligible retirement plan. A qualified annuity plan the distribution must be to an eligible individual. For example, the form 1040 page is at. Qualified 2020 disaster retirement plan distributions and repayments.

Repayments of current and prior year qualified disaster distributions. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. The withdrawal must come from an eligible retirement plan. Qualified 2020 disaster retirement plan distributions and repayments. For instructions and the latest information. 501 page is at irs.gov/pub501; Department of the treasury internal revenue service. Almost every form and publication has a page on irs.gov with a friendly shortcut. Web instructions, and pubs is at irs.gov/forms. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax.

Web instructions, and pubs is at irs.gov/forms. Qualified 2020 disaster retirement plan distributions and repayments. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. The expectation is that it may be appended in the future years foregoing the need to establish a new. Sounds to me like someone is pulling someones leg. How can that be when the irs has not released the form yet. (january 2022) qualified disaster retirement plan distributions and repayments. A qualified annuity plan the distribution must be to an eligible individual. For instructions and the latest information. Almost every form and publication has a page on irs.gov with a friendly shortcut.

form 8915 e instructions turbotax Renita Wimberly

501 page is at irs.gov/pub501; Web instructions, and pubs is at irs.gov/forms. Department of the treasury internal revenue service. Sounds to me like someone is pulling someones leg. Qualified 2020 disaster retirement plan distributions and repayments.

Are You Ready? Big Changes to the 2020 Federal W4 Withholding Form

Other items you may find useful all form 8915 revisions about publication 575, pension and annuity income about publication 976, disaster relief Qualified 2020 disaster retirement plan distributions and repayments. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Almost every form and publication has.

8915 D Form Fill Out and Sign Printable PDF Template signNow

The expectation is that it may be appended in the future years foregoing the need to establish a new. Almost every form and publication has a page on irs.gov with a friendly shortcut. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. We are removing three examples and revising the worksheet 1b section. For example,.

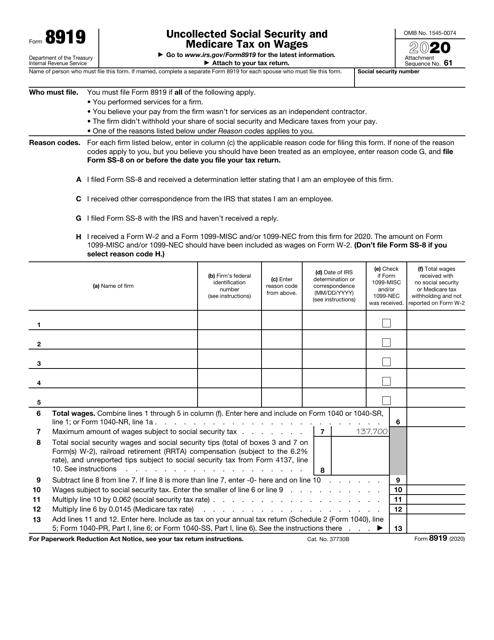

IRS Form 8919 Download Fillable PDF or Fill Online Uncollected Social

How can that be when the irs has not released the form yet. The withdrawal must come from an eligible retirement plan. Web instructions, and pubs is at irs.gov/forms. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Other items you may find useful all form 8915 revisions about publication 575, pension and annuity income.

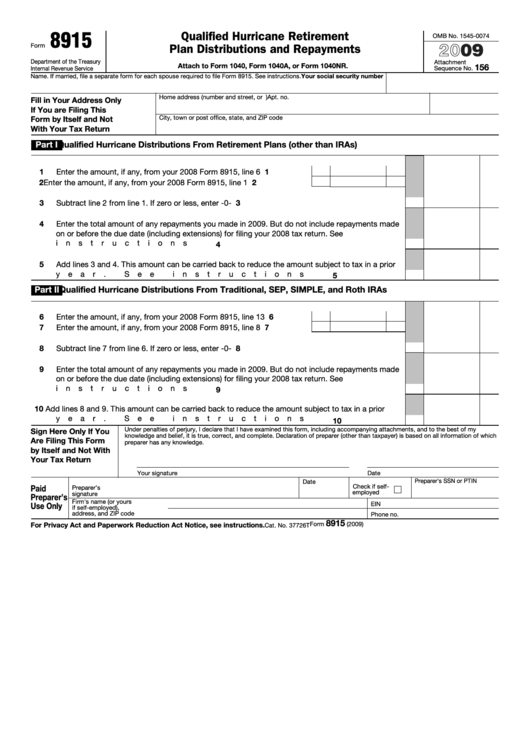

Form 8915 Qualified Hurricane Retirement Plan Distributions and

We are removing three examples and revising the worksheet 1b section. How can that be when the irs has not released the form yet. Sounds to me like someone is pulling someones leg. Almost every form and publication has a page on irs.gov with a friendly shortcut. Department of the treasury internal revenue service.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

This could be any of the following: A qualified annuity plan the distribution must be to an eligible individual. Web instructions, and pubs is at irs.gov/forms. Repayments of current and prior year qualified disaster distributions. We are removing three examples and revising the worksheet 1b section.

8915F LHR 32D Sargent Mortise Exit Devices SECLOCK

Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Sounds to me like someone is pulling someones leg. Almost every form and publication has a page on irs.gov with a friendly shortcut. How can that be when the irs has not released the form yet. A qualified annuity plan the distribution must be to an.

8915e tax form instructions Somer Langley

(january 2022) qualified disaster retirement plan distributions and repayments. The withdrawal must come from an eligible retirement plan. This could be any of the following: We are removing three examples and revising the worksheet 1b section. For example, the form 1040 page is at.

Fillable Form 8915 Qualified Hurricane Retirement Plan Distributions

Repayments of current and prior year qualified disaster distributions. For example, the form 1040 page is at. Department of the treasury internal revenue service. We are removing three examples and revising the worksheet 1b section. Qualified 2020 disaster retirement plan distributions and repayments.

The IRS 8822 Form To File or Not to File MissNowMrs

Almost every form and publication has a page on irs.gov with a friendly shortcut. The expectation is that it may be appended in the future years foregoing the need to establish a new. For instructions and the latest information. Qualified 2020 disaster retirement plan distributions and repayments. For instructions and the latest information.

This Could Be Any Of The Following:

And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Web instructions, and pubs is at irs.gov/forms. How can that be when the irs has not released the form yet. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax.

For Instructions And The Latest Information.

Repayments of current and prior year qualified disaster distributions. (january 2022) qualified disaster retirement plan distributions and repayments. 501 page is at irs.gov/pub501; Qualified 2020 disaster retirement plan distributions and repayments.

Sounds To Me Like Someone Is Pulling Someones Leg.

The withdrawal must come from an eligible retirement plan. The expectation is that it may be appended in the future years foregoing the need to establish a new. A qualified annuity plan the distribution must be to an eligible individual. For instructions and the latest information.

Almost Every Form And Publication Has A Page On Irs.gov With A Friendly Shortcut.

Other items you may find useful all form 8915 revisions about publication 575, pension and annuity income about publication 976, disaster relief Department of the treasury internal revenue service. We are removing three examples and revising the worksheet 1b section. Department of the treasury internal revenue service.