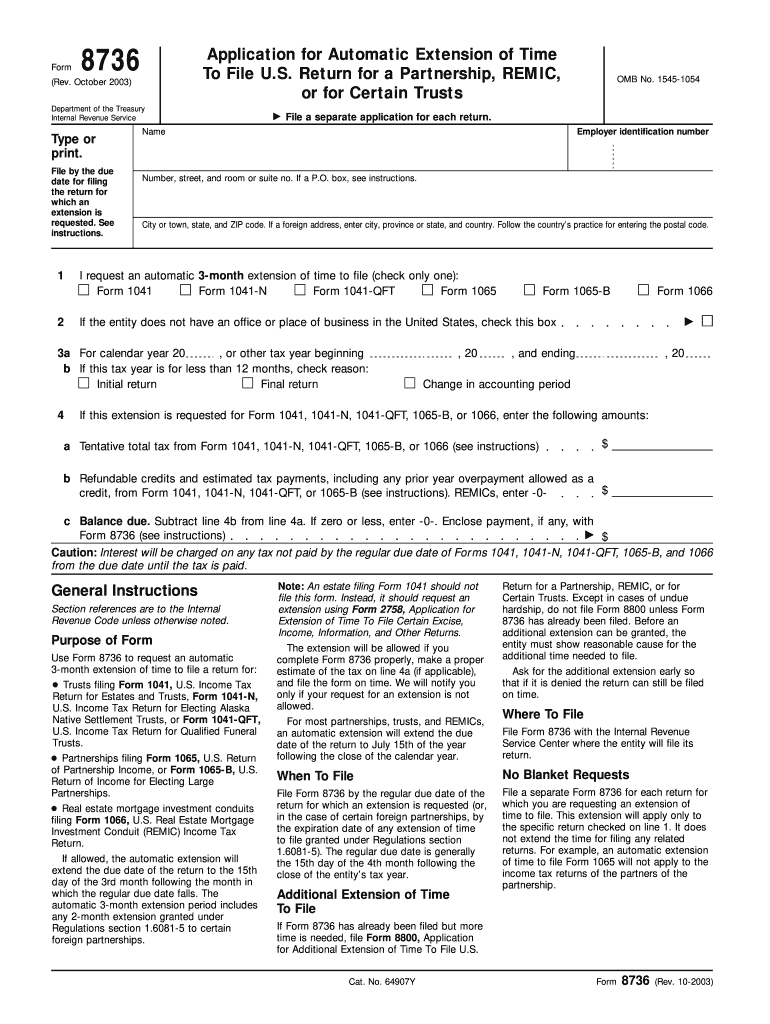

Irs Form 8736

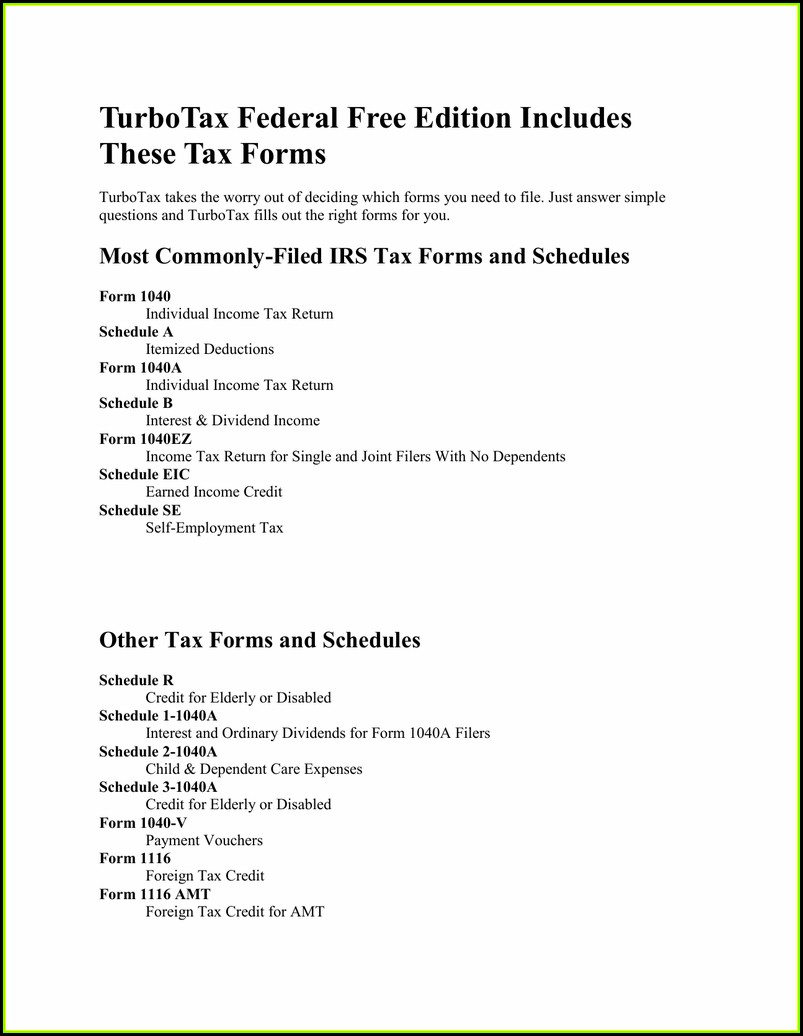

Irs Form 8736 - Edit your irs form 8736 online. Web find irs form 8736 and then click get form to get started. Recordkeeping 3 hr., 7 min. October 1998) application for automatic extension of time to file u.s. Payments made in liquidation of the interest of a retiring partner or a deceased partner shall, to the extent such payments (other than payments. Take advantage of the instruments we offer to submit your form. January 1997) application for automatic extension of time to file u.s. Do you have to file. Web form 8736, application for automatic extension of time to file u.s. Trusts filing form 1041, u.s.

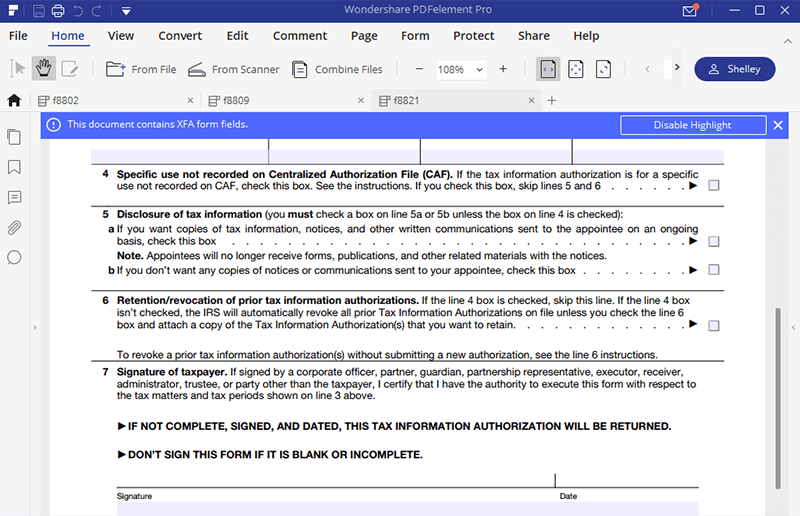

Web find irs form 8736 and then click get form to get started. Return for a partnership, remic, or for certain trusts. Also use form 8936 to figure your credit for. Payments made in liquidation of the interest of a retiring partner or a deceased partner shall, to the extent such payments (other than payments. Web from the 8736. Web (3) show the amount properly estimated as tax for the estate or trust for the taxable year. Web where do i file irs form 8736? Edit your irs form 8736 online. January 1997) application for automatic extension of time to file u.s. Highlight relevant segments of your documents.

Payments made in liquidation of the interest of a retiring partner or a deceased partner shall, to the extent such payments (other than payments. § 736 (b) (1) general rule —. Web find irs form 8736 and then click get form to get started. Highlight relevant segments of your documents. Web send where to file irs form 8736 via email, link, or fax. (c) no extension of time for the payment of tax. Return for a partnership, remic, or for certain trusts (online) title form 8736, application for automatic extension. You can also download it, export it or print it out. Type text, add images, blackout. Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,.

VA Form 268736 Application for Authority to Close Loans on an

Web find irs form 8736 and then click get form to get started. Do you have to file. Web send where to file irs form 8736 via email, link, or fax. Payments made in liquidation of the interest of a retiring partner or a deceased partner shall, to the extent such payments (other than payments. Return for a partnership, remic,.

Irs Form 8736 Fill Online, Printable, Fillable, Blank pdfFiller

Also use form 8936 to figure your credit for. Do you have to file. October 1998) application for automatic extension of time to file u.s. Tax analysts is a tax publisher and does not provide tax advice or preparation services. Highlight relevant segments of your documents.

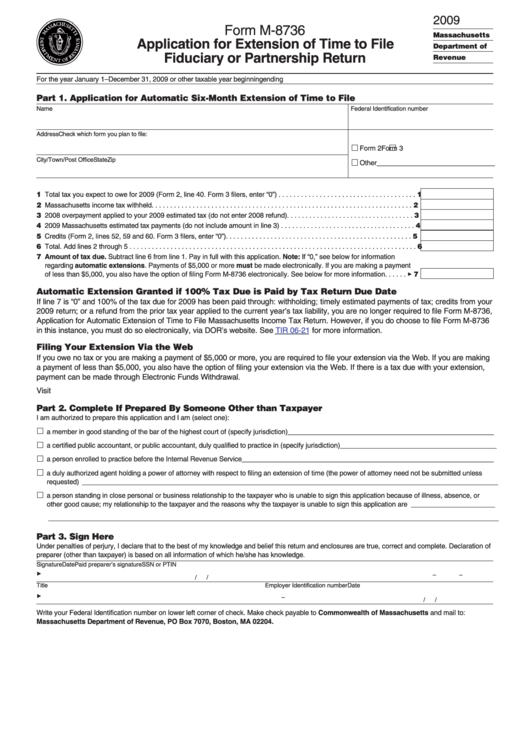

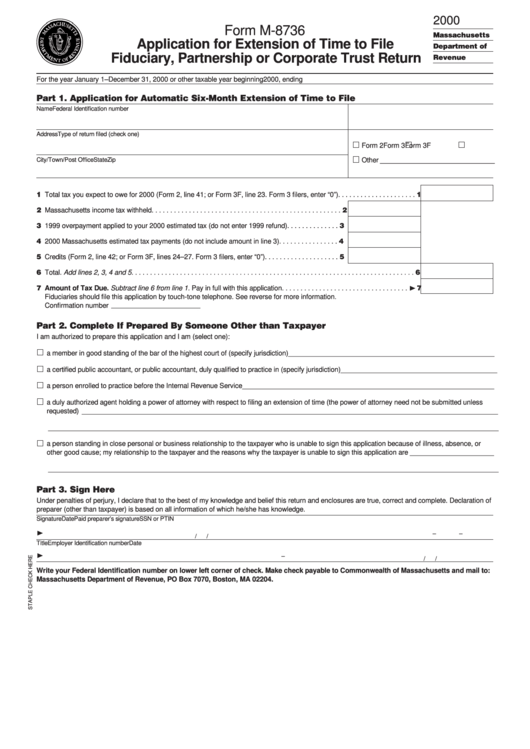

Form M8736 Application For Extension Of Time To File Fiduciary Or

Edit your irs form 8736 online. Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Web (3) show the amount properly estimated as tax for the estate or trust for the taxable year. Return for a partnership, remic, or for certain trusts (online) title form 8736, application for automatic extension. Take.

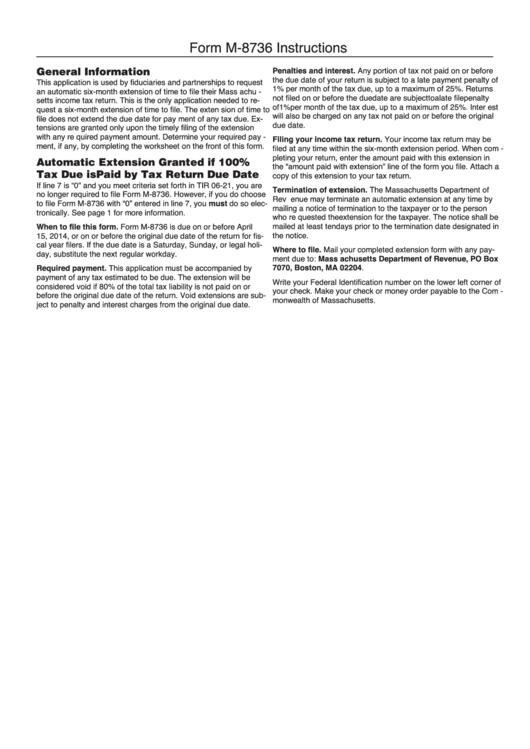

Form M8736 Instructions Application For A SixMonth Extension Of

Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. You can also download it, export it or print it out. Payments made in liquidation of the interest of a retiring partner or a deceased partner shall, to the extent such payments (other than payments. Return for a partnership, remic, or for.

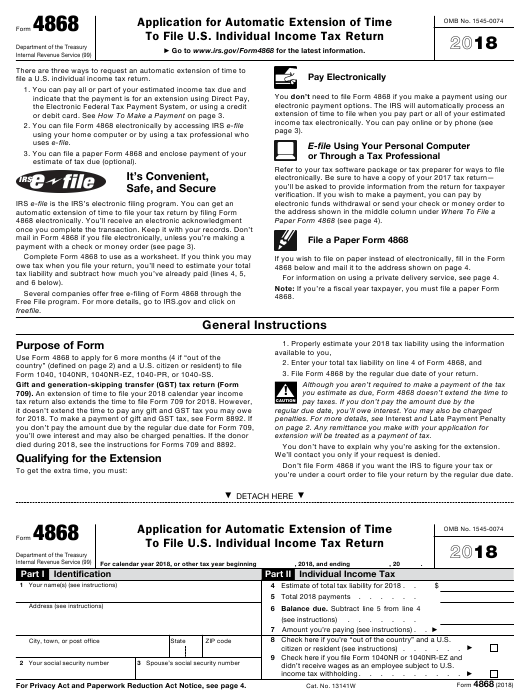

Free Printable Irs Form 4868 Printable Form 2022

Web where do i file irs form 8736? January 1997) application for automatic extension of time to file u.s. An automatic extension of time for filing a. October 1998) application for automatic extension of time to file u.s. Web form 8736, application for automatic extension of time to file u.s.

Irs Form 9465 Fee Form Resume Examples o7Y38zLVBN

Take advantage of the instruments we offer to submit your form. § 736 (b) (1) general rule —. Return for a partnership, remic, or for certain trusts. Web send where to file irs form 8736 via email, link, or fax. Edit your irs form 8736 online.

IRS Form 8821 Fill it out with the Best Program

Web form 8736, application for automatic extension of time to file u.s. Edit your irs form 8736 online. Highlight relevant segments of your documents. Web send where to file irs form 8736 via email, link, or fax. Return for a partnership, remic, or for certain trusts (online) title form 8736, application for automatic extension.

Form M8736 Application For Extension Of Time To File Fiduciary

§ 736 (b) (1) general rule —. Income taxreturn for estates and. Web from the 8736. October 1998) application for automatic extension of time to file u.s. Learning about the law or the form 24 min.

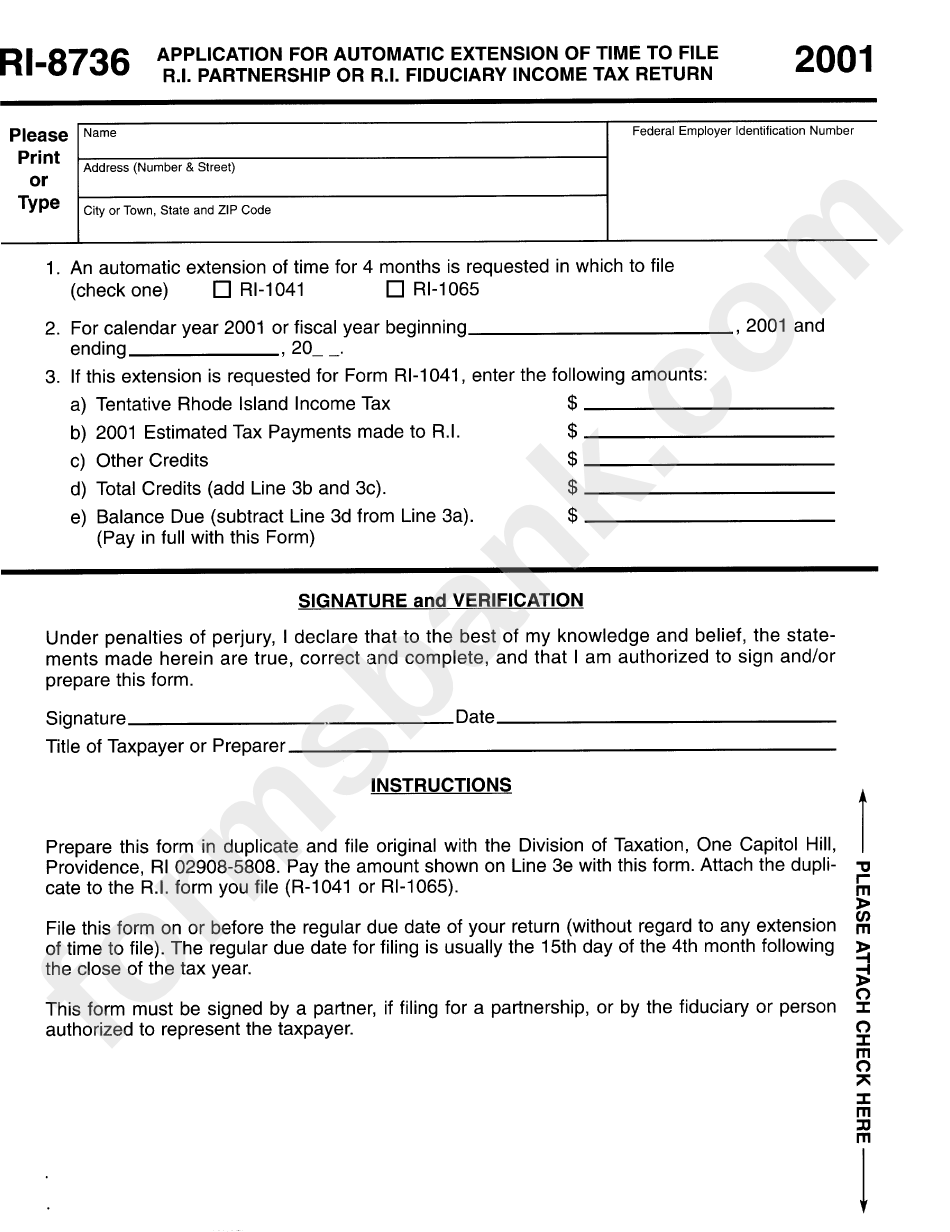

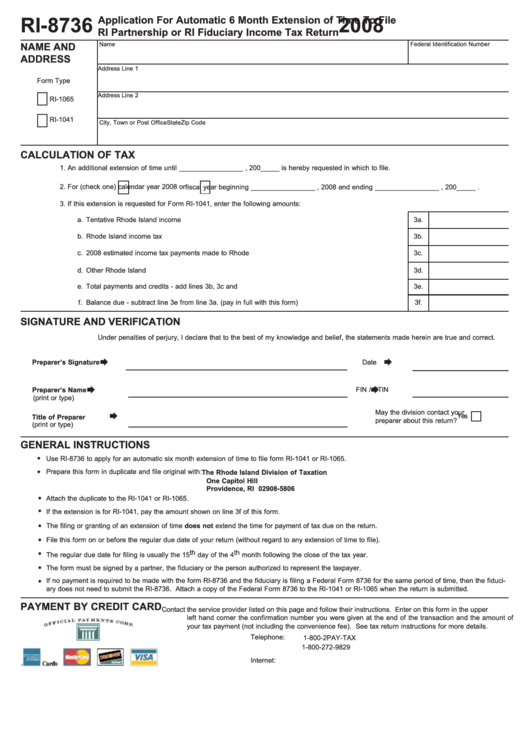

Form Ri8736 Application For Automatic Extension Of Time To File

Highlight relevant segments of your documents. Web form 8736, application for automatic extension of time to file u.s. January 1997) application for automatic extension of time to file u.s. Income taxreturn for estates and. Return for a partnership, remic, or for certain trusts (online) title form 8736, application for automatic extension.

Form Ri8736 Application For Automatic 6 Month Extension Of Time To

Learning about the law or the form 24 min. Web find irs form 8736 and then click get form to get started. Trusts filing form 1041, u.s. Return for a partnership, remic, or for certain trusts (online) title form 8736, application for automatic extension. Highlight relevant segments of your documents.

October 1998) Application For Automatic Extension Of Time To File U.s.

(c) no extension of time for the payment of tax. You can also download it, export it or print it out. Return for a partnership, remic, or for certain trusts (online) title form 8736, application for automatic extension. Also use form 8936 to figure your credit for.

Learning About The Law Or The Form 24 Min.

Web form 8736, application for automatic extension of time to file u.s. Do you have to file. Trusts filing form 1041, u.s. Return for a partnership, remic, or for certain trusts.

Edit Your Irs Form 8736 Online.

Take advantage of the instruments we offer to submit your form. Payments made in liquidation of the interest of a retiring partner or a deceased partner shall, to the extent such payments (other than payments. Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Web send where to file irs form 8736 via email, link, or fax.

Web (3) Show The Amount Properly Estimated As Tax For The Estate Or Trust For The Taxable Year.

Tax analysts is a tax publisher and does not provide tax advice or preparation services. Income taxreturn for estates and. Highlight relevant segments of your documents. January 1997) application for automatic extension of time to file u.s.