Irs Form 703

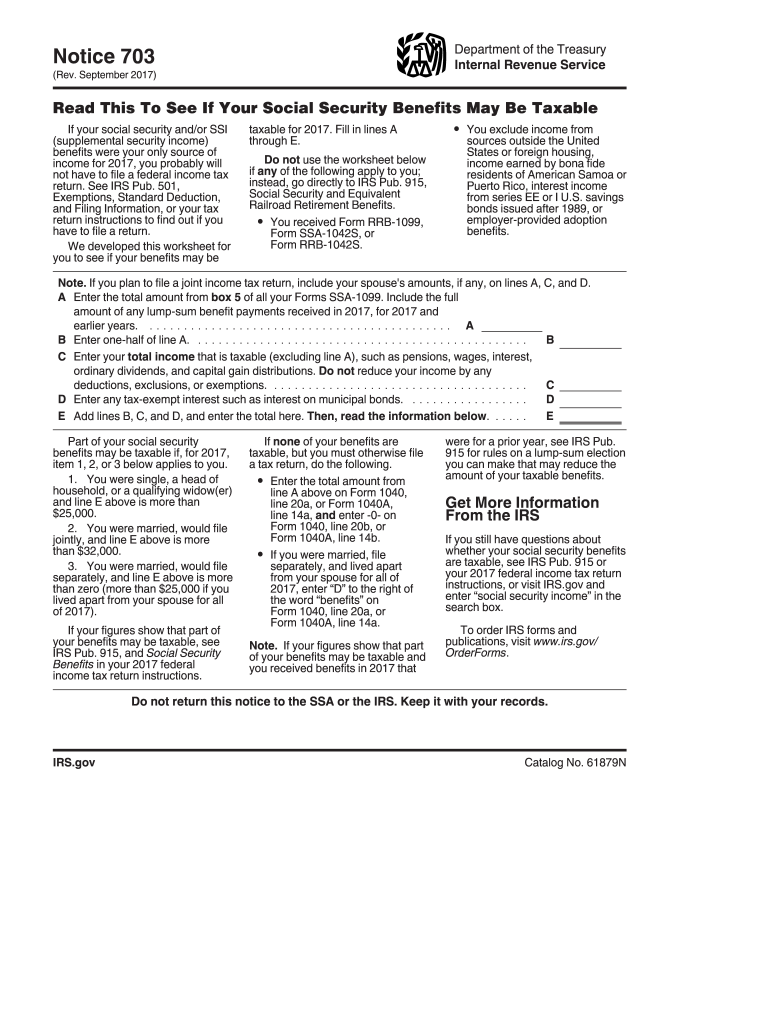

Irs Form 703 - Many s firm owners must include s corporation stock basis information with their 1040s. Web the irs estimates that nearly 70,000 impacted respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form. While this worksheet was not a required form and was provided for the shareholder’s internal tracking purposes, starting. Web form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been generated as part of returns for s corporation shareholders in most tax software programs. Et in the auditorium of the internal revenue building, 1111 constitution avenue nw, washington, dc. Depending on the amount of your other retirement income and your filing status, you could owe taxes on up to 85% of your social security benefits. The tax form for social security income. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent updates, related forms and instructions on how to file. Web get the current filing year’s forms, instructions, and publications for free from the irs. Web new form 7203.

Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. Web the irs estimates that nearly 70,000 impacted respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form. Many s firm owners must include s corporation stock basis information with their 1040s. Due to building security procedures, visitors must enter at the constitution avenue entrance. Et in the auditorium of the internal revenue building, 1111 constitution avenue nw, washington, dc. October 2022) read this to see if your social security benefits may be taxable department of the treasury internal revenue service if your social security and/or ssi (supplemental security income) benefits were your only source of income for 2022, you probably will not have to file a federal income tax return. Easily fill out pdf blank, edit, and sign them. Web get the current filing year’s forms, instructions, and publications for free from the irs. Web a public hearing has been scheduled for august 30, 2023 beginning at 10 a.m. Web form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been generated as part of returns for s corporation shareholders in most tax software programs.

Web form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been generated as part of returns for s corporation shareholders in most tax software programs. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent updates, related forms and instructions on how to file. Web a public hearing has been scheduled for august 30, 2023 beginning at 10 a.m. By cooper melvin, jd, cpa. The tax form for social security income. Save or instantly send your ready documents. Et in the auditorium of the internal revenue building, 1111 constitution avenue nw, washington, dc. October 2022) read this to see if your social security benefits may be taxable department of the treasury internal revenue service if your social security and/or ssi (supplemental security income) benefits were your only source of income for 2022, you probably will not have to file a federal income tax return. That time estimate sure seems high.

20172020 Form IRS Notice 703 Fill Online, Printable, Fillable, Blank

Due to building security procedures, visitors must enter at the constitution avenue entrance. Depending on the amount of your other retirement income and your filing status, you could owe taxes on up to 85% of your social security benefits. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. Save.

Social Security Tax Worksheet Master of Documents

Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. Web get the current filing year’s forms, instructions, and publications for free from the irs. That time estimate sure seems high. Web form 7203 is a new form.

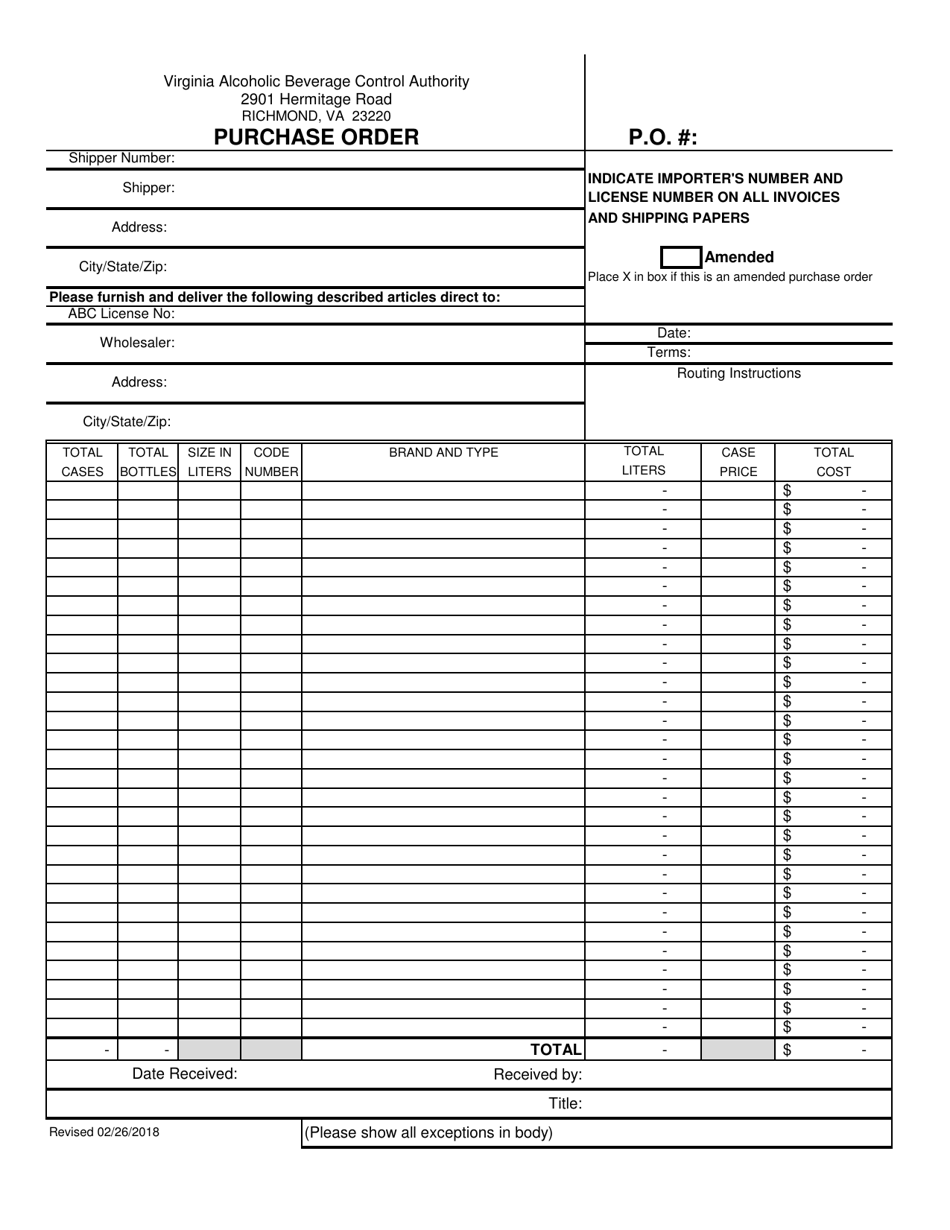

Form 70334 Download Printable PDF or Fill Online Purchase Order

Many s firm owners must include s corporation stock basis information with their 1040s. Web a public hearing has been scheduled for august 30, 2023 beginning at 10 a.m. Easily fill out pdf blank, edit, and sign them. Depending on the amount of your other retirement income and your filing status, you could owe taxes on up to 85% of.

Savinelli Pfeife "Sirmione" Form 703 Tiefster Preis

Web information about notice 703, read this to see if your social security benefits may be taxable, including recent updates, related forms and instructions on how to file. The tax form for social security income. By cooper melvin, jd, cpa. Web new form 7203. Due to building security procedures, visitors must enter at the constitution avenue entrance.

IRS Notice 703 Social Security Form SuperMoney

Due to building security procedures, visitors must enter at the constitution avenue entrance. Easily fill out pdf blank, edit, and sign them. While this worksheet was not a required form and was provided for the shareholder’s internal tracking purposes, starting. Many s firm owners must include s corporation stock basis information with their 1040s. Web new form 7203.

Form DS703 Article 19A Bus Driver's Blood Pressure FollowUp New

Web the irs estimates that nearly 70,000 impacted respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form. The tax form for social security income. Et in the auditorium of the internal revenue building, 1111 constitution avenue nw, washington, dc. Web information about notice 703, read this.

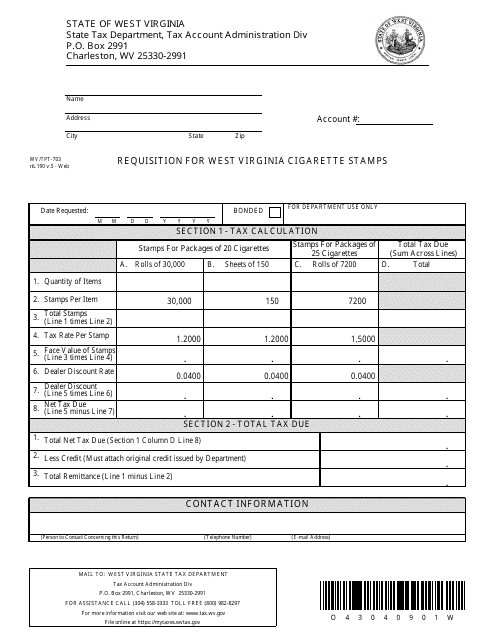

Form WV/TPT703 Fill Out, Sign Online and Download Printable PDF

Easily fill out pdf blank, edit, and sign them. Web the irs estimates that nearly 70,000 impacted respondents will have to complete form 7203 and that it will take each respondent 3 hours and 46 minutes to complete the form. Web information about notice 703, read this to see if your social security benefits may be taxable, including recent updates,.

Irs form 703 for 2011 Fill out & sign online DocHub

While this worksheet was not a required form and was provided for the shareholder’s internal tracking purposes, starting. Web get the current filing year’s forms, instructions, and publications for free from the irs. Web a public hearing has been scheduled for august 30, 2023 beginning at 10 a.m. Save or instantly send your ready documents. Web the irs estimates that.

Form VSD 703.1 Download Fillable PDF, Seller's Report of Sale

Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. The tax form for social security income. While this worksheet was not a required form and was provided for the shareholder’s internal tracking purposes,.

Form STD.703 Download Fillable PDF or Fill Online Vision Plan Direct

Web form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been generated as part of returns for s corporation shareholders in most tax software programs. Easily fill out pdf blank, edit, and sign them. That time estimate sure seems high. Save or instantly send your ready documents. Web.

Save Or Instantly Send Your Ready Documents.

Easily fill out pdf blank, edit, and sign them. October 2022) read this to see if your social security benefits may be taxable department of the treasury internal revenue service if your social security and/or ssi (supplemental security income) benefits were your only source of income for 2022, you probably will not have to file a federal income tax return. By cooper melvin, jd, cpa. Web form 7203 is a new form developed by irs to replace the shareholder’s stock and debt basis worksheet that has previously been generated as part of returns for s corporation shareholders in most tax software programs.

Depending On The Amount Of Your Other Retirement Income And Your Filing Status, You Could Owe Taxes On Up To 85% Of Your Social Security Benefits.

Due to building security procedures, visitors must enter at the constitution avenue entrance. Web get the current filing year’s forms, instructions, and publications for free from the irs. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. Web new form 7203.

Web A Public Hearing Has Been Scheduled For August 30, 2023 Beginning At 10 A.m.

Et in the auditorium of the internal revenue building, 1111 constitution avenue nw, washington, dc. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may be taxable. The tax form for social security income. Many s firm owners must include s corporation stock basis information with their 1040s.

Web The Irs Estimates That Nearly 70,000 Impacted Respondents Will Have To Complete Form 7203 And That It Will Take Each Respondent 3 Hours And 46 Minutes To Complete The Form.

Web information about notice 703, read this to see if your social security benefits may be taxable, including recent updates, related forms and instructions on how to file. While this worksheet was not a required form and was provided for the shareholder’s internal tracking purposes, starting. That time estimate sure seems high.