Irs Form 7004 Due Date

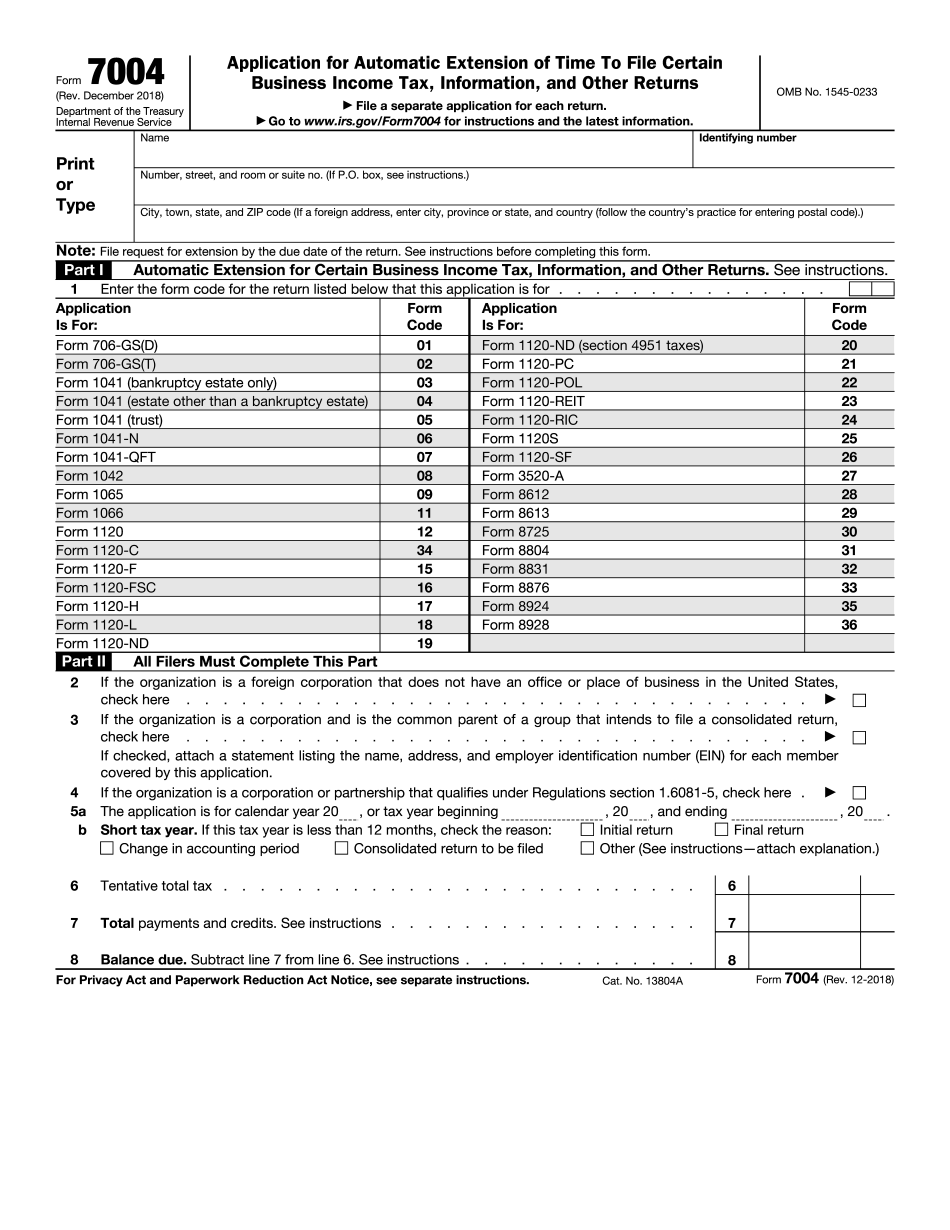

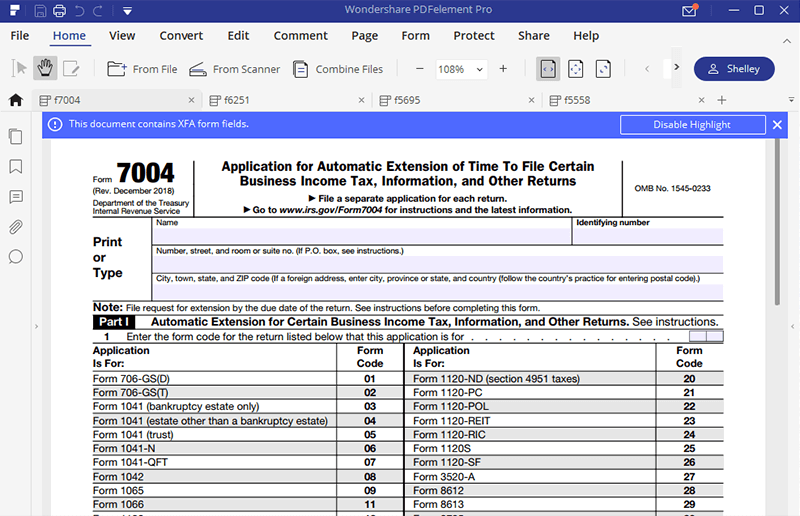

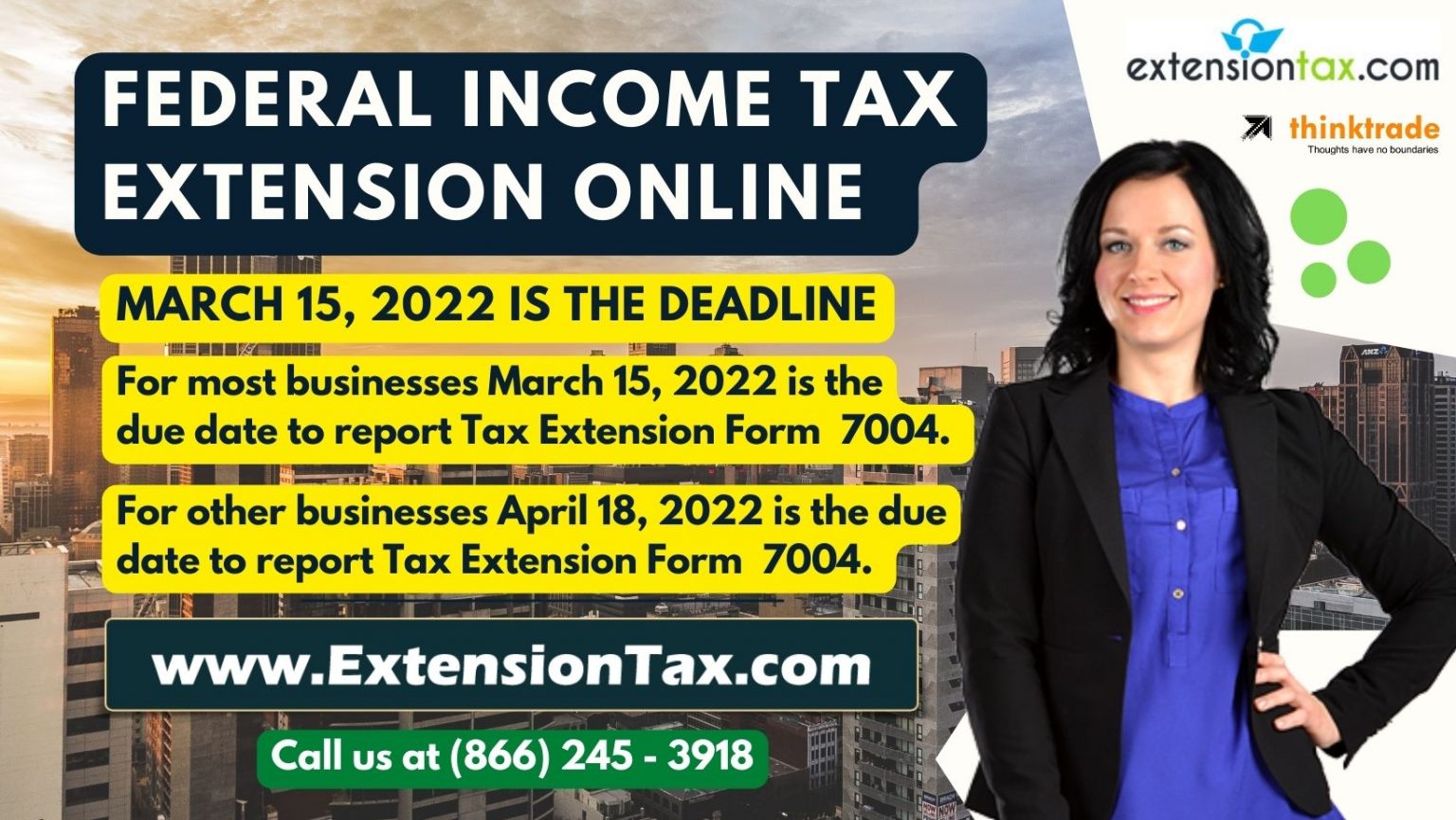

Irs Form 7004 Due Date - Web the irs tax form 7004 should be filed on or before the due date of the applicable tax returns. And for the tax returns such as 1120, 1041 and others. Web payment of tax form 7004 does not extend the time to pay any tax due. Fill in your business's name, address, and employer identification. In the case of s corporations and partnerships, the tax returns are due by march 15th. Web 1 select your business entity type that the irs elected you. Web us based support due date to file business tax extension form 7004 businesses seeking an extension for the tax returns 1120, 1120s, 1065, 1041 and more. The approval process is automatic, so you won’t receive a confirmation if your. Web in part i, indicate the business entity you are filing for, such as a corporation, partnership, nonprofit, or trust. Generally, payment of any balance due on part ii, line 8, is required by the due date of the return.

Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021. Web if the year ends on december 31st, taxes must be filed and paid by april 15th. Web due dates for form 7004. The approval process is automatic, so you won’t receive a confirmation if your. Web in part i, indicate the business entity you are filing for, such as a corporation, partnership, nonprofit, or trust. Web 1 select your business entity type that the irs elected you. Generally, form 7004 must be filed on or before the due date of the applicable tax return. Generally, payment of any balance due on part ii, line 8, is required by the due date of the return. 2 choose your business tax return that you are required to file. And for the tax returns such as 1120, 1041 and others.

Web in part i, indicate the business entity you are filing for, such as a corporation, partnership, nonprofit, or trust. Fill in your business's name, address, and employer identification. Generally, form 7004 must be filed on or before the due date of the applicable tax return. Web for example, if your business tax return is due on march 15, you must submit a fillable form 7004 or printable by that date to receive an extension. February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. Web due dates for form 7004. By the tax filing due date (april 15th for most businesses) who needs to file: This determines which income tax return you need to file. Partnerships, llcs, and corporations that need extra time to file certain tax documents. The approval process is automatic, so you won’t receive a confirmation if your.

The IRS Delays The Deadline to File Personal Taxes Until May 17

January 6, 2022 | last updated: Web for example, if your business tax return is due on march 15, you must submit a fillable form 7004 or printable by that date to receive an extension. This determines which income tax return you need to file. Web the irs tax form 7004 should be filed on or before the due date.

Online Form How to Fill 7004 Form App Blog

By the tax filing due date (april 15th for most businesses) who needs to file: The due dates of the returns can be found in. Web if the year ends on december 31st, taxes must be filed and paid by april 15th. Partnerships, llcs, and corporations that need extra time to file certain tax documents. Generally, form 7004 must be.

Irs Form 7004 amulette

This determines which income tax return you need to file. Partnerships, llcs, and corporations that need extra time to file certain tax documents. Web you’ll need to file 7004 on or before the due date of the applicable tax return. Web due dates for form 7004. Web payment of tax form 7004 does not extend the time to pay any.

Irs Fillable Form 7004 Fill online, Printable, Fillable Blank

Web payment of tax form 7004 does not extend the time to pay any tax due. Generally, form 7004 must be filed on or before the due date of the applicable tax return. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021..

IRS Tax Extension Form 7004 and Form 4868 are Due this April 15

Generally, form 7004 must be filed on or before the due date of the applicable tax return. Web the table below shows the deadline for filing form 7004 for business tax returns. Web for example, if your business tax return is due on march 15, you must submit a fillable form 7004 or printable by that date to receive an.

for How to Fill in IRS Form 7004

Web due dates for form 7004. February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. Fill in your business's name, address, and employer identification. Web you’ll need to file 7004 on or before the due date of the applicable tax return. Web payment of tax form 7004 does.

Form 7004 Automatically Extend Your 1120 Filing Due date IRSForm7004

Web payment of tax form 7004 does not extend the time to pay any tax due. 2 choose your business tax return that you are required to file. Web us based support due date to file business tax extension form 7004 businesses seeking an extension for the tax returns 1120, 1120s, 1065, 1041 and more. Web in part i, indicate.

extension form 7004 for 2022 IRS Authorized

This determines which income tax return you need to file. The extension that this form brings is automatic when properly. Web the table below shows the deadline for filing form 7004 for business tax returns. And for the tax returns such as 1120, 1041 and others. Web the entity must file form 7004 by the due date of the return.

When is Tax Extension Form 7004 Due? Tax Extension Online

Web for example, if your business tax return is due on march 15, you must submit a fillable form 7004 or printable by that date to receive an extension. Web the irs tax form 7004 should be filed on or before the due date of the applicable tax returns. The extension that this form brings is automatic when properly. Web.

Irs Form 7004 amulette

Generally, form 7004 must be filed on or before the due date of the applicable tax return. Web for example, if your business tax return is due on march 15, you must submit a fillable form 7004 or printable by that date to receive an extension. January 6, 2022 | last updated: Web the irs has extended the filing and.

Web 1 Select Your Business Entity Type That The Irs Elected You.

The approval process is automatic, so you won’t receive a confirmation if your. This determines which income tax return you need to file. Generally, payment of any balance due on part ii, line 8, is required by the due date of the return. Partnerships, llcs, and corporations that need extra time to file certain tax documents.

Fill In Your Business's Name, Address, And Employer Identification.

Web in part i, indicate the business entity you are filing for, such as a corporation, partnership, nonprofit, or trust. Generally, form 7004 must be filed on or before the due date of the applicable tax return. Web due dates for form 7004. In the case of s corporations and partnerships, the tax returns are due by march 15th.

2 Choose Your Business Tax Return That You Are Required To File.

Web the table below shows the deadline for filing form 7004 for business tax returns. February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. January 6, 2022 | last updated: Web payment of tax form 7004 does not extend the time to pay any tax due.

Web You’ll Need To File 7004 On Or Before The Due Date Of The Applicable Tax Return.

Web the irs tax form 7004 should be filed on or before the due date of the applicable tax returns. Web for example, if your business tax return is due on march 15, you must submit a fillable form 7004 or printable by that date to receive an extension. The due dates of the returns can be found in. Web us based support due date to file business tax extension form 7004 businesses seeking an extension for the tax returns 1120, 1120s, 1065, 1041 and more.