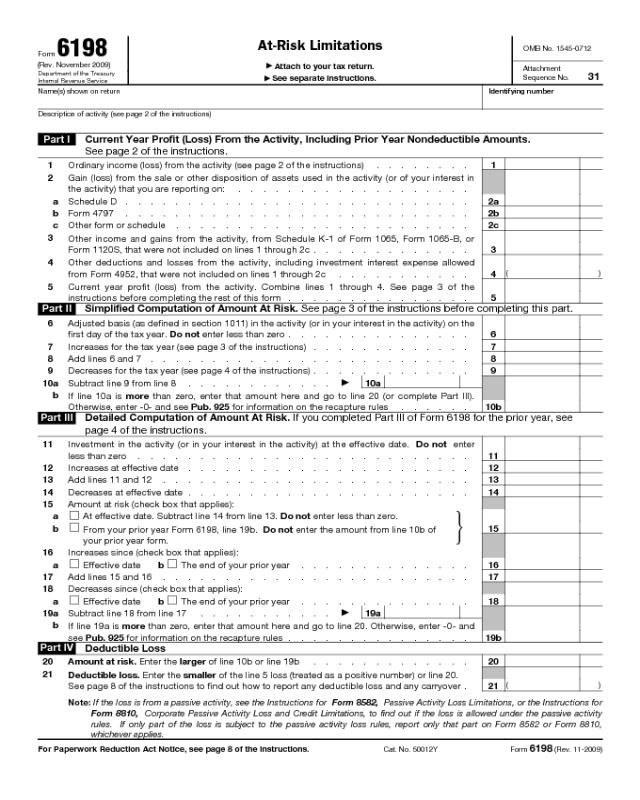

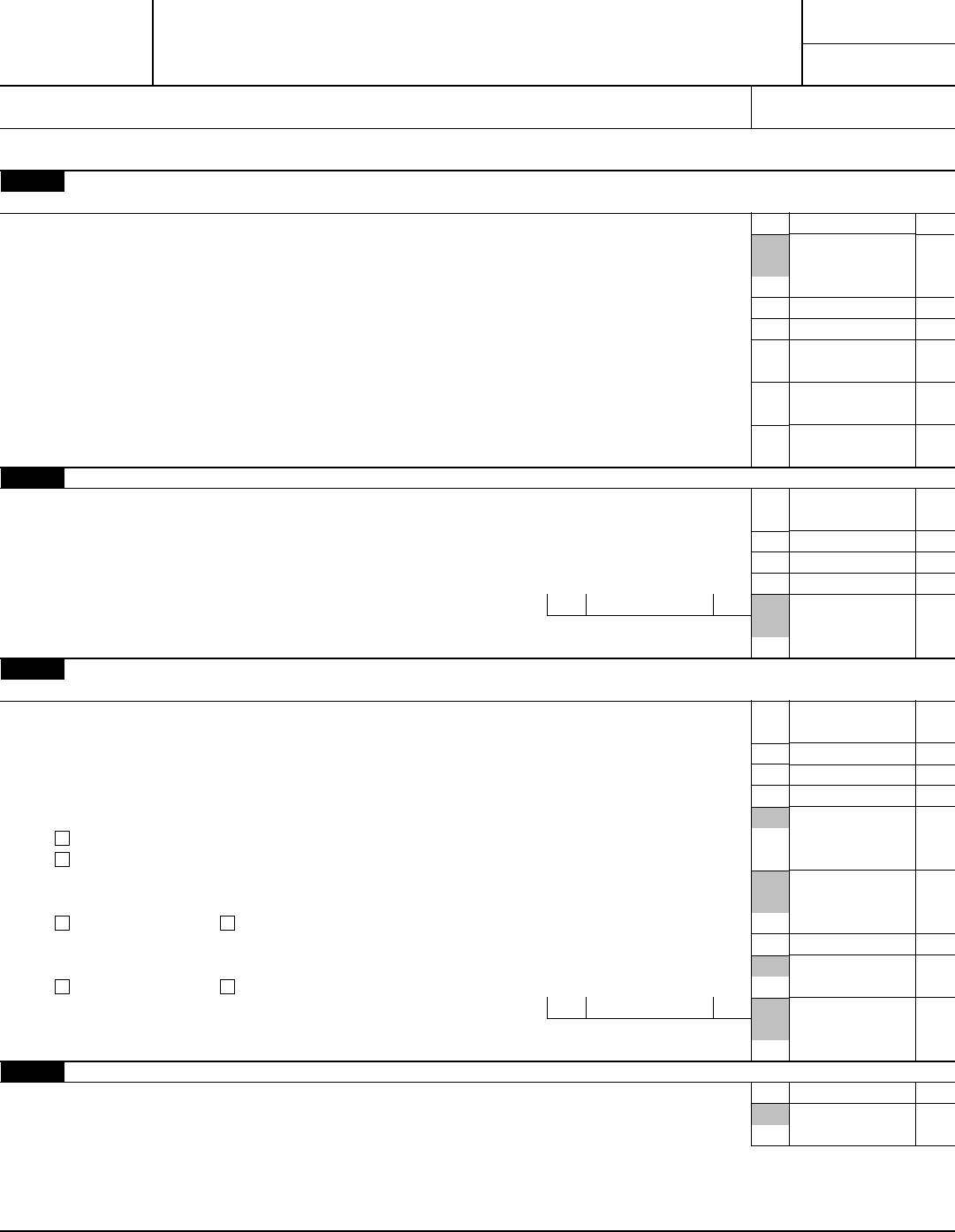

Irs Form 6198

Irs Form 6198 - To www.irs.gov/form6198 for instructions and the latest information. Most investors go into business expecting to make a profit. For instructions and the latest information. Description of activity (see instructions) part i December 2020) department of the treasury internal revenue service. Determine losses for the present year. December 2020) department of the treasury internal revenue service name(s) shown on return go omb no. So if ending capital is negative you're not at. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. Attach to your tax return.

For instructions and the latest information. But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. December 2020) department of the treasury internal revenue service. To www.irs.gov/form6198 for instructions and the latest information. December 2020) department of the treasury internal revenue service name(s) shown on return go omb no. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. Determine losses for the present year. Description of activity (see instructions) part i So if ending capital is negative you're not at.

But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. Attach to your tax return. Determine losses for the present year. Most investors go into business expecting to make a profit. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. Estimate the amount at risk within the business. For instructions and the latest information. December 2020) department of the treasury internal revenue service. To www.irs.gov/form6198 for instructions and the latest information. So if ending capital is negative you're not at.

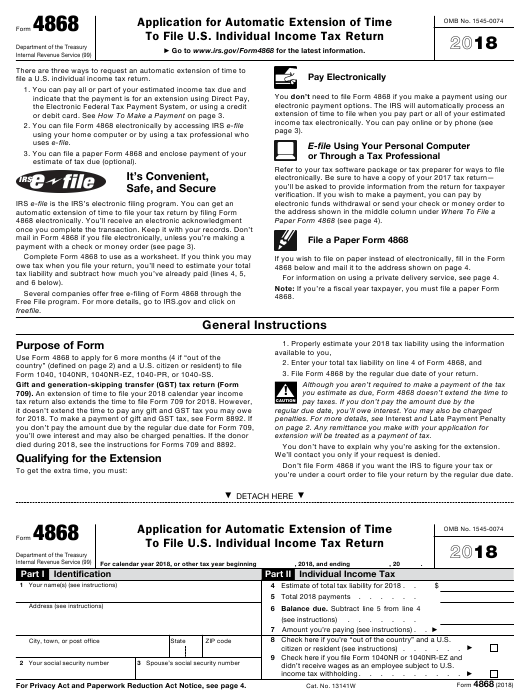

Free Printable Irs Form 4868 Printable Form 2022

But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. So if ending capital is negative you're not at. To www.irs.gov/form6198 for instructions and the latest information. December 2020) department of the treasury internal revenue service. December 2020) department of the treasury internal revenue service name(s) shown on return go omb.

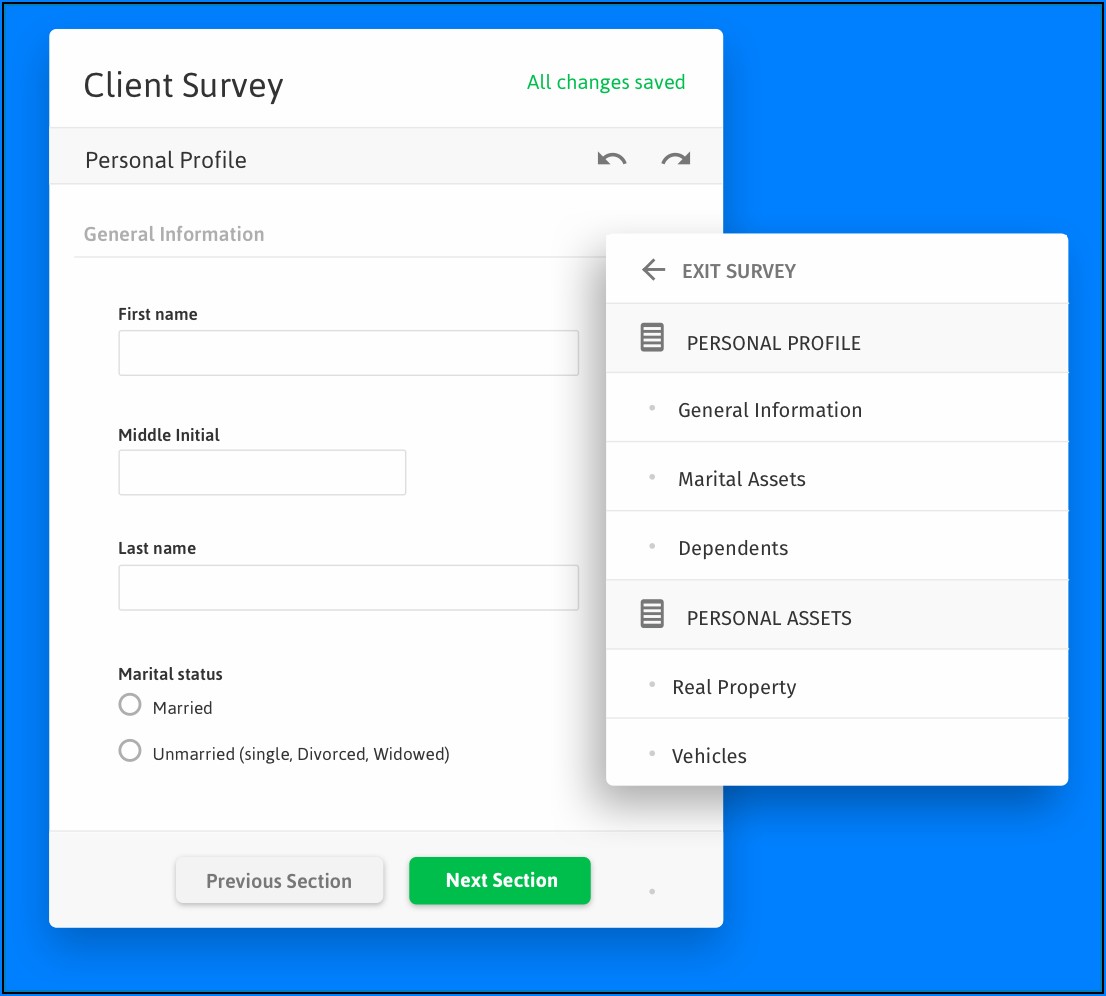

2023 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Estimate the amount at risk within the business. December 2020) department of the treasury internal revenue service. Determine losses for the present year. We have no way of telling if this is the case. Description of activity (see instructions) part i

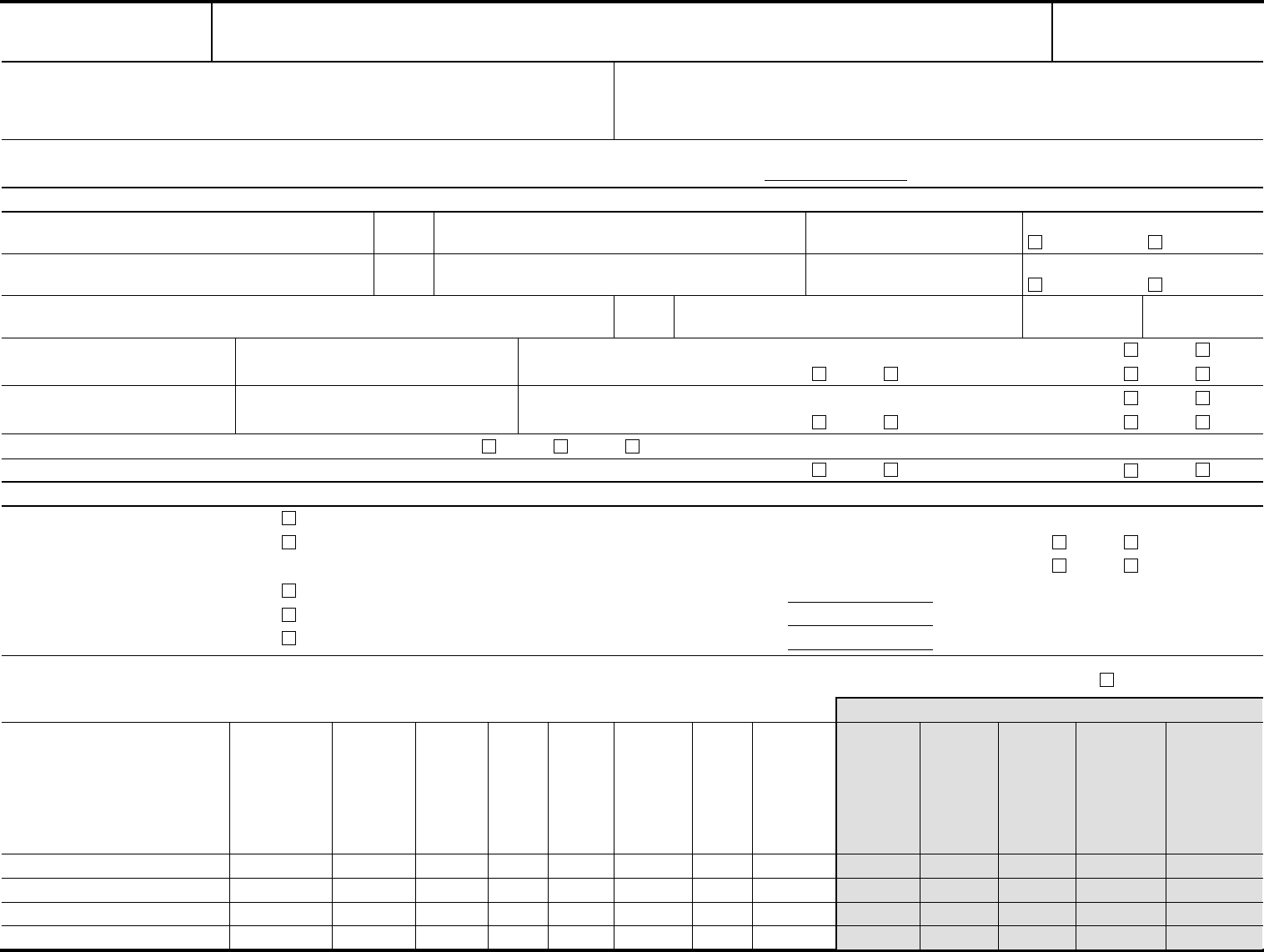

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

December 2020) department of the treasury internal revenue service name(s) shown on return go omb no. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. Description of activity (see instructions) part i Web.

Form 13614C Edit, Fill, Sign Online Handypdf

So if ending capital is negative you're not at. Most investors go into business expecting to make a profit. Description of activity (see instructions) part i We have no way of telling if this is the case. For instructions and the latest information.

Form 6198 Edit, Fill, Sign Online Handypdf

Determine losses for the present year. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. Description of activity (see instructions) part i December 2020) department of the treasury internal revenue service. Most investors.

IRS Tax Form 6198 Guide TFX.tax

December 2020) department of the treasury internal revenue service. But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. To www.irs.gov/form6198 for instructions and the latest information. Description of activity (see instructions) part i Web form 6198 helps you find out the highest amount you'll be able to deduct after facing.

Download IRS Form 5498 for Free FormTemplate

So if ending capital is negative you're not at. Description of activity (see instructions) part i To www.irs.gov/form6198 for instructions and the latest information. Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. For instructions and the latest information.

Solved 1. Relate the following document's facts to the U.S.

But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. Description of activity (see instructions).

IRS Form 6198 Download Fillable PDF or Fill Online AtRisk Limitations

But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. We have no way of telling if this is the case. Attach to your tax return. For instructions and the latest information. So if ending capital is negative you're not at.

Fill Free fillable AtRisk Limitations Form 6198 (Rev. November 2009

Most investors go into business expecting to make a profit. But, when business expenses exceed profits and a loss occurs, a tax deduction may be the only silver lining. Determine losses for the present year. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f.

December 2020) Department Of The Treasury Internal Revenue Service Name(S) Shown On Return Go Omb No.

December 2020) department of the treasury internal revenue service. Determine losses for the present year. Attach to your tax return. To www.irs.gov/form6198 for instructions and the latest information.

For Instructions And The Latest Information.

Web form 6198 helps you find out the highest amount you'll be able to deduct after facing a company loss within the tax year. So if ending capital is negative you're not at. We have no way of telling if this is the case. Description of activity (see instructions) part i

But, When Business Expenses Exceed Profits And A Loss Occurs, A Tax Deduction May Be The Only Silver Lining.

Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a schedule c, schedule e, or schedule f and some or all of their investment is not at risk. Most investors go into business expecting to make a profit. Estimate the amount at risk within the business.