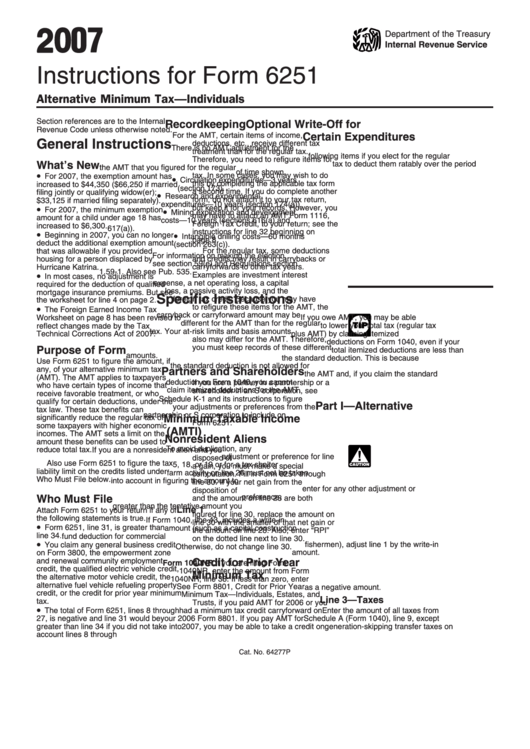

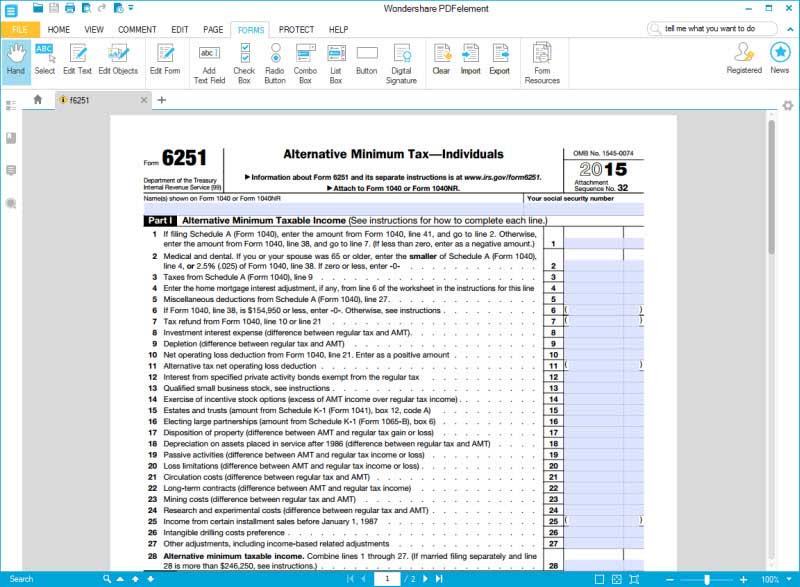

Instructions Form 6251

Instructions Form 6251 - If you need to report any of the following items on your tax return, you must file form 6251, alternative minimum. Fill in form 6251 through minimum taxable any, of. Upload, modify or create forms. A little planning can help you avoid the amt. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). In turbotax online, sign in to your account, select pick up where you left off; Department of the treasury internal revenue service (99) go to. The best way to plan ahead for the amt is to. Web purpose of form at a gain, you must make a special part i—alternative use form 6251 to figure the amount, if computation.

The amt applies to taxpayers who have certain types of income that receive. In turbotax online, sign in to your account, select pick up where you left off; Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. Web purpose of form at a gain, you must make a special part i—alternative use form 6251 to figure the amount, if computation. Web study form 6251 each time you prepare your tax return to see how close you are to paying the amt. Evaluate how close your tentative minimum tax was to your. Department of the treasury internal revenue service (99) alternative minimum tax—individuals. Fill in form 6251 through minimum taxable any, of. You must enclose the completed form 6251 with your form m1. Web attach form 6251 to your return if any of the following statements are true.

Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The amt applies to taxpayers who have certain types of income that receive. Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. Web if form 6251 is required, taxact will populate the form based on your tax items. Web to add form 6251, here are the steps: Upload, modify or create forms. Web purpose of form at a gain, you must make a special part i—alternative use form 6251 to figure the amount, if computation. Information about form 6251 and its separate instructions is at. Try it for free now! Form 6251, line 7, is greater than line 10.

for How to Fill in IRS Form 6251

Web form 6251 with your federal return. Fill in form 6251 through minimum taxable any, of. In order for wealthy individuals to. Try it for free now! Ad access irs tax forms.

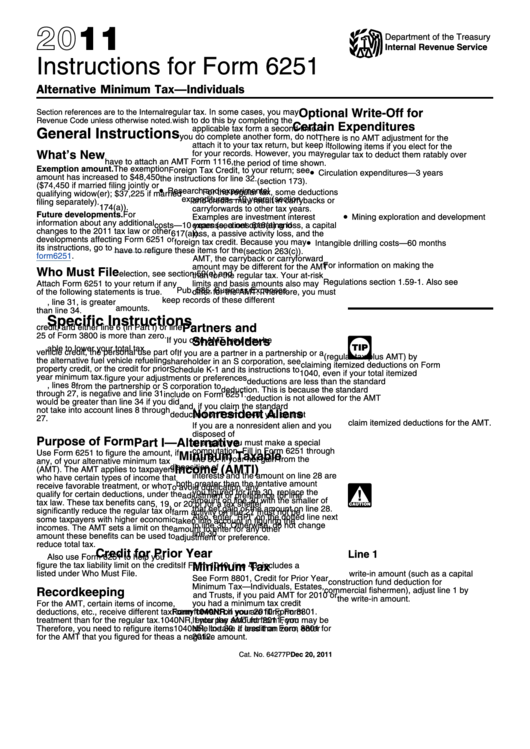

Instructions For Form 6251 Alternative Minimum Tax Individuals

Department of the treasury internal revenue service (99) alternative minimum tax—individuals. Department of the treasury internal revenue service (99) go to. Web you may need to file form 6251 if you have specific amt items. Evaluate how close your tentative minimum tax was to your. Web use form 6251 to figure the amount, if any, of your alternative minimum tax.

form 6251 instructions 2020 2021 Fill Online, Printable, Fillable

Web attach form 6251 to your return if any of the following statements are true. In order for wealthy individuals to. Form 6251, line 7, is greater than line 10. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to. You claim any general business credit, and either.

Dividend Payment Instruction Forms Computershare

Complete, edit or print tax forms instantly. Web study form 6251 each time you prepare your tax return to see how close you are to paying the amt. You must enclose the completed form 6251 with your form m1. Information about form 6251 and its separate instructions is at. In turbotax online, sign in to your account, select pick up.

Worksheet To See If You Should Fill In Form 6251 Fill Online

The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to. Upload, modify or create forms. In turbotax online, sign in to your account, select pick up where you left off; The amt is a separate tax that is imposed in addition to your regular tax. Web purpose of.

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2011

Web form 6251 with your federal return. Department of the treasury internal revenue service (99) go to. Ad access irs tax forms. You must enclose the completed form 6251 with your form m1. On the left menu, select federal;

Worksheet to See if You Should Fill in Form 6251 Line 41

You claim any general business credit, and either. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. In order for wealthy individuals to. Upload, modify or create forms. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt).

Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to. Web study form 6251 each time you prepare your tax return to see how close you are to paying the amt. Get ready for tax season deadlines by completing any required tax forms today. In order for wealthy.

Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

Department of the treasury internal revenue service (99) alternative minimum tax—individuals. Upload, modify or create forms. Web if form 6251 is required, taxact will populate the form based on your tax items. Complete, edit or print tax forms instantly. Web purpose of form at a gain, you must make a special part i—alternative use form 6251 to figure the amount,.

Instructions for How to Fill in IRS Form 6251

Web form 6251 with your federal return. The best way to plan ahead for the amt is to. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Complete, edit or print tax forms instantly. Form 6251, line 7, is greater than line 10.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

A little planning can help you avoid the amt. Web purpose of form at a gain, you must make a special part i—alternative use form 6251 to figure the amount, if computation. Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. Evaluate how close your tentative minimum tax was to your.

Web Study Form 6251 Each Time You Prepare Your Tax Return To See How Close You Are To Paying The Amt.

In turbotax online, sign in to your account, select pick up where you left off; Try it for free now! Web if form 6251 is required, taxact will populate the form based on your tax items. Web calculate your taxable income, but with fewer tax exclusions and tax deductions, as dictated by the amt rules (irs form 6251 has the details on which tax.

Department Of The Treasury Internal Revenue Service (99) Go To.

The amt applies to taxpayers who have certain types of income that receive. If you need to report any of the following items on your tax return, you must file form 6251, alternative minimum. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. The amt is a separate tax that is imposed in addition to your regular tax.

Upload, Modify Or Create Forms.

Department of the treasury internal revenue service (99) alternative minimum tax—individuals. Fill in form 6251 through minimum taxable any, of. Web you may need to file form 6251 if you have specific amt items. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to.