Instructions Form 1116

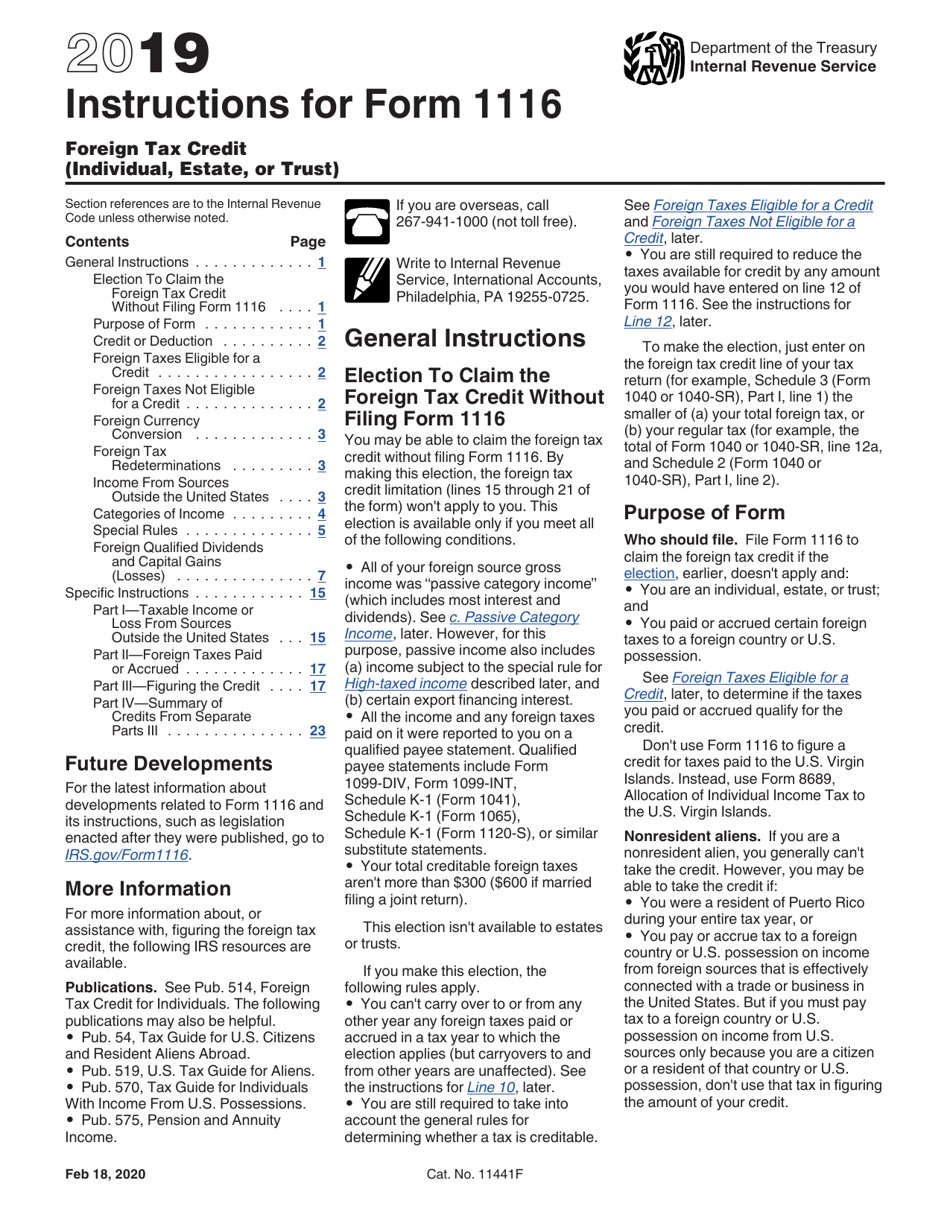

Instructions Form 1116 - And •you paid or accrued certain foreign taxes to a. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116. Web a separate form 1116 must be completed for foreign income from a sanctioned country, using the “section 901(j) income” category. Web per irs instructions for form 1116, on page 16: Web the instructions for form 1116 walk you through each line item and include worksheets. •you are an individual, estate, or trust; This is beyond the scope of the vita/tce. Find out if you qualify for the foreign tax credit to be eligible for the foreign tax credit, four stipulations must be met: Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. The foreign tax credit can be claimed for tax paid.

Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Web form 1116 instructions step one: See the instructions for line 12, later. These two resources can give you all the guidance you need, but we're just going to summarize. Web per irs instructions for form 1116, on page 16: And •you paid or accrued certain foreign taxes to a. Web the instructions for form 1116 walk you through each line item and include worksheets. The foreign tax credit can be claimed for tax paid. •you are an individual, estate, or trust; As shown on page 1 of your tax return.

Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: Web the instructions for form 1116 walk you through each line item and include worksheets. Taxpayers are therefore reporting running. •you are an individual, estate, or trust; Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Credit or deduction instead of claiming. As shown on page 1 of your tax return. Find out if you qualify for the foreign tax credit to be eligible for the foreign tax credit, four stipulations must be met: Web a separate form 1116 must be completed for foreign income from a sanctioned country, using the “section 901(j) income” category. The foreign tax credit can be claimed for tax paid.

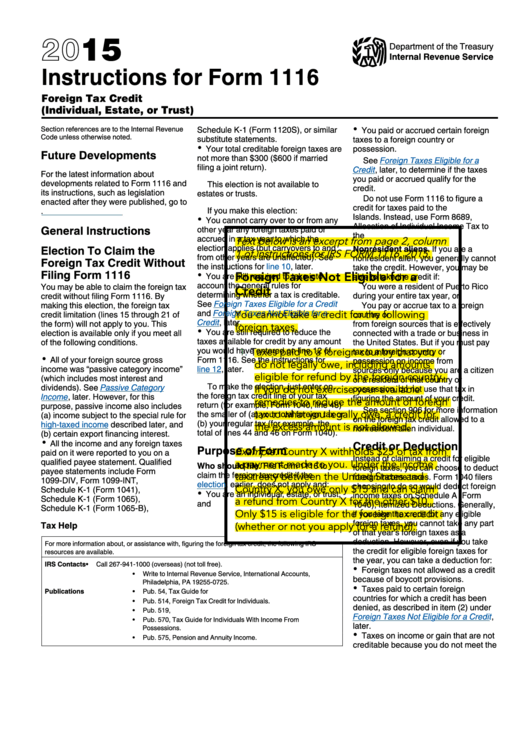

2015 Instructions For Form 1116 printable pdf download

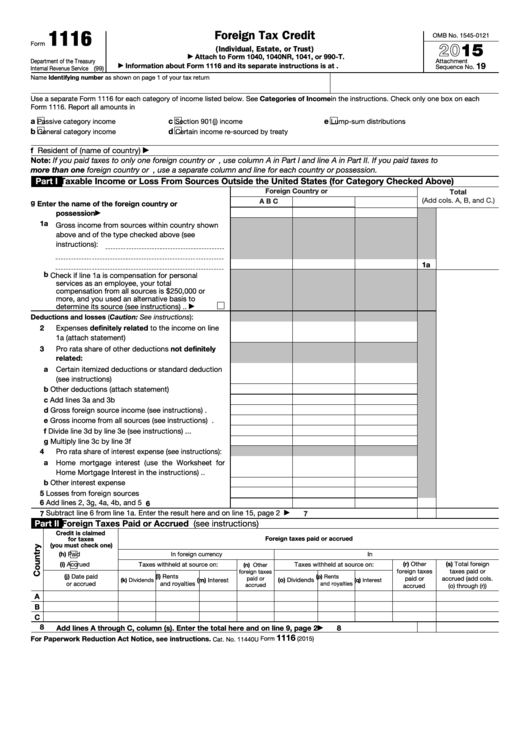

Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: Find out if you qualify for the foreign tax credit to be eligible for the foreign tax credit, four stipulations must be met: Part 1 calculates taxable foreign income part 2 lists taxes paid in both the foreign currency and their equivalent in.

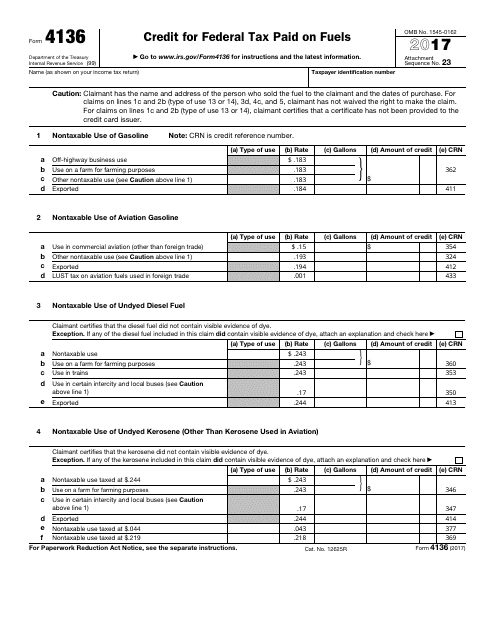

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

•you are an individual, estate, or trust; Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. And •you paid or accrued certain foreign taxes to a. •you are an individual, estate, or trust; The foreign tax credit can be claimed for tax paid.

Fillable Form 1116 Foreign Tax Credit printable pdf download

And •you paid or accrued certain foreign taxes to a. Web form 1116 includes four sections: As shown on page 1 of your tax return. Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: These two resources can give you all the guidance you need, but we're just going to summarize.

Form 1116 part 1 instructions

As shown on page 1 of your tax return. Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form1116. Web for instructions and the latest information. Lines 3d.

Form 1116 Instructions 2021 2022 IRS Forms Zrivo

Find out if you qualify for the foreign tax credit to be eligible for the foreign tax credit, four stipulations must be met: Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Lines 3d and 3e for lines 3d and 3e, gross income means the total of.

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

And •you paid or accrued certain foreign taxes to a. Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: And •you paid or accrued certain foreign taxes to a. Part 1 calculates taxable foreign income part 2 lists taxes paid in both the foreign currency and their equivalent in u.s. To make.

Form 18479 Edit, Fill, Sign Online Handypdf

Web per irs instructions for form 1116, on page 16: Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: The foreign tax credit can be claimed for tax paid. You provide detailed information using each of the form's four sections: Web everyone should utilize instructions to form 1116 and pub 514 ftc.

Foreign Tax Credit Form 1116 Instructions

See the instructions for line 12, later. •you are an individual, estate, or trust; Web form 1116 instructions step one: As shown on page 1 of your tax return. Web per irs instructions for form 1116, on page 16:

Tax form 1116 instructions

Web form 1116 instructions step one: This is beyond the scope of the vita/tce. Web a separate form 1116 must be completed for foreign income from a sanctioned country, using the “section 901(j) income” category. See the instructions for line 12, later. And •you paid or accrued certain foreign taxes to a.

Publication 514, Foreign Tax Credit for Individuals; Simple Example

Web form 1116 instructions step one: This is beyond the scope of the vita/tce. To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i, line. Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: Web a separate form.

And •You Paid Or Accrued Certain Foreign Taxes To A.

Taxpayers are therefore reporting running. Web file form 1116 to claim the foreign tax credit if the election, earlier, doesn't apply and: Find out if you qualify for the foreign tax credit to be eligible for the foreign tax credit, four stipulations must be met: To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i, line.

Generally, If You Take The Described On.

Lines 3d and 3e for lines 3d and 3e, gross income means the total of your gross receipts (reduced by cost of goods sold),. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Web a separate form 1116 must be completed for foreign income from a sanctioned country, using the “section 901(j) income” category. The foreign tax credit can be claimed for tax paid.

Web For Instructions And The Latest Information.

And •you paid or accrued certain foreign taxes to a. As shown on page 1 of your tax return. The foreign tax credit can be claimed for tax paid. Web the instructions for form 1116 walk you through each line item and include worksheets.

You Provide Detailed Information Using Each Of The Form's Four Sections:

This is beyond the scope of the vita/tce. Web everyone should utilize instructions to form 1116 and pub 514 ftc for individuals. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. See the instructions for line 12, later.