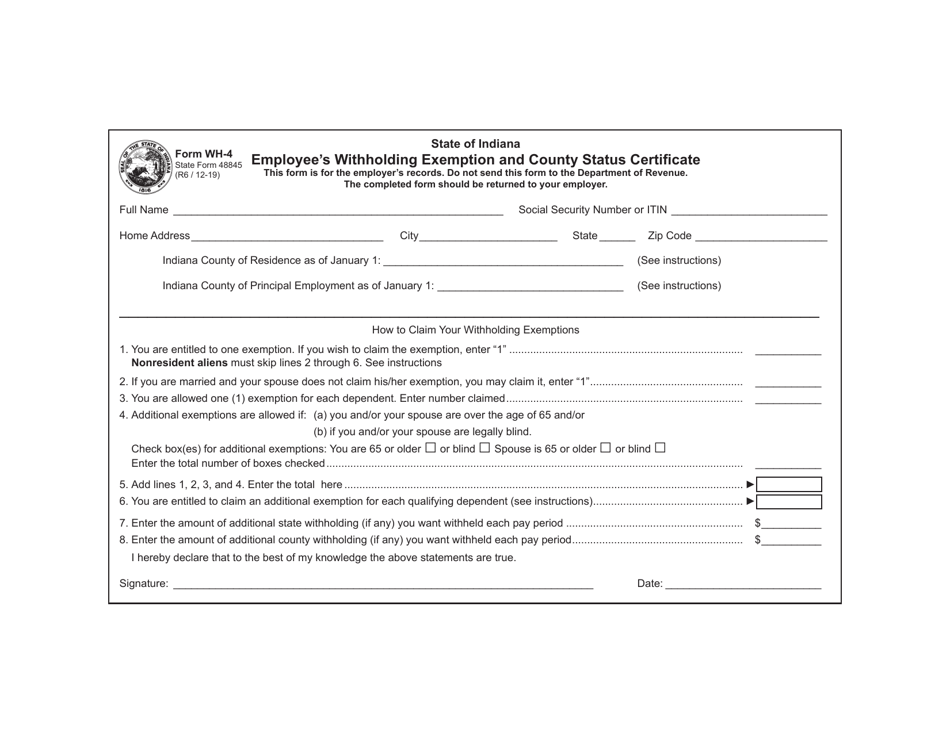

Indiana Form Wh 4

Indiana Form Wh 4 - Instead, there is a five. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Do not send this form to the. The first question is 1. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. You are entitled to one exemption. Print or type your full name, social. The new form no longer uses withholding allowances. Web send wh 4 form 2019 via email, link, or fax.

If too little is withheld, you will generally owe tax when you file your tax return. The new form no longer uses withholding allowances. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. In addition, the employer should look at. You can also download it, export it or print it out. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. Print or type your full name, social. You are entitled to one exemption. If too little is withheld, you will generally owe tax when. Instead, there is a five.

If too little is withheld, you will generally owe tax when you file your tax return. Print or type your full name, social. If too little is withheld, you will generally owe tax when. In addition, the employer should look at. The new form no longer uses withholding allowances. You are entitled to one exemption. Web send wh 4 form 2019 via email, link, or fax. Edit your 2019 indiana state withholding form online. You can also download it, export it or print it out. Table b is used to figure additional dependent exemptions.

1996 IN Form 46800 Fill Online, Printable, Fillable, Blank pdfFiller

Do not send this form to the. In addition, the employer should look at. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. Edit your 2019 indiana state withholding form online.

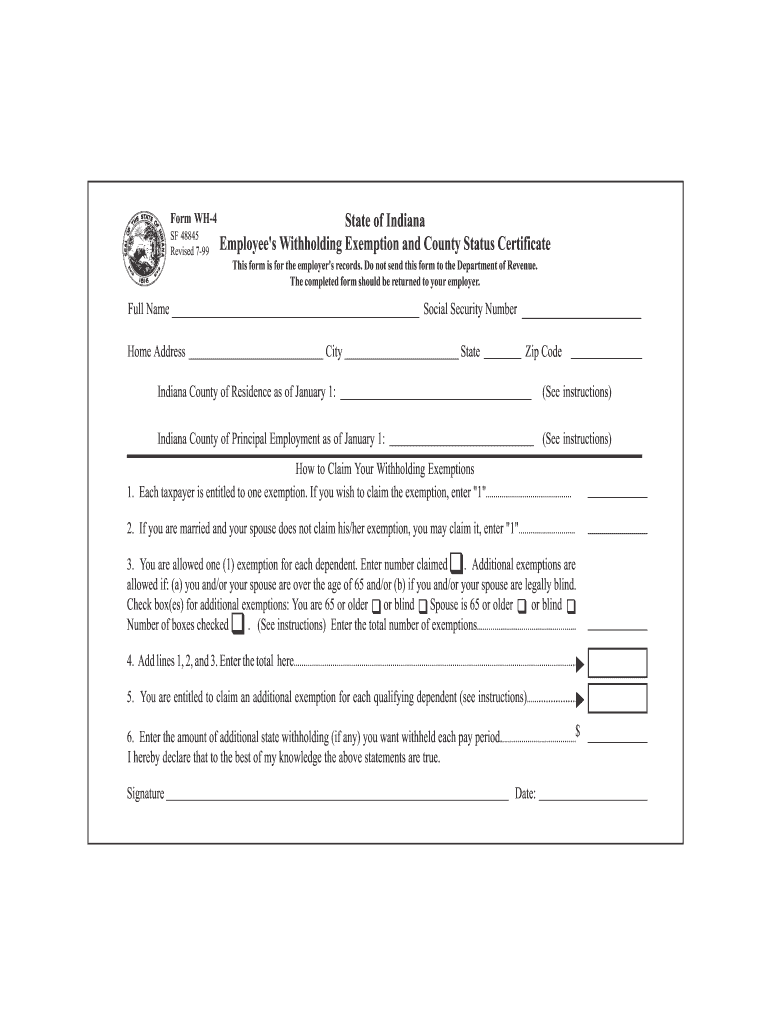

IN Form WH4 1999 Fill and Sign Printable Template Online US Legal

Print or type your full name, social. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. Print or type your full name, social. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web send wh 4 form 2019 via email, link, or fax.

Indiana State Form 1940 Fill Online, Printable, Fillable, Blank

Instead, there is a five. In addition, the employer should look at. Do not send this form to the. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. Web send wh 4 form 2019 via email, link, or fax.

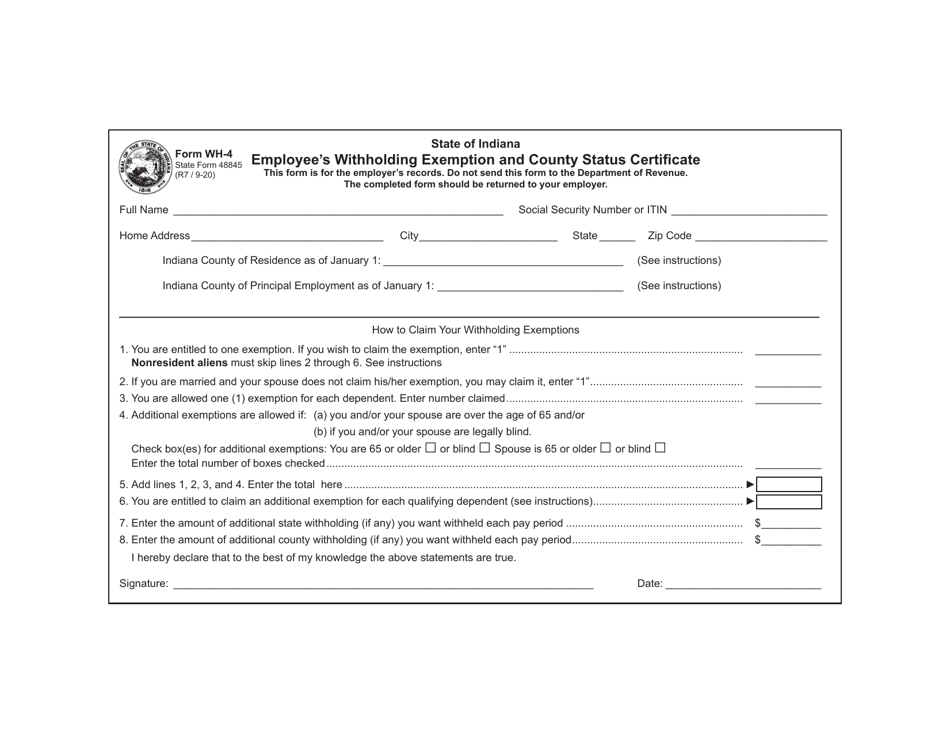

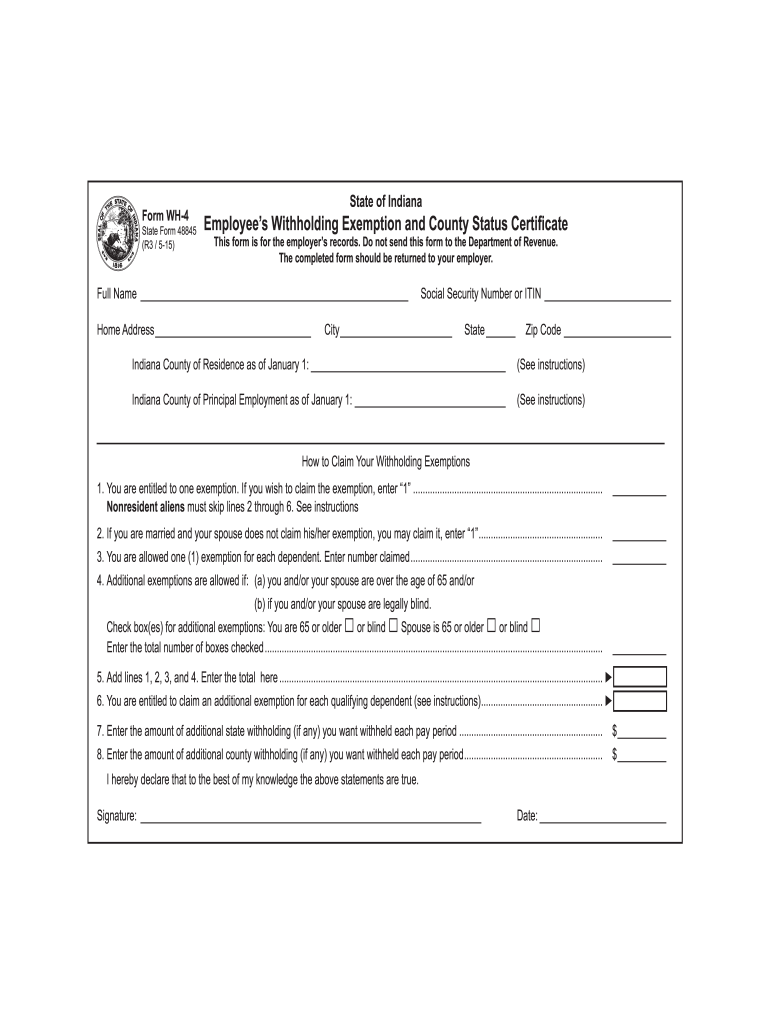

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

Do not send this form to the. The new form no longer uses withholding allowances. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Instead, there is a five. Print or type your full name, social.

Download Form WH4 State of Indiana for Free TidyTemplates

In addition, the employer should look at. The first question is 1. Print or type your full name, social. Instead, there is a five. If too little is withheld, you will generally owe tax when.

Certificate Of Residence {WH47} Indiana

Edit your 2019 indiana state withholding form online. You are entitled to one exemption. Instead, there is a five. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government.

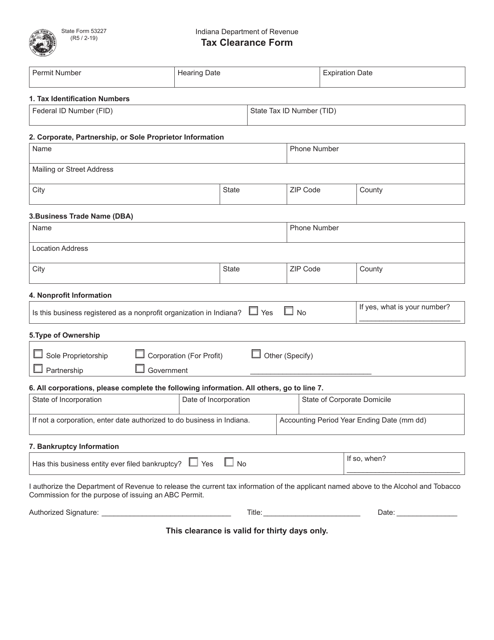

State Form 53227 Download Fillable PDF or Fill Online Tax Clearance

The first question is 1. If too little is withheld, you will generally owe tax when you file your tax return. Web send wh 4 form 2019 via email, link, or fax. Table b is used to figure additional dependent exemptions. In addition, the employer should look at.

Form wh 4 2019 indiana Fill Out and Sign Printable PDF Template SignNow

If too little is withheld, you will generally owe tax when. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Do not send this form to the. The first question is 1. Table b is used to figure additional dependent exemptions.

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

Table b is used to figure additional dependent exemptions. Do not send this form to the. Print or type your full name, social. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. You are entitled to one exemption.

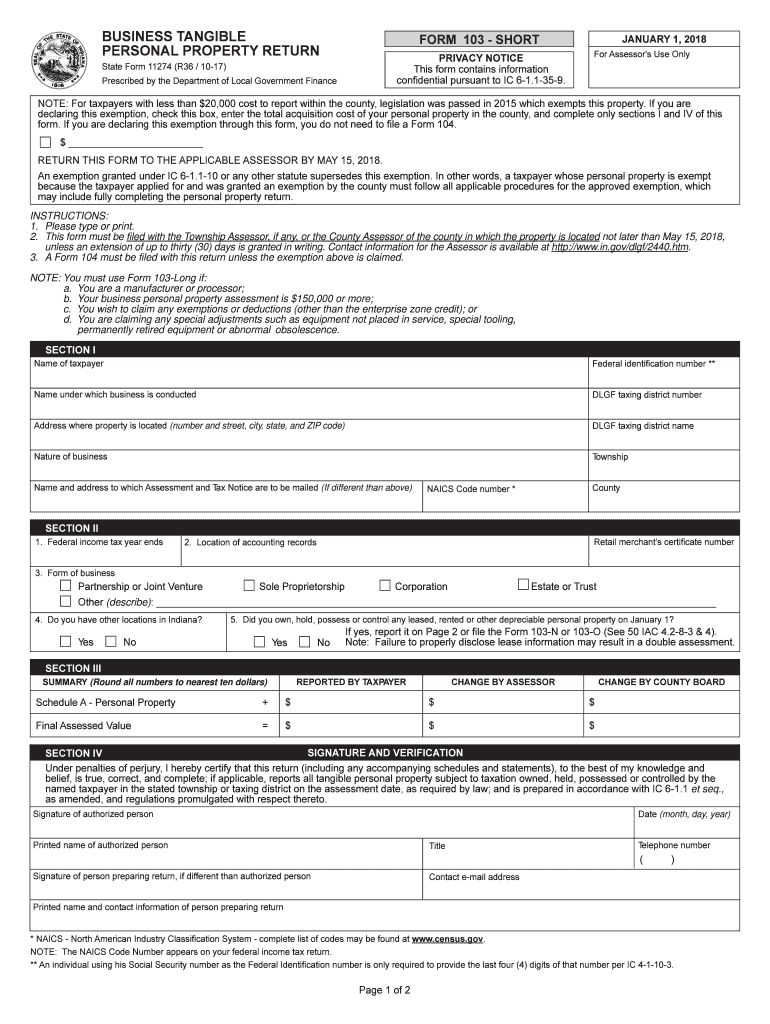

Indiana Form 11274 Fill Out and Sign Printable PDF Template signNow

The first question is 1. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Do not send this form to the. Web send wh 4 form 2019 via email, link, or fax. Table b is used to figure additional dependent exemptions.

The First Question Is 1.

In addition, the employer should look at. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. If too little is withheld, you will generally owe tax when you file your tax return.

Do Not Send This Form To The.

Edit your 2019 indiana state withholding form online. Print or type your full name, social. Web send wh 4 form 2019 via email, link, or fax. Instead, there is a five.

Table B Is Used To Figure Additional Dependent Exemptions.

You are entitled to one exemption. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. You can also download it, export it or print it out. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax.

The New Form No Longer Uses Withholding Allowances.

If too little is withheld, you will generally owe tax when. Print or type your full name, social.