Indiana Form Sc-40 2022

Indiana Form Sc-40 2022 - Web see individual tax forms for 2022. Indiana department of revenue p.o. Sign up and sign in. Web adhere to this straightforward instruction to redact sc 40 tax form 2021 in pdf format online at no cost: Unified tax credit for the elderly: Web individual income tax forms. Who may use this form to claim the unifi ed tax credit. Web this schedule, or a statement showing the same information, must be filed with the contributor’s income tax return. Web returns should be mailed to one of the following addresses: You may be able to claim the unified tax credit for the elderly if you or your spouse meet all the following.

2005 unified tax credit for the elderly married claimants must file jointly do not write above you must file this form by. Web 68 rows form code form name ; Web individual income tax forms. Prior year tax forms can be found in the indiana state prior. To download a form, click on the form name in the left column in the tables below. Web this schedule, or a statement showing the same information, must be filed with the contributor’s income tax return. Web the national average price for a gallon of regular gasoline surged by 4 cents on tuesday to $3.64, according to aaa. Check box if you were age 65 or older by dec. Unified tax credit for the elderly: Web adhere to this straightforward instruction to redact sc 40 tax form 2021 in pdf format online at no cost:

Web 68 rows form code form name ; To download a form, click on the form name in the left column in the tables below. Web adhere to this straightforward instruction to redact sc 40 tax form 2021 in pdf format online at no cost: Web individual income tax forms. Register for a free account, set a strong password, and. Unified tax credit for the elderly. The easiest way to complete a filing is to file your individual income taxes online. You may be able to claim the unified tax credit for the elderly if you or your spouse meet all the following. 2005 unified tax credit for the elderly married claimants must file jointly do not write above you must file this form by. Web returns should be mailed to one of the following addresses:

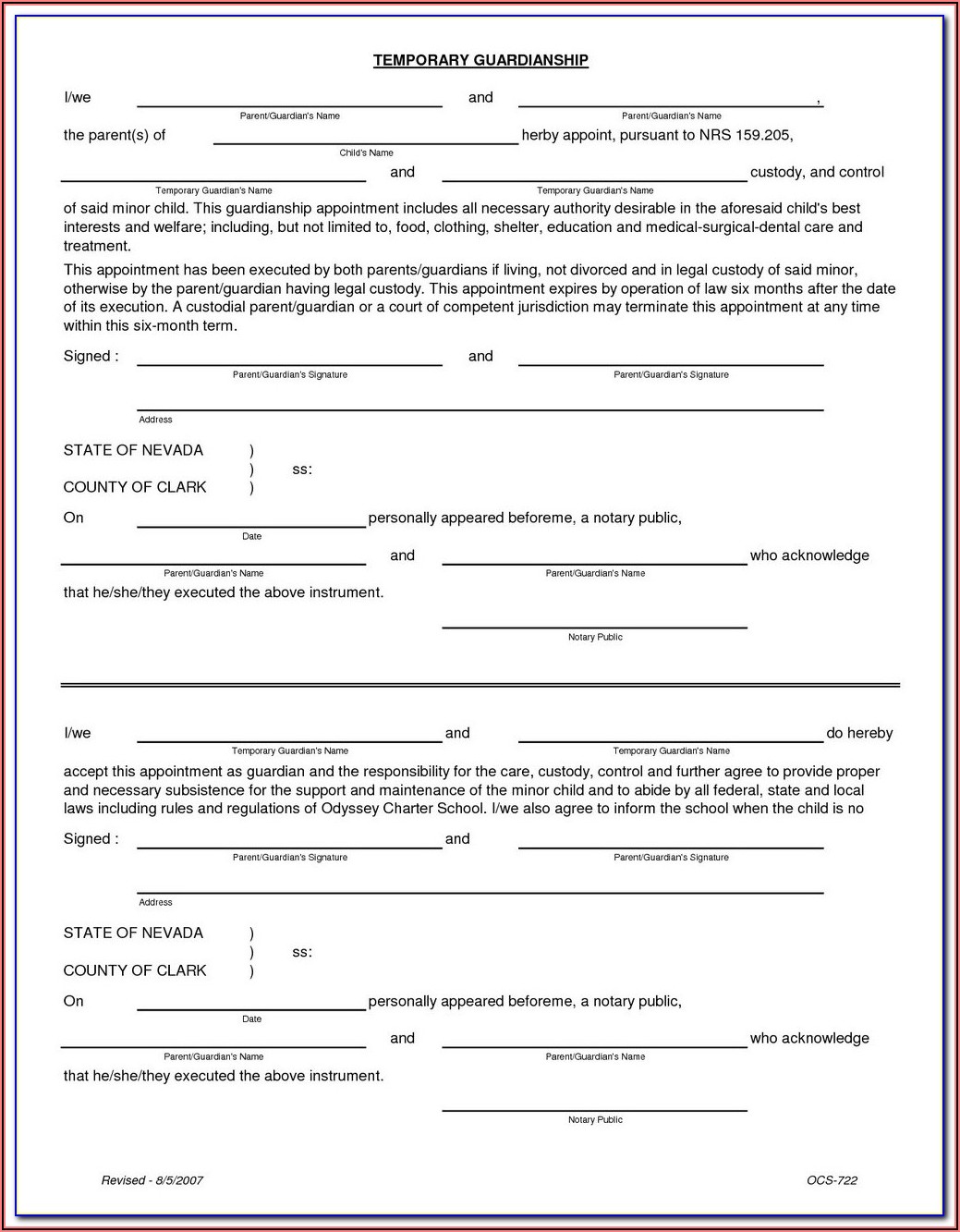

Indiana Dot Cdl Physical Form Form Resume Examples goVLdXJgVv

Unified tax credit for the elderly. You may be able to claim the unified tax credit for the elderly if you or your spouse meet all the following. Web the national average price for a gallon of regular gasoline surged by 4 cents on tuesday to $3.64, according to aaa. Web adhere to this straightforward instruction to redact sc 40.

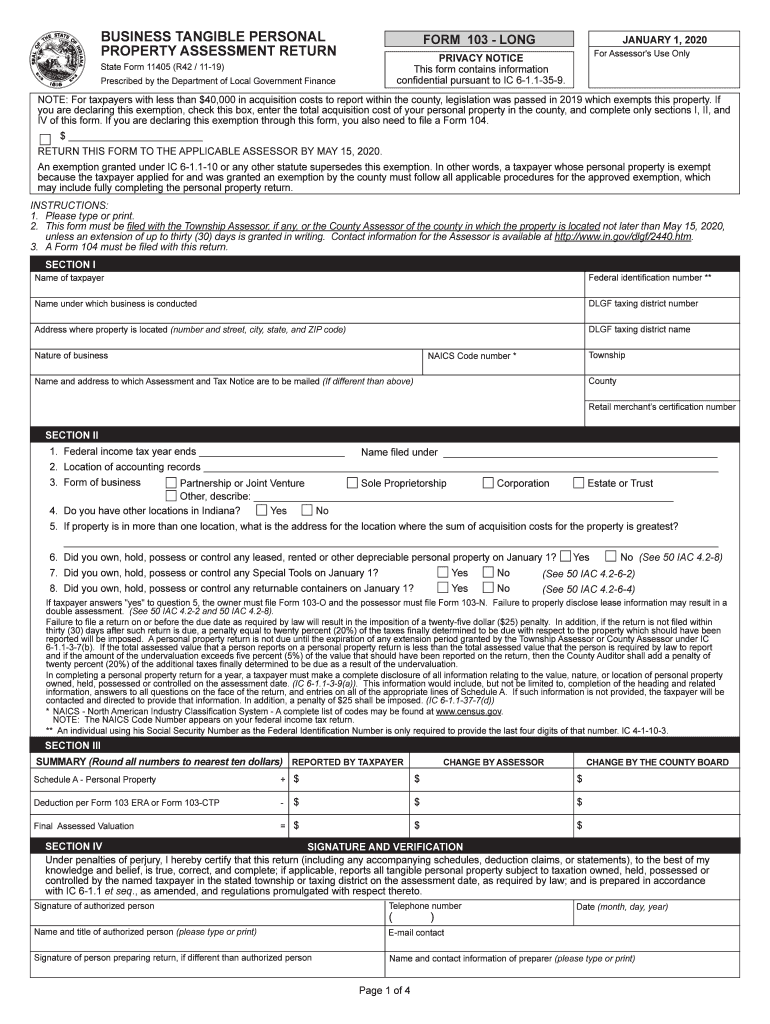

Rutherford County Tangible Personal Property Online Fill Out and Sign

2005 unified tax credit for the elderly married claimants must file jointly do not write above you must file this form by. Web this schedule, or a statement showing the same information, must be filed with the contributor’s income tax return. Web returns should be mailed to one of the following addresses: Refunds are issued in a matter of. Unified.

20142021 IN Form 20070 Fill Online, Printable, Fillable, Blank pdfFiller

Indiana department of revenue p.o. Web the national average price for a gallon of regular gasoline surged by 4 cents on tuesday to $3.64, according to aaa. Refunds are issued in a matter of. Prior year tax forms can be found in the indiana state prior. Who may use this form to claim the unifi ed tax credit.

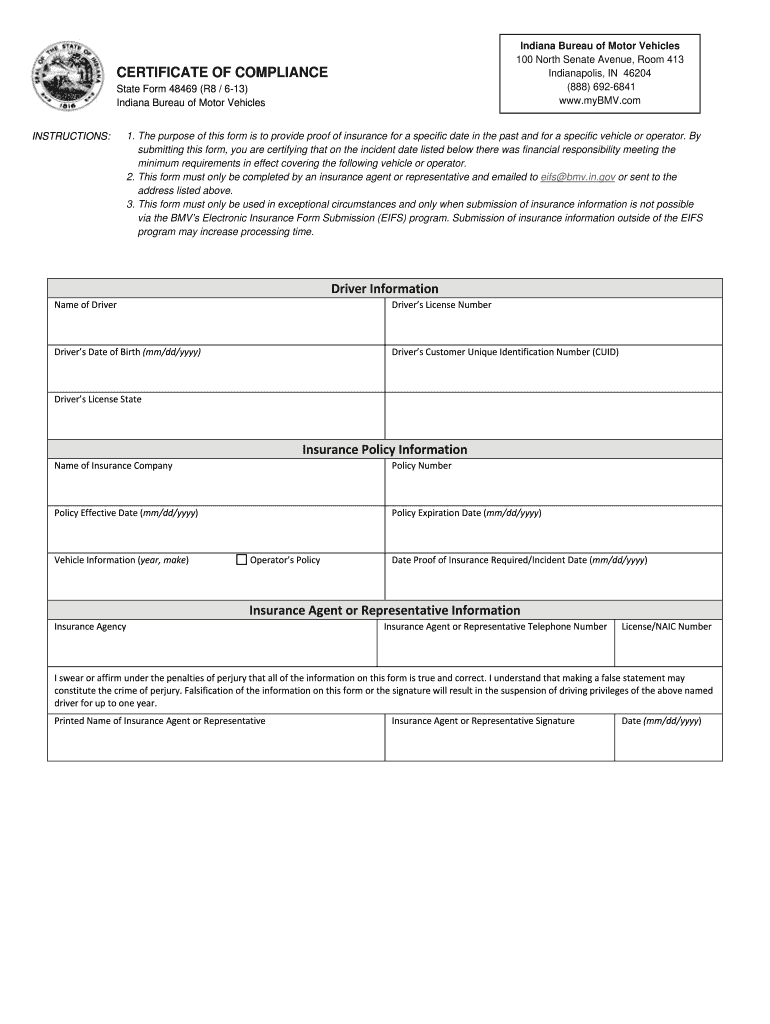

Certificate Of Compliance Indiana Fill Online, Printable, Fillable

Unified tax credit for the elderly. The easiest way to complete a filing is to file your individual income taxes online. Web individual income tax forms. Indiana department of revenue p.o. Web 68 rows form code form name ;

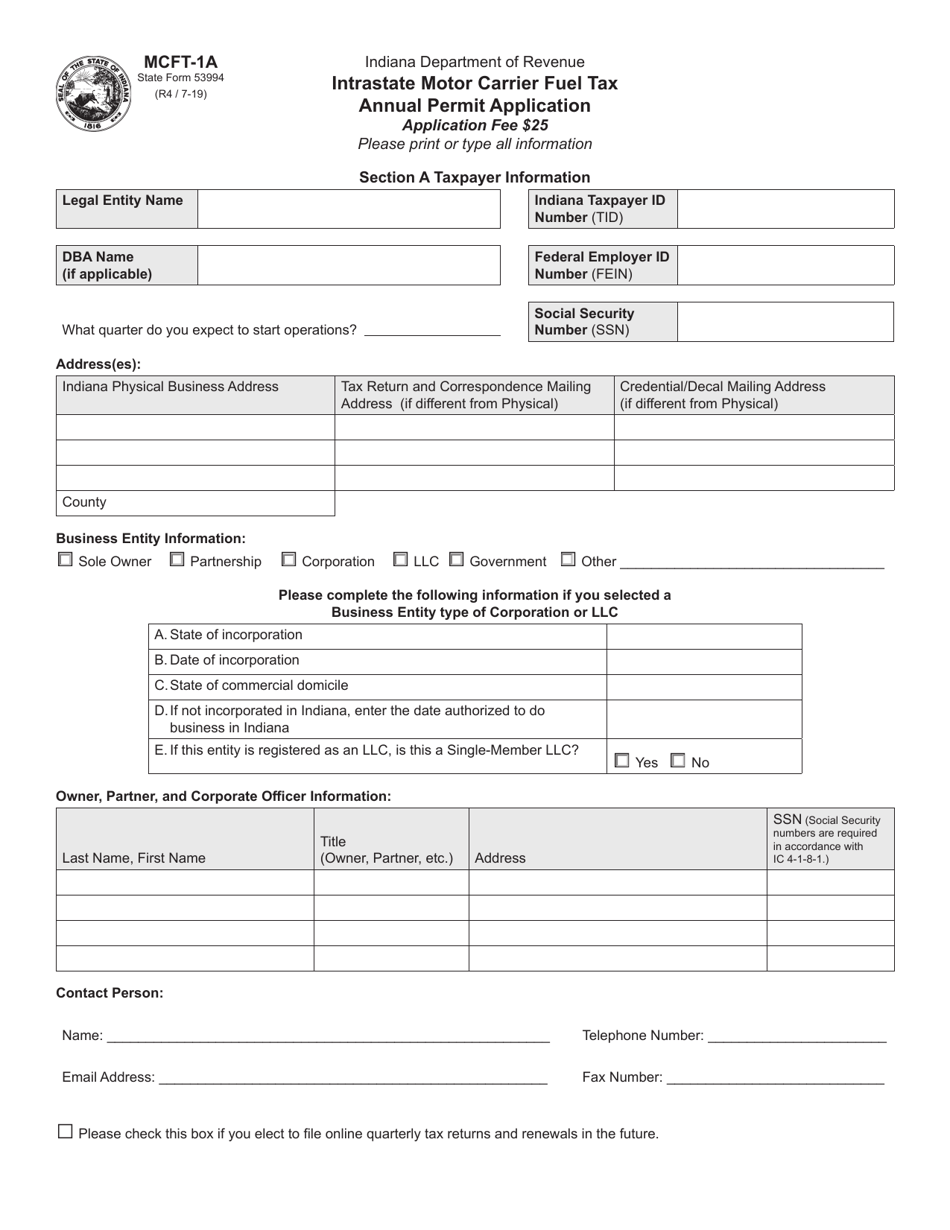

Form MCFT1A (State Form 53994) Download Fillable PDF or Fill Online

Web individual income tax forms. Sign up and sign in. You may be able to claim the unified tax credit for the elderly if you or your spouse meet all the following. Unified tax credit for the elderly. Prior year tax forms can be found in the indiana state prior.

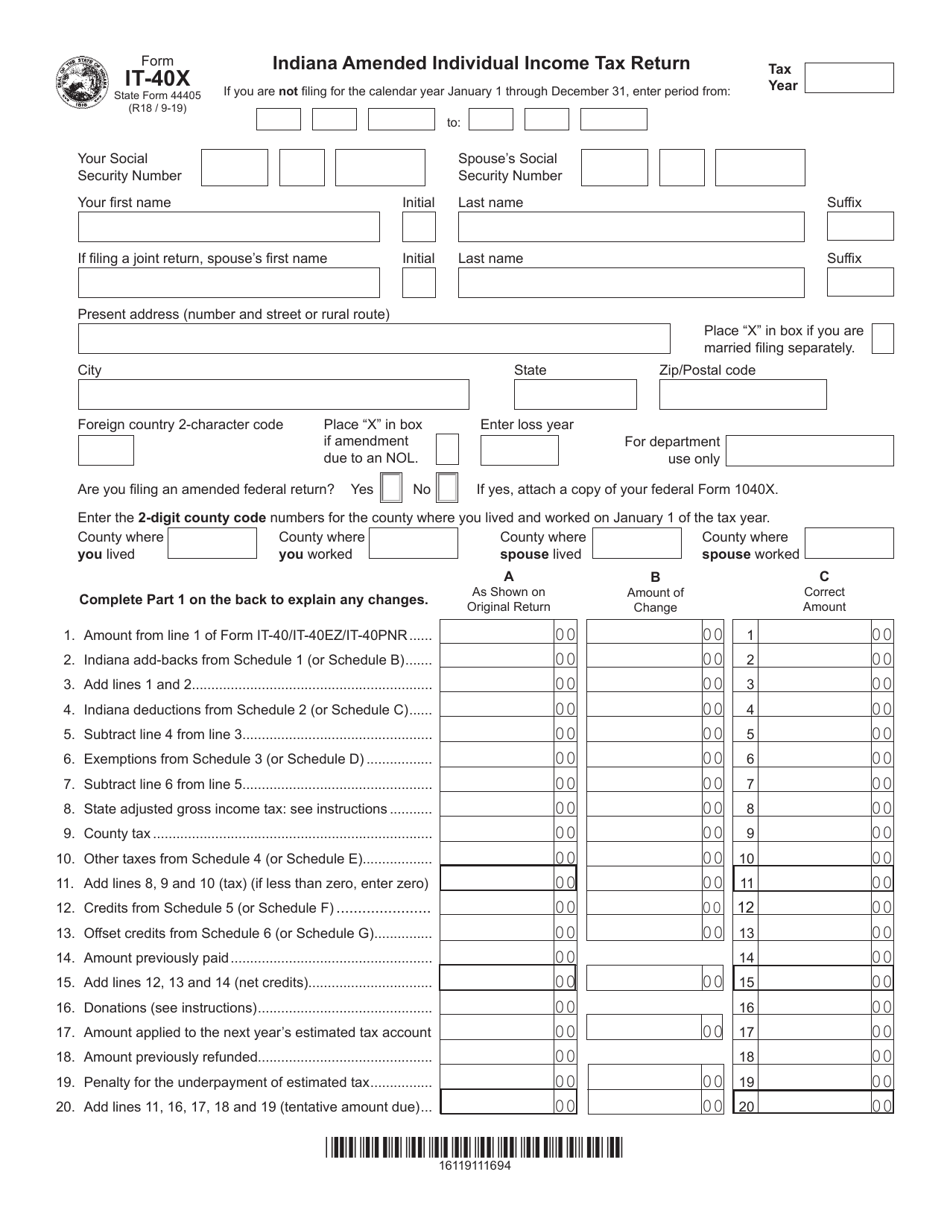

Form IT40X (State Form 44405) Download Fillable PDF or Fill Online

Register for a free account, set a strong password, and. Unified tax credit for the elderly: Refunds are issued in a matter of. Who may use this form to claim the unifi ed tax credit. Web 68 rows form code form name ;

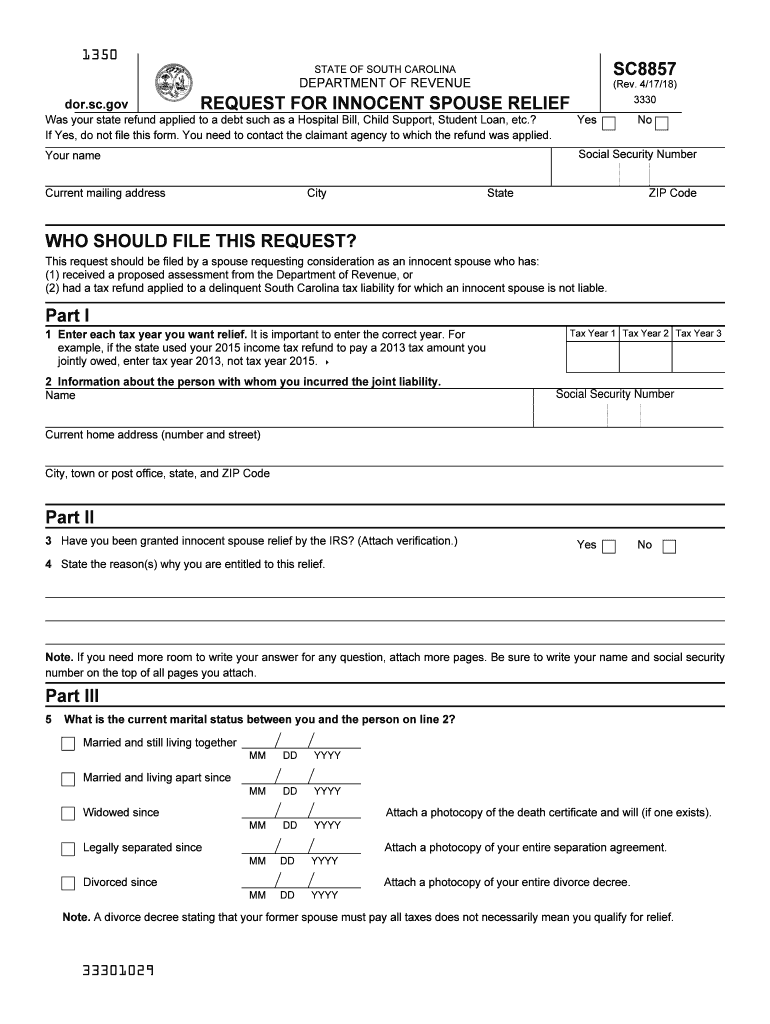

20182022 Form SC SC8857 Fill Online, Printable, Fillable, Blank

Who may use this form to claim the unifi ed tax credit. Refunds are issued in a matter of. Sign up and sign in. Check box if you were age 65 or older by dec. Indiana department of revenue p.o.

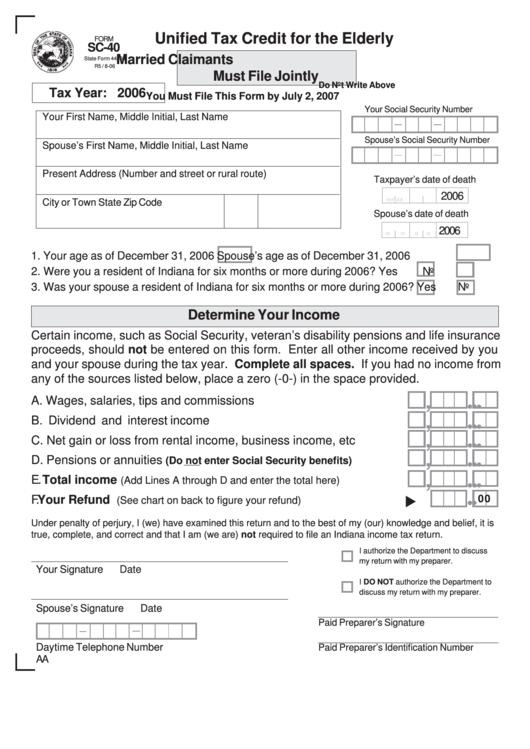

Form Sc40 Unified Tax Credit For The Elderly State Of Indiana

Refunds are issued in a matter of. Who may use this form to claim the unifi ed tax credit. Web see individual tax forms for 2022. To download a form, click on the form name in the left column in the tables below. The easiest way to complete a filing is to file your individual income taxes online.

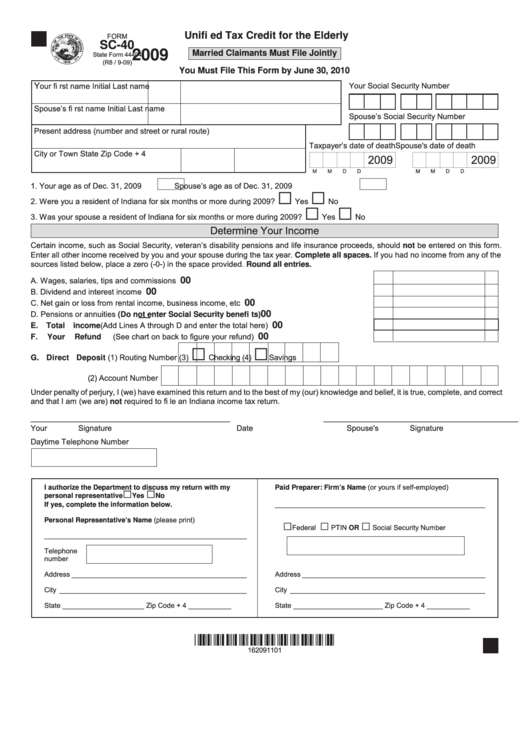

Fillable Form Sc40 Unified Tax Credit For The Elderly 2009

Web this schedule, or a statement showing the same information, must be filed with the contributor’s income tax return. Sign up and sign in. Web 68 rows form code form name ; If you are including payment: Refunds are issued in a matter of.

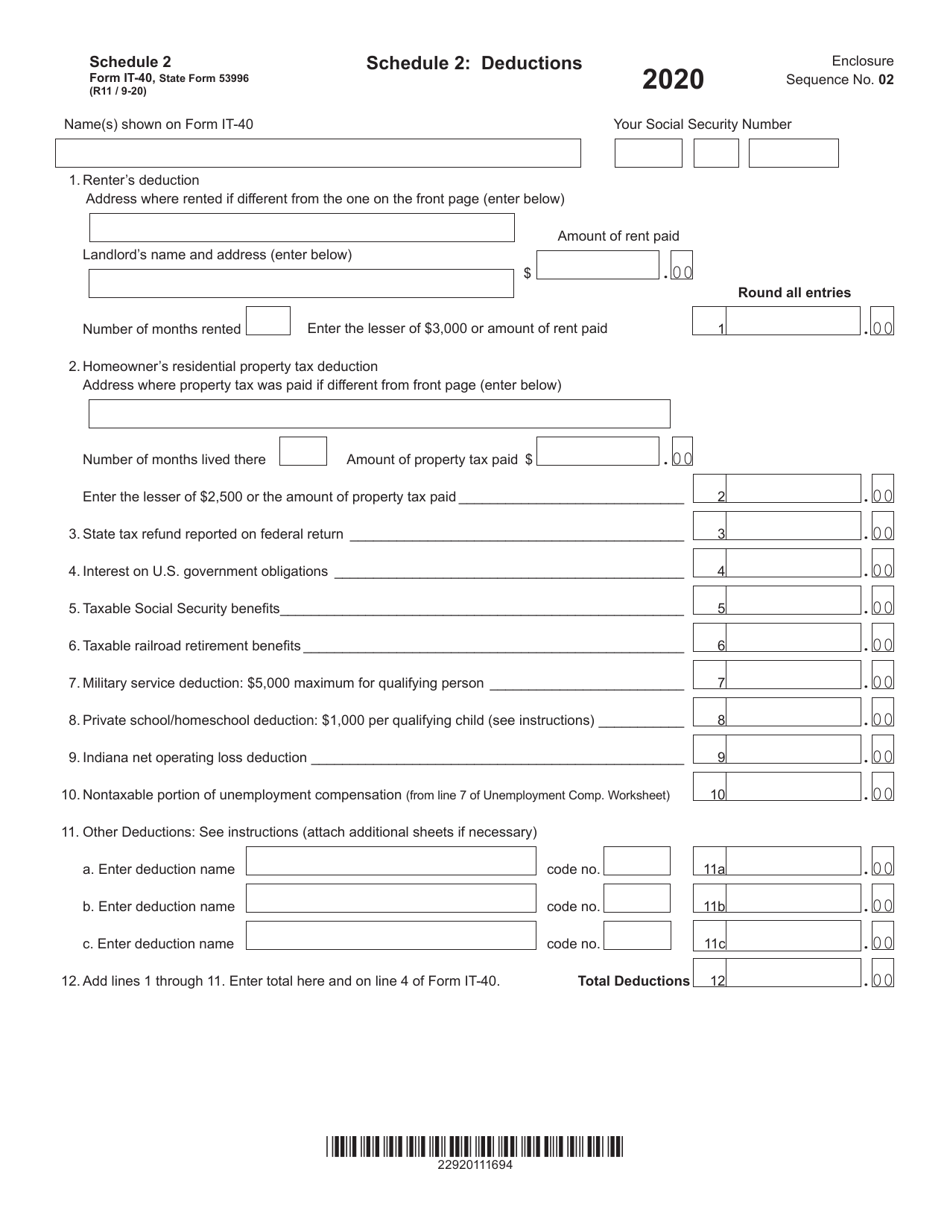

Form IT40 (State Form 53996) Schedule 2 Download Fillable PDF or Fill

Web this schedule, or a statement showing the same information, must be filed with the contributor’s income tax return. Sign up and sign in. 2005 unified tax credit for the elderly married claimants must file jointly do not write above you must file this form by. Register for a free account, set a strong password, and. Unified tax credit for.

Unified Tax Credit For The Elderly:

Web this schedule, or a statement showing the same information, must be filed with the contributor’s income tax return. Refunds are issued in a matter of. Who may use this form to claim the unifi ed tax credit. Web individual income tax forms.

Web Adhere To This Straightforward Instruction To Redact Sc 40 Tax Form 2021 In Pdf Format Online At No Cost:

2005 unified tax credit for the elderly married claimants must file jointly do not write above you must file this form by. Indiana department of revenue p.o. You may be able to claim the unified tax credit for the elderly if you or your spouse meet all the following. If you are including payment:

The Easiest Way To Complete A Filing Is To File Your Individual Income Taxes Online.

Sign up and sign in. Web the national average price for a gallon of regular gasoline surged by 4 cents on tuesday to $3.64, according to aaa. Web returns should be mailed to one of the following addresses: Prior year tax forms can be found in the indiana state prior.

Register For A Free Account, Set A Strong Password, And.

Check box if you were age 65 or older by dec. Unified tax credit for the elderly. Web 68 rows form code form name ; Web see individual tax forms for 2022.