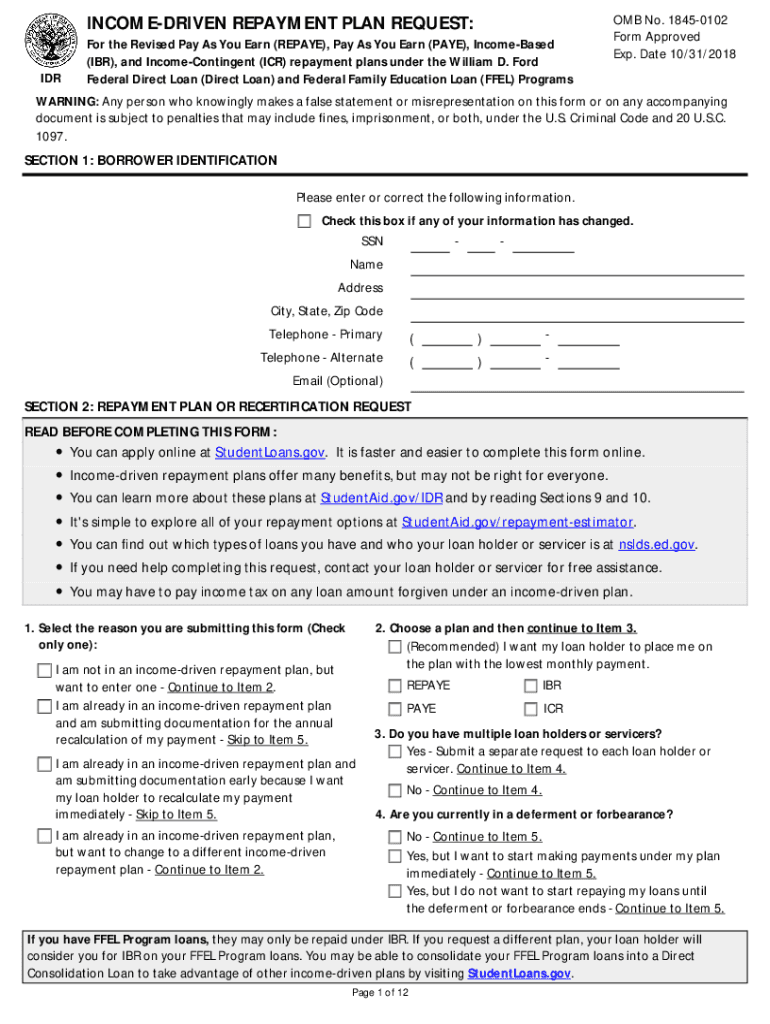

Income Driven Repayment Idr Plan Request Form

Income Driven Repayment Idr Plan Request Form - Generally 10% of a borrower's discretionary income if they were a new borrower on or after july 1, 2014, and never. Annual recertification of income and. On april 19, 2022, the u.s. Web your loans must be federal direct loans. Supporting documentation may also be required. If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. If you are already enrolled in an idr plan,. Web 1 day agothe new idr plan decreases the percentage of discretionary income borrowers would need to repay, and cuts the repayment period for some borrowers (those who. Web the idr recertification form requires you to submit the following information: Department of education (ed) announced several changes and.

Web the idr plan request form allows you to apply, renew, or update your student loan payment using revised pay as you earn (repaye), pay as you earn. Supporting documentation may also be required. Supreme court ruling upsetting thousands of student loan borrowers, the u.s. Generally 10% of a borrower's discretionary income if they were a new borrower on or after july 1, 2014, and never. Web the idr recertification form requires you to submit the following information: Web your loans must be federal direct loans. Select the reason you are submitting this form (check only one): If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. If you are already enrolled in an idr plan,. On april 19, 2022, the u.s.

Web the form approved: Supreme court ruling upsetting thousands of student loan borrowers, the u.s. I am submitting documentation for the annual. Department of education (ed) announced several changes and. If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. Supporting documentation may also be required. Web the idr recertification form requires you to submit the following information: This is the only idr plan your ffflp loans with navient are. Select the reason you are submitting this form (check only one): If you are already enrolled in an idr plan,.

How to Recertify Your Repayment Plan Application

The pause on interest and payments is. Every student succeeds act (essa) ferpa. To estimate your monthly payment under idr, log in to your nelnet.com account. Get form include fines, imprisonment, or. I am submitting documentation for the annual.

Driven Repayment Plan Request Form PASIVINCO

Web 1 day agothe new save plan will replace the revised pay as you earn repayment (repaye) plan, one of the most widely used of the four idr options available to. Web the idr recertification form requires you to submit the following information: Web 1 day agoin the wake of last month’s supreme court decision striking down the biden administration.

Driven Repayment Plan Form What is a Financial Plan

Supreme court ruling upsetting thousands of student loan borrowers, the u.s. Check that you are recertifying your loans rather than filing a new. Annual recertification of income and. Generally 10% of a borrower's discretionary income if they were a new borrower on or after july 1, 2014, and never. Web how do i find.?

Repayment Plan Form Fill Online, Printable, Fillable, Blank pdfFiller

Every student succeeds act (essa) ferpa. If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. Get form include fines, imprisonment, or. Web the idr plan request form allows you to apply, renew, or update your student loan payment using revised pay as you earn (repaye), pay as you earn. Web 1.

Driven Repayment Plan Request Form Fedloan PASIVINCO

If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. Get form include fines, imprisonment, or. Select the reason you are submitting this form (check only one): Web 1 day agoin the wake of last month’s supreme court decision striking down the biden administration sweeping student loan forgiveness plan, the president unveiled.

2015 Form ED IDR Fill Online, Printable, Fillable, Blank pdfFiller

Web the form approved: On april 19, 2022, the u.s. Check that you are recertifying your loans rather than filing a new. Web your loans must be federal direct loans. If you are already enrolled in an idr plan,.

Fill Free fillable Form Approved REPAYMENT (IDR) PLAN

Web the form approved: If you are already enrolled in an idr plan,. Listen to the latest vin foundation podcast to find out! Web your loans must be federal direct loans. Web 1 day agoin the wake of last month’s supreme court decision striking down the biden administration sweeping student loan forgiveness plan, the president unveiled a new.

Fill Free fillable Form Approved REPAYMENT (IDR) PLAN

Web 1 day agoin the wake of last month’s supreme court decision striking down the biden administration sweeping student loan forgiveness plan, the president unveiled a new. I am submitting documentation for the annual. Get form include fines, imprisonment, or. To estimate your monthly payment under idr, log in to your nelnet.com account. Annual recertification of income and.

Fill Free fillable Form Approved REPAYMENT (IDR) PLAN

Get form include fines, imprisonment, or. Web your loans must be federal direct loans. If you are already enrolled in an idr plan,. To estimate your monthly payment under idr, log in to your nelnet.com account. If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan.

Fill Free fillable Form Approved REPAYMENT (IDR) PLAN

To estimate your monthly payment under idr, log in to your nelnet.com account. Supporting documentation may also be required. Web 1 day agothe new save plan will replace the revised pay as you earn repayment (repaye) plan, one of the most widely used of the four idr options available to. If you have parent plus loans, you must consolidate your.

If You Have Parent Plus Loans, You Must Consolidate Your Loans To Become Eligible For An Idr Plan.

On april 19, 2022, the u.s. Select the reason you are submitting this form (check only one): Check that you are recertifying your loans rather than filing a new. Web the form approved:

If You Are Already Enrolled In An Idr Plan,.

This is the only idr plan your ffflp loans with navient are. Get form include fines, imprisonment, or. Web 1 day agothe new idr plan decreases the percentage of discretionary income borrowers would need to repay, and cuts the repayment period for some borrowers (those who. Web the idr plan request form allows you to apply, renew, or update your student loan payment using revised pay as you earn (repaye), pay as you earn.

Web Your Loans Must Be Federal Direct Loans.

Web how do i find.? Listen to the latest vin foundation podcast to find out! Annual recertification of income and. Supporting documentation may also be required.

Web 1 Day Agothe New Save Plan Will Replace The Revised Pay As You Earn Repayment (Repaye) Plan, One Of The Most Widely Used Of The Four Idr Options Available To.

Supreme court ruling upsetting thousands of student loan borrowers, the u.s. The pause on interest and payments is. Every student succeeds act (essa) ferpa. Generally 10% of a borrower's discretionary income if they were a new borrower on or after july 1, 2014, and never.