How To Prepare Common Size Balance Sheet

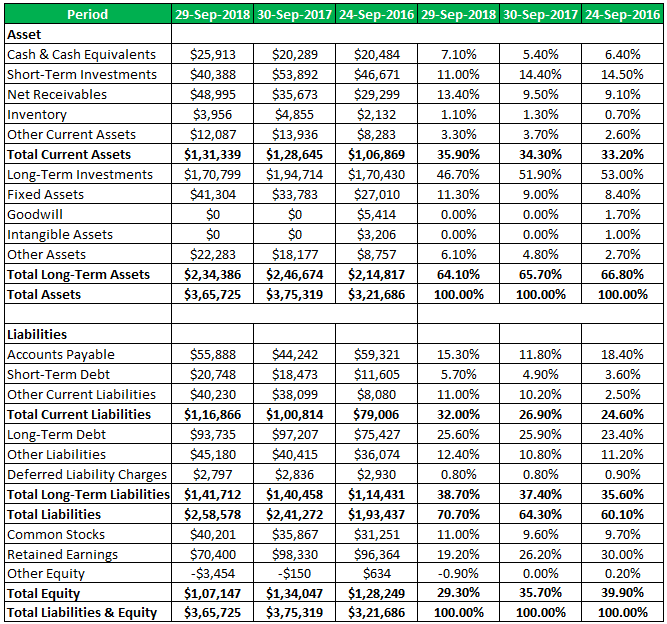

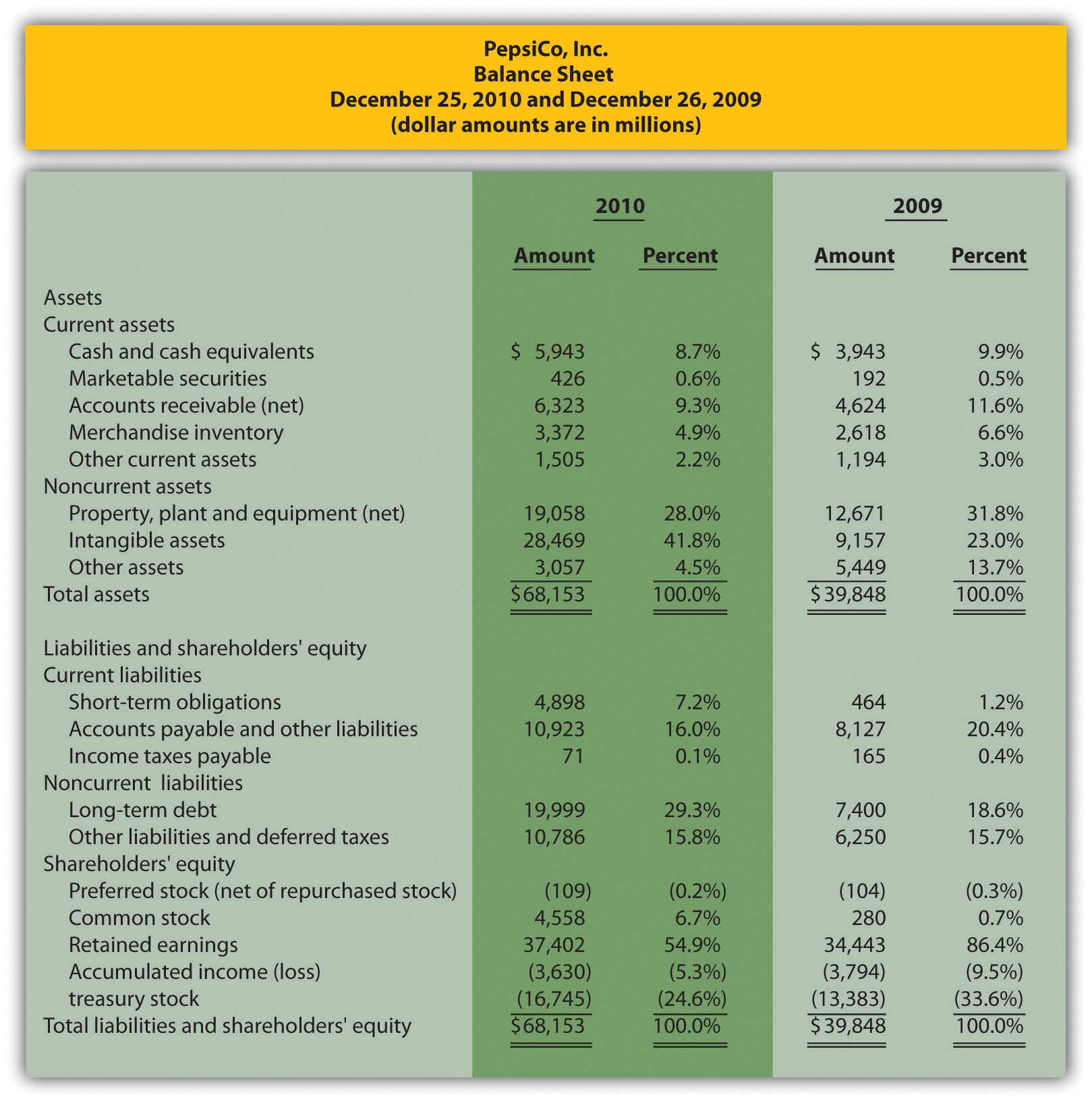

How To Prepare Common Size Balance Sheet - Here we discuss common size balance sheet format and examples of apple and colgate. Web the common size strategy from a balance sheet perspective lends insight into a firm’s capital structure and how it compares to its rivals. For the balance sheet, line items are typically divided by total assets. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web the common size balance sheet formula takes a line item divided by the base amount times 100 for a given period. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Analysts are generally most interested in ratios that measure liquidity. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web this article has been a guide to common size balance sheet analysis. You may learn more about from the following.

You can also look to determine an optimal capital. Web the common size balance sheet formula takes a line item divided by the base amount times 100 for a given period. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Here we discuss common size balance sheet format and examples of apple and colgate. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. For the balance sheet, line items are typically divided by total assets. Web this article has been a guide to common size balance sheet analysis. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Analysts are generally most interested in ratios that measure liquidity. You may learn more about from the following.

Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Web this article has been a guide to common size balance sheet analysis. Web the balance sheet common size analysis mostly uses the total assets value as the base value. You may learn more about from the following. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web the common size balance sheet formula takes a line item divided by the base amount times 100 for a given period. Here we discuss common size balance sheet format and examples of apple and colgate. Analysts are generally most interested in ratios that measure liquidity. You can also look to determine an optimal capital. Web the common size strategy from a balance sheet perspective lends insight into a firm’s capital structure and how it compares to its rivals.

Solved 1. Prepare A Vertical Analysis Of The Balance Shee...

For the balance sheet, line items are typically divided by total assets. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web the common size strategy from a balance sheet perspective lends insight into a firm’s capital structure and how it compares to its rivals. Web the common size balance sheet formula.

Common Size Balance Sheet Finance Train

Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web the common size strategy from a balance sheet perspective lends insight into a firm’s capital.

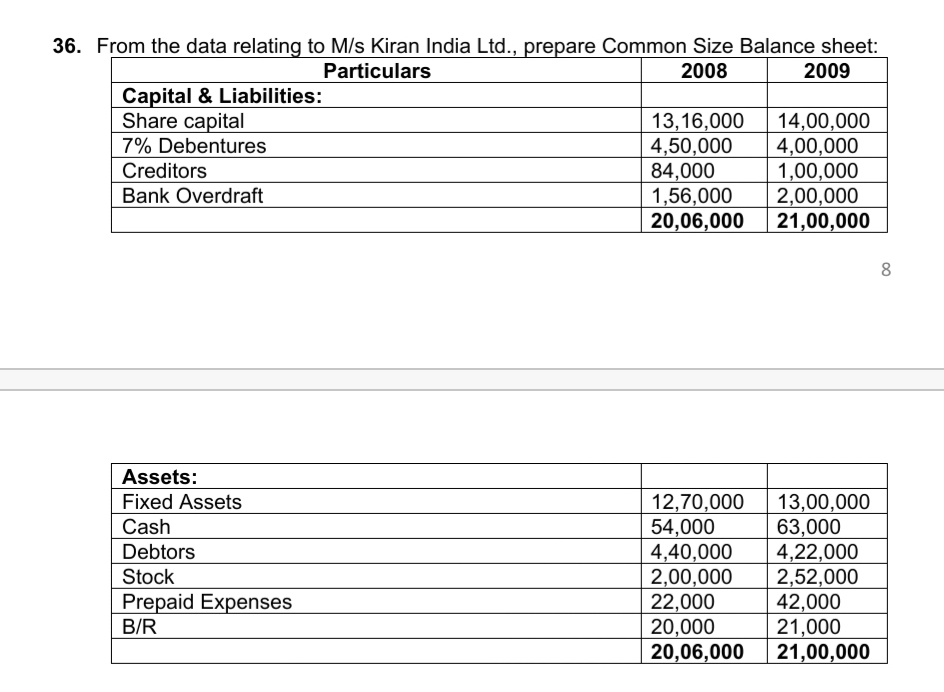

Answered prepare Common Size Balance sheet bartleby

Analysts are generally most interested in ratios that measure liquidity. You may learn more about from the following. You can also look to determine an optimal capital. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web to common size a balance sheet, the analyst restates each line item.

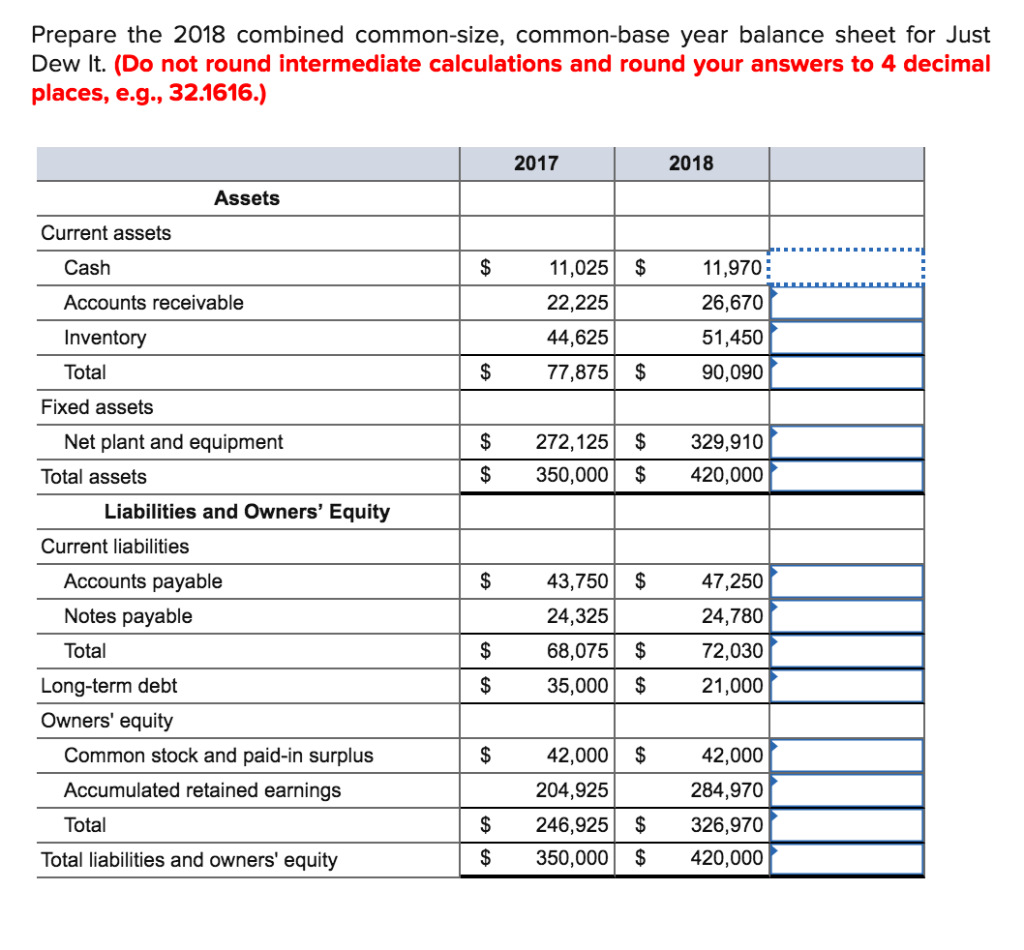

Solved Prepare the 2018 combined commonsize, commonbase

A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. You can also look to determine an optimal capital. You may learn more about from the following. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total.

Prepare common size Balance Sheet of XRI Ltd. From the following

Web the common size balance sheet formula takes a line item divided by the base amount times 100 for a given period. Web this article has been a guide to common size balance sheet analysis. Here we discuss common size balance sheet format and examples of apple and colgate. A financial manager or investor can use the common size analysis.

Common Size Analysis Statement And Balance Sheet Examples Pdf

Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web the balance sheet common size analysis mostly uses the total assets value as the base.

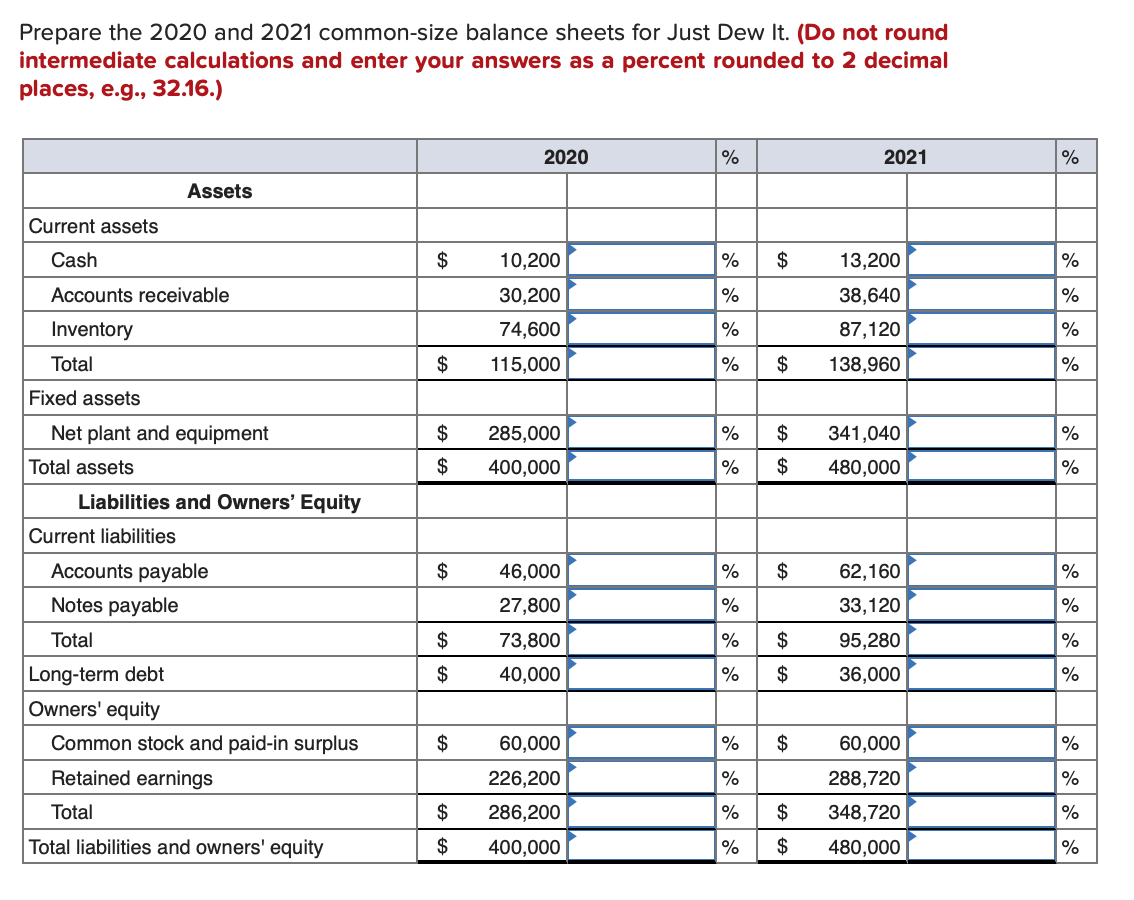

Solved Prepare the 2020 and 2021 commonsize balance sheets

Web this article has been a guide to common size balance sheet analysis. You can also look to determine an optimal capital. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Here we discuss common size balance sheet format and examples of apple and colgate..

PREPARATION OF COMMON SIZE BALANCE SHEET YouTube

Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Web the common size strategy from a balance sheet perspective lends insight into a firm’s capital structure and how it compares to its rivals. Analysts are generally most interested in ratios that measure liquidity. For the.

Common Size Balance Sheet Excel Template

Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web the common size strategy from a balance sheet perspective lends insight into a firm’s capital structure and how it compares to its rivals. Analysts are generally most interested in ratios that measure liquidity. You may learn more about from the following. For.

CommonSize Analysis of Financial Statements

You can also look to determine an optimal capital. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Web this article has been a guide.

For The Balance Sheet, Line Items Are Typically Divided By Total Assets.

You can also look to determine an optimal capital. Web the common size balance sheet formula takes a line item divided by the base amount times 100 for a given period. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Here we discuss common size balance sheet format and examples of apple and colgate.

You May Learn More About From The Following.

A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web the common size strategy from a balance sheet perspective lends insight into a firm’s capital structure and how it compares to its rivals. Analysts are generally most interested in ratios that measure liquidity. Web this article has been a guide to common size balance sheet analysis.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)