How To Form Reit

How To Form Reit - Invest at least 75% of total assets in real estate, cash, or u.s. Complete, edit or print tax forms instantly. Investment and must distribute at least 90. Web because reits generate income in different ways, there are typically three types of dividends: Web a portfolio of the next generation of great technology companies. Web specifically, a company must meet the following requirements to qualify as a reit: Types of reits private reits are real estate funds or companies that are exempt from sec registration and whose shares do not trade on national stock. Web how to qualify as a reit? Web real estate investment trusts (reits) can offer investors a unique combination of inflation hedging, income potential, and capital appreciation. Money made from collecting rent or mortgage.

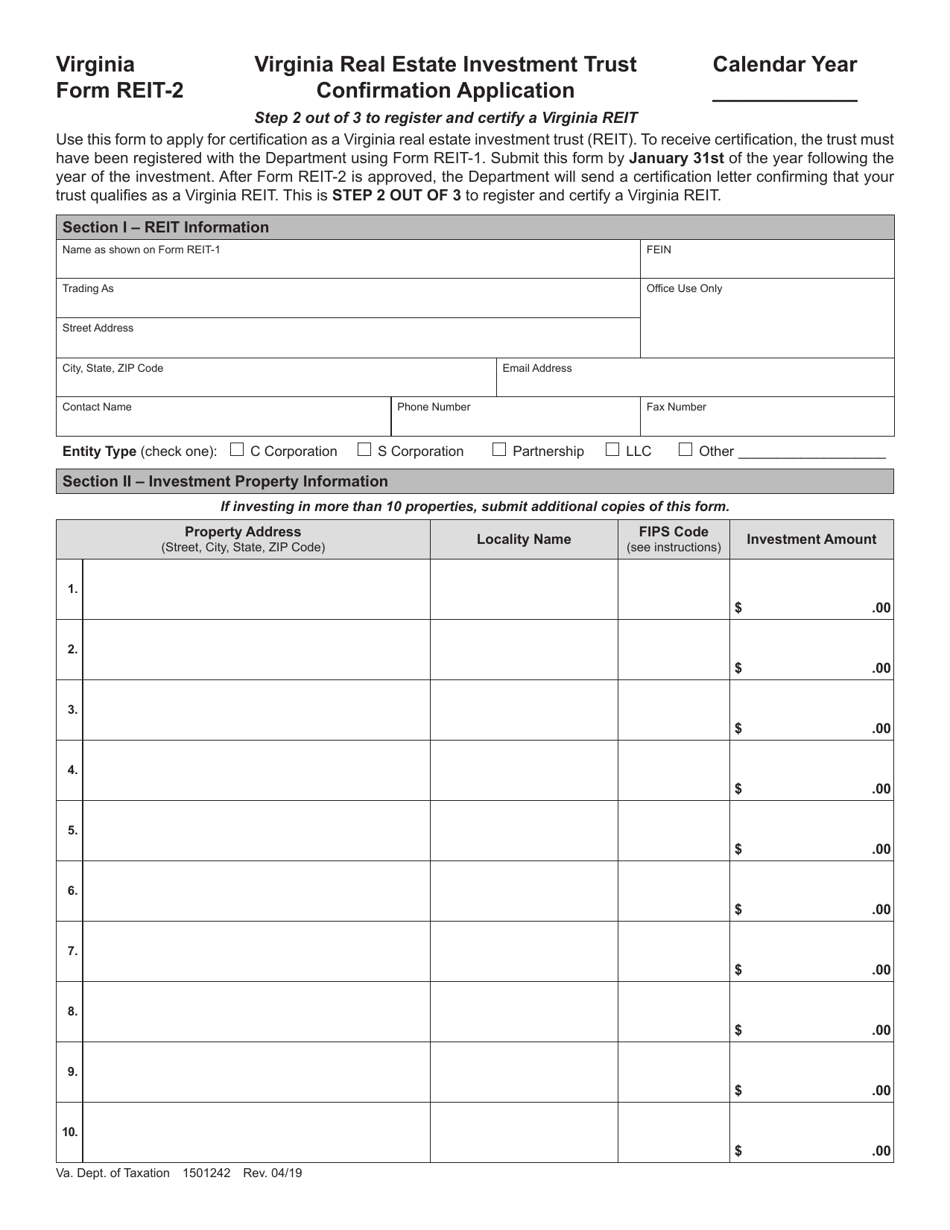

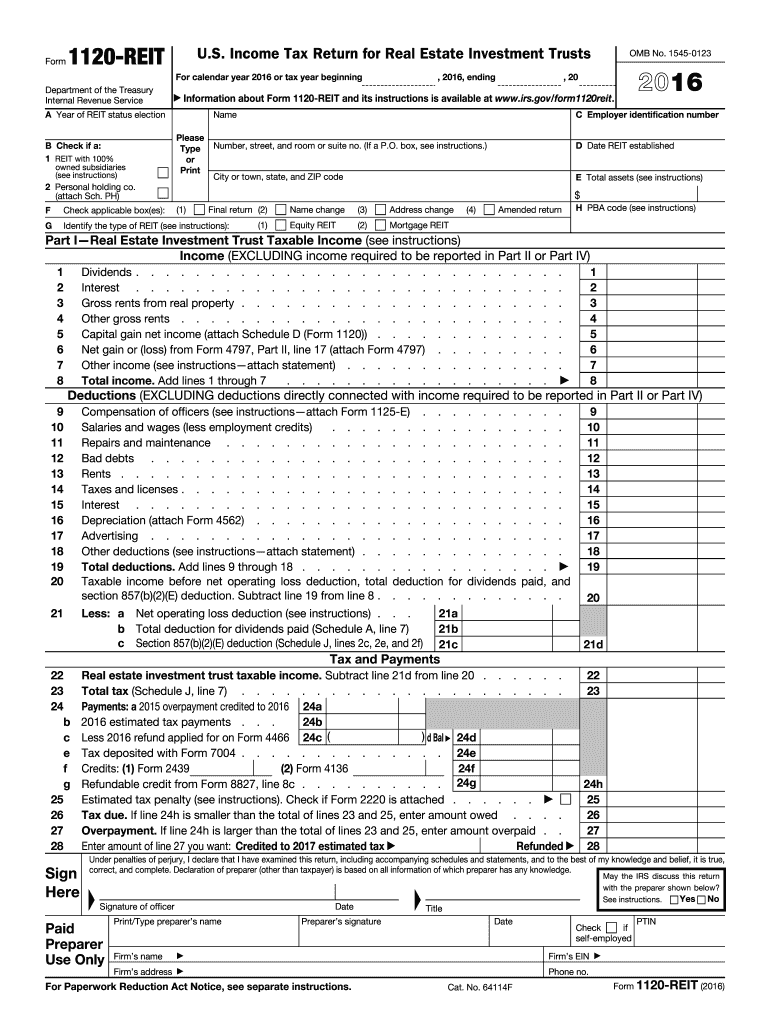

To qualify as a reit, a company must have the bulk. Income tax return for real estate investment trusts. Complete, edit or print tax forms instantly. Since this form is not due until march, the reit does not. Investment and must distribute at least 90. Web because reits generate income in different ways, there are typically three types of dividends: Web most reits operate along a straightforward and easily understandable business model: Corporation, trusts, and associations electing to be treated as real estate. By leasing space and collecting rent on its real estate, the company. Web to qualify as a reit, an organization:

Must be managed by one or more trustees or directors. By leasing space and collecting rent on its real estate, the company. Of its assets and income connected to real estate. Web a portfolio of the next generation of great technology companies. Money made from collecting rent or mortgage. Types of reits private reits are real estate funds or companies that are exempt from sec registration and whose shares do not trade on national stock. Complete, edit or print tax forms instantly. Web most reits operate along a straightforward and easily understandable business model: Real estate investment trust companies are corporations that make their profits. Must be a corporation, trust, or association.

Form 1120REIT Tax Return for Real Estate Investment Trusts

Web because reits generate income in different ways, there are typically three types of dividends: Web how to form a reit real estate investment trust companies. Money made from collecting rent or mortgage. Invest at least 75% of total assets in real estate, cash, or u.s. Investment and must distribute at least 90.

REIT Statistics Everything to Know About REITs in 2020 Millionacres

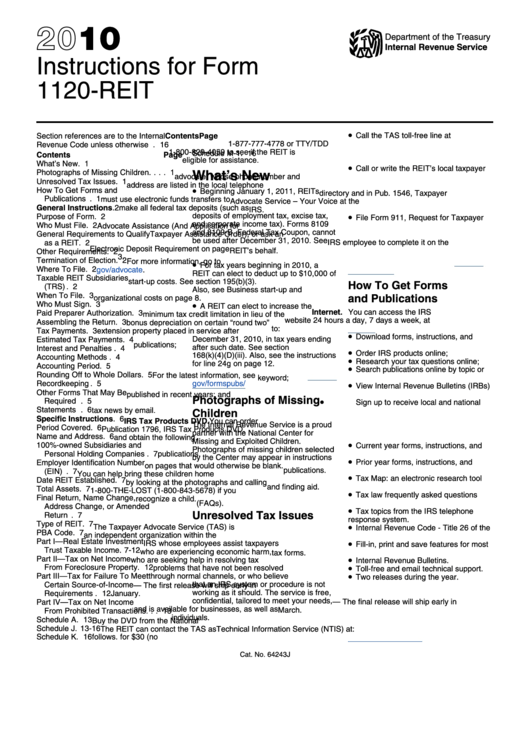

Web how to qualify as a reit? A worksheet is added to provide a reasonable method to track and compute your. Web a method to track losses or deductions suspended by other provisions. To qualify as a reit, a company must have the bulk. Web because reits generate income in different ways, there are typically three types of dividends:

Form 1120REIT Tax Return for Real Estate Investment Trusts

Real estate investment trust companies are corporations that make their profits. Web to qualify as a reit, an organization: Web most reits operate along a straightforward and easily understandable business model: Since this form is not due until march, the reit does not. Web real estate investment trusts (reits) can offer investors a unique combination of inflation hedging, income potential,.

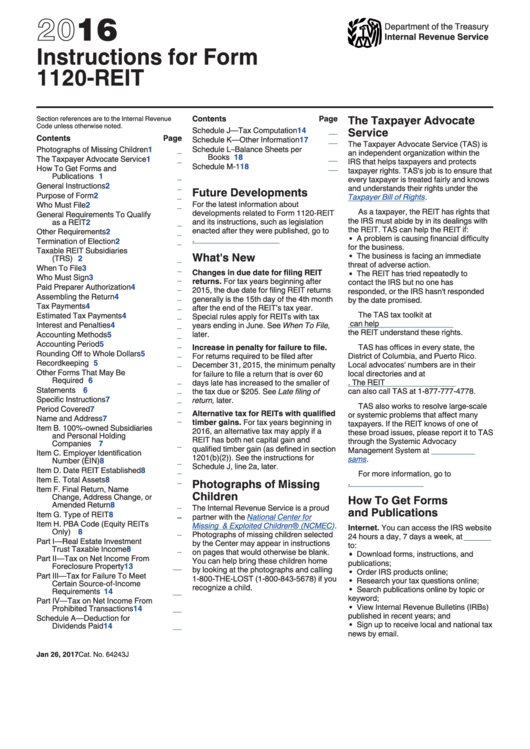

Instructions For Form 1120Reit 2016 printable pdf download

To qualify as a reit, a company must have the bulk. Web because reits generate income in different ways, there are typically three types of dividends: There are a variety of commercial and. Invest at least 75% of total assets in real estate, cash, or u.s. Web to qualify as a reit, an organization:

Form REIT2 Download Fillable PDF or Fill Online Virginia Real Estate

Web a method to track losses or deductions suspended by other provisions. Web how to qualify as a reit? Types of reits private reits are real estate funds or companies that are exempt from sec registration and whose shares do not trade on national stock. Web specifically, a company must meet the following requirements to qualify as a reit: Web.

Form 1120 REIT Irs Fill Out and Sign Printable PDF Template signNow

Web most reits operate along a straightforward and easily understandable business model: A beginner's guide to real estate investment trusts reits offer investors of all sizes an. Investment and must distribute at least 90. A worksheet is added to provide a reasonable method to track and compute your. Web reit stands for real estate investment trust, and its popularity is.

Instructions For Form 1120Reit 2010 printable pdf download

Invest at least 75% of total assets in real estate, cash, or u.s. Income tax return for real estate investment trusts. Web reit stands for real estate investment trust, and its popularity is growing for investors who seek to expand their portfolio beyond publicly traded stocks. A worksheet is added to provide a reasonable method to track and compute your..

How To Form REIT? Forming a Real Estate Investment Trust Nareit

Web home what's a reit? Money made from collecting rent or mortgage. They also must mail out a letter to shareholders each year that delineates. A beginner's guide to real estate investment trusts reits offer investors of all sizes an. Income tax return for real estate investment trusts.

Form 1120REIT Tax Return for Real Estate Investment Trusts

A worksheet is added to provide a reasonable method to track and compute your. Complete, edit or print tax forms instantly. Of its assets and income connected to real estate. Must be managed by one or more trustees or directors. Web how to form a reit real estate investment trust companies.

Form 1120REIT Tax Return for Real Estate Investment Trusts

Must be a corporation, trust, or association. Of its assets and income connected to real estate. Web how to qualify as a reit? A worksheet is added to provide a reasonable method to track and compute your. Since this form is not due until march, the reit does not.

Types Of Reits Private Reits Are Real Estate Funds Or Companies That Are Exempt From Sec Registration And Whose Shares Do Not Trade On National Stock.

Web reit stands for real estate investment trust, and its popularity is growing for investors who seek to expand their portfolio beyond publicly traded stocks. A worksheet is added to provide a reasonable method to track and compute your. Web a portfolio of the next generation of great technology companies. Income tax return for real estate investment trusts.

Invest At Least 75% Of Total Assets In Real Estate, Cash, Or U.s.

By leasing space and collecting rent on its real estate, the company. Web home what's a reit? Web because reits generate income in different ways, there are typically three types of dividends: Web how to form a reit real estate investment trust companies.

Since This Form Is Not Due Until March, The Reit Does Not.

A beginner's guide to real estate investment trusts reits offer investors of all sizes an. Of its assets and income connected to real estate. Money made from collecting rent or mortgage. There are a variety of commercial and.

Web Real Estate Investment Trusts (Reits) Can Offer Investors A Unique Combination Of Inflation Hedging, Income Potential, And Capital Appreciation.

Complete, edit or print tax forms instantly. Must be a corporation, trust, or association. Corporation, trusts, and associations electing to be treated as real estate. Must be managed by one or more trustees or directors.